You may have heard how mortgages come with “points” – a polite synonym for fees or premiums – your lender charges for loan origination or refinancing.

Sound familiar?

Why would you want points? Well, when you buy a point or two along with your mortgage, you get a lower interest rate and lower monthly payments.

Pay $3,000 for a point now, and you could save that much and more later on over the course of the loan.

So, is it a no-brainer? Well… let’s talk about that.

Table of Contents

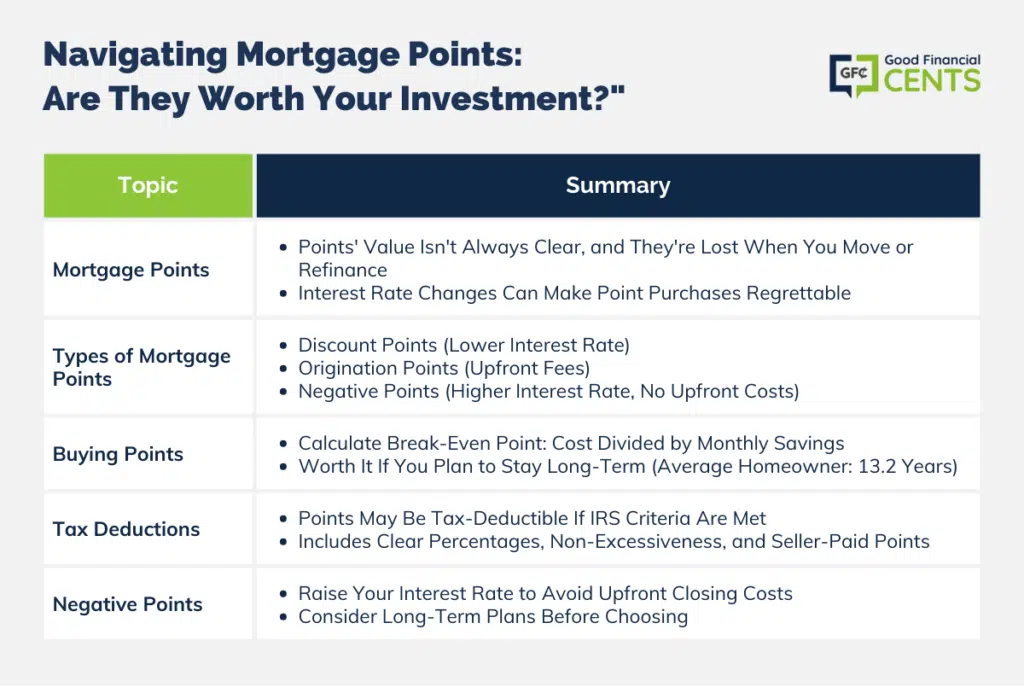

Are Mortgage Points Pointless?

The math on points is simple: one-point equals 1% of the amount of the loan you take out, two points equal 2%, and so forth.

While the math is easy, the real value of a point is not always so simply calculated.

But it may seem pointless.

The problem is points don’t move when you do.

Who stays in one home for 30 years these days?

If you have a 30-year loan and you sell your home and move five years from now, you lose the points and the benefits with them. The same applies when you refinance.

There’s also the interest rate aspect.

Let’s say you buy two points at 6% interest when you get your mortgage. What if two years later, interest rates fall to 4%? You’ll regret your purchase.

Types of Points You Can Get

There are three types of mortgage points you may encounter:

- Discount Points (what we are going to focus on)

- Origination Points

- Negative Points

The bulk of our discussion is going to look at the advantages and disadvantages of discount points. These are the points which lower your interest rate.

Before we dig into the discount points, I’m going to quickly explain origination points to help you understand the difference.

They are basically the fees you have to pay before the insurance company will give you a mortgage. They are essentially a nice way of saying “fee.”

Should You Buy Points (Or Are They a Scam)?

When you’re going through the mortgage application process, there are dozens of factors you need to consider. It can be a confusing process.

When trying to decide if you should buy mortgage points, there is a simple equation you should do. You need to calculate how long it will take you to break even.

Don’t worry, the math is simple.

Take the cost of the points and then divide the number how much you’ll save every month. The number you get is how many months it will take for you to break-even.

If you want to make those points worth it, you will need to be in your home past the break-even point. If you don’t plan on being in your home for that long, then buying the points is a waste of money.

The average homeowner stays in their home for 13.2 years. Compared to 2020, that’s down from 13.5 years.

What this tells me is for most people, the points probably won’t be worth the upfront cost, but every situation is different. Do those quick calculations and you can decide if it’s worth buying a point.

Are Mortgage Points Tax-Deductible?

Sometimes.

Usually, points are amortized over the duration of your mortgage – that is, paid off in installment payments over the life of the loan. But you might be able to deduct the cost of these points at tax time.

If you took out your mortgage to buy or refinance your primary residence, you could qualify for a deduction in the tax year you took out the loan, if your loan meets certain conditions.

The IRS has a 9-point test, and the key points are:

1. Points must be a percentage of a principal amount clearly defined on the settlement statement

2. Points can’t be paid in place of separately stated amounts elsewhere on the settlement statement

3. Funds supplied by the buyer + points paid by the seller must be equal to or greater than points charged

4. Points charged must not be excessive, and

5. Charging of points must be “an established business practice” for such a mortgage. If you buy a home and the seller pays any points, you can deduct those points.

If you’re refinancing, there is no quick tax break.

Points have to be amortized unless you are using part of the loan for home improvement. Then a partial deduction is allowable.

Negative Points

A lesser-known point is negative points. These points are “lender credits,” and they actually cause your interest rates to go up. Seems like an odd choice, right?

If you use negative points, you don’t pay for your closing costs out-of-pocket. Instead of paying your closing costs, you receive a higher interest rate, the closing costs will be paid by the higher monthly payments.

Just like with mortgage points, you should decide how long you are going to be living in the home. If you play on sticking around for 20 years, these points are going to be a waste of money.

They work as an inverse.

The Bottom Line – What Are Mortgage Points (And Should You Buy Them)?

Mortgage points, representing an upfront fee to lower interest rates, may initially seem attractive, especially with the promise of lower monthly payments.

However, the true value of purchasing points gets muddied when considering modern homeownership trends, where the length of stay in a single home is often shorter than the break-even point.

Furthermore, fluctuating interest rates can also impact the perceived savings from points. The option of negative points, offering a workaround for closing costs at the expense of higher interest rates, also presents a contrary avenue.

Ultimately, the decision to buy points is a personal one, hinged on individual financial circumstances and long-term living plans.

It’s prudent to engage with a mortgage professional to fully understand the implications before making such a decision.