Homeownership stands as a testament to one’s hard work and financial prudence. Yet, the journey to maintaining it isn’t without its hurdles, especially when the unexpected strikes.

Mortgage Unemployment Protection Insurance (MUPI) emerges as a beacon of hope for homeowners navigating the choppy waters of economic uncertainty. It’s a financial shield, guarding against the potential fallout of job loss.

At the heart of MUPI lies the promise of stability: it’s an investment in peace of mind, ensuring that the achievements of today aren’t undone by the trials of tomorrow.

The relevance of such protection can’t be overstated in an era where job security can sometimes feel as fleeting as the weather. MUPI isn’t just a product; it’s a strategic move, a savvy safeguard against the unforeseen twists of fate that might otherwise jeopardize one’s financial well-being.

By delving into the essence of MUPI, homeowners can arm themselves with knowledge, transforming a house into a fortress of security.

Table of Contents

What Is Mortgage Unemployment Protection Insurance?

Definition and Key Features of MUPI

At its core, MUPI is an ally in the face of adversity. This specialized insurance serves as a financial buffer, stepping in to cover mortgage payments when a homeowner loses their job.

It’s not a blanket solution but a targeted measure crafted to address a specific and potent threat to financial stability. Imagine it as a watchdog for your home, one that barks only when the threat of unemployment looms, safeguarding one’s living quarters from the repercussions of income loss.

MUPI’s key features set it apart from the usual insurance fare. It’s not just about paying out in the event of a job loss; it’s about crafting a tailored response to this particular scenario.

There’s a nuanced mechanism at work here, one that factors in the duration of unemployment, the amount of coverage, and the period until benefits kick in, ensuring that the support it offers isn’t just a stopgap but a sturdy bridge over troubled waters.

How MUPI Provides Financial Aid During Unemployment

The real magic of MUPI unfolds during the tumult of unemployment. When jobs are cut, and incomes vanish, MUPI steps into the breach, delivering financial assistance that can mean the difference between keeping a roof overhead and facing the dread of foreclosure.

It provides not just money but time—time to regroup to search for new employment without the crushing weight of mortgage payments looming large.

The assistance MUPI offers is more than monetary; it’s psychological. Knowing that there’s a safety net can instill a sense of boldness and clarity, allowing one to navigate the job market without desperation clouding judgment.

It’s this dual benefit—economic and emotional—that makes MUPI a pillar of modern financial planning for homeowners.

The Distinction Between MUPI and Other Mortgage-Related Insurances

MUPI is not a lone ranger in the world of financial protection. It stands amid a pantheon of insurance, each with its own role to play. Unlike life or property insurance, which responds to mortality and calamity, MUPI is uniquely tuned to the rhythms of the job market.

This focus on employment distinguishes MUPI from its insurance kin. Where others might cast a wide net, MUPI casts a precise one, designed to catch homeowners should they stumble on the path of their career journey.

It’s this precision that makes it an essential consideration for those mapping out their financial defenses against the unknown.

Evaluating the Pros and Cons of MUPI

As with any financial product, it is important to analyze both the positive and negative aspects of MUPI to determine its suitability for an individual’s specific situation.

Advantages of MUPI

Financial Security and Peace of Mind

The primary allure of MUPI is the sense of security it provides. It acts as a financial buffer during the turbulence of unemployment, offering a form of income replacement that can help maintain mortgage payments.

This peace of mind is invaluable, as it allows homeowners to focus on finding new employment without the added stress of imminent housing instability.

Avoiding Default and Foreclosure

One of the stark realities of unemployment is the risk of defaulting on a mortgage, which can spiral into foreclosure. MUPI steps in as a bulwark against this, ensuring that mortgage payments continue even when personal income does not.

This protection not only preserves the home but also maintains the legacy of homeownership that might have taken years to establish.

Credit Score Protection

In the world of finance, a credit score is a powerful indicator of one’s fiscal health, and its protection is critical. Late or missed mortgage payments can have a detrimental effect on credit ratings.

MUPI indirectly safeguards this score by covering mortgage payments during periods of joblessness, thereby avoiding negative entries that could otherwise damage creditworthiness for years to come.

Disadvantages of MUPI

Additional Cost and Premiums

For all its benefits, MUPI does not come without cost. The premiums represent an additional expense for homeowners, adding to the myriad of financial obligations already present.

These costs must be weighed against the potential benefits, considering both the short-term financial impact and the long-term security it may offer.

Exclusions and Eligibility Requirements

MUPI policies are often riddled with exclusions and stringent eligibility requirements. Not all circumstances of unemployment will trigger the insurance benefits. For instance, voluntary resignation or termination due to misconduct are typically not covered.

Furthermore, pre-existing job insecurity or ongoing employment issues may render a homeowner ineligible for coverage, potentially limiting the utility of MUPI for some.

Policy Limits and Waiting Periods

MUPI is not a carte blanche solution even when a homeowner is deemed eligible. Policies usually have defined limits on how much they pay out and for how long. Additionally, there are often waiting periods before benefits commence, during which the homeowner must still cover mortgage payments.

These terms can vary significantly between policies, and understanding them is crucial to determining the practical value of MUPI in one’s financial planning.

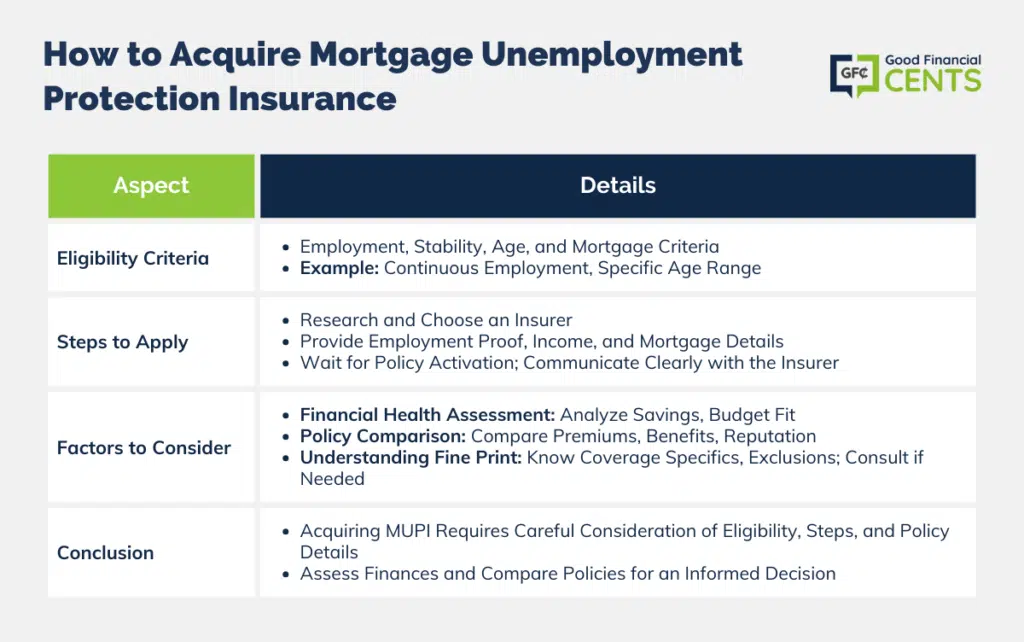

How to Acquire Mortgage Unemployment Protection Insurance

Securing a home through mortgage payments is a significant commitment, one that demands foresight and planning.

Mortgage Unemployment Protection Insurance (MUPI) is one of the tools at a homeowner’s disposal to ensure continuity in this commitment, even during the financial hardship of unemployment.

Eligibility Criteria for Applicants

Understanding the eligibility criteria for MUPI is the first step towards acquiring this financial safety net. Insurers generally set specific conditions that applicants must meet to qualify for coverage.

These can include the applicant’s employment history, the stability and type of employment, age limits, and the status of the mortgage itself.

For instance, some insurers may require that you have been employed continuously for a certain period before the policy inception and that you’re within a certain age range.

It’s vital for potential policyholders to review these criteria closely to determine their eligibility before investing time and resources into the application process.

Steps to Apply for MUPI

Applying for MUPI typically involves several steps. Firstly, a homeowner must research and select an insurer that offers a policy that suits their needs. This is followed by providing necessary documentation, which may include proof of employment, income verification, and mortgage details.

After submission, the insurer may require a waiting period before the policy becomes active. During this process, clear communication with the insurer is crucial to ensure that all requirements are met and to understand when the coverage will start.

Factors to Consider Before Purchasing MUPI

Financial Health Assessment

Prior to purchasing MUPI, it’s crucial to perform a thorough financial health assessment. Homeowners should analyze their savings, investments, and overall financial stability to determine if the cost of insurance premiums is manageable within their budget.

This self-audit helps in gauging whether insurance is a necessity based on one’s financial cushion or if other forms of financial safety nets are adequate.

Comparison of Different Policies and Providers

Not all MUPI policies are created equal. Differences in premiums, benefits, coverage limits, and exclusion clauses are common. Hence, it is essential to compare policies from different providers to find the one that offers the best coverage for the most reasonable cost.

This comparison should extend beyond the premiums to include the reputation of the insurer, customer service, claim settlement ratio, and reviews from other policyholders.

Understanding the Fine Print

One of the most critical steps in acquiring MUPI is to understand the fine print of the policy. This includes the specifics of coverage, such as what constitutes a qualifying unemployment event, any waiting periods before benefits begin, the duration of coverage, and the process for filing a claim.

Awareness of potential policy exclusions and limitations ensures that there are no surprises when it comes time to use the policy. It is often beneficial to consult with a financial advisor or an insurance expert to clarify complex terms and conditions.

Alternative Strategies to MUPI for Protecting Your Home

While Mortgage Unemployment Protection Insurance provides a specific solution for safeguarding your home during unemployment, it’s not the only strategy available. A robust financial plan often includes various protective measures to ensure resilience in the face of economic adversity.

Building an Emergency Savings Fund

An emergency savings fund is the cornerstone of personal financial security. It is the reservoir from which you can draw during unexpected life events, such as job loss, without having to rely on external sources.

Financial experts often recommend that this fund should cover three to six months’ worth of living expenses, including mortgage payments. Having this buffer can give you the time needed to seek new employment or adjust your financial plans without the immediate risk of defaulting on your mortgage.

Other Types of Insurance Policies

Income Protection Insurance

Income protection insurance is a broader safety net than MUPI. It pays out a percentage of your gross wages if you’re unable to work due to illness or injury, thus ensuring a continued influx of funds that can be used to cover your mortgage and other expenses.

Unlike MUPI, it is not specifically tied to unemployment and thus offers a wider range of coverage.

Critical Illness Cover

Critical illness cover is another form of financial protection that can be crucial in maintaining mortgage payments. This insurance provides a lump sum payment if you are diagnosed with one of the specific critical illnesses covered by the policy.

While it does not cover unemployment per se, the financial relief it offers can help manage mortgage payments and other costs during recovery from serious health issues.

Government Assistance Programs

Many governments offer unemployment benefits and assistance programs designed to help those who have lost their jobs. While these programs vary by location and have eligibility criteria, they often provide financial assistance that can help cover living expenses, including mortgage payments.

Additionally, some programs may offer job training and placement services to support re-employment.

Mortgage Forbearance and Modification Options

Mortgage forbearance or modification programs can be vital for homeowners facing financial difficulties. Forbearance is a temporary postponement of mortgage payments, whereas modification involves changing the mortgage terms to make the payments more affordable.

These options can provide crucial time to regain financial stability without the immediate threat of foreclosure.

The Bottom Line – Afraid of Losing Your Job? Consider Mortgage Unemployment Protection Insurance

Mortgage Unemployment Protection Insurance stands as a vigilant sentinel for homeowners, providing a financial bastion in the tumultuous event of job loss. Its importance has been underscored, offering a means to uphold the sanctity of homeownership during economic upheavals.

Weighing the merits and drawbacks is crucial; the premiums and terms of MUPI must be evaluated well against its potential to avert financial distress. The key to unlocking MUPI’s benefits lies in understanding its nuances and placing it within a broader context of personal financial planning.

Homeowners are encouraged to look beyond MUPI, considering alternative strategies such as emergency savings, other insurance products, and government assistance to craft a comprehensive defense against the job market changes. Securing MUPI requires diligence—assessing eligibility.

Very interested in getting a quote for unemployment protection insurance on my mortgage.

I am interested in applying for your unemployment protection. I have been with my company for over 3 years. My mortgager does not have any of these surgeries. You can reach me at 337 802 8516.

Thank you

I would like a quote for unemployment insurance. My mortgage is $320000 and my age is 57.

Interested in unemployment mortgage insurance.

Looking for mortgage protection insurance Incase of any life unexpected emergency.. please contact me through email