Shopping for insurance can be a momentous task. PolicyGenius is an easy-to-use tool that allows you to compare dozens of insurance quotes without having to go to each company’s website or call those agents one by one.

Luckily, there are some tools you can use to make the process as simple as a few clicks. This is where PolicyGenius comes in.

Table of Contents

Policygenius at a Glance

| Placed Coverage | $45 billion |

| Year Founded | 2014 |

| Coverage Area | Nationwide |

| HQ Address | 50 West 23rd Street, Floor 9

New York, NY 10010 |

| Phone Number | 1-855-695-2255 |

Take the first step and get a free quote with PolicyGenius today.

PolicyGenius Company Information

PolicyGenius is an easy-to-use tool that allows you to compare dozens of quotes without having to go to each company’s website or call those agents one by one.

One unique feature of PolicyGenius is they can help you get quotes for just about any type of insurance plan out there.

They can help you find quotes for:

- Life Insurance

- Disability Insurance

- Health Insurance

- Renter’s Insurance

- Homeowner’s Insurance

- Jewelry Insurance

- Auto Insurance

- Travel Insurance

- Identify Theft Insurance

- Long-Term Care Insurance

- Vision Insurance

- and more

They are becoming a one-stop shop for insurance needs. They can help you find just about any possible plan out there.

How Does PolicyGenius Compare?

How does PolicyGenius compare to other popular insurance companies? Check out this table where we compare My PolicyGenius, Coverhound, and The Zebra.

| Company | Insurance Offered | Online Quotes Offered |

|---|---|---|

| PolicyGenius | All insurance needs | Yes |

| Coverhound | Business and Personal Insurance | Yes |

| The Zebra | Car and Home Insurance | Yes |

History of PolicyGenius

PolicyGenius was founded in 2014 by Jennifer Fitzgerald and Francois de Lame. Both founders had the goal of making the insurance purchasing process as simple as possible.

PolicyGenius works with the top insurance companies to bring all of the quotes directly to you.

All of their brokers are licensed, and they can sell insurance in all 50 states. Regardless of where you live, PolicyGenius can help you find what you’re looking for.

How to Get Started With PolicyGenius

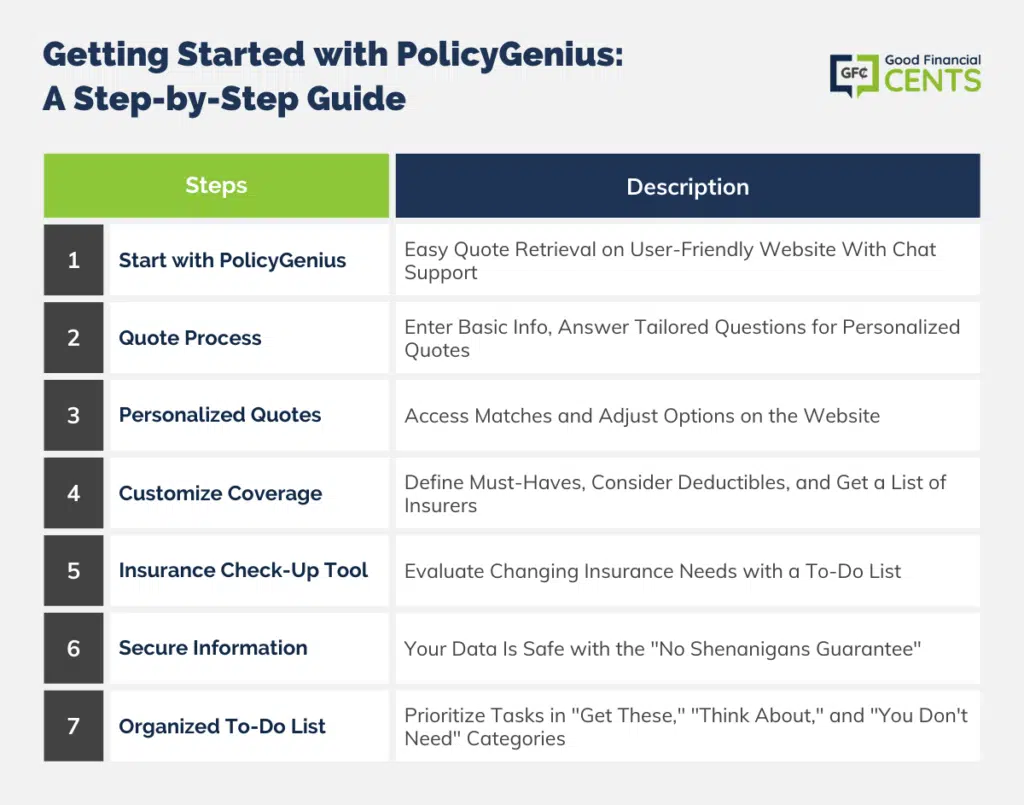

When you log onto PolicyGenius, they make it very easy to get quotes.

Their website is clean and comfortable to use. Even if you have minimal technological skills, you’ll be able to get quotes. If you have any problems, they have a chat feature you can use to walk you through the process.

To get quotes, all you have to enter is some basic information, like

- your first name

- your gender

- birthday

- ZIP code

- occupation

- employment status

Depending on the type of plan you’re looking for, they may ask you some additional questions.

Then they will ask you a short set of questions. These questions are going to help them give you more accurate quotes. They are basic questions like tobacco usage, your health, and other simple questions.

After you’ve entered all the personal info and answered the questions, you will get access to the personalized quotes.

Your insurance matches will pop up, and you can access those plans through their website. If you aren’t ready to go through with the process, you can save your results, or you can adjust your coverage amounts or policy type.

PolicyGenius wants to know what your “must-haves” and “nice to haves” are. This could be different things from deductibles, coverage limits, and much more.

After you’ve decided what matters most to you, they will give you a list of insurance companies.

Insurance Check-up Tool

Your life changes constantly. Your insurance needs can change as well.

You could have some holes in your insurance coverage. Not having proper insurance protection could leave you with some massive debts or expenses. You never know what’s going to happen, which means you should take the time to evaluate your insurance products or your insurance needs.

PolicyGenius understands the importance of insurance plans and how confusing the process can be.

That’s why they created the Insurance Check-Up Tool.

This tool will ask you a dozen different questions and can give you a blueprint of your insurance needs and the areas you already have covered. They will give you an insurance “to-do list,” and they help you check off the things on the list.

If you’re worried about giving PolicyGenius your information, don’t worry, they have a “No Shenanigans Guarantee.”

They promise they will only use the information to give you insurance advice and will keep your information secure.

After you’ve answered their questionnaire, PolicyGenius will break up your to-do list into three separate categories:

- Get These

- Think About

- You Don’t Need

You can probably guess what each category means. They make it simple to decipher their to-do list, and they also make it easy to get the insurance plans to complete the to-do list.

Advantages of Using PolicyGenius

There is a reason PolicyGenius has such excellent reviews from their previous customers. While I was researching the company and looking at reviews, I saw consistent five-stars and rave comments about PolicyGenius.

One of the main advantages of PolicyGenius is how quick and easy it is to get your quotes.

You can receive your personalized quotes in a matter of minutes. If you tried to do all of this yourself, you could spend hours and hours on the phone.

PolicyGenius can save you time and money on all of your insurance plans.

Unlike working with a traditional insurance company, you don’t have to worry about working with a biased agent.

Traditional agents work for one company, which means they are going to say whatever they have to get you to buy a plan from them, which could lead you to higher rates.

With PolicyGenius, you’re going to impartial advice. They aren’t working for a specific company; it’s their goal to get you the most affordable insurance policies out there.

Not only do you get unbiased quotes and advice from their quote tool and agents, but you also won’t have to sit through the sale pitch.

Let’s say you’re looking for life insurance or auto insurance quotes. If you purchase the plan through a traditional insurance company, some agents are going to try and sell you additional plans or extra coverage you don’t need.

Should You Use PolicyGenius?

Now for the big question: should YOU actually use PolicyGenius?

Before I answer this question, you should realize the importance of comparing insurance quotes. Regardless of how you do it, with PolicyGenius or one of the other options, you want to make sure you’re surveying the entire marketplace.

Every insurance company is different, and all of them have different rating systems, which means you’ll get drastically varying rates depending on the company you choose.

Finding the best company for you is the difference between getting an affordable plan or one that will break your bank every month.

With life insurance, for example, the rates you get could rates which are hundreds of dollars apart. If you’re looking for several insurance plans, you’re about to take on a couple of serious investments.

Now, back to the main question, should you use PolicyGenius?

The short answer is, maybe.

Yes, they help you compare dozens of insurance companies at once, but the problem is there are plenty of insurance companies they don’t work with.

PolicyGenius works for some of the highest-rated companies out there, and they can give you excellent coverage. Their algorithm for searching through insurance companies is much better than the competition, but as an algorithm, there is only so much it can do.

One of the pitfalls of PolicyGenius is if you’re looking for life insurance. You may not be in the best health, which can lead to some expensive rates if you go through PolicyGenius.

The main disadvantage here is they don’t work with some of the more “specialized” companies.

For example, let’s say you’re an applicant with a severe health complication, like diabetes or you’ve had a heart attack. If you use PolicyGenius, you’re going to get a lot of expensive quotes for your life insurance policy.

There are a lot of applicants who assume they can’t get affordable life insurance because of their health and the quotes they received, but this isn’t true. There are plenty of insurance companies that work with high-risk applicants and offer cheaper coverage.

Another area where PolicyGenius falls short is with key person insurance. PolicyGenius can connect you with just about any kind of insurance, but they don’t offer life insurance geared towards business owners or any key man insurance.

These plans are becoming more and more popular, but PolicyGenius won’t be the best route for finding your plan.

Even with all of these disadvantages and drawbacks, there is nothing wrong with using PolicyGenius. They are a completely legit company that has helped serve thousands and thousands of people.

According to their website, they have helped over 4.5 million people shop for insurance and sold more than $20 billion in coverage. As long as you’re the “average” customer, then you probably won’t have any problems getting a quality and affordable insurance policy.

Using an Independent Insurance Agent

PolicyGenius is not the first company to work with more than one insurance company.

In fact, people have been doing this for a dozen years. There are hundreds and hundreds of independent insurance agents out there.

Some agents work with a lot more companies than PolicyGenius, and the more companies you get quotes from, the more likely you are to get lower insurance rates.

Instead of using the PolicyGenius automated tool, I would suggest using a real live independent insurance agent.

Sure, it’s not going to be as fast as using their tool, and you’ll have to actually talk to someone, but a live agent can get some of the details and information they need to pick the perfect company for you.

There are limitations to a quoting tool, which live independent agents don’t face.

Summary: PolicyGenius Review

If you need help gathering and comparing quotes for various types of insurance, PolicyGenius is a great choice.

Overall, PolicyGenius is a helpful, comprehensive tool that makes the process of getting insurance easier.

Get started with PolicyGenius today! >>>

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback.

By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

PolicyGenius Review

Product Name: PolicyGenius

Product Description: PolicyGenius is a digital insurance marketplace that simplifies the process of shopping for various insurance products. Through its platform, users can compare and purchase policies from top insurance providers for needs ranging from life and health to auto and home. PolicyGenius offers unbiased advice, ensuring users can make informed decisions tailored to their unique circumstances.

Summary of PolicyGenius

Launched with the goal of demystifying the insurance-buying process, PolicyGenius provides a seamless online platform where individuals can compare a plethora of insurance products side by side. By gathering quotes from top insurance providers, the platform empowers users to make cost-effective decisions without sacrificing coverage quality. Beyond mere comparisons, PolicyGenius offers comprehensive guides, calculators, and expert insights to educate users on different insurance aspects. This combination of technology and expert advice positions PolicyGenius as a one-stop-shop for many individuals navigating the often complex world of insurance.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Broad Comparison: PolicyGenius provides a wide range of quotes from various top insurance companies, offering users a comprehensive view of available options.

- Educational Resources: The platform offers in-depth articles, tools, and advice, helping users make informed decisions.

- Unbiased Recommendations: PolicyGenius emphasizes its role as an impartial advisor, not favoring any particular insurance provider.

- User-Friendly Experience: The intuitive interface and streamlined application process simplify insurance shopping.

Cons

- Not a Direct Provider: PolicyGenius is an intermediary; they don’t underwrite or directly provide insurance, which means actual policy services are in the hands of third-party providers.

- Potential for Marketing Contacts: After using the platform, users might receive marketing communications from various insurance providers.

- Not Always the Absolute Lowest Rates: While they provide a broad range of quotes, there’s no guarantee of getting the absolute cheapest rate for every insurance type.