Established in 1961 and headquartered in Williston, New England Federal Credit Union (NEFCU) is Vermont’s largest credit union, with 165,000 members and investable assets of more than $3 billion. Serving six counties in the northwestern portion of the state, NEFCU’s stated goal is “empowering members to make good financial decisions so they can improve their overall quality of life.”

Its primary mortgage loan products include fixed-rate and Adjustable Rate Mortgages (ARMs), Federal Housing Administration (FHA), Veterans Affairs (VA), jumbo, land, construction, and investment or non-owner occupied.

Table of Contents

New England Federal Credit Union Mortgage Facts

- NEFCU is headquartered in Williston, with five locations serving six counties (Addison, Chittenden, Franklin, Grand Isle, Lamoille, and Washington).

- Provides a full range of financial products and loan services, including mortgages.

- Mortgage offerings are wide-ranging, with fixed-rate, adjustable-rate, VA loans, FHA loans, jumbo loans, FHA, and construction among them.

- Member-owned institution, totaling 165,000 and investable assets topping $3 billion.

- Largest credit union in the Green Mountain State.

- In addition to mortgages, NEFCU offers financial education workshops both for members and the general public. Car loans and credit cards are also available through NEFCU.

History of NEFCU

Chartered and regulated by the National Credit Union Administration, New England Federal Credit Union was established in 1961 as a credit union. It’s since grown to be the largest one in the Green Mountain State, with five locations in the six counties it serves, all located in the northwest portion of the state.

Although sizeable for a low-population state, NEFCU does not make the cut as one of the largest lenders in the U.S., at least not in the top 10, according to HousingWire.

Current NEFCU Mortgage Rates

NEFCU Loan Specifics

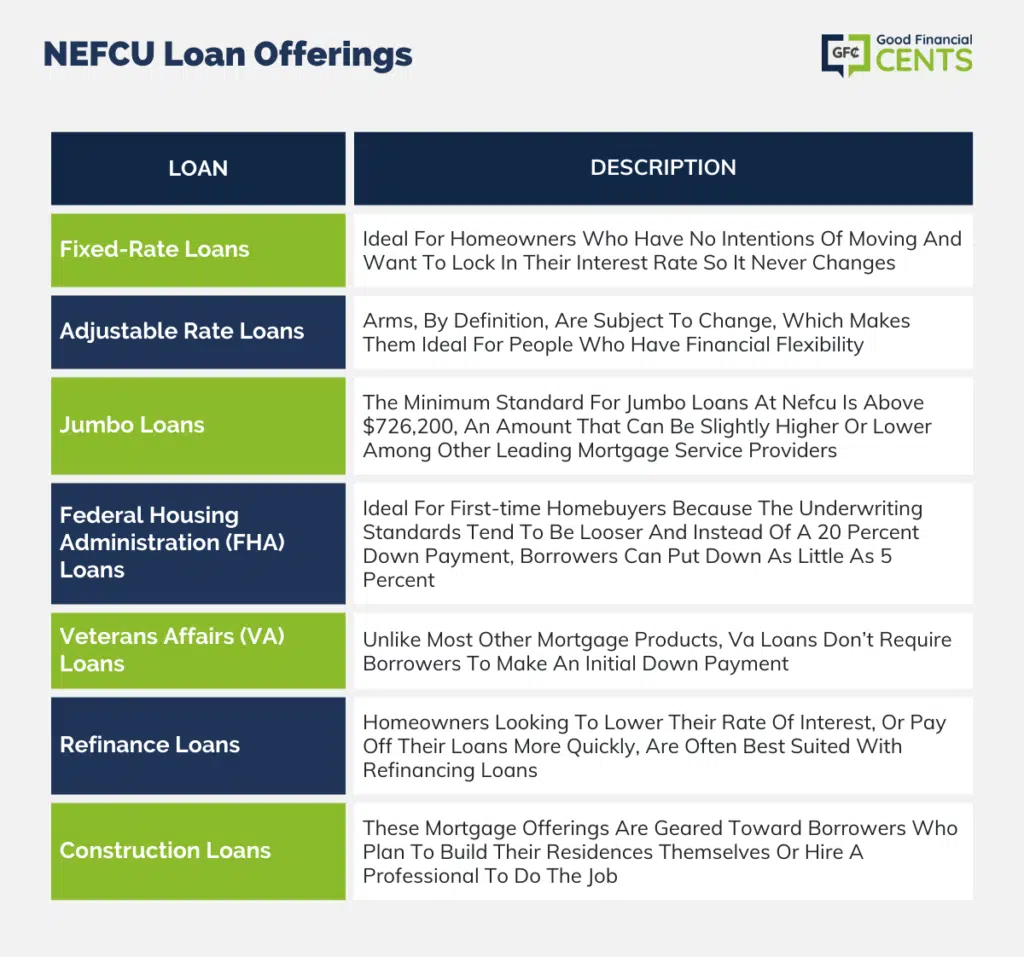

NEFCU mortgage rates and loan offerings appeal to those with particular needs or interests, particularly those who are brand new to the home search. Several first-time home buyer options exclusive to NEFCU are available (Vermont Housing Finance Agency, Home Possible Advantage, NEFCU’s HOME Program), but they also include standard mortgage offerings, which include:

Fixed-rate loans

In 15-year or 30-year increments, fixed-rate loans are ideal for homeowners who have no intentions of moving and want to lock in their interest rate so it never changes. Fifteen-year fixed loans are beneficial for those wanting to pay less interest over the life of the loan, while 30-year loans are more affordable on a cost-per-month basis.

Adjustable-rate loans

ARMs, by definition, are subject to change, which makes them ideal for people who have financial flexibility. The market determines whether the adjustment causes interest to rise or fall, while the lender decides the periods wherein borrowers pay the variation in rates. For example, NEFCU has several non-conforming options, including 7/1 ARM.

Jumbo loans

The minimum standard for jumbo loans at NEFCU is above $766,550, an amount that can be slightly higher or lower among other leading mortgage service providers. Jumbo loans with NEFCU are available in fixed and ARM, with a down payment of as little as 5-10% depending on loan size.

Federal Housing Administration (FHA) loans

The Federal Housing Administration, as its title implies, backs FHA loans, which are primarily utilized by people who are buying a house for the first time. FHA loans are ideal for first-time homebuyers because the underwriting standards tend to be looser and instead of a 20 percent down payment, borrowers can put down as little as 5 percent.

Veterans Affairs (VA) loans

VA loans are also government-backed, only by the U.S. Department of Veterans Affairs. They serve the active or veteran military community, specifically those who served in one of the five branches (Air Force, Army, Marine Corps, Navy, Coast Guard). Unlike most other mortgage products, VA loans don’t require borrowers to make an initial down payment.

Refinance loans

Homeowners looking to lower their rate of interest, or pay off their loans more quickly, are often best suited with refinancing loans. They can help borrowers improve their cash flow, take advantage of rates that weren’t available when they first applied for a mortgage, or “cash out” a percentage of their home’s equity to fund high-dollar purchases.

NEFCU has a MyChoice Mortgage option, which allows borrowers to determine their fixed rate and term, ranging up to 10 years.

Construction loans

These mortgage offerings are geared toward borrowers who plan to build their residences themselves or hire a professional to do the job. AT NEFCU, construction loans have six to 12-month terms, with permanent financing available upon completion of the project. The down payment requirement is at least 10 percent of the home’s value.

NEFCU Mortgage Customer Experience

Although NEFCU has five full-service branch locations in Northwest Vermont, many of the services and products that the firm makes available are accessible on its website. For example, applicants can request a pre-approval, purchase a loan, or cash-out refinance product by filling in the requested material.

Applicants must provide personal information, such as their name, date of birth, Social Security Number, and listing of assets. A mortgage officer contacts the applicant upon completion, although no information as to when that will be available.

In addition to the latest on NEFCU mortgage rates, this mortgage provider features a number of helpful resources on its website, including mortgage calculators (refinance, comparing terms), informative articles, free seminars (pending time and location), downloadable worksheets and charts for budgeting tips, as well as brief podcasts (mostly about three to five minutes long).

There are also courses that visitors can take at their leisure. Each is interactive and runs between 15 and 30 minutes long. Course topics include creating a budget, strengthening credit scores, and understanding how credit works, planning for retirement. The “tools” section of NEFCU’s website also has guidelines on how potential buyers can determine how much house they can afford to buy.

NEFCU is a regular “Daysie” winner, an award program run by Seven Days, a weekly publication that covers the Vermont region. Last year, NEFCU won its seventh straight Daysie for “Best Bank/Credit Union” in Vermont and its fifth consecutive award for “Best Mortgage Broker” in the state. Readers of Seven Days decide from a list of nominees. Nearly 22,000 cast their votes in the 2018 iteration of the Daysies.

NEFCU Phone Number & Additional Details

Homepage URL: http://www.nefcu.com

Company Phone: 800-400-8790

Headquarters Address: 141 Harvest Lane P.O. Box 527 Williston, VT 05495

The Bottom Line

New England Federal Credit Union (NEFCU), Vermont’s largest credit union, provides a vast array of mortgage products suitable for both first-time homeowners and seasoned borrowers. Established in 1961, NEFCU has steadily expanded its footprint and offerings, emphasizing member empowerment and financial literacy. With commendable customer satisfaction and recognition in the local market, it remains a trusted financial institution in Vermont.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: New England Federal Credit Union Product Description: New England Federal Credit Union (NEFCU) is Vermont's largest credit union, offering a wide array of financial products from mortgages to car loans. Founded in 1961, NEFCU is a member-driven institution with a mission to empower its members to make sound financial decisions. Summary of New England Federal Credit Union NEFCU, headquartered in Williston, Vermont, stands as a beacon of financial reliability in the state with over 165,000 members and more than $3 billion in investable assets. Serving six counties in northwestern Vermont, they offer diverse mortgage products including fixed-rate, adjustable-rate, FHA, and VA loans, among others. NEFCU prides itself not just on its financial products, but also on its commitment to financial education, offering workshops for both members and the general public. Their expansive online resources, inclusive of mortgage calculators and informative articles, further underline their member-first approach. Pros Cons

New England Federal Credit Union Review

Overall