Old National Bank was founded in 1834 as the first bank in the city of Evansville, Indiana. It had multiple names, including Evansville National Bank and Old State National Bank, before it was officially named Old National Bank in 1922.

The bank persisted after the stock market crashed in 1929, though other banks in the area were closed. Old National Bank acquired First United Savings Bank in 1995 and Workingsmen Capital Holdings in 1996, further expanding its Midwestern footprint.

Table of Contents

Overview of Old National Bank

Since its founding in 1834, Old National Bank has expanded its services across the Midwest, acquiring pre-existing banks.

Old National Bank offers a variety of financial services, including lease financing, debit cards, online banking, cash management services, wealth management, investment, brokerage, and investment consulting.

Old National Bank continues to be recognized for its excellence in the banking industry.

In 2023, Jim Roolf, Senior Vice President and Corporate Relations Officer at Old National Bank, was named Banker of the Year by the Illinois Bankers Association.

Additionally, Old National Bank earned a perfect score on the Disability Equality Index’s Best Place to Work for Disability Inclusion in 2023.

Further demonstrating their commitment to the community, Old National Bank team members volunteered over 7,200 hours during their ‘Better Together Days’ volunteer blitz in 2023.

These recent awards highlight Old National Bank’s ongoing dedication to its employees, customers, and the communities it serves.

The Ethisphere Institute named Old National Bank as one of the world’s most ethical companies in 2018.

Old National Bank Mortgage Rates

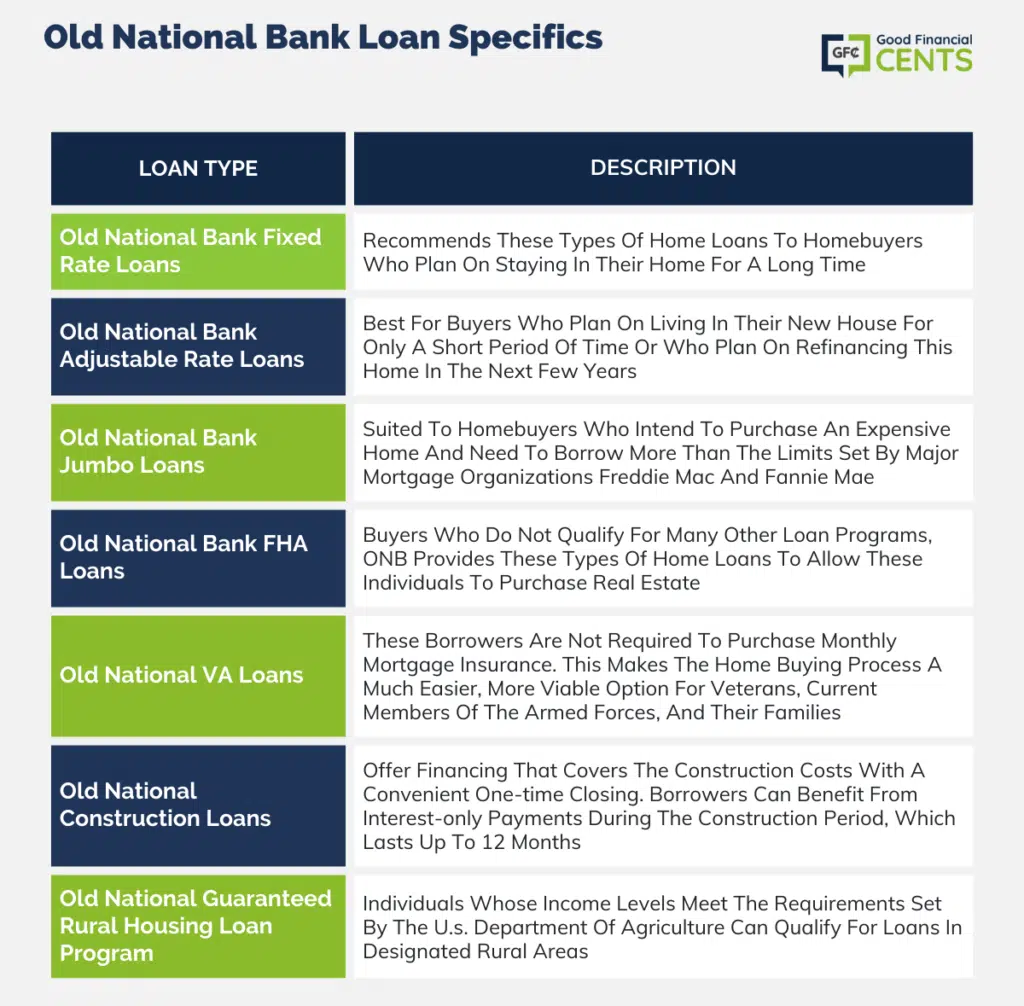

Old National Bank Loan Specifics

Old National Bank offers its customers competitive rates on a wide selection of mortgage and refinancing options. Individuals living in the Midwestern U.S. can benefit from ONB’s competitive rates and a broad selection of mortgage offerings.

Old National Bank Fixed Rate Loans

ONB generally recommends these types of home loans to homebuyers who plan on staying in their home for a long time. These loans offer stable monthly rates, which can make for intuitive budgeting over an extended period of time.

Old National Bank Adjustable Rate Loans

These home loan types are best for buyers who plan on living in their new house for only a short period of time or who plan on refinancing this home in the next few years.

They are also a good choice for buyers who believe the current interest rate for fixed-rate mortgages is too high and will decrease in the near future.

Adjustable-rate loans have a fixed payment period that lasts for the first few years of the loan before the rates switch to an adjustable payment amount based on the market.

Old National Bank Jumbo Loans

Jumbo loans are best suited to homebuyers who intend to purchase an expensive home and need to borrow more than the limits set by major mortgage organizations Freddie Mac and Fannie Mae.

For 2023, the conforming loan limit is $650,000 for most US counties. However, in certain high-cost areas, the limit can reach up to $950,000.

Old National Bank FHA Loans

The Federal Housing Administration provides FHA loans for buyers who do not qualify for many other loan programs.

These buyers may not have the funds to put 20 percent down on their home or may have a credit score below industry standards. ONB provides these types of home loans to allow these individuals to purchase real estate.

Old National VA Loans

Veterans, military members, and their spouses can apply for these types of government-sponsored home loans through Old National. Eligible applicants can put this financing toward either a mortgage or refinance.

VA loans with ONB offer borrowers affordable monthly payments and the option to put a down payment that is less than 20 percent on the home.

In addition, these borrowers are not required to purchase monthly mortgage insurance. This makes the home buying process a much easier, more viable option for veterans, current members of the Armed Forces, and their families.

Old National Construction Loans

Homebuyers who are planning on building a new home can borrow these types of mortgages from ONB.

These loans offer financing that covers the construction costs with a convenient one-time closing. Borrowers can benefit from interest-only payments during the construction period, which lasts up to 12 months.

Old National Guaranteed Rural Housing Loan Program

Individuals whose income levels meet the requirements set by the U.S. Department of Agriculture can qualify for loans in designated rural areas.

These mortgages offer 100 percent financing and no down payment requirement, making it an affordable choice for individuals looking to purchase real estate in a rural area.

Old National Bank Mortgage Customer Service

Old National Bank allows prospective borrowers to apply for home loans in a variety of ways. They have an online application, which allows individuals to create an online account and apply using an intuitive form.

Borrowers might prefer to contact a loan professional directly; ONB provides a phone number for general customer support, as well as the phone numbers of ONB’s excellent loan officers. Lastly, individuals may apply for a home loan in person at a nearby Old National Bank location.

This financial organization also has plenty of helpful resources on its website to educate homebuyers on the mortgage process.

They have various mortgage calculators, which allow customers to figure out their expected mortgage payment instantly, determine the costs of buying vs. renting property, and find out how much home they can afford.

Old National Bank offers its customers a variety of ways to make their mortgage payments. They can make a one-time mortgage payment, sign up for automatic payments, or set up budget drafting on ONB’s website.

Borrowers can also visit any Old National Banking Center to pay their bills in person. They can even mail a check to ONB or pay by phone, though the latter typically requires a small fee.

Old National Bank Lender Reputation

Old National Bank is a financial services company that has been in operation for almost two centuries. This bank services borrowers in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

Old National Bank is accredited by the Better Business Bureau with an A+ rating. With six customer reviews, the bank has an average of 1 out of 5 stars, as well as 32 complaints.

Old National Bank has won several awards in the past few years for its dedicated executives, community involvement, and employee experience. ONB offers sponsorships and grants to charitable, nonprofit organizations to lend a helping hand to the many communities the bank serves.

Old National Bank Mortgage Qualifications

Old National Bank has similar mortgage qualifications to most of the other lenders in the U.S. The most important factor ONB considers when qualifying prospective customers for home loans is the credit score.

Although individuals with a credit score above 700 should have no trouble securing a mortgage with ONB, those with credit scores in the “excellent” range should expect the best mortgage rates.

| Credit score | Quality | Ease of approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| n/a | No credit score | Difficult |

Old National Bank Phone Number & Additional DetailsBorrowers with a good credit score, a debt-to-income ratio of 36 percent or less, and the ability to put at least 20 percent down on the home (unless they are applying for government-sponsored mortgages) have the best chances of approval for a mortgage by Old National Bank.

- Homepage URL: https://www.oldnational.com/

- Company Phone: 1-812-464-1425

The Bottom Line – Old National Bank Mortgage Rates Review

Old National Bank, with its rich history dating back to 1834, offers a range of mortgage options for Midwest residents. Their competitive rates and various loan types cater to different homebuying needs.

Moreover, the bank’s commitment to ethical practices, community involvement, and employee experience adds to its credibility.

However, limited service coverage and mixed customer reviews suggest potential room for improvement in customer satisfaction and expansion to more states.

How We Review Mortgage Lenders

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment.

Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Old National Bank Mortgage Rates Review

Product Name: Old National Bank Mortgage Rates

Product Description: Old National Bank Mortgage Rates offer competitive options for Midwest residents seeking to purchase or refinance homes. With a history dating back to 1834, the bank provides a variety of mortgage types, including fixed-rate, adjustable-rate, jumbo loans, FHA loans, VA loans, construction loans, and rural housing loans.

Summary of Old National Bank Mortgage Rates

Old National Bank Mortgage Rates cater to the diverse needs of homebuyers in the Midwest region. The bank’s long-standing presence in the industry, dating back to the 19th century, reflects its commitment to serving the community. They offer various mortgage options, such as fixed-rate loans for stability, adjustable-rate loans for flexibility, jumbo loans for high-value properties, and government-sponsored options like FHA and VA loans.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Historical Legacy

- Diverse Mortgage Options

- Ethical Recognition

Cons

- Limited Service Area

- Mixed Customer Reviews

- State Restrictions