Investing has a way of teaching a great life lesson: Our changing world can be unpredictable.

Even “safe” investments — companies or assets with long histories of solid earnings — can change quickly in the volatile global market.

As financial advisors, we encourage clients to prepare for these waves by diversifying portfolios.

But there’s another tool savvy investors use to navigate choppy waters. I’m talking, of course, about options.

Table of Contents

What Is an Option?

When you hold an option, you hold the right to buy or sell a security at a certain price by a certain date. Typically, a single option includes 100 shares of the security in question.

The option does not obligate you to buy or sell the security. You can let the option expire without exercising your right to buy or sell.

And that’s why an option can be so powerful: If economic conditions change — or even if your personal situation changes — and you no longer wish to buy or sell the security, you’re off the hook.

This difference between buying and selling defines the two types of options, so let’s go there next.

The Two Types of Options

At their simplest, you can divide options into two categories: call options and put options:

- Call Option: A call option means you have the right to buy 100 shares of the security at a specified price by a certain date.

- Put Option: A put option gives you the right to sell 100 shares of the security at a specified price by a certain date.

This seems simple enough, right? Yet, in my experience, options remain one of the more nuanced and complicated concepts for beginning investors to master.

Why is that? I think options can be tough to master precisely because they are so simple. You can do a lot with these two choices.

And therein lies the fun lies for experienced investors. We’ll get to that soon enough.

First, though, let’s get a little more familiar with the vocabulary of options. Options have their own glossary of terms like “strike price,” “intrinsic value,” and “assignment.”

I won’t give you a quiz, but knowing these terms will help you understand how to unlock the power of options to make your investing more flexible and controlled. (This knowledge could also help impress your broker!)

The Language of Options

Any kind of special trade language has a way of making outsiders feel, well, outside. So to keep that from happening, let’s get up to speed with some key options terms.

Strike Price

Remember when we said an option gives you the right to buy or sell securities at a stated price before a specific date? The “strike price” is the price stated in the option.

Some traders use the term “exercise price” instead.

Exercising

If you own an option and take advantage of it — to buy the shares (with a call option) or to sell them (with a put option) — you have exercised the option.

Exercising your option requires the issuing party to either buy (with a put option) or sell (with a call option) the shares.

Expiration Date

You guessed it. The expiration date refers to the date after which your option is no longer valid.

After the expiration date, your option no longer has any value. An expiration date can be months or even years into the future.

At, In, or Out of the Money

The strike price of your option remains the same until the option expires or you exercise it. However, the price of the security continues to fluctuate on the open market.

The following terms refer to the relationship between your strike price and the current market price:

- At the Money: When the strike price and the current market price are the same, your option is at the money (ATM).

- In the Money: When your strike price gives you an advantage over the market, you’re in the money (ITM). For a call option, this happens when the strike price is below the market; for a put option, it’s when the strike price is above the market price.

- Out of the Money: The opposite of in the money, of course. When you’re out of the money (OTM), the current market price is either above the strike price for your call option or the current market price is below the strike price for a put option.

Kinds of Value

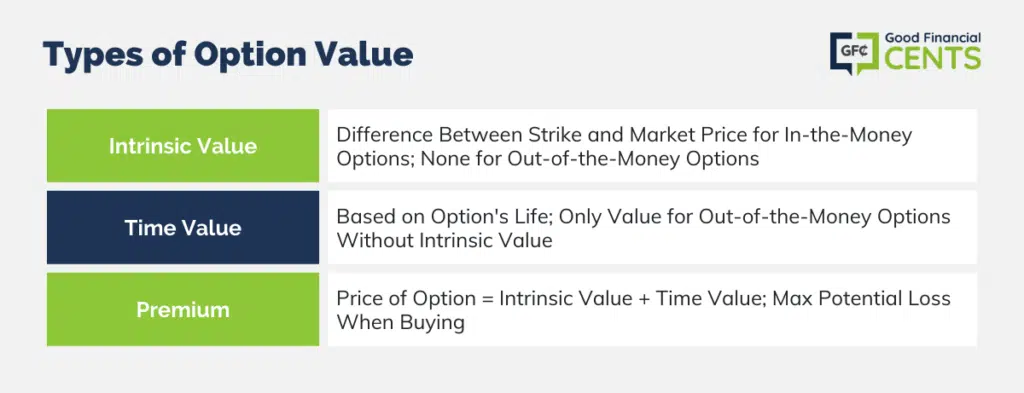

An option can have different values at different times depending on the expiration date and current market conditions:

- Intrinsic Value: If an option is in the money, the option’s intrinsic value refers to the difference between the strike price and the market price. An out-of-the-money option has no intrinsic value.

- Time Value: An option is less valuable if it is about to expire. If the option has a longer life, it has a bigger time value. Since an out-of-the-money option has no intrinsic value, it has only time value.

- Premium: The price paid for the option itself. The premium is comprised of intrinsic value + time value. The amount of the premium is also the most money you could lose if you buy the option.

Writers and Assignments

This has nothing to do with English class. Instead, it refers to the way options originate, and it has implications when you exercise an option.

- Writer: The initial seller of a new option is the “writer” of the option. Before they can be traded, options must be written into existence.

- Assignment: By writing the option, the seller makes an assignment. The assignee is obligated to sell (call) or buy (put) the shares if the owner exercises the option.

Long vs Short

When you own an option, you are “long” in the security; the option gives you a right to buy or sell.

You can also be “short” if you have the assignment; that is if you are the party obligated to buy or sell shares if the owner exercises the option.

Equity vs Index Options

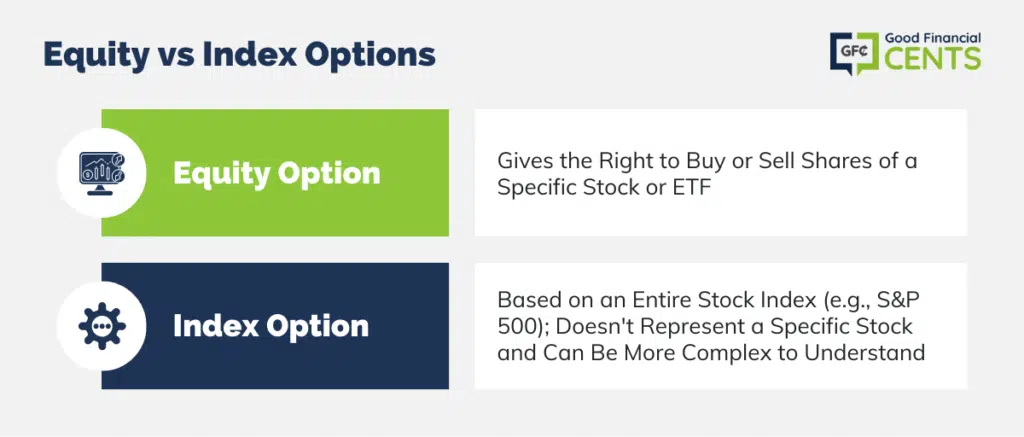

An option can give you the right to buy or sell 100 shares of a specific stock or exchange-traded fund (ETF) or 100 shares from a specific index:

- Equity Option: With an equity option, also known as a stock option, you’ll have the right to buy or sell shares of a specific stock or ETF.

- Index Option: An entire stock index, such as the S&P 500, underlies an index option. These can be a little harder to comprehend since they do not represent one specific stock.

Stock Options Quote

A stock options quote shows you all the pertinent information in one place, usually along one line of text:

- the stock abbreviation (AAPL, AMZN, GOOGL, etc.)

- the strike price

- the expiration date

- call vs put

- the premium price

Volatility and Deviation

Options are hypothetical in nature.

When you start thinking about volatility, you’re hypothesizing about the hypothetical to a certain degree. If this is too much too soon, just skim on down to the next header.

Brokers measure two kinds of volatility:

- Historical Volatility: This measures the actual changes in a particular stock over a specific period of time.

- Implied Volatility: This indicator anticipates the future volatility of a security based on measurable variables. An option whose underlying shares have a higher implied volatility tends to have a higher premium.

Along those same lines, brokers and investors will also discuss standard deviation. This also refers to the potential movement of a stock and can impact an option’s premium.

Why Trade in Options?

Experienced investors like options because they limit losses without necessarily limiting the potential for gain.

An example may be helpful here: Let’s say you are thinking about buying $10,000 worth of stock in Hypothetical Industries (HIDY) because you think the stock could be worth $12,000 in three months.

Rather than spending the $10,000 to buy the stock, you could buy a call option for $200, for example, and still control the $10,000 worth of stock.

If the stock performs well, like you thought it would, you could exercise the option or trade on its intrinsic value.

If not, rather than losing your significant investment, you’d lose only the $200 premium you paid for the option.

This may be the simplest example of how to use options, and it’s also a common approach we call speculation. You’re using your hunch or, hopefully, your market research to anticipate changes in the market then buying an option to take advantage if you’re right.

Investors use options to speculate because they can create leverage, especially if you buy an out-of-the-money option and it goes in-the-money. Options have even more elaborate and elegant applications:

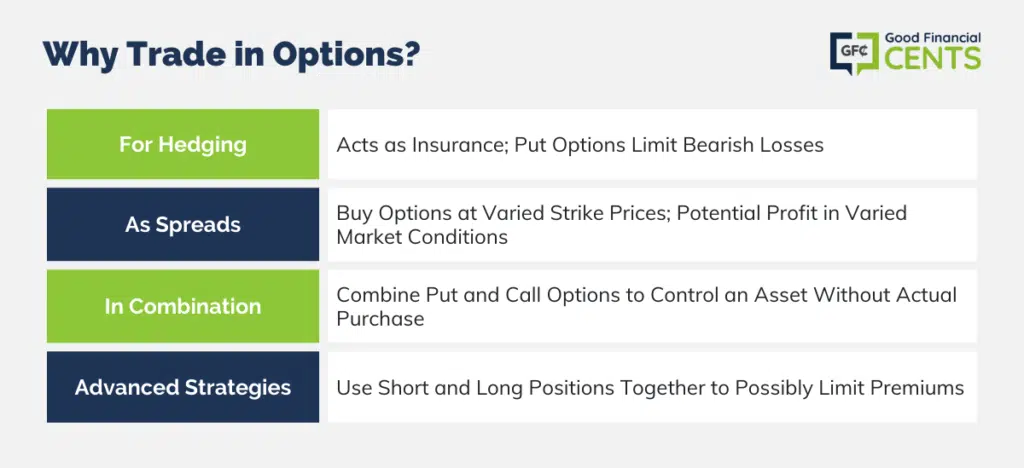

For Hedging

Options originally evolved to address this need. In this case, options work like an insurance policy.

Hopefully, you’ll never have to file a claim on your homeowners insurance, but you’re still wise to pay the premiums just in case.

Likewise, investors who use put options for hedging may never exercise their options unless their securities perform more bearishly than they’d expected.

If that happens, though, they have the option to sell at a price that limits losses.

As Spreads

Here’s where it gets really complicated. Savvy investors often create spreads when they buy multiple options at two or more strike prices.

A well-designed spread can profit no matter how the market performs.

In Combination

Similarly, investors can combine put and call options on the same security to control an asset. Some investors call this a “synthetic” position since you’re synthesizing ownership of a stock without actually buying it.

More Advanced Options Strategies

With some knowledge and experience, you can create your own win-win scenarios using options. Combining short (selling an option) and long (buying an option) positions can even limit the premium you pay to buy the options to begin with.

Your short position can help defray the cost of your long position.

Someone new to options should seek the guidance of a professional financial advisor.

Where to Trade Options

While you have a wide variety of options, pun intended when it comes to trading, we have a few favorite platforms for online options trading.

Ally Invest: Ally Invest is one of the best online brokerages, with no minimum account balance and low trading fees.

E*TRADE: If you’re a pro looking for an affordable active trading option, E*TRADE is a solid choice.

TD Ameritrade: TD Ameritrade offers affordable trading and expert advice for new and seasoned investors.

While these brokerages are excellent places to start investing in options, you should read on for a little bit more insight into what traditional brokerages entail.

How to Get Started

You’ll need to open an account with a brokerage, either in person or online before you can start trading in options. Take your time when looking for a brokerage house to make sure it fits your style and your budget.

Brokers usually charge per trade or charge by a percentage. Find out exactly what services you’re getting in return for your fees.

For example, if you want to use a sleek app to make trades, you may be willing to pay a higher commission to a broker who offers quality mobile services.

Also, if you expect your broker to guide you more actively, you should be willing to pay a little more.

Some brokers allow only one position at a time on an option. This will be fine if you’d like to simply invest in some put or call options.

But once you’ve gained some experience and you’re ready to start using spreads or combinations, you’d need a different broker.

Bottom Line

Many brokerage houses require clients to go through a screening process to assess their knowledge before allowing them into more complex options schemes.

Options can be among the safest and smartest investments you’ll ever make, but they can also cost you if your strategies don’t match the reality of your financial situation or if you’re not quite sure what’s going on.

To unlock the power of options, be patient and keep learning.

Get your feet wet before diving into the deep end.

Before long, you’ll be doing the backstroke while waving at the lifeguard.