While college graduation may be a time to party for many, leaving college also serves as a painful introduction to adulthood for those with crushing levels of student loan debt.

With average debt levels surging over $102,400 for 2023 graduates, many must spend the next decade of their lives (or longer) paying off student loans.

While most lenders offer a grace period of 6 months or more before you must begin repayment, the monthly payments that will follow are inevitable.

No matter how much you owe, and no matter your financial situation, student loan debt cannot normally be discharged in bankruptcy. The vast majority of the time, the only way forward is to get on a payment plan and keep going – whether you like it or not.

Still, there are plenty of ways to shorten your repayment timeline, save money on interest, and even get a large percentage of your student loans forgiven. Which path is best depends on the individual, their debt levels, and their long-term career goals as well as their salary.

“Never accept your loan at face value”, says Taylor Schulte, CFP® a San Diego Financial Planner and the founder of Define Financial. “I see too many clients assume they don’t have any alternative options or they are stuck with the monthly payment displayed on their statement.

If you don’t do anything else, pick up the phone, call the number on your student loan statement, and start asking questions. A few months ago, I made this call with a client and simply asked “What can we do to lower the rate on this loan?”

“To my client’s surprise, they said that if she simply signed up for auto-pay they would knock the rate down by 0.25%. All it took was a quick phone call and we had our first win.”

Before you let your student loans get you down, you should take a hard look at all of your options.

Table of Contents

Loan Forgiveness Programs

If you earned a degree in a low-paying field, you should take a close look at student loan forgiveness programs to see if they might be your best option.

These programs are offered through the federal government, and offer forgiveness of your loan balances after you meet certain repayment requirements for anywhere from 10 – 25 years.

The first type of loan forgiveness program worth considering applies to those who might be able to work in the public sector upon graduating.

Public Service Loan Forgiveness (PSLF) forgives the remaining balance on your loans after you make 120 timely payments while working for a “qualifying employer” for a full ten years.

That last part – the “qualifying employer” part – is the tradeoff you’ll make if you sign up for this program. According to the U.S. Department of Education, a qualifying employer for PSLF can include:

- Government organizations at any level (federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that provide certain types of qualifying public services

Since careers in public service tend to pay lower salaries, you’ll generally earn less during this ten-year period than if you had found work in the private sector. So, while your student loans may ultimately be forgiven, you may need to sacrifice higher earnings to get there.

Of course, there are several other loan forgiveness programs to look at that are considered “income-driven.” These programs ask you to pay a certain percentage of your “discretionary income” towards your loans for anywhere from 20-25 years.

That’s a long time to slug away at those payments for sure, but for those with a high level of debt, who failed to get college loans without a cosigner, income-driven repayment plans can be the smartest, and most feasible, option.

The chart below highlights income-driven repayment plans and how their benefits stack up side-by-side:

Income-Driven Repayment Plans

| INCOME-DRIVEN REPAYMENT PLAN | PAYMENT AMOUNT | REPAYMENT TIMELINE |

|---|---|---|

| REPAYE Plan – Revised Pay As You Earn Payment Plan | 10% Of Your Discretionary Income | 20 Years for Undergraduate Loans, 25 Years if Some of Your Loans Were for Graduate Study |

| PAYE Plan – Pay As You Earn Repayment Plan | 10% Of Your Discretionary Income, but Not More Than the 10-Year Standard Repayment Plan Amount | 20 Years |

| IBR Plan – Income-Based Repayment Plan | 10% Of Your Discretionary Income if You’re a New Borrower After July 1, 2014, but Never More Than the 10-Year Standard Repayment Plan Amount | 20 Years if You’re a New Borrower on or After July 1, 2014 – Otherwise, 25 Years |

| ICR Plan – Income-Contingent Repayment Plan | The Lesser Of: – 20% Of Discretionary Income – What You Would Normally Pay For 12 Years of Standard Repayment | 25 Years |

Whether an income-driven repayment plan is right for you depends on several factors, including:

- How much you may earn in your career during the next 20-25 years

- Whether you want to pay down your student loans for two decades or more

- Whether you would be better off paying your student loans on a faster timeline to become debt-free

- How not taking advantage of loan forgiveness could affect your quality of life

At the end of the day, only you can decide if loan forgiveness is right for your situation. You can read more about the intricacies of each income-driven repayment plan on the U.S. Department of Education’s resource page.

Jobs That Offer Student Loan Forgiveness

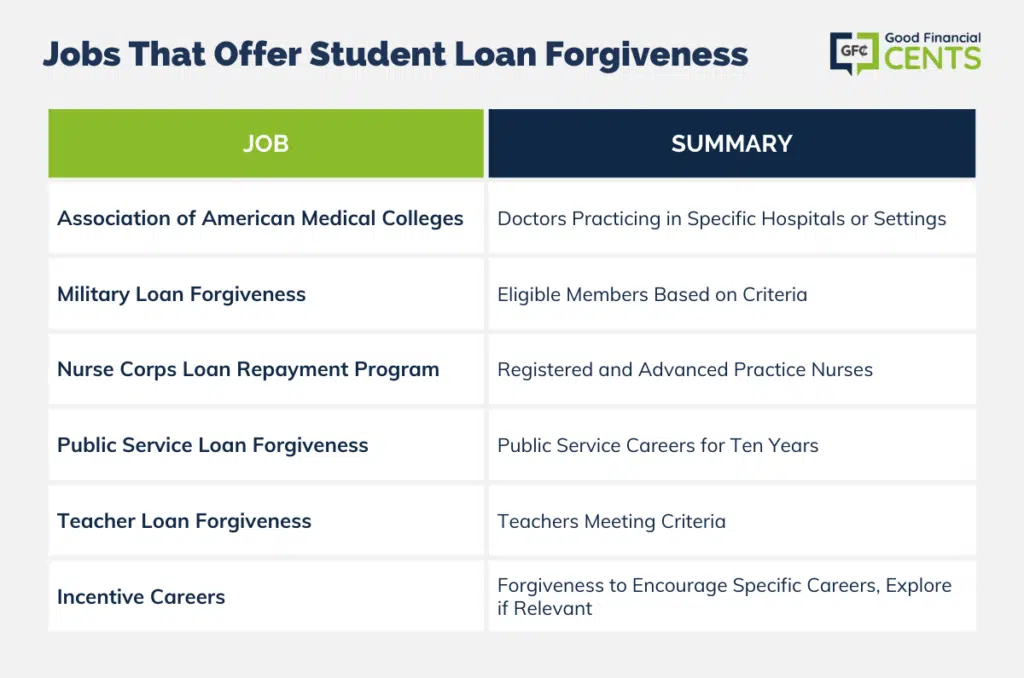

While federal student loan forgiveness programs offer the most obvious way to get your balances forgiven at some point in the future, certain jobs and careers may offer forgiveness as part of your compensation package – or as an employee perk.

Jobs that offer student loan forgiveness can include:

- Association of American Medical Colleges – Across the nation, 67 separate programs are available for doctors who agree to practice in certain hospitals or settings.

- Military Loan Forgiveness – Certain members may be eligible for loan forgiveness or scholarships if they meet certain criteria.

- Nurse Corps Loan Repayment Program – This loan forgiveness program is available to registered and advanced practice nurses who qualify.

- Public Service Loan Forgiveness – Public Service Loan Forgiveness is offered to individuals who agree to work in public service careers for ten years or longer.

- Teacher Loan Forgiveness – Teacher loan forgiveness is available for teachers who meet certain criteria.

These are just some of the jobs that may offer forgiveness to incentivize you to stick with a certain career. If you plan to work in one of these fields regardless, these programs are definitely worth checking out.

Should You Refinance Your Loans?

While loan forgiveness programs are a smart idea for many young people saddled with debt, some of us have no desire to make student loan payments for decades on end, work in the public sector, or stick with a job we don’t truly enjoy.

Many students may find relief from crushing student loan debt simply by refinancing their student loans into a new product that offers a lower interest rate and better terms.

The best part is, that refinancing your loans means never having to work in a certain profession or pay a percentage of your discretionary income for decades. With refinancing, you remain in control of your life – and your career.

Credible is a company that offers student loan refinancing at competitive rates that may be lower than what you’re paying now. If you feel your rate is high, check out Credible to see if they can offer a better option.

Other companies that offer student loan refinancing include:

- LendEDU

In addition to securing a lower interest rate, here are some other reasons it might make sense to refinance:

- You Have Multiple Loans at Several Interest Rates: If you are paying several payments each month, it can refinance all your loans into one product with a low rate and ideal terms.

- Your Loans Have a Variable Interest Rate: If you worry about how a variable rate could affect your loan payments in the future, you can consider refinancing into a fixed-rate loan product with monthly payments that will never change.

- You’ll Earn Too Much to Qualify for Income-Driven Repayment Plans Anyway: If you earn too much to qualify for a loan forgiveness program, refinancing or consolidating at a lower interest rate might be your best – and only – real option.

However, it’s important to remember that refinancing federal loans with a private lender will result in the loss of certain protections from the federal government, including deferment and forbearance.

Refinancing federal loans also means you’re no longer qualified to take advantage of loan forgiveness programs in the future – even if your situation changes down the line.

Also, if your credit is poor, you are going to have a hard time getting student loans without a cosigner. This puts you in a spot where refinancing may not be possible.

If refinancing sounds like it could be right for your situation, check out this calculator at SoFi to see how much you could save.

Debt Snowball vs Debt Avalanche

Whether you choose to refinance your loans and get approved for a loan with a rate that is better all around, or not, this last section is something you’ll want to pay attention to.

Once you are happy with the terms of your loan and your interest rate, you have the option to pay your loans down much faster than the normal 10 or 15-year timeline. That’s right; destroy your loans, and don’t stop until they’re gone!

| If you have just one loan to contend with, your strategy is simple: Throw as much money as you can towards your loan payment every month in order to a) reduce the principal on your loan as quickly as possible, b) get out of debt faster, and c) save money on interest. |

If you have several loans to service, your choices are a little trickier. While there is no “wrong way” to pay down debt, most people choose from one of these two strategies:

Debt Snowball Method – The debt snowball method requires you to list your loans from smallest to largest balance.

In order to score “psychological wins,” you’ll pay the minimum payments on all of your biggest loans and throw all your “extra” money towards your smallest balance until it’s dead and gone.

This method is great for people who want to minimize the number of payments they’re making altogether and destroy their loan balances – from smallest to largest.

Debt Avalanche Method – While the debt snowball method is smart if you want to annihilate your small loans right away, the debt avalanche method might be a better move if several of your loans are at a really high-interest rate.

With this strategy, you’ll list all your loans by interest rate and start throwing all your “extra” funds at the loan with the highest rate instead of the smallest balance.

This will help you pay down the loan with the highest interest rate first, which will ultimately save you money.

However, it might mean paying several student loan payments for a longer duration, which may not be ideal. Then again, you could always consider refinancing and consolidating all your loans with SoFi.

The Bottom Line

Leaving college with tens of thousands of dollars in student loan debt is certainly not ideal, but that doesn’t mean you have to lay down and die.

Most of the time, a solution such as refinancing or loan forgiveness can help ease the burden of carrying so much debt – or at least make the experience a lot less painful.

The key to minimizing the impact of your debts is researching all your options and choosing the best solution based on your debt levels and personal goals.

There may be no “wrong” way to pay down your student loans, but there are several ways to get out of debt faster, lower your monthly payments, and save money along the way.

As always, it’s up to you to figure out how to approach your student loans, and whether to tackle them outright or set yourself up for forgiveness down the line.

With anywhere from 10 -25 years of payments and thousands of dollars of interest on the line, we suggest you choose carefully.

I am 62 with a mountain of parent plus loan debt (200k), any suggestions other than the ones given above.

is there any help for a person who is in judgement? Since 2004 I have been trying to get help but to no avail. Ohio State is holding my transcripts and have been since 2004 because of a private loan of 1500. and now it is over 20,000. I have student loans with federal loans, and it has been over 20 years that I have tried to use my bachelors degrees in order to pay my loans but I can’t get a job in my field.

Hi Sammy – A judgement is a tough one because it’s court ordered. You can try to negotiate with the original creditor, but you may need to get an attorney. As well, it will depend on the laws in your state. This is really a legal matter that this blogger doesn’t have a concrete answer for.

Fortunately I had my first four years of college paid for by my grandparents. Deciding to stay two extra years dug me a small, yet still painful amount of student loan debt. With a little diligence, and patience, I made the payments every month and on schedule found myself student debt free.

That’s the way to do it Eric. If the debt is high enough, you almost have to hit it with everything you’ve got until it’s gone. The payoff for the sacrifice is that once the debt is gone you’re free to get on with your life.

Yes, the key to minimize the impact of debt is to keep control on loans that you borrow. Leaving college with burden of debt is certainly a thing of past. you can manage it with little efforts.

Debt avalanche for the win! Some people praise the snowball, but I like mathematics. I’d rather have the cash than the fleeting psychological benefits 🙂