As Americans grappled with the financial consequences of the pandemic in March of this year, the federal government took several actions to help cash-strapped consumers. For starters, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in late March 2020, which included a temporary suspension of payments and interest for government-owned student loans through the end of September 2020.

Beyond just suspending payments and interest, the act also halted all collections activities on federal student loans. Americans pursuing Public Service Loan Forgiveness (PSLF) would see these non-payment months counted toward the 120 months of payments needed to have their loans forgiven.

You can continue making payments on your federal student loans during the deferment period if you want to. Whether you should, depends on your goals and your situation.

This announcement was a huge relief for Americans with student debt since it meant they could pause federal student loan payments without accruing interest or facing penalties for several months. And recently, this assistance was extended for the remainder of 2020.

Table of Contents

About the Student Loan Deferment Order

According to a memorandum from the White House, this extension intends to “provide such deferments to borrowers as necessary to continue the temporary cessation of payments and the waiver of all interest on student loans held by the Department of Education until December 31, 2020.”

What does this mean for borrowers? The extension of this order means that those with federally owned student loans (not private student loans) can continue skipping payments for the duration of 2020. Interest won’t accrue on federal student loans during this time, and penalties won’t come into effect for those who choose to defer loan payments.

How Does This Help Student Loan Borrowers?

Although unemployment numbers have improved since the summer, the initial pause on federal student loan payments was of massive help for borrowers struggling with job loss or a loss in pay.

After all, getting a break from student loan payments made room for funds to go toward other household needs and bills. Keep in mind that the average student loan payment is approximately $393 for all borrowers, but that many with advanced degrees pay significantly more than that every month.

When the Presidential action was released, it was unclear whether borrowers pursuing PSLF would still receive credit for non-payment months. However, a U.S. Department of Education press release clarified that PSLF borrowers would, in fact, receive credit toward loan forgiveness as if they’d made on-time payments.

Keep In Mind

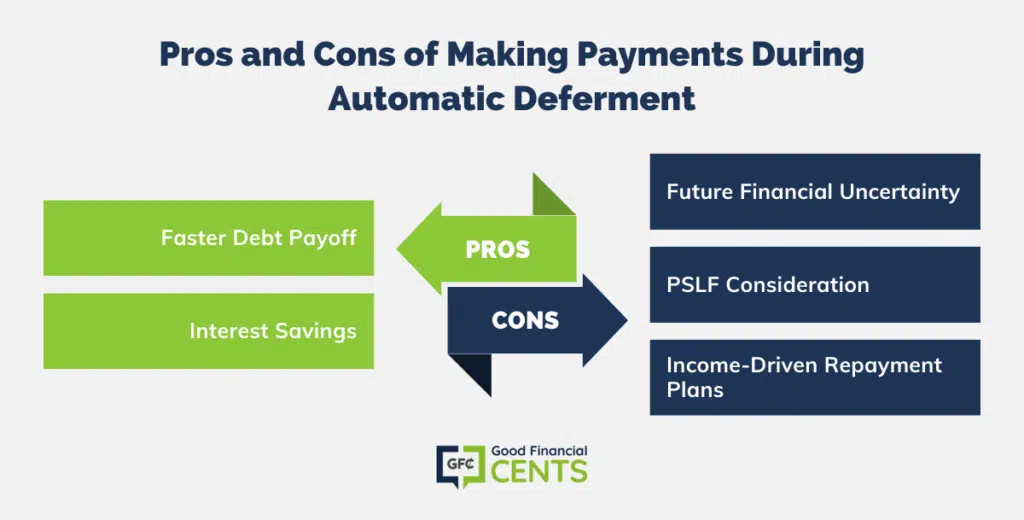

Pros and Cons of Making Payments During Automatic Deferment

One interesting detail from this order is buried in the fine print:

In summary, you can continue making payments on your federal student loans during the deferment period if you want to. Whether you should, depends on your goals and your situation.

Benefits of Making Loan Payments

If you haven’t faced a loss in income, then you might be tempted to continue making payments on your student loans. The benefits of doing so include:

- Paying down your student loan debt faster. The Department of Education says that, through the end of 2020, “the full amount of your payments will be applied to principal once all the interest that accrued prior to March 13 is paid.” This means that every cent thrown toward your loans right now applies to your loan balance, quickly reducing your student debt on a dollar-for-dollar basis.

- Saving money on interest. Because of the way interest accrues on student loans and other debts, reducing your balance will automatically save you money on interest over the long haul. The more you pay toward your student loans now, the more money you save.

Disadvantages of Making Loan Payments

There are a few potential downsides to making student loan payments when they’re not required. Plus, borrowers with certain types of student loans should not be making payments right now.

Here are a few considerations to keep in mind.

- You may need the money later on. Even if your income is fine right now, the financial fallout from the pandemic is far from over. If you choose to make student loan payments through the end of the year and lose your job in a few months, you might wish you had saved that extra cash instead.

- Those pursuing PSLF shouldn’t make payments. If you’re pursuing PSLF, then this deferment period is counted toward the 120 on-time payments you need for loan forgiveness. If you continued making payments through the end of the year, you would be throwing money down the drain.

- Most borrowers on income-driven repayment plans have little incentive to make payments. If you’re on an income-driven repayment plan like Pay As You Earn (PAYE) or Income Based Repayment (IBR), then your loan payment is only a percentage of your discretionary income, and your loans will be forgiven after 20-25 years of on-time payments. Borrowers who aim to have their loans forgiven after 20-25 years anyway should skip payments through the end of the year and set aside their cash for a rainy day instead.

The Bottom Line: Should You Pay During COVID-19 Student Loan Deferment?

Individuals who want to pay off their loans quickly would be smart to pay as much as they can, but only if they can afford it. It also makes sense to be cautious about any extra income you have for the time being. After all, more economic pain may be on the way, and it’s possible you could face a loss in income later in the year.

Without any interest accruing on federally owned student loans during this historic forbearance, however, you could always put your student loan payments into a high-yield savings account until the end of the year. At that point, you can assess your financial situation and make a large, lump sum payment toward your loans if you want.

This strategy creates a greater safety net for the remainder of 2020 while also paying down debt faster with a large payment before the end of December. Run the numbers and make sure you have a plan (and a backup plan) in place.