Two of the most popular web-based financial service providers available are Empower (formerly Personal Capital) and Mint.

The two provide a lot of similar services, but each specializes in a few areas of your finances that the other doesn’t.

Both offer a free service, though Empower has an attractive premium service in which they will manage your investments for you.

Which is the best service for you?

Both do a few things well and omit a few others, but which will work best for you will depend on what it is you want to do. Both services are highly ranked in my The 11 Best Personal Finance Software to Get Your Money Swag On post.

Table of Contents

But let’s do a summary review of each to help you see which will fit your needs.

Empower Summary

Since we essentially have to cover two services in this article, we’re going to do summary reviews of each platform. I’ve also done a more detailed review of Empower if you’d rather read that.

Empower is a financial aggregator, which means that you can have all of your financial accounts on one platform. That includes investments, savings, checking, credit cards, and other loan accounts. It does handle investment management for you, but it goes well beyond that single function.

With the free version, you are provided a personalized analysis of your financial situation. Empower will analyze your current investment mix and perform an assessment of the risks and opportunities that may be available to you. They will then make recommendations based on that analysis.

The free version also includes full use of the dashboard, the 401(k) analyzer, an investment check-up feature, and the retirement analyzer. You will also have access to the mobile app.

The paid version uses Empower’s Wealth Management program, in which the platform will take direct control of your investment portfolio. Your investments will then be actively managed by Empower’s investment advisors.

Empower Fees

Fees apply to the premium Wealth Management program and currently look like this:

- 0.89% of the first $1 million

- 0.79% of the first $3 million

- 0.69% of the next $2 million (up to $5 million)

- 0.59% of the next $5 million (up to $10 million)

- 0.49% on balances over $10 million

One of the more positive aspects of doing business with Empower is that the fee structure is all-inclusive – there are no additional fees like commissions, account administration fees, or other investment fees. And the fee applies only to the actual amount that you have under management. Accounts included on the platform – but not actively managed by Empower – such as a 401(k) plan or investments held with other brokerage firms, are not subject to the fee.

Empower Account Minimum

Your minimum initial investment is $100,000, which applies only to the paid version.

Empower Investment Strategy

Empowerr determines your risk tolerance, life’s goals, and personal preferences to determine how much growth (risk) they incorporate into your investment portfolio. Like many investment management firms, they use Modern Portfolio Theory, or MPT, to manage your portfolio. MPT holds that asset class selection is more important than individual security selection.

They generally use index funds, invested in six main asset classes – US stocks, US bonds, international stocks, international bonds, alternative investments (including commodities), and cash. But they don’t limit investments to index funds alone.

They will also include a mix of 70 to 100 individual US stocks that they will use for greater diversification as well as improved tax efficiency. However, index funds are used exclusively for clients who have less than $100,000 under management.

Since Empower aggregates all of your investments, they do consider your other investments that are not under their direct management in building your portfolio.

- Personal Financial Advisor: Everyone who uses Empower is assigned a personal financial advisor, whether you use the free or premium version of the program. You can contact this person when needed for advice.

- Empower’s Private Client Group: This service is available to investors who have at least $1 million to invest through the platform. It offers personalized investing and wealth planning and gives you direct access to a certified financial planner and a whole team of licensed advisors. This service level also comes with private banking services and legacy planning that can help you establish trusts for your heirs.

- Tax Optimization: This is another perk of the Wealth Management program, and it seeks to lower the tax bite of your investing activities. They do this through the use of individual stocks, which are more easily bought and sold and can readily be used for tax loss harvesting, or TLH. TLH is the process of selling losing stocks to offset gains on the sale of profitable stocks. It creates a backdoor tax deferral system that enables your investments to grow with minimal negative impact from income taxes.

They also employ a tax allocation strategy, in which income-producing investments, like high-yield stocks and REITs, are held in tax-deferred accounts, while investments that generate capital gains – like stocks and ETFs – are held in taxable accounts so that tax loss harvesting can be used to lower capital gains taxes.

The Empower Mobile App

Empower’s mobile app is available for your Apple iPhone, iPad, Apple Watch, and Android. The mobile version has everything that is available on the desktop platform, and it’s absolutely free.

Other Empower Features

Empower has a wide range of tools and features that provide real benefits to the users.

Some of those tools include:

- Retirement Planner: This tool helps you to know if you’re on track to retire and even allows you to make adjustments for major life changes, such as job/career/income changes, illness, childbirth, or saving for college.

- 401(k) Fund Allocation: Even though Empower can’t manage your employer-sponsored retirement plan, they can analyze the plan and make asset allocation suggestions based on all of the investment options available in the plan,

- Net Worth Calculator: Track your assets and liabilities so that you can quickly find your net worth at any time. This tool will help you to really know if you’re on track to reach your long-term financial goals.

- Cash Flow Analyzer: Use this tool to create a budget where you can track your income and expenses, whatever the sources. This will help you see where you’re spending money so that you can free up income for savings, investing, and debt payoff.

- Investment Checkup Tool: This can provide a risk assessment of your portfolio, including your retirement plan. It will make suggestions to help you improve your asset allocation plan to make it consistent with your goals and personal preferences.

Empower is an all-in-one financial management platform with a heavy emphasis on successful investment management. It’s one of the very best services of its kind.

Mint Summary

One of the big advantages of Mint is that the service is completely free to use. The service is easy to sign up for and simple.

Much like Empower, Mint is an aggregator for your entire financial life. That includes checking and savings accounts, credit cards, loans, and investment accounts. The service claims to be able to connect with “almost every US financial institution connected to the internet”.

The service is valuable for creating a budget, but it also helps you to track your finances and monitor all of your financial accounts on the same platform.

Some of the features Mint has include:

Budgeting

This is Mint’s strong suit and the primary reason you would use the service. Once you sync your accounts and transactions, they will be automatically sorted into the appropriate categories going forward. Updates then occur in real-time.

You can also set up sub-categories of certain expenses to customize the presentation in a way that works best for you. Once you have your account set up, you’ll be able to track, analyze, and adjust expenses and spending habits as needed.

The site does enable you to make adjustments to your expenses even after they have been categorized. Once changes are made, Mint will automatically place similar transactions within the same expense categories.

Mint Bills

Mint enables you to be able to connect an unlimited number of accounts, which means you can add any and all bills you have, including credit cards and other loan payments. Not only does it provide you with alerts of upcoming due dates, but it also shows you your available cash and credit next to the upcoming bills.

You can pay bills with either a bank account or credit card, and it even allows you to schedule payments. The feature is available on your personal computer and your mobile device.

Custom Tips and Savings

Mint analyzes your accounts and then makes recommendations that will save you money based on your lifestyle and goals. In fact, they have an entire page dedicated to saving you money on credit cards (in the “Find Savings” tab at the top of the main page).

But since they analyze all of your financial accounts, they may also be able to find and recommend banks and investments where you can earn higher returns, the lowest insurance rates, plus more attractive cash-back offers from credit cards.

Establishing Goals

You can create goals within the Mint application. This can include saving money for specific purposes (college, retirement, vacation, etc.), paying off debt, or paying off your mortgage.

Mint Alerts

By signing up for alerts, you will be notified by email or by smartphone when there are significant changes in your finances. Alerts will be sent when there is a large purchase, an upcoming bill payment, late fees, loan rate changes, and when you may be in danger of going over your budget.

Mint Mobile App

The full Mint suite is also available on the Mint mobile app. This will provide you with all of the information and services that are on the website while you are on the go.

Check into your finances anytime, anywhere. The mobile app works with Apple iPhone and iPad and Google’s Android. And like Mint itself, all mobile apps are free.

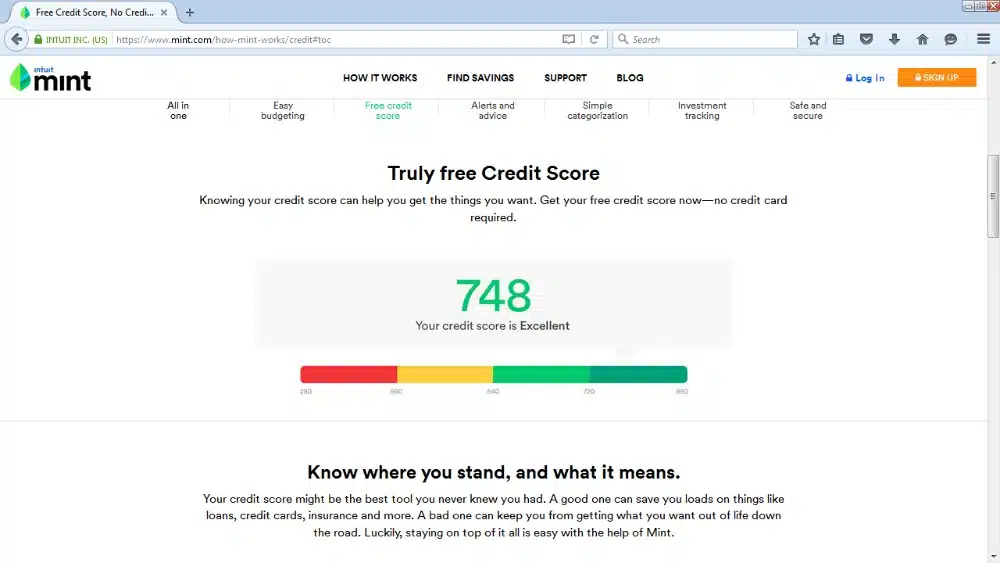

Credit Score Monitoring

Mint offers credit monitoring, and no credit card is required to participate. This makes it a truly free credit monitoring service. You can get your credit score in as little as two minutes, enjoy daily monitoring, and get credit alerts when Equifax (one of the three major credit bureaus) receives new information from your creditors.

The service even shows you the factors that are impacting your credit score and how to use them to improve your score.

Investing With Mint

Mint doesn’t actually manage your investments, but as an aggregator, it provides a complete picture of your investment portfolio, including charts and graphs. They do provide advice, tips, and tools to help you better manage your investments based on your own investment style.

For example, Mint can provide an analysis of your retirement accounts and brokerage accounts to let you know about investment fees that may be buried in places you can’t see them. They’ll make you aware of these fees and suggest possible workarounds.

Mint may be the perfect service if you’re looking for a budgeting program – with credit score monitoring – free of charge.

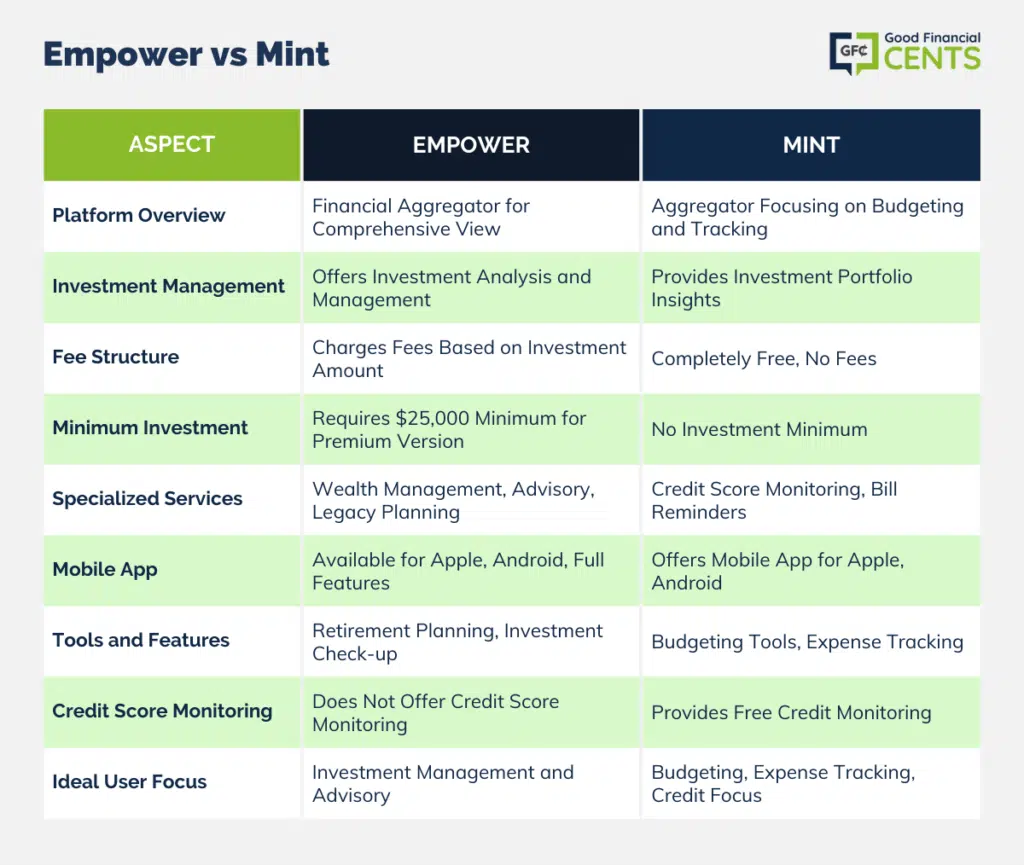

Empower vs Mint – Where They’re the Similar

Both Empower and Mint are financial account aggregators, which means that they each offer you the opportunity to keep and monitor your entire financial life on one platform. In addition, each offers its service free of charge.

Both services also offer mobile apps, including valuable account alerts to keep you on track with your finances.

Empower vs Mint – Where They’re Different

Where the two seriously part company is in regard to their primary missions. For example, Mint is, first and foremost, a budgeting program. In that regard, it is the superior platform if you are primarily looking to get control of your finances.

They not only help you to stay on track with your budget, but they also make suggestions as to how you can do that more efficiently. The free credit score monitoring feature is an added bonus since so many people need both budgeting assistance and ongoing credit monitoring.

Where Empower shines is with investing. While Mint offers supplemental investment assistance, Empower offers professional investment management. This includes levels of investment help, from assisting you in your own efforts at do-it-yourself investing all the way up to comprehensive wealth management.

And the Winner is…it Depends

In most head-to-head comparisons, it’s rare that any one service is better than another, and that’s the case with Empower and Mint. If your primary emphasis is on budgeting and monitoring your credit – which typically comes before you start investing – then Mint is the clear winner.

But if you’re looking primarily for investment expertise and management, then Empower should get the nod. This is especially true for high-net-worth individuals, who may be particularly interested in wealth management, private banking services, tax optimization, and estate planning.

As similar as these two services often appear on the surface, they each have specializations that make them very different platforms.

What are your thoughts on Empower and Mint? Have you had experience with either?

The Bottom Line – Empower vs Mint Financial Services

Choosing between Empower and Mint depends on your financial priorities. While both offer free services, they excel in different areas. Mint is a budgeting-focused platform with credit score monitoring, making it ideal for those seeking control over their finances.

On the other hand, Empower specializes in investment management and wealth planning, making it a better fit for those looking to enhance their investments and financial strategy. The winner depends on whether you prioritize budgeting or investment management. Both platforms have unique strengths that cater to different financial needs, providing valuable tools for users to consider.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Empower (formerly Personal Capital) Financial Services Product Description: Empower is a digital wealth management tool designed to give users a holistic view of their finances. With its primary focus on investments and long-term financial planning, it combines robust analytical tools with personalized advice. Summary Empower offers a comprehensive suite of financial tools, including a dashboard that consolidates all assets and liabilities to provide a complete financial picture. It excels in tracking and analyzing investments, and its built-in retirement planner aids in ensuring users are on track. Additionally, with access to human financial advisors, the platform bridges the gap between technology and personalized financial advice. Pros Cons

Empower (formerly Personal Capital) Financial Services Review

Overall

I installed PC and started loading information and links and immediately a Red Flag went up in my head. Am I the only one nervous about giving an app access to all my financial accounts? I only have 5 different institutions holding my investable assets. But why on earth would I allow an app the power to see all 5? Look, call me a Neanderthal and I’m a retired federal law enforcement type and military officer. Which maybe is exactly why there’s no way I’m going to let any for profit commercial types know 100% about my finances. Not smart.

Please I’m all ears- why would I want to do give PC this powerful information? Oh, and if/when they’re hacked. It’s called compartmentalization, folks. Never, ever let someone you don’t personally trust know everything about you.

Thanks for your breakdown.

I just signed up for Mint the other day, set up my budgets tonight. I think I will set up everything identically in Personal Capital tomorrow.

I’ll run them both for a few weeks and see which to stay with. My focus right now is budgeting but within 3 years it will shift to investing, so I may prefer Mint for now . . .we’ll see!

I’ve used Personal Capital for several years now. They perform as advertised UNLESS anything changes with your interface access to your accounts. My bank changed their software which messed up the interface access. It has been two months now and their IT department still hasn’t fixed the interface with no relief in sight. What good is the account if you cannot update transactions and balances? Sure the service is worth what you paid for it. But it leaves me wondering if they would manage your money like this also. I’ll contact support again in six months. In the mean time I’m back to using Mint. They fixed their interface with my bank within two weeks. Just sayin…

I’m looking to move on from Quicken 16 (not into paying $45/year for subscription fee) – but something I’m not sure of and haven’t been able to find out for sure … does PC or Mint allow users to reconcile accounts? Seems like all the Quicken alternatives allow users to download from external institutions (banks , credit cards , etc) … but I’m not sure if they all allow users to reconcile accounts?

Hi Rob – Unfortunately, neither Personal Capital nor Mint offer account reconciliation 🙁

I liked Mint but it seems like they frequently have issues connecting to financial institutions. Personal capital has issues too but a lot less frequent than Mint. It was a he main reason I made the switc to personal capital.

Hi Richard – I have heard similar stories from others. It may be that Mint is having difficulty syncing with certain institutions, or perhaps a flaw in their system itself.

Ive used Mint for years. It’s an excellent tool BUT! At times security at my bank has changed and then I’ve had to add my accounts back in, which then cause them to be fragmented. It happened 3 times so I now have 15 fragmented, unlinked accounts. So when I go to have my taxes done this year I dont know where to start as far as collecting all my numbers. I called customer service and they were happy to help me for $100. No thanks.

Did you ever get it worked out? I love that PC is a “one-stop shop” for all of my investments and accounts, but there is a credit card with my credit union that, for whatever reason, won’t show up. So those purchases aren’t reflected in my transactions until I pay the card.

I sent my request in about a week ago and have heard nothing.

In the week+ since I set up PC I have been unable to establish a link with my primary checking and savings account holder – Capital One Bank. PC is adamant that they have established users linked to CO but so far, they cannot resolve this. I called CO and they informed me that PC does not have authorize to sync with CO.

What am I missing here?

Hi Jack – The only thing I can think of is to have someone at PC contact Capital One. If not, you may just have to leave that account out. Or contact Capital One and threaten to close your account if they don’t help. You’re in a tough spot with no easy answers.

I like the layout and organization of information on Personal Capital, but have had problems syncing my main accounts (saving, checking, two credit cards) which are at Fifth Third bank. I’ve been waiting 20 days now since my support request was submitted. Other accounts sync fine. If they can’t or won’t fix this, I’ll give up the app.

an Excel spreadsheet is must simpler and safer for budgeting. Add tabs to monitor and track investments. Do you really want all of your finances in someone else’s hands? Be wary of hackers….they’re all around us.

Great post. I have used both Mint and Personal Capital for the past 3+ years and still do to this day. They live right next to each other on my phone – since they both have pluses and minuses. Like you mentioned I use personal capital for the investment recommendations, it helps me ensure I have a balanced portfolio – which twice it has gotten out of whack and I noticed and re-balanced. I also really like the Personal Capital emails they send at the end of every week on Sundays saying how much your spending compared to the previous month. Mint since I have been using it for 6+ years I can use the historical data to see how much my net worth has grown. Thanks for sharing your review. Love the blog.

Mint is a joke. They need to spend a few years working on their ability to connect to financial institutions and to allow their users to log in. I know it’s free, but losing access to it for weeks at a time (this happens a A LOT) makes it an utter non-starter.

To easily put it: Personal Capital for investors, Mint for everyone else.

I prefer the Mint budget but Personal Capital is miles ahead in investments!

We actually stopped recommending Mint.com to our wealth management clients because of how spammy it is now. It’s too bad because it made it so easy. Now, I use Personal Capital for everything and I love it!

I really love PC but I’ve never bought in all the way because of the lack of features. For example, I currently use iBank (now Banktivity) because I want reports that show my my total spending including deductions. This is very useful when selecting which insurance I want to use. Having the paycheck deductions included is critical. How have your clients gotten around this problem? Do they even worry about that?

Not really Brian.

I currently have an account with both and I’m having trouble deciding which is better. I feel PC could be the winner if it just played nicer with my credit union. I have two accounts with the same bank and I can never get the second account to load. While both but especially mint takes time to manage when it comes to transactions. A $300 withdrawal in cash goes to rent and a car payment. Nothing is 100% hands free I suppose.

Did you ever figure out how to fix the “two accounts with the same bank” problem in PC (or does anyone else know how)? My wife and I each have checking accounts at the same banks (don’t ask why they’re still separate) and also have our own 529 accounts for our kids with the same 529 plan (which are separate for much better reasons). But even though PC says that you can link an account with a different login, every time I try to add one of my wife’s accounts, the program just replaces the login info for my account with her login info. It’s quite annoying, and I can’t figure out what to do with that. Any suggestions would be welcome. Thx.

Nice article. I have tried both services in the past, and both Mint and Personal capital are great free services for linking financial accounts. With Personal Capital I’m able to also link my Certificate of Deposit account I have with a credit union, where as with Mint I was unable to do that. So both have advantages and disadvantages.

I am not a fan of Personal Capital. I find it bloated and too difficult to use. Maybe it’s because Mint was my first love, but I just can’t get behind PC. Still, anything that gets people to save money and invest is a solid app in my opinion.

Great article, Jeff!

I appreciate your summary of PC Premium and would love a comparison of their service vs Betterment, Wealthfront, etc….

My wife and I are using PC (Free) for budgeting, net worth and monitoring our investments…

The positives are: 1. It is easy to evaluate each expense 2. It is easy to determine net worth. 3. We love the everything in one place. and 4. I don’t seem to get a bunch of ads for related products using PC like I did with Mint.

The PC improvement opportunities: 1. There is no good way to account for cash expenditures 2. You cannot create your own customized categories (a source of irritation for my super anal wife! 🙂 ) 3. It doesn’t actually aggregate every fund. We have a fund that doesn’t work with PC and asked them to include it and they essentially said they would only when it was popular enough.