Many investors are becoming more interested in applying the “do-it-yourself” approach to managing their portfolios.

But let’s be clear: Managing your own investments is not easy.

Good investment management practices are complex and time-consuming, requiring discipline, patience, and consistency of application.

Some investors can handle it. Let’s just say that I’ve met my fair share that can’t. At all.

Too many investors fail to follow some simple, time-tested tenets that improve the odds of achieving success and, at the same time, reduce the anxiety naturally associated with an uncertain undertaking.

Portfolio Monkey has made a solution to help the self-directed individual achieve just that.

Portfoliomonkey.com is a free site that can help you manage your portfolio.

You did catch I said “FREE”, right? Just checking….. 🙂

Table of Contents

“Portfolio Monkey is a social venture whose mission is to educate and provide self-directed investors the most simple-to-use and sophisticated investment portfolio management tools available.”

This site is also a perfect way to review your portfolio or 401k and the options inside of it. You can run tests to see if you can develop a portfolio with better returns and lower volatility. Portfolio Monkey has designed the site to help you analyzes and better allocate your portfolio. They have developed a tool to help you optimize your allocations within your portfolio.

“So how do I use this awesome site?” you say. Well, I am here to show you how!

After a decade of providing investment tools and educational resources to self-directed investors, Portfolio Monkey has announced the closure of its operations. The company, known for its user-friendly tools and commitment to financial empowerment, has ceased all services and will no longer be accessible to users.

Why Portfolio Monkey?

First, you’re probably wondering, “Why am I writing about Portfolio Monkey?” Good question.

I’ve been searching for an easy web based tool that the average investor could easily use to do a portfolio review on their 401k (and other investments). There’s paid services like Morningstar, which is great, by the way. But Morningstar is better suited for more experienced investors. For newbie investors, it can be very overwhelming.

By blind luck I stumbled across Portfolio Monkey and was blown away on how simplistic their site was to use. And the best part? It’s free!

Okay, let’s take a look at Portfolio Monkey and see how it works.

Step 1: Sign Up

The first step is getting signed up for the site at www.portfoliomonkey.com.

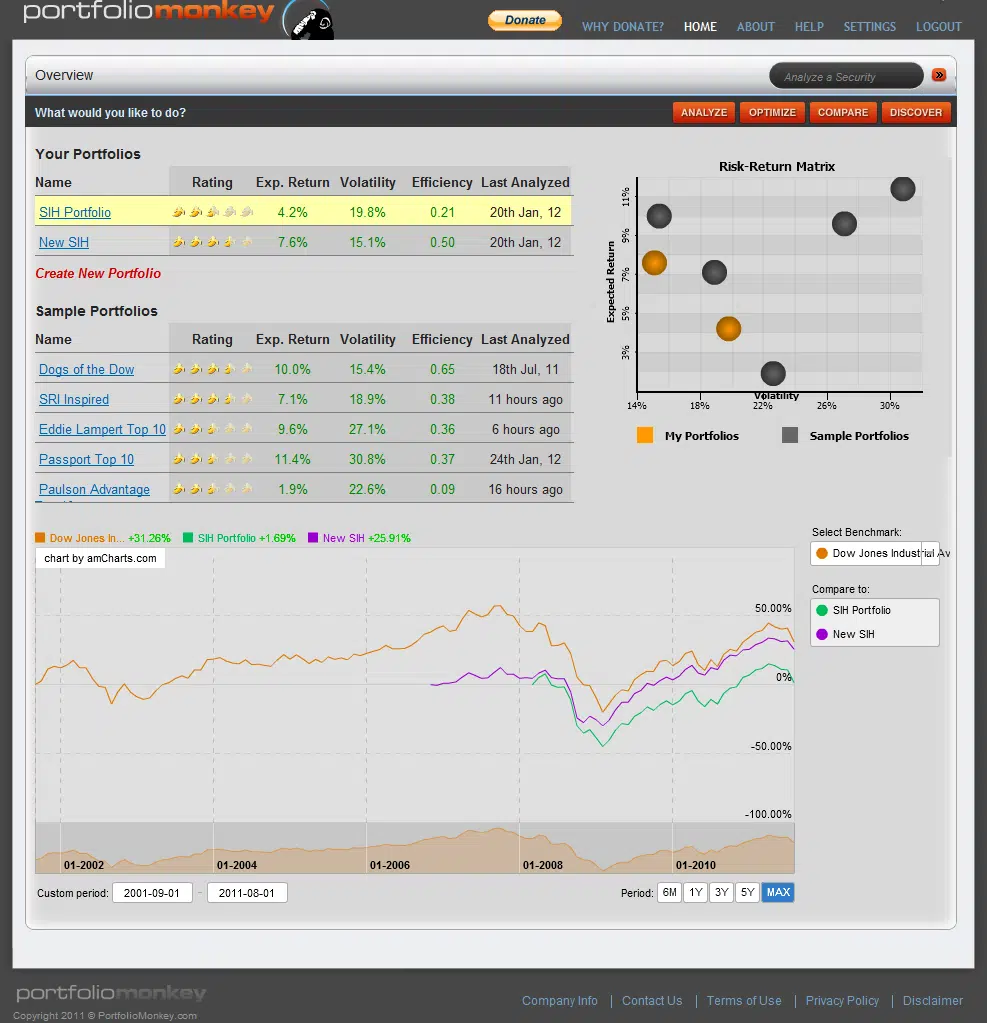

After you have signed up, it will take you to your HOME page. This is where you can see any portfolios that you have created, as well as some sample portfolios from Portfolio Monkey. Each portfolio will have an expected return and volatility percentage, along with an efficiency score and Portfolio Monkey rating. These ratings will help you determine how efficient your portfolio really is.

Step 2: Creating Your Portfolio

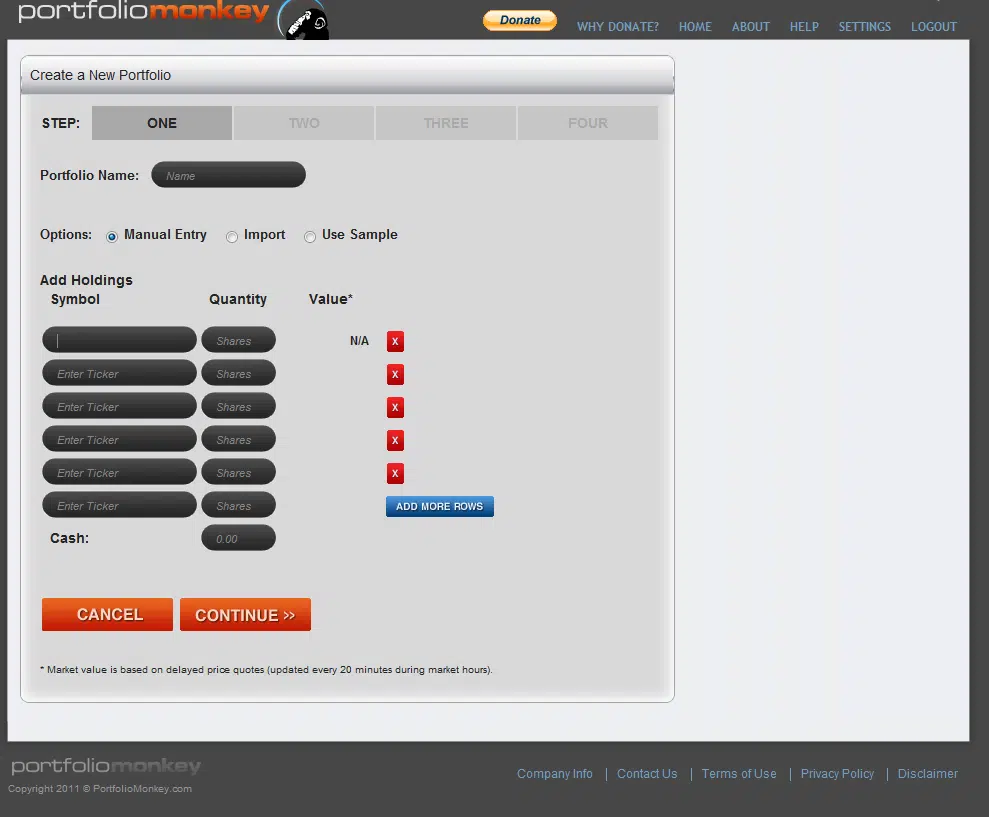

To add or create a portfolio, click the analyze button on the top right tool bar. From there click the New Portfolio button on the bottom left.

To add a new stock or mutual fund to your portfolio, type in the ticker, or symbol. The only thing i didn’t like about this process was that you have to enter your total shares, instead of dollar or percentage amount.

This makes it hard when you are trying to find the best allocation for your portfolio or 401K before you begin investing. If you need to find how much individual shares cost go to Yahoo Finance or another financial site to get this needed information.

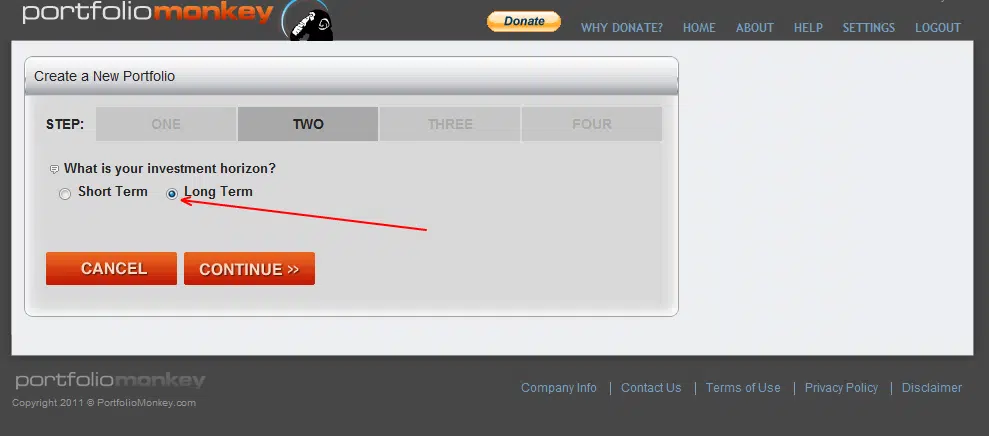

After you have entered your desired stocks or mutual funds, it will take you to the second step in the process which is your investment horizon. For someone that is going to retire in the near future, 5 years or sooner, it is best to select the short term time horizon. For everyone else it is best to select the long term.

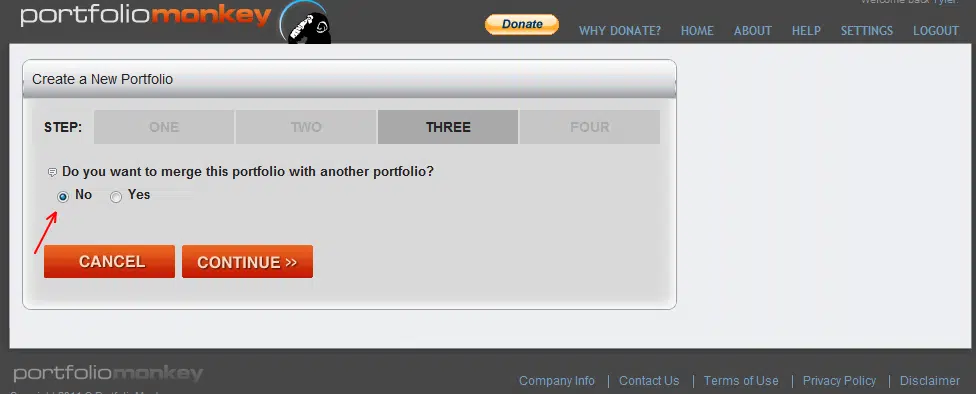

Step 3: Merge or New

The third step is deciding if you want to merge this portfolio with another one you have created, or just make a new one. For this situation we will be making a new portfolio.

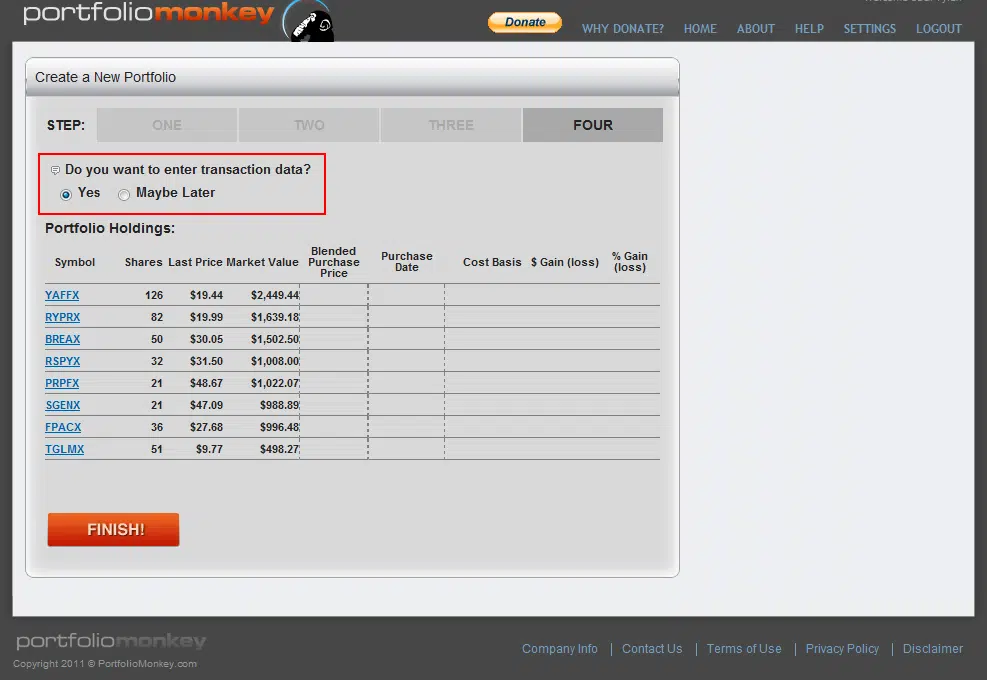

Step 4: Data Entry

The fourth step is entering your transaction data. If you have your purchase dates and costs you can enter it in here to see what your gain or loss percentage is. If you do not have this information or are just trying to determine if this portfolio is right for you, select the maybe later button.

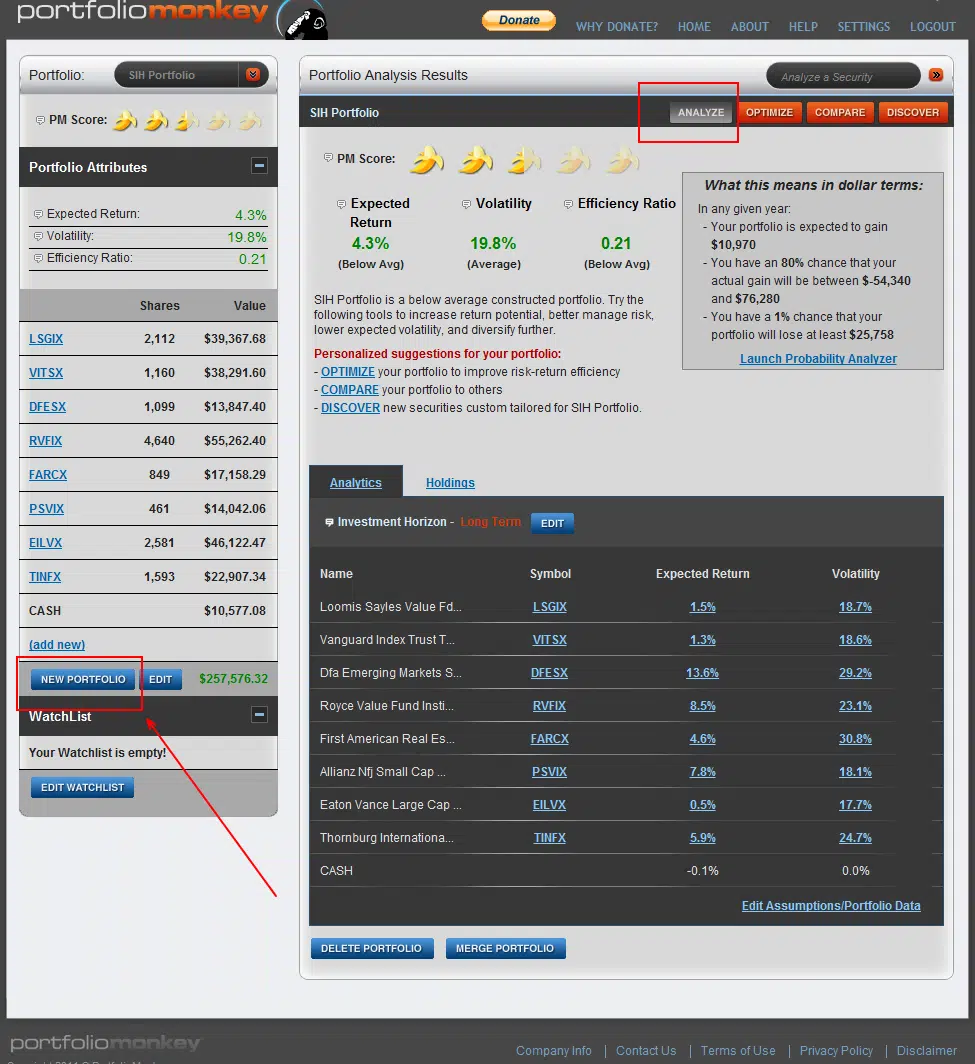

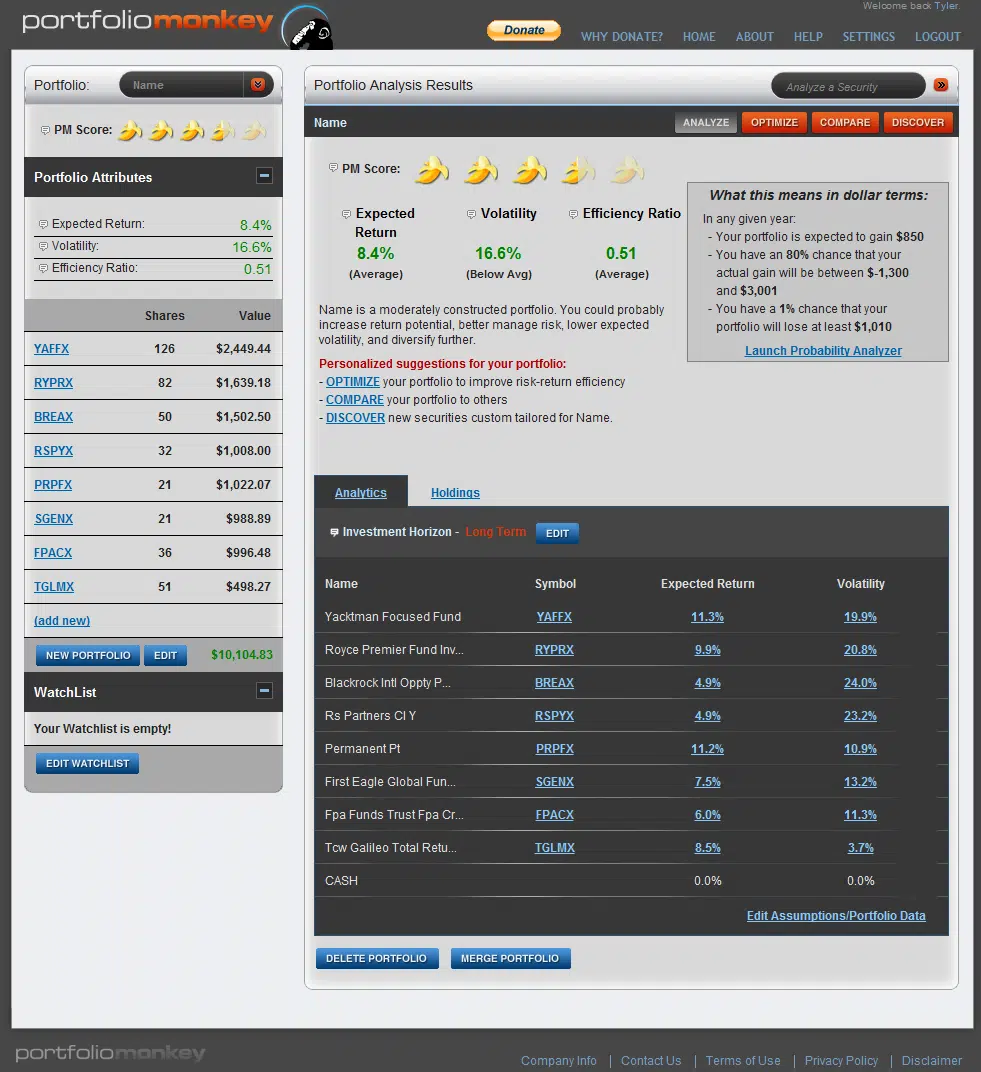

Your Portfolio Details

Now that you have done all the steps, it is time to see if this portfolio is the right fit for you. The portfolio will give you an expected return and volatility, as well as an efficiency ratio. At the bottom it breaks down the portfolio into the expected return and volatility for each holding. This may show you that a particular stock or mutual fund may not be the right fit for your portfolio, such as a mutual fund with too much risk for the return it is expected to earn.

Up in the top right it gives you the statistical probability of how much your portfolio will return in a given year. As you can see with this portfolio my expected return is $850. I also have a 80% chance that my return will be between $1,300 to $3,001.

If you want to dig deeper into your portfolio, you can also check out the optimize section, which shows you how much of each stock or mutual fund you should be holding at any given time. This optimization tool follows each stock or mutual fund and will try to optimize your portfolio instead of a buy and hold strategy.

For the self-directed investor, the tools for allowing you to manage your portfolio keep getting better and better. Portfolio Monkey is a great way to help you manage and analyze your portfolio.

The Bottom Line – Does Your 401k Need a Monkey on its Back?

In the world of self-directed investing, Portfolio Monkey emerges as a valuable ally. This online platform provides a straightforward and free solution for investors looking to manage their portfolios and 401(k) plans effectively. Unlike some complex alternatives, Portfolio Monkey offers simplicity in portfolio review, analysis, and optimization. Its user-friendly interface guides investors through the process, helping them make informed decisions about asset allocation and potential returns. While the platform may have some minor limitations, such as requiring the entry of total shares, its accessibility and efficiency make it a practical choice, especially for those who prefer a hassle-free approach to managing their investments.

After a decade of providing investment tools and educational resources to self-directed investors, Portfolio Monkey has announced the closure of its operations. The company, known for its user-friendly tools and commitment to financial empowerment, has ceased all services and will no longer be accessible to users.

How We Review Making Money Online Opportunities

Good Financial Cents assesses a range of online money-making opportunities, considering factors like profitability, sustainability, and overall legitimacy. We aim to offer readers a balanced view, helping them navigate the vast online income landscape. Editorial transparency guides our reviews.

We gather firsthand information from various online platforms and pay close attention to user feedback. By merging this feedback with our research, we can provide a holistic evaluation. Each opportunity is then rated based on its merits, leading to a star rating from one to five.

For further insight into the criteria we use to rate making money opportunities and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Portfolio Monkey Review

Product Name: Portfolio Monkey

Product Description: Portfolio Monkey was an online investment portfolio management tool designed for self-directed investors. This free platform simplifies portfolio analysis, optimization, and review, making it accessible to investors of all levels of experience, however, it has ceased operations.

Summary of Portfolio Monkey

Portfolio Monkey stands out as an ideal solution for individuals seeking a user-friendly and cost-effective way to manage their investment portfolios. Whether you’re a seasoned investor or new to the world of finance, this platform offers a straightforward approach to portfolio management.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Simplicity and Ease of Use

- Efficient Portfolio Analysis

- Free Service

Cons

- Limited Ticker Entry Options

- Geographic Focus

- Data Entry Requirements

Looks like a great tool! Thanks for the review!