While federal student loans are the best place to start when you have to borrow money for college, there are plenty of instances where private student loans can make sense.

Maybe you maxed out federal borrowing limits for the year and still need additional money to cover expenses, or perhaps your residency status disqualifies you from federal aid. Or maybe you have federal loans already but want to refinance them to get a better interest rate.

Whatever the reason, you’ll be happy to know there are a ton of lenders that offer high-quality, competitive private student loans, most of which let you compare and apply for their loan products online.

However, you may be easily overwhelmed by the sheer number of loan options available, as well as the dizzying number of factors you’ll have to compare to find the best loan for your needs.

Table of Contents

- 8 Important Things to Look For in a Private Student Loan

- 1. Affordable Interest Rate

- 2. Discount for AutoPay

- 3. Repayment Term Options

- 4. Eligibility Requirements

- 5. Ability to Apply With a Cosigner

- 6. Low Fees and No Prepayment Penalty

- 7. Reasonable Borrowing Limits

- 8. Helpful Online Tools

- Final Thoughts – Finding The Right Private Student Loan

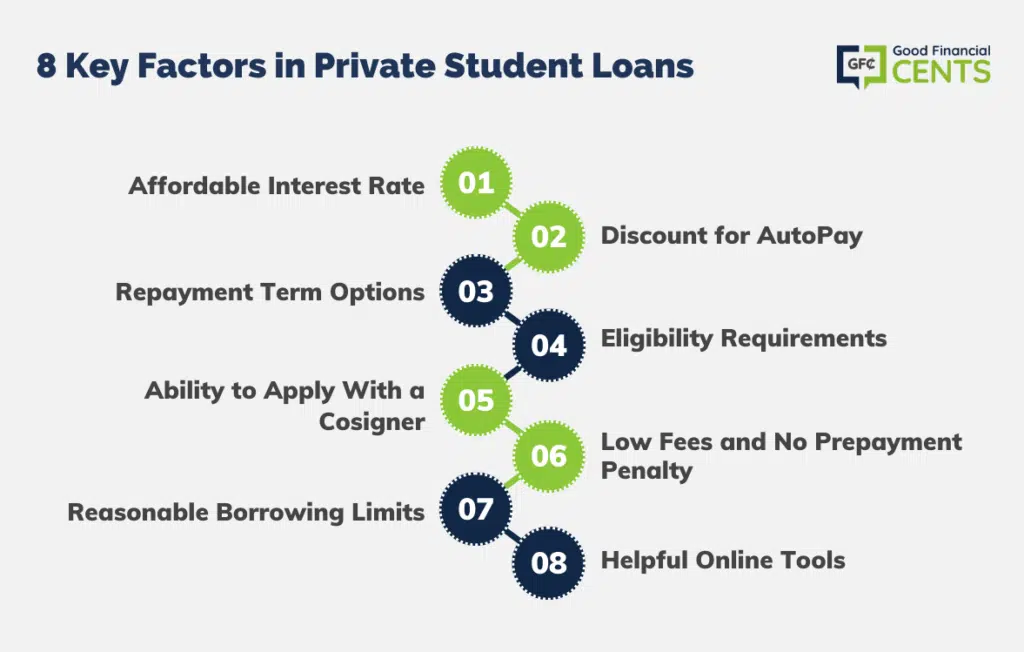

8 Important Things to Look For in a Private Student Loan

If you’re one of those students in the market for a private student loan, here are the main factors you’ll want to look for:

- Affordable Interest Rate

- Discount for AutoPay

- Repayment Term Options

- Eligibility Requirements

- Ability To Apply With A Cosigner

- Low Fees & No Prepayment Penalty

- Reasonable Borrowing Limits

- Helpful Online Tools

1. Affordable Interest Rate

Because private student loans are offered by private companies, their interest rates aren’t set by the government like you find with federal student loans. This is both good and bad for consumers, and it all depends on your credit score and creditworthiness. Having excellent credit can help you qualify for private student loan rates as low as 3.70% APR, whereas less than stellar credit will leave you paying more.

As you search for a private student loan, make sure to compare rates among different providers. Also, note that some private student loan providers like College Ave let you get prequalified for a student loan without a hard inquiry on your credit report.

Finally, make sure you’re checking whether each lender is offering fixed interest rates, variable rates, or both. Where private student loans with fixed interest rates come with a set rate and monthly payment that will never change, loans with variable rates can cause your monthly payment to go up based on economic factors beyond your control. However, variable rates can often be lower at first, so make sure to compare options thoroughly.

2. Discount for AutoPay

Also note that many private student loan lenders, including College Ave, offer interest rate discounts if you set up your monthly payments on autopay. While these discounts tend to be on the smaller side, the savings can add up to substantial sums of cash over time if you go this route.

Also, make sure that when you’re comparing student loan interest rates, you take any discounts for autopay into account.

3. Repayment Term Options

While the monthly payment on your student loan is important, how long you make that payment is equally crucial. Ideally, you’ll wind up with a student loan that has a monthly payment you can afford and repay in a reasonable amount of time.

Also, consider private student loan companies that let you choose from various repayment options depending on your current income and other factors. College Ave, for example, lets you choose your repayment terms. With College Ave, you can make full principal and interest, interest-only payments, flat payments, and deferred payments.

4. Eligibility Requirements

Since private student loans are offered by private companies, they can each set their own eligibility requirements for their loans. Many have credit and income requirements you’ll want to know and understand before you apply.

Many private student loan providers have a page on their website where they list eligibility requirements, but others list their requirements in a Frequently Asked Question (FAQ) format.

5. Ability to Apply With a Cosigner

Because private student loans can be difficult to qualify for when you have little to no credit or a steady income, many let you apply with a cosigner. Having a cosigner with good or excellent credit can help you not only qualify for a private student loan, but it may help you secure a low rate and the best terms available.

Remember:

6. Low Fees and No Prepayment Penalty

In addition to the interest rate you’ll pay on a private student loan, you’ll want to check out and compare the fees they charge. Some student loans charge an origination fee to get your loan started, for example. Others charge late fees and additional fees for returned payments.

You should also be aware of student loans that come with prepayment penalties. Both federal and private student loans typically come without any prepayment penalties, so you should steer clear of any company offering loans with prepayment fees attached. You should be able to pay off your loans whenever you want without any financial consequences, so make sure any loan you take out won’t penalize you for doing so.

But some companies do not charge any origination, application, or prepayment fees. Make sure to shop around.

7. Reasonable Borrowing Limits

The private lender you wind up with should be able to let you borrow as much as you need to finish your degree. However, private student lenders may set specific borrowing limits based on their internal procedures, your income and creditworthiness, and other factors.

Make sure any private lender you plan to work with has the capacity to let you borrow the money you need to finish your degree and graduate from school. If they don’t, you’ll want to consider other lenders with higher loan limits.

8. Helpful Online Tools

Finally, don’t forget to look for lenders that offer online tools that can help you make a decision about your student loans. Student loan payment calculators can be immensely helpful as you figure out how your loan might fit into your budget and lifestyle based on your interest rate, your repayment timeline, and other factors.

Student loan refinancing calculators can also help you figure out your potential savings if you’re switching from federal loans to a private lender in order to secure a lower interest rate. College Ave even has a student loan calculator that can help you determine how long it will take you to pay off your loan, considering various factors like whether you make payments in school and how much you plan to pay each month after you graduate.

Final Thoughts – Finding The Right Private Student Loan

Your student loans will likely be part of your life for years or even decades to come, so this is one factor of your life you’ll want to get right from the start.

As you look at loans from different lenders, make sure to think about short-term and long-term loan costs. Also, think long and hard about the monthly payment you’ll end up with and how it will fit in with your monthly budget, your lifestyle, and your goals.

Private student loans can be valuable tools if they’re used to help you earn a lucrative college degree, but that doesn’t mean they’re created equal. You’ll have to do some digging to find the right private student loan to meet your needs, but the savings and peace of mind will be worth it in the end.