This financial institution was founded in 1971 as First Alabama Bancshares. It changed its name to Regions Financial Corporation in 1994, naming its banking subsidiary Regions Bank.

Regions is headquartered in Birmingham, Alabama, and offers a range of financial services, including banking, retirement planning services, and lending for individuals and businesses of all sizes.

In this review, we will discuss everything you need to consider before purchasing a mortgage through Regions.

Table of Contents

Regions Bank Mortgage Highlights

- Even though Regions Bank was only founded in 1971, it is a leading bank in 16 U.S. counties in the southern and mid-western U.S.

- Offers a selection of mortgage and refinancing options, such as fixed rate, adjustable rate, VA, FHA, construction, and renovation loans, among others.

- Two noteworthy scandals in the last decade, one in 2011 and the other in 2015.

- Provides a Home Buyers Center, an online set of resources that can help buyers plan out their mortgage and refinancing options.

- Have an online mortgage calculator for budgeting and estimating monthly payments.

- Supports Regions Field, a minor league baseball stadium in Birmingham, Alabama.

- States Serviced: Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, Texas, Virginia.

History of Regions Bank

Established less than fifty years ago, Regions Bank has made its mark across the Midwestern and Southern U.S.

This financial company operates almost 2,000 ATMs and approximately 1,500 branches, servicing 16 U.S. states. It offers a wide variety of mortgage and refinance options for both new and experienced homebuyers.

Regions Bank has received plenty of awards and has topped a few lists of top mortgage lenders in the U.S. Generally, its customers’ reviews are mixed, though many of the bank’s negative reviews come from its banking services rather than its lending offerings.

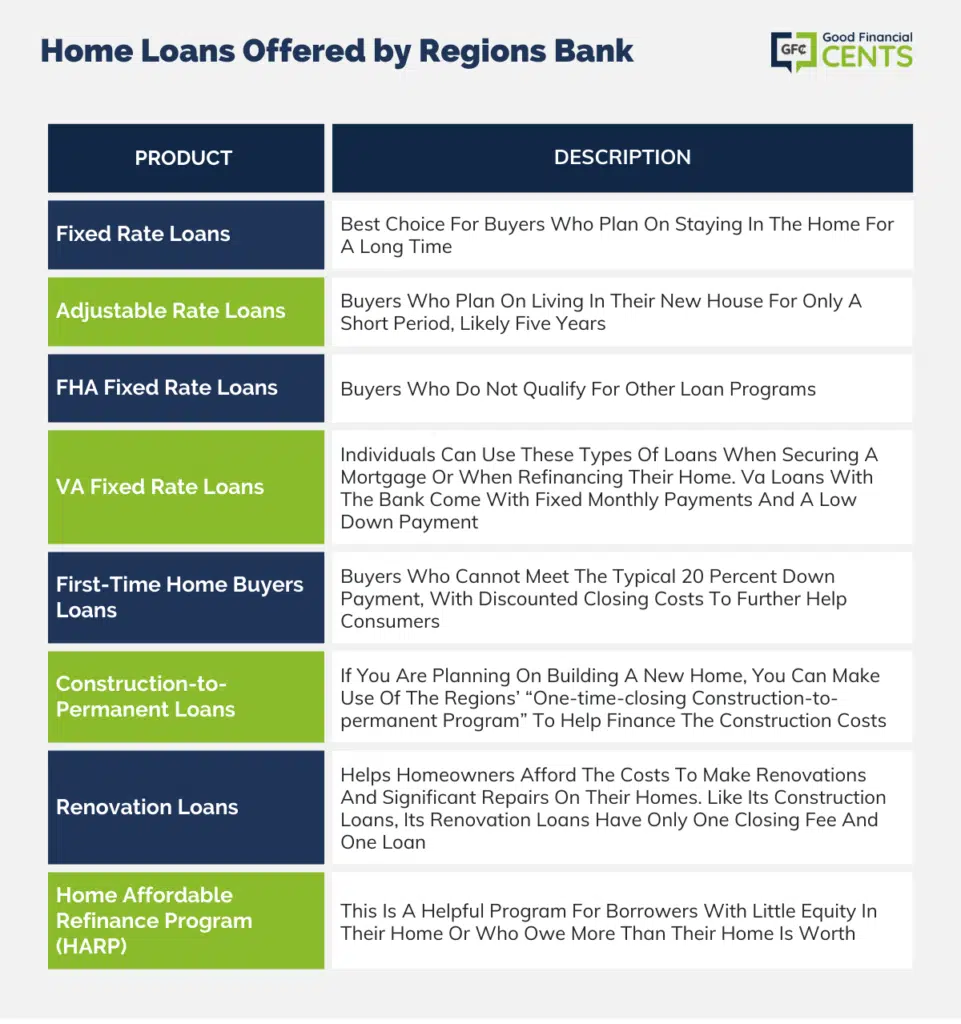

Home Loans Offered by Regions Bank

Regions Bank offers its customers competitive rates on both standard and less conventional mortgage and refinancing options.

However, since it only provides service to the South and Midwest, property location is a crucial factor when deciding on this lender, as it cannot offer mortgages to buyers moving outside these geographical areas.

Fixed Rate Loans

These types of loans are the best choice for buyers who plan on staying in the home for a long time. They are also most helpful to buyers who want a predictable monthly rate, as fixed-rate mortgages provide interest rates and payments that do not change throughout the life of the loan.

The Regions Bank offers a variety of options on fixed-rate loans, but 15- and 30-year fixed-rate mortgages are its most popular offerings.

Adjustable Rate Loans

These types of home loans are best suited to buyers who plan on living in their new house for only a short period, likely five years.

They’re also a viable option for buyers who have the funds to pay the loan off quickly. Adjustable rate mortgages begin with a fixed rate for a specified set of years, likely 1, 3, 5, 7, or 10. After this period of time, payments fluctuate based on market trends, changing every year.

FHA Fixed Rate Loans

The Federal Housing Administration (FHA) offers these loans to buyers who do not qualify for other loan programs.

Regions Bank offers FHA mortgages at a fixed rate, which allows borrowers to put down a small down payment and have predictable, regular monthly payments throughout the loan’s term.

VA Fixed Rate Loans

Qualifying veterans, military members, and their spouses can apply for VA loans through Regions. Individuals can use these types of loans when securing a mortgage or when refinancing their home. VA loans with the bank come with fixed monthly payments and a low down payment.

First-Time Home Buyers Loans

Regions offer plenty of mortgages for first-time home buyers who cannot meet the typical 20 percent down payment, with discounted closing costs to further help consumers.

Construction-to-Permanent Loans

If you are planning on building a new home, you can make use of the Regions’ “One-Time-Closing Construction-to-Permanent Program” to help finance the construction costs.

Regions can convert a construction loan into a permanent loan when the construction is finished, giving you only one set of closing costs and one loan.

Renovation Loans

Regions’ “Renovation & Repair Program” helps homeowners afford the costs to make renovations and significant repairs on their homes. Like its construction loans, its renovation loans have only one closing fee and one loan.

Home Affordable Refinance Program (HARP)

The FHA created this type of mortgage refinance option in 2009 to assist homeowners with Fannie Mae or Freddie Mac-backed loans before May 31, 2009.

This is a helpful program for borrowers with little equity in their home or who owe more than their home is worth. Regions and the FHA empower homeowners to refinance their homes with a more affordable mortgage.

Regions Bank Mortgage Customer Experience

Regions Bank offers a variety of ways for customers to apply for mortgages. First off, there’s an online application form consumers can fill out if they’d prefer to forgo phone conversations. Consumers can also create an account so they can start an application and resume it at a later time.

If you’d like to speak to a customer service individual to inquire about a mortgage but don’t want to wait on hold, you can fill out an online form so that they can contact you at a time that is convenient for you.

Regions Bank also provides other helpful resources online to help potential borrowers understand the mortgage process. The mortgage calculator can help you decide how much home you can afford and estimate the cost of your mortgage.

It also has a Home Buyers Center, which includes articles that walk you through each stage of refinancing and taking out a mortgage, as well as providing other practical advice for homebuyers.

However, the Consumer Financial Bureau Monthly Complaint Report included Regions Financial in the top ten list of most-complained companies in the state of Tennessee.

As the seventh most complained-about bank in this state, it seems a majority of complaints came from Regions’ banking services, with only a small amount of claims arising from its mortgage products.

Regions Bank Lender Reputation

Regions Bank is a public financial services company that has been serving 16 states in the U.S. for just shy of 50 years. Regions Financial Corporation National Mortgage Licensing System’s (NMLS) number is 174490.

Regions Bank faced its fair share of scandals in the past few years. In 2011, Regions had to pay a $200 million settlement to the U.S. Securities and Exchange Commission. It stemmed from Regions’ misleading pricing on high-risk mortgage bonds as part of the bank’s Morgan Keegan subsidiary.

In 2015, the CFPB fined Regions $7.5 million after it charged customers illegal and inaccurate overdraft fees, without asking its consumers to voluntarily opt into overdraft fees during monetary transactions.

That’s not it:

Despite these controversies, Regions Financial Corporation has received a large number of awards and recognition over the decades. For the fifth year in a row, Regions has ranked in the top 10 percent of companies listed in the Temkin Experience Ratings.

Greenwich Associates also awarded Regions with 23 Excellence awards and three Best Brand awards in 2017. For the second consecutive year, Regions won the Javelin’s Trust in Banking Leader Award as a result of the bank’s trust and loyalty to its consumers.

*Information collected on December 4, 2018

Regions Bank Mortgage Qualifications

Regions Bank has the same mortgage qualifications as many other lenders in the U.S. When qualifying customers for home loans, credit score is the most critical factor. Borrowers with credit scores above 760 should expect the best mortgage rates.

| Credit Score | Quality | Ease of Approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| n/a | No credit score | Difficult |

Borrowers with a good credit score, a debt-to-income ratio of 36 percent or less, enough savings, and the ability to put 20 percent down on the home have the best chances of being approved for a mortgage by Regions Bank.

However, state and federal down payment assistance programs, such as VA and FHA loans, allow buyers to put less than 20 percent down.

Regions Bank Phone Number & Additional Details

- Homepage URL: https://www.regions.com/personal-banking

- Company Phone: 1-800-734-4667

- Headquarters Address: 1900 Fifth Avenue North, Birmingham, AL 35203

The Bottom Line

Regions Bank, with its roots dating back to 1971, has established itself as a prominent financial institution serving 16 U.S. states in the Southern and Midwestern regions.

The bank offers a variety of mortgage and refinancing options, including fixed-rate, adjustable-rate, FHA, VA, and renovation loans, catering to a diverse range of homebuyers and homeowners.

While Regions Bank has received accolades for its customer experience and mortgage offerings, it has not been without its share of controversies, including legal settlements related to high-risk mortgage bonds and overdraft fees.

Nonetheless, the bank’s commitment to customer trust and loyalty has earned it recognition and awards.

Regions Bank provides an array of online resources, including a mortgage calculator and a Home Buyers Center, to assist potential borrowers in understanding the mortgage process and estimating costs.

However, it’s worth noting that some consumer complaints have been associated with the bank’s non-mortgage services.

Ultimately, Regions Bank is a well-established lender with a wide geographical reach, offering competitive mortgage options. To qualify for their best rates, borrowers should aim for excellent credit scores and a sound financial profile.

For those within their service areas, Regions Bank can be a viable choice for home financing, provided they carefully consider the full range of available mortgage products and customer feedback.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process.

Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Regions Bank Product Description: Regions Bank is a well-established financial institution with a history dating back to 1971. It offers a comprehensive suite of financial services, including personal and business banking, mortgages, loans, and wealth management solutions. Regions Bank is known for its extensive branch network across 16 U.S. states, making it accessible to a wide range of customers. Summary of Regions Bank Regions Bank is a reputable financial institution that provides a diverse range of financial products and services to individuals, businesses, and communities. With over four decades of experience, the bank has grown to serve 16 U.S. states in the Southern and Midwestern regions, offering a strong presence in the banking industry. Regions Bank offers a variety of banking solutions, including checking and savings accounts, credit cards, and lending services such as mortgages, auto loans, and personal loans. For businesses, it provides commercial banking, treasury management, and lending options to support growth and financial stability. Pros Cons

Regions Bank Review

Overall

Do bank buy antique coins