Robo-investing is a new concept – only a few years old – that’s taking the investment industry by storm. There are now dozens of robo-advisors offering automated investing services and fees that are well below what is being charged by traditional investment managers.

If you’re looking for low-cost investment management – the kind that handles every investment detail for you – then you need to take a close look at robo-advisors. They can be the perfect solution to your investment needs.

Table of Contents

What Is a Robo-Advisor?

A robo-advisor is an online, automated investing platform. It acts as an online financial advisor who handles all of the day-to-day management of your investments.

When you sign up with a robo-advisor, you provide the money to fund the account, and then the platform handles everything else for you.

Your entry into robo-investing usually starts with the questionnaire.

The robo-advisor will ask you a handful of questions that are designed to establish your goals and your risk tolerance.

Once that’s been determined, the platform will create a portfolio that’s designed to help you reach your goals while maintaining a risk level that’s consistent with your risk temperament.

Robo-investing only began to become a thing around 2010, when Wealthfront, currently the two largest independent robo-advisors, launched their services.

Robo-advisors provide an attractive mix of automated investing and a low fee structure.

Ironically, none of the services that they provide are actually new. Traditional human investment advisors have been offering these services for many years.

However, they charge much higher fees and work only with very large investment portfolios. In a real way, robo-advisors are bringing professional investment management to the masses at an affordable price.

How Do Robo-Advisors Work?

No two robo-advisors are exactly alike, but they all share certain common characteristics.

Modern Portfolio Theory (MPT)

Virtually all robo-advisors use MPT as their basic investment methodology. MPT essentially holds that proper asset allocation is the key to investment success. For that reason, it focuses investment activity on maintaining exposure to certain basic asset classes rather than specific security selection.

Exchange Traded Funds (ETFs)

Consistent with MPT, robo-investing makes heavy use of ETFs in portfolio construction. The ETFs are typically index funds invested in a handful of market sectors.

For example, a robo-advisor platform may invest in index-based ETFs that cover the US stock market, international markets, emerging markets, US government bonds, US corporate bonds, and foreign government bonds.

A typical robo-advisor platform will generally work with a small number of ETFs, with one fund representing each broad market.

For that reason, your investment portfolio will be limited to no more than 10 to 12 ETFs. However, that small number of funds actually provides exposure to many thousands of individual securities.

A big advantage of ETFs is the fact they are low-cost investment vehicles. ETFs don’t charge load fees that are typical with mutual funds. And since they’re based on the index of broad markets, they rarely trade securities within the fund.

That means that they have very low investment fees. For that reason, more of the investment gains are passed on to investors.

Fully Automated Investing

Automated investing means that the entire investment process takes place out of sight, or at least out of the investor’s sight.

Once you sign up to invest with a robo-advisor, the entire process is handled for you. That includes portfolio construction, periodic rebalancing, and day-to-day management responsibilities.

Your only responsibility in the investment mix is to fund your account. Everything else is handled for you, which is the primary reason why the platforms are referred to as robo-advisors.

Tax Optimization

Most robo-advisors offer this service automatically and typically free of charge. At a minimum, the use of ETFs minimizes the amount of capital gains that will be generated in the account.

The ETFs – because they don’t actively trade stocks – simply grow in value as the securities that they include rise in price.

They rarely sell securities, which means there are few capital gains to pass on to investors. In addition, where capital gains are incurred, they tend to be long-term.

That means that you can take advantage of the lower tax rates that apply to long-term capital gains. By contrast, the short-term capital gains that are generated by actively traded mutual funds are taxable at your ordinary income tax rates. By using ETFs, robo-advisors avoid this situation completely.

Investment allocation is another tax optimization strategy commonly used in robo-investing.

The platforms often seek to allocate interest- and dividend-generating investments in tax-sheltered retirement accounts while assigning potential capital gains-generating investments to regular taxable accounts, where they can get the benefit of lower long-term capital gains tax rates.

Tax Loss Harvesting, or TLH

This is a process of selling off losing positions in order to generate capital losses that will offset capital gains from other investments. Like-kind investments are purchased later on in order to avoid IRS wash sale rules.

This process enables you to maintain asset positions over the long run while creating tax-reducing asset sales to lower your annual tax liability.

Some robo-advisors – like Wealthfront – offer TLH to all investors, regardless of portfolio size. Others offer it as a premium service for an additional fee. Some others don’t offer it at all, though it is becoming more popular throughout the industry.

Tax-loss harvesting is a complicated topic. If you want to learn more about it, Wealthfront has created an excellent source in the Wealthfront Tax-Loss Harvesting White Paper. It’s a long read, but it will explain the intricacies of TLH, as well as the long-term benefits that it produces.

The white paper maintains that you can improve your long-term investment performance by at least 1.27% per year.

Low Fees

The type of online financial advice that robo-investing offers has long been available from traditional human investment advisors.

However, those advisors charge much higher fees for their services. You can generally expect to pay between 1% and 2% of your portfolio value each year for their services.

Needless to say, that can take a big chunk out of your return on investment. What’s more, traditional investment advisors typically require that you have a very large portfolio size – often $500,000 or more.

But fee structure is where robo-investing really stands out. Robo-advisors typically charge an annual fee of between 0.25% and 0.50% of your portfolio value.

That’s just a fraction of what traditional human investment advisors charge. What’s more, there are also robo-advisors who provide their service for free.

This is probably the single biggest advantage of robo-investing and the primary attraction for investors of all portfolio sizes. A difference of 1% per year in annual fees can increase the return on investment on a portfolio from 6% to 7%. And that can make a huge difference.

$100,000 invested for 30 years at 6% will produce a portfolio of $574,350. But 7% will produce a portfolio of $761,225. That’s a difference of about $187,000, and that’s why robo-advisors are getting so popular so fast.

An Orientation Toward New and Small Investors

At least two factors that we’ve discussed so far work heavily in favor of new and small investors – automated investing and low fees. But there’s a third. Robo-advisors have very low minimum deposit requirements.

Some require a few thousand dollars, some only a few hundred, and some have no minimum deposit requirement whatsoever (see Table). This is perfectly suited to the new or small investor, who may be working with very little money at the start.

Robo-advisors are even quite friendly to investors with little or no upfront money whatsoever, and they encourage regular automatic account deposits as a way to build up your account.

You can simply payroll deduct a certain amount of money into your robo-advisor account in the same way you do with your checking, savings, and retirement accounts.

The money will grow slowly over time and then be automatically invested for you along the way.

Key Aspects of Robo-Advisor Investment Strategies

| Aspect | Description |

|---|---|

| Modern Portfolio Theory (MPT) | Invests in Asset Classes for Success, Not Individual Securities |

| Exchange Traded Funds (ETFs) | Uses Low-Cost ETFs for Diversified Portfolios |

| Fully Automated Investing | Handles All Investment Tasks, Leaving Investors with Funding Alone |

| Tax Optimization | Minimizes Capital Gains, Allocates Tax-Efficient Investments |

| Tax Loss Harvesting (TLH) | Sells Losing Assets to Offset Gains, Follows IRS Rules |

| Low Fees | Charges 0.25% to 0.50% Annually, Saving Money Compared to Human Advisors |

| Orientation Toward New and Small Investors | Welcomes Small Investments with Low Minimum Requirements Encourages Regular Contributions |

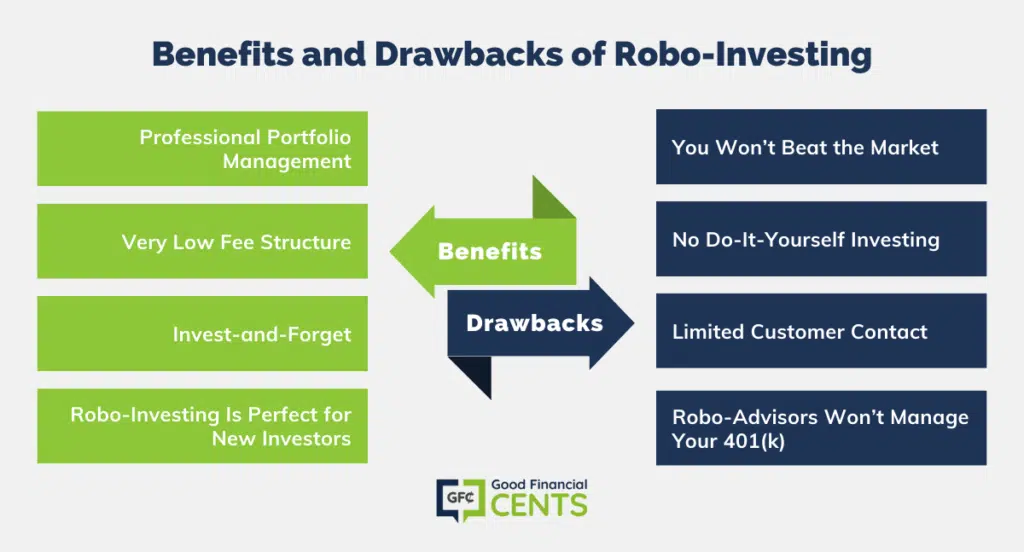

The Benefits of Robo-Investing

There’s a reason why robo-advisors are becoming so popular so quickly. They offer too many benefits to be ignored. Many offer services comparable to what you will find with much higher-priced traditional investment advisors.

Here are examples of those services:

Professional Portfolio Management

Robo-investing enables you to get the benefits that come from traditional investment advisors. You get professional investment management through an allocated mix of asset classes, which are rebalanced as needed. This is the kind of service that larger investors pay a lot more money for.

Robo-advisors essentially provide an online financial advisor service that handles all of the details of your investment activity for you. This means that you don’t have to do a lot of research into investing or worry about investment selection or when to buy and sell. It’s all handled for you.

Very Low Fee Structure

A traditional investment manager might charge you something like 1.5% of your portfolio every year to manage it for you.

But with a robo-advisor, you can get essentially the same investment management services for 0.5% or less. This not only improves your net investment returns over the long run, but it also makes investing less risky in general.

Consider the possibility that you might lose, say, 10% of your investment in one year. If your investment advisor charges you 1.5% on top of that, your net loss will be 11.5%. Now, if you suffer the same 10% loss with a robo-advisor, your net loss will be only 10.5%.

That at least somewhat cushions the blow of the decline in your investment position. And any strategy that minimizes losses also reduces risk.

Invest-and-Forget

It’s an unfortunate fact that do-it-yourself investing is a lot more complicated and time-consuming than a lot of the get-rich-quick gurus will ever admit to.

You have to define your investment objectives, create a portfolio mix that will be likely to achieve those objectives, investigate various securities, purchase the securities, rebalance the portfolio periodically, and then know when to sell said investments.

But robo-advisors act as your online financial advisor.

They handle the entire investment process for you. All you need to do is fund your account, and the online investment advisor takes care of the rest for you. This frees you up to concentrate on the rest of your life.

You can become an ongoing investor – without having to get your hands dirty – but still have all of your time to do whatever else you need or want to do.

That’s a perfect arrangement for both large and small investors. After all, not everyone has the time, inclination, or interest to become a master investor.

In fact, very few individual investors are particularly good at it. That’s why it’s best for most people to rely on the experts who invest for a living. You’re taking advantage of their expertise and the tools they have available and doing it at an extremely low fee.

Robo-Investing Is Perfect for New Investors

For most new investors, the challenge with investing is coming up with the money to invest. You probably don’t have time to do all the research that you need to create a winning investment portfolio.

The automated investing process that robo-advisors provide enables new investors to work on just one aspect of the investment process, and that’s funding their accounts.

Everything else is handled for you. Robo-advisors are also an excellent way to begin investing before you have the skill and expertise to do it yourself.

For example, can start out using a robo-advisor to earn money on your investments and to grow your portfolio.

But once you have enough money in that portfolio, you might want to expand and consider do-it-yourself investing.

If you reach that point, you can continue to leave the majority of your money to be managed by the robo-advisor while moving a small amount of it into a self-directed account.

You can then try your hand at direct investing, safe in the knowledge that most of your money continues to be professionally managed by an online financial advisor.

The Drawbacks of Robo-Investing

As you might suspect, robo-advisors are hardly perfect investment vehicles. They do have some drawbacks that you need to be aware of before jumping in. But don’t expect to be shocked by any of these drawbacks.

They’re what you might expect to see in any kind of managed investment platform, particularly one that comes at such a low cost.

You Won’t Beat the Market

Having your money professionally managed doesn’t mean that you will beat the market. Some investors fully expect investment managers to be able to do just that. For example, if the S&P 500 rises by 10%, they expect the investment advisor to produce a return of 15%.

But that’s not how professional investment management works, even with robo-advisors. As a general rule, using any type of investment advisor, including robo-advisors, will generally underperform the market.

That’s because all well-managed investment portfolios diversify into various asset classes. A typical portfolio will include an allocation into bonds as well as stocks.

So, if the stock market rises by 10%, but the bond market provides a return of just 3%, the overall return on your portfolio will be something less than 10%. Of course, the flip side is equally true.

Should the stock market lose 10% and the bond market provides a return of 3%, the overall loss on your portfolio will be something less than 10%.

That’s the whole purpose of investment diversification – modification on the way up but protection on the way down.

Understand that robo-advisors don’t exist to make you rich but rather to properly manage your investment portfolio for you, and at a very low fee.

No Do-It-Yourself Investing

Some investors like some action with their investment activities. Robo-investing is a completely passive investment activity. As I said earlier, your sole responsibility is to fund your account.

All of the activity within that account will be handled by automated investing. If you’re the type who likes action in your portfolio, that can be kind of boring.

In addition, most robo-advisors don’t allow you to select your own investments. You will not be able to buy individual stocks or even other ETFs and add them to your portfolio.

If you want the safety and predictability of automated investing but also want some ability to trade securities on your own, you will have to set up a separate account with an investment brokerage firm that offers self-directed investing.

Limited Customer Contact

Part of the reason why robo-advisors can offer such low fee structures is because they provide only limited customer service.

Though many are increasing the amount of customer contact and direct online financial advice they provide, it’s still typically well below that offered by major brokerage firms, particularly full-service brokers.

You may not be able to contact a robo-advisor at 3 o’clock in the morning because your portfolio is losing money, and you can’t sleep. Automated investing is just what the name implies, so there’s only limited ability for direct intervention.

Robo-Advisors Won’t Manage Your 401(k)

For a lot of investors, their single biggest investment account is their employer-sponsored 401(k) plan. Unfortunately, robo-advisors can’t offer a lot of assistance in this area, at least not at this time.

Betterment for Business, which is targeting the management of employer-sponsored 401(k) plans.

But it’s a brand-new offering and is only being provided through a limited number of small employer plans. However, despite the fact that robo-advisors are inching their way into the 401(k) universe, the service isn’t available with most plans.

As well, robo-advisors lack the authority to directly manage existing 401(k) plans. What this means is that while robo-advisors may be able to manage your regular brokerage account, as well as any IRA plan you have, you will not be able to take advantage of their services to manage your 401(k) plan.

Some robo-advisors, such as Personal Capital, can monitor your 401(k) plan and make investment recommendations for you. But they cannot get involved in the day-to-day process of managing the plan for you completely.

Will Robo-Investing Work for You?

Robo-investing won’t work for everybody, but it could be an advantage for most investors. If you’re a new or small investor, you should definitely look into robo-investing. The advantage of no- or low-minimum initial deposits, plus very low management fees, is the perfect combination for a small investor.

As well, the fact that you can get professional investment advice at the very beginning of your investment career is no small advantage. You have to pay a lot more money to get that level of service from traditional investment advisors.

If you are currently investing with a traditional investment manager and tired of paying high fees for the service, moving at least some of your money over to a robo-advisor could work well for you.

You may even find after a time that the investment returns provided by the robo-advisor match or exceed what your traditional investment advisor is providing. At that point, you can make a wholesale switch over to robo-investing.

If you don’t know a whole lot about investing or don’t really have an interest in it, robo-advisors could be the perfect solution for your investment needs.

All you need to do is fund your account, and the automated investing that robo-advisors provide will take care of all of the management details for you. It should also go without saying that if you have a busy life overall and really don’t have time for investing, robo-investing can be the answer to a prayer.

You can turn your money over to a robo-advisor to be professionally managed and then get on with the rest of your life. The investing side of your life will be fully covered by the robo-advisor, freeing up your time and your mind for other pursuits.

The only type of investor that robo-investing won’t work for is the committed self-directed investor. Since robo-investing is a fully automated venture, the do-it-yourself investor will find little reason to use it.

Still, even for a do-it-yourself investor, it can help to have at least some of your money professionally managed.

Given the flexibility and low fees that robo-advisors provide, using one could offer a perfect hybrid strategy in which some of your portfolio is professionally managed while you go the self-directed route with the rest.

There is perhaps one other investor that robo-investing won’t appeal to, and that’s the investor who wants a large amount of very personal service. That service level can only be provided by traditional investment managers.

They have the resources – and a higher fee structure – that can accommodate a one-on-one relationship with a personal financial advisor, who is always available to you.

But if you get tired of paying high fees for that level of service, there is a robo-advisor who can provide the same basic services but without the concierge touch.

List of Popular Robo-Advisors

We’ve compiled a list of 15 of the most popular robo-advisors in the market space. But the field is new and growing rapidly. New robo-advisors are coming to the market all the time, so please check back periodically for any additions to this list.

Despite the similarities between all robo-advisors, there are significant differences in the service levels. For example, there are different minimum deposit requirements, different fee structures, and even different types of accounts handled.

You may have to investigate several robo-advisors in order to find the one that works for you. And that’s why we’ve compiled this list.

- Betterment

- Minimum Initial Deposit $0

- Annual Fees 0.25% of Account Balance; higher on premium accounts

- Account Types Regular individual and joint, traditional, Roth, rollover & SEP IRAs, Trusts

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes

- Learn More

- Acorns

- Minimum Initial Deposit None, but $5 minimum to begin investing

- Annual Fees $3-$9 per month

- Account Types Taxable accounts for individuals only

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting N/A

- Learn More

- Facet Wealth – Online CFP Service

- Minimum Initial Deposit $0

- Annual Fees $2,400 to $8,000, depending on the services required

- Account Types Total Asset Value < $1,000,000

- Mobile App Video conferencing and chat

- Automatic Rebalancing N/A

- Tax-Loss Harvesting N/A

- Learn More

- Stash Invest

- Minimum Initial Deposit $5

- Annual Fees $36 for the lowest tier of services, $108 for the premium-level tier

- Account Types Regular individual accounts

- Mobile App Yes

- Automatic Rebalancing N/A

- Tax-Loss Harvesting N/A

- Learn More

- Wealthfront

- Minimum Initial Deposit $500

- Annual Fees First $10,000 free; 0.25% on higher balances

- Account Types Regular individual and joint, traditional, Roth & SEP IRAs, 401(k) rollovers, Trusts, 529 plans

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes

- Learn More

- Empower

- Minimum Initial Deposit $100,000

- Annual Fees 0.49% to 0.89%

- Account Types Regular individual and joint, traditional & Roth IRAs, Trusts, College savings plans

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes

- Learn More

- E*TRADE Adaptive Portfolios

- Minimum Initial Deposit $10,000 ($5,000 on IRA accounts)

- Annual Fees 0.30%

- Account Types Regular individual and joint, traditional, Roth & Rollover IRAs, and custodial accounts

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting N/A

- Learn More

- Fidelity Go

- Minimum Initial Deposit $5,000

- Annual Fees 0.35% (0.40% “all in” costs)

- Account Types Regular individual and joint, traditional, Roth and rollover IRAs

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting N/A

- Learn More

- FutureAdvisor

- Minimum Initial Deposit $10,000

- Annual Fees 0.50% + $7.95 on some trades ( 0.65% “all in” costs)

- Account Types Regular individual and joint, traditional, Roth, rollover & SEP IRAs, Custodial, Trusts, some 401(k)

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes

- Hedgeable

- Minimum Initial Deposit $1

- Annual Fees 0.30% to 0.75%

- Account Types Regular individual and joint, traditional, Roth, rollover, SEP and SIMPLE IRAs, Trusts, Custodial, and Solo 401(k) plans

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes

- Rebalance IRA

- Minimum Initial Deposit $100,000

- Annual Fees 0.50% + $250 account set-up fee

- Account Types Traditional, Roth and SEP IRAs

- Mobile App None

- Automatic Rebalancing Yes

- Tax-Loss Harvesting N/A

- Charles Schwab Intelligent Portfolios

- Minimum Initial Deposit $5,000

- Annual Fees $0

- Account Types Regular individual and joint, traditional, Roth & SEP IRAs, Custodial & Trusts

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes, on accounts of $50,000+

- Learn More

- Vanguard Personal Advisor Services

- Minimum Initial Deposit $50,000

- Annual Fees 0.30%

- Account Types Regular individual and joint, traditional, Roth & SEP IRAs, Trusts

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting N/A

- WiseBanyan

- Minimum Initial Deposit $10,000

- Annual Fees None

- Account Types Regular individual and joint, traditional, Roth & SEP IRAs

- Mobile App Yes

- Automatic Rebalancing Yes

- Tax-Loss Harvesting Yes, w/ 0.25% fee (maximum of $20/mo)

Care to Compare?

If you want to see how some of these stack up to each other, we’ve gone ahead and put a few of them, well, head-to-head. (Silly play on words, I know!)

Here’s a quick list of comparisons:

I’m interesting about the Acorns Robo- investing.

Please contact with me.

Sincerely,

Ildiko Danka

Hi Ildiko – Check with the Acorns website to get more specific information on the app. In our article, we’ve just provided an overview of the platforms.

I am an African, precisely Nigerian I am interested in this Robo investing. Am I eligible? also I love to register with your company, how can I go about it.

Hi Joshua – Most probably won’t allow you since you aren’t a US resident. But check with a few and see what they can do. Not sure what you mean by “register with your company”, can you please explain?

”Goodfinancialcents.com”, I would want to register with you.

Hello,

Great article! Are these websites only for American investors? Are any of them suitable for international investors?

Most are limited to US residents Mariya. It has to do with government regulations. But you can check with each individually and see if they’ll accept non-US residents.

Excellent article Jeff. I’ve been looking at robo-investing for some time and just haven’t pulled the trigger. I think I’m nervous about what could happen if there was a “glitch” in the algorithm.

I’m assuming you would say that the chance of this happening is slim to none? (and you are probably correct).

I’m currently testing out Acorns – not for my main investment account, but just to stash some extra cash away and see what happens.

I can understand your hesitation. Robo-advising is fairly new. But what you might want to do is to try it with a small amount of your investment money, maybe no more than 10%. See how you like it for a while. My guess is that you’ll gradually increase the amount you have with one.

One thing that can be annoying come tax time, though it is touted as a feature, is that there is no cash reserves in these solutions. So every quarter when they need to get their fee’s there is a tax related transaction as they sell some of the portfolio (in a way to head back to the target portfolio). Even if you don’t buy/sell much of the portfolio, this can add dozens of taxable transactions to your taxes.