- Services cities and towns within Massachusetts and Rhode Island

- A discount of .125 percent is available for mortgages fully completed online

- Offers low- to medium-income mortgage options, including FHA, MassHousing, and MHP loans

- Some loan options require down payments as low as 3 percent for qualified borrowers

- Mortgage products have received no customer complaints via the BBB website

- Operates 85 physical branches located within New England

Table of Contents

Rockland Trust History

Rockland Trust was founded in 1907 by a group of businessmen from Rockland, Massachusetts who wanted to stimulate economic growth in the region. The bank expanded into neighboring communities over the following decades, in part because of the success of its unique automobile banking service.

Following a series of mergers and acquisitions from 1985 to 2009, the bank began servicing cities and towns around Cape Cod and the Metrowest regions, eventually branching out to Rhode Island in 2011.

Rockland Overall

During its 112 years of operation, Rockland Trust has provided affordable mortgage products and services to customers throughout Massachusetts and (more recently) Rhode Island.

The commercial bank has continuously expanded its network of physical branches and online resources, which has helped thousands of residents and businesses obtain sustainable property loans.

Rockland’s success has helped it establish a strong presence within the regional market, though it remains quite small compared to its massive, nationwide competitors.

Rockland Trust has built a positive reputation by offering a range of mortgage loan products that meet the specific needs of Massachusetts residents, especially those with low to moderate income.

Over the years, the bank has partnered with nonprofit organizations like the Massachusetts Housing Partnership and MassHousing to ensure first-time homebuyers and borrowers with low credit scores can secure fair interest rates.

This dedication to helping lower-income families is one reason the Better Business Bureau gave Rockland Trust an A rating.

Rockland Trust Loan Specifics

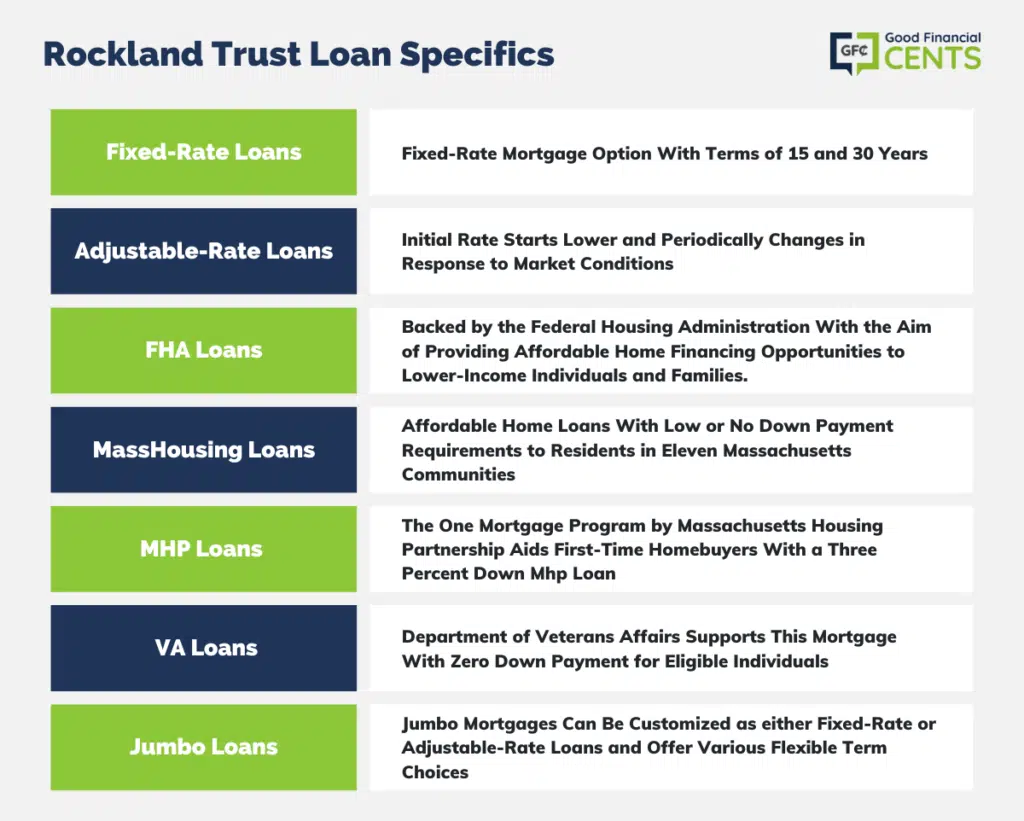

Rockland Trust provides borrowers in Massachusetts and Rhode Island with a wide range of mortgage options to choose from, including conventional fixed and adjustable rates, Federal Housing Administration, Veterans Affairs, and jumbo loans.

While some of their offerings are tailored explicitly for MA residents, such as the MassHousing and MHP loans, Rockland Trust is dedicated to helping first-time homebuyers and borrowers with low-to-moderate income secure affordable mortgage rates anywhere in their service region.

Fixed-Rate Loans

This mortgage option locks in a fixed rate for the full life of the loan term, providing homebuyers with maximum rate stability. Rockland Trust offers mortgage terms of 15 years and 30 years for loans up to $484,350 on a single-family residence.

Depending on the selected loan term, borrowers may be able to negotiate interest rates as low as 4.375 percent, along with a 4.68 percent APR. This type of mortgage is beneficial to homebuyers who want to invest in their property long-term and do not plan to relocate.

Adjustable-Rate Loans

In contrast to the fixed-rate loan type, an adjustable-rate mortgage (ARM) offers a lower starting rate that periodically adjusts based on market conditions. Borrowers can lock down an initial fixed rate as low as 4.25 percent for the first three (3/1 ARM), five (5/1 ARM), or seven (7/1 ARM) years of the loan term.

Once the fixed-rate period has elapsed, interest rates and monthly payments may increase or decrease depending on market performance. However, the amount a rate can increase from year to year and over the life of the loan is capped.

This mortgage type is perfect for homebuyers who plan to stay in their home for a few years, rather than a few decades.

FHA Loans

This loan type is insured by the Federal Housing Administration and was created to ensure that lower-income Americans have access to affordable mortgages.

Rockland Trust FHA mortgages can be obtained with down payments of 3.5 percent for borrowers with credit scores of 580+ or 10 percent for those with scores between 500 to 579. These mortgages can be negotiated as fixed-rate or adjustable-rate loans, depending on a homebuyer’s personal preferences.

It is great for borrowers who have low credit scores, cannot afford a standard 20 percent down payment, or are unable to be approved for private mortgage insurance.

MassHousing Loans

As a partner of MassHousing’s Buy Cities program, Rockland Trust offers affordable home loans with low or no down payment requirements to homebuyers in eleven Massachusetts communities.

This special program makes 30-year fixed-rate loans available to residents with a modest income, but the eligibility guidelines can be strict. To learn more about this mortgage option, contact a Rockland Trust lender or visit MassHousing’s website.

MHP Loans

The ONE Mortgage program was launched by the Massachusetts Housing Partnership to help first-time homebuyers secure financially sustainable loans. As part of the program, borrowers can obtain an MHP loan with as little as three percent down and are not required to invest in private mortgage insurance.

Contact a Rockland Trust lender directly or visit the MHP website to learn more about the eligibility guidelines.

VA Loans

The Department of Veterans Affairs backs this mortgage option and offers zero money down for veterans, service members, and certain military spouses. Rockland Trust offers both fixed-rate and adjustable-rate loan options and does not require homebuyers to sign up for private mortgage insurance.

According to the bank’s website, borrowers who have served at least 181 days of active duty or at least six years in the National Guard are eligible for this loan option.

Jumbo Loans

For mortgages that exceed standard borrower limits, Rockland Trust offers a variety of jumbo loans that can cover purchases of $424,100 to $1.5 million. These jumbo mortgages can be negotiated as fixed-rate or adjustable-rate loans, and boast a range of flexible term options.

This loan type is useful for borrowers looking to purchase a vacation or second home.

Rockland Trust Mortgage Customer Experience

Since its founding, Rockland Trust has focused on providing personalized service for communities near the southern shore of Massachusetts.

This regional specialization has enabled Rockland Trust to support the financial needs of over 250,000 individuals, families, and businesses within its expanding network, both in-person and online.

Although online customer reviews for Rockland Trust are sparse, the lender currently boasts an A rating from the Better Business Bureau, though it’s not BBB accredited at this time.

The Rockland Trust website has a variety of useful resources, including a mortgage calculator, a 15-minute loan pre-application tool, and an extensive help center.

The bank regularly updates its page with additional informative content and lender information to help streamline the application process. By providing the bank with personal details like name, address, phone number, and social security number, homebuyers can obtain timely and accurate rate estimates.

According to DS News, mortgage lenders using digital mortgage technology cut the average processing time by 63%.

Borrowers can obtain this discount by utilizing Rockland Trust’s customer portal starting from the pre-application process and extending through to the closing signatures.

Rockland Trust Lender Reputation

With over 110 years of experience, Rockland Trust has built a positive reputation as one of New England’s premier customer-focused banking institutions. Its consistent performance has helped it earn accreditation as an Equal Housing Lender and a member of the FDIC.

According to its BBB profile, Rockland Trust has had no customer complaints about its mortgage offerings. Additionally, the Consumer Financial Protection Bureau archive has no record of enforcement action taken against this lender.

- Information collected on Jan. 1, 2019

Rockland Trust Mortgage Qualifications

| Loan Type | Rate Type | Down Payment Requirement | Mortgage Insurance Requirement |

|---|---|---|---|

| Fixed-Rate Loans | Fixed | 5 - 20% | Yes, if down payment totals <20% |

| Adjustable-Rate Loans | Variable | 5 - 20% | Yes, if down payment totals <20% |

| FHA Loans | Fixed or Variable | 3.50% | Yes, if down payment totals <10% |

| MassHousing Loans | Fixed | 0 - 3% | Yes, if down payment totals <20% |

| MHP Loans | Fixed | 3% | No |

| VA Loans | Fixed or Variable | 0% | No |

| Jumbo Loans | Fixed or Variable | 5 - 20% | Yes, if down payment totals <20% |

When determining a borrower’s program eligibility, Rockland Trust considers a range of financial information like credit score, credit history, down payment amount, and property location.

Each mortgage option offered by Rockland Trust has different eligibility guidelines, though products like the FHA and VA loans conform to the pre-established qualifications of the federal government.

The interest rates listed on its website assume a 25% down payment amount, so it’s essential to make use of their mortgage calculator or speak with a lending agent directly.

The final APR amount may also be higher than listed, depending on the homebuyer’s credit history, loan-to-value ratio, and the amount of credit requested.

It is unclear from the Rockland Trust website whether they accept non-traditional credit histories as a part of their loan applications. All listed rates were calculated using a FICO credit score of 740 or higher, which suggests traditional credit score plays a significant role in the final rate offerings.

Rockland Trust Phone Number & Additional Details

- Homepage URL: https://www.rocklandtrust.com/

- Company Phone: 1-800-222-2299

- Headquarters Address: 288 Union Street, Rockland, MA 0237

- States Serviced: Massachusetts and Rhode Island