This is another guest post from JoeTaxpayer. On my blog, I’ve shared several articles that discussed the Roth IRA conversion event of 2010 in great length and detail. While this can be a great opportunity for many, there are several instances that a conversion does not. I looked to JoeTaxpayer to share some pros and cons of the Roth IRA conversion and for unforeseen consequences that could result.

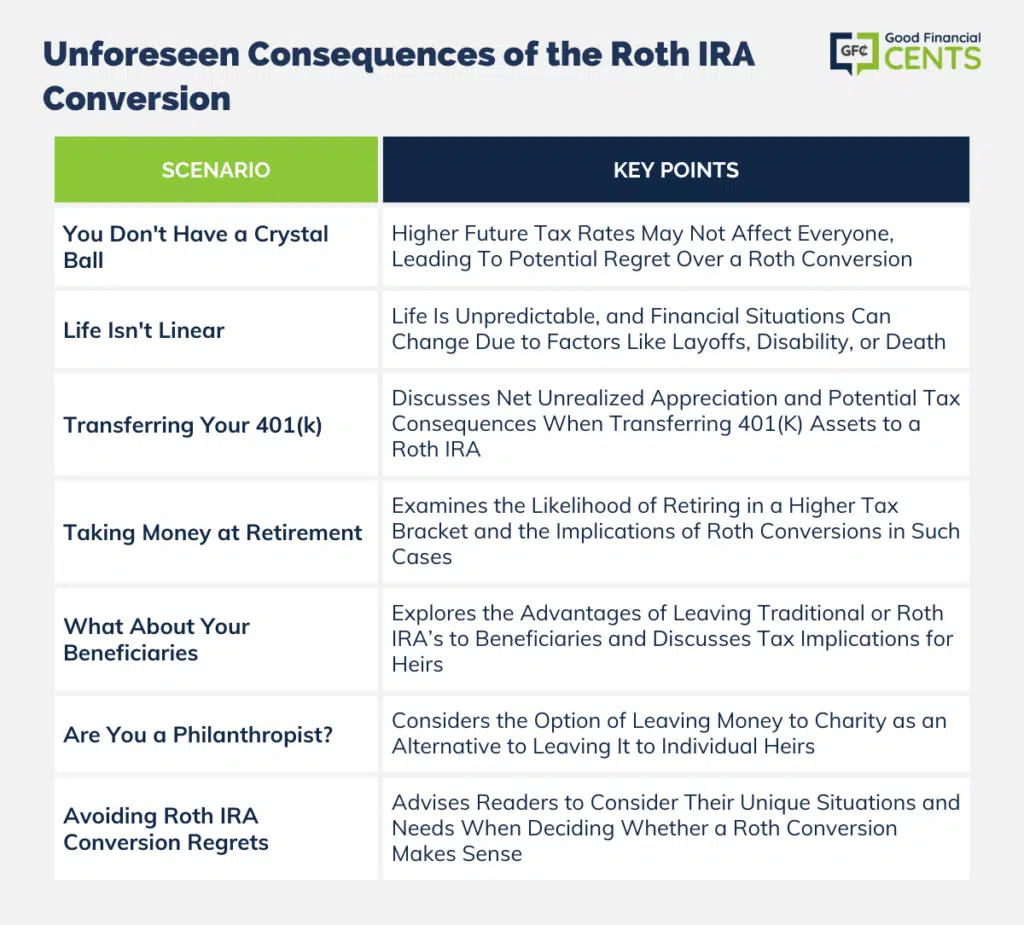

There’s been much hype regarding the ability for anyone to convert their retirement money to Roth regardless of their income. Many professional planners and writers of financial blogs have offered compelling reasons why one should convert. Today, I’d like to share some scenarios where you might regret that decision.

Table of Contents

You Don’t Have a Crystal Ball

All signs point to higher marginal rates, this is one factor that prompts the advice to convert, but who exactly would that impact, and by how much? Let’s look at the first risk of regret. You are single, and an above-average wage earner, just barely in the 24% bracket. (This simply means your taxable income is above $95,376 but less than $182,100, quite a range). Any conversion you make now is taxed at 24%, by definition. You get married and start a family quickly, your spouse staying home.

That same income can easily drop you into the 12% bracket as you now have three exemptions, and instead of a standard deduction, you have a mortgage, property tax, and state tax which all put you into Schedule A territory and a taxable income of less than $89,450. Now is when you should use the conversion or Roth deposits to take advantage of that 12% bracket before your spouse returns to work and you find yourself in the 25 or 24% bracket again. It’s then that you should convert enough (or use Roth in lieu of a traditional IRA) to ‘top off’ your current bracket.

Life Isn’t Linear

It’s human nature to expect the next years to be very similar to the past few. Yet, life doesn’t work quite that way. The person who makes more money year after year, from their first job right through retirement is the exception. For more people, there are layoffs, company closings, major changes in family status, disability, and even death.

Except for permanent disability or death, the other situations can be considered opportunities to take advantage of a full or partial Roth conversion. If one should become disabled, the ability to withdraw that pretax money at the lowest rates is certainly preferable to having paid tax on it all at your marginal rate.

Transferring Your 401(k)

The Roth conversion is available for holders of 401(k) (and other) retirement accounts as well as holders of traditional IRA accounts. Back in October 07, I cautioned my readers on a somewhat obscure topic they need to be aware of when considering a transfer from the 401(k) to their IRA and the same caution exists for conversion to a Roth. Net Unrealized Appreciation refers to the gains on company stock held within your 401(k). The rules surrounding this allow you to take the stock from the 401(k) and transfer it to a regular brokerage account.

Taxes are due only on the cost of that stock, not the current market value. The difference up to the market value at the time of sale (thus the term Net Unrealized Appreciation) is treated as a long-term capital gain. Current tax law offers a top LT Cap Gain rate of 15%. A loss of 10% or more if you are in the 25% bracket or higher and convert that company stock to a Roth.

Taking Money at Retirement

Given the low saving rate of the past decades, all projections point to fewer than the top 10% of retirees coming close to ‘retiring in a higher bracket.’ Consider how much taxable income it would take to be at the top of the 15% bracket in 2023. For a couple, the taxable income needs to exceed $89,450. Add to this the $25,900 standard deduction. This totals $115,350. Using a 4% withdrawal rate, it would take $2,883,750 in pretax money to generate this annual withdrawal.

What a shame it would be to pay tax at 25% to convert only to find yourself with a mix of pre and post-tax money that puts you toward the bottom of that bracket. Whose marginal rates do you believe will rise? Couples making less than $70,000? I doubt it. What’s the risk? That you should be in the 25% bracket at retirement? That’s still breaking even in the worst scenario.

What About Your Beneficiaries

While a tax-free inheritance might be great for the kids, a properly inherited, properly titled Beneficiary IRA can provide them a lifetime of income. Consider, that if you leave a portion of your traditional IRA to your grandchild, a 13-year-old, his first-year RMD (required minimum distribution) will only be about 1.43% of the account balance. For a $100,000 account left to him, this RMD falls shy of the current $3,164/yr limit before he is subject to the kiddie tax.

To ensure that he doesn’t withdraw the full remaining amount at 18 or 21, consult a trust attorney to set up the right account for this purpose. If left to your own adult children, the advantage can go either way depending on their income and savings level.

Are You a Philanthropist?

If you don’t have individual heirs you wish to leave your assets, the ultimate poke at Uncle Sam is to leave your money to charity. No taxes at all are due. Leaving Roth money to charity just means that our government already got its piece of the pie.

Avoiding Roth IRA Conversion Regrets

Today, I’ve shared with you some scenarios that are cause for regretting a conversion. As I always caution my readers, your situation may differ from anything I addressed here, and your unique needs are all that matters. If you have any questions on when or if a conversion makes sense for you, post a comment and we’ll be happy to discuss.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Please see a tax professional before implementing any sort of IRA conversion. JoeTaxPayer is not affiliated with or endorsed by LPL Financial.

Final Thoughts on Unforeseen Consequences of the Roth IRA Conversion

The decision to convert to a Roth IRA is multifaceted, demanding careful consideration of individual financial circumstances and future goals. While certain scenarios may warrant conversion, others may lead to regrettable financial consequences. This discussion has illuminated some of these potential pitfalls. It’s imperative to remember that life’s unpredictable nature can profoundly impact financial decisions.

Consequently, a tailored approach, possibly in consultation with a tax professional, is essential to navigate the complexities of Roth IRA conversions and ensure they align with one’s long-term objectives.

0 Comments