Most people are aware that if you withdraw funds from a tax-sheltered retirement plan before you reach age 59 1/2 you will have to pay income tax on the amount of the distribution plus a 10% early withdrawal penalty.

Many are also at least vaguely aware that there are exceptions to the early withdrawal penalty. And in fact, there are actually several of them, and that’s where it can get confusing. Which one do you take, and how much and when?

Cathleen R. of Massachusetts wrote in with a question that covers the range of possibilities:

“I will be separating from my company in May of 2016, and turning 55 in July of 2016. I plan to withdraw funds from my 401K to build a house. I am familiar with the IRS Rule of 55, and know that I will have to claim the withdrawal as income, but I will not have to pay the 10% penalty.

My question is, do I have to take the withdrawal from my 401K in 2016, the year in which I separate service and the year I turn 55? Or can I wait until 2017 and still take a penalty free withdrawal? My goal is to minimize my taxable income as I will have earned income Jan-May of 2016.

I would also like to know if I can take multiple penalty free withdrawals, essentially taking a withdrawal from my 401K in 2017 and 2018 in order to minimize my taxable income? (Note, I have no immediate plans to roll my 401K into an IRA, as I know IRA’s are not qualified plans to the Rule of 55.)”

Cathleen’s question addresses three topics: the general application of the Rule of 55, when it will need to be taken, and how to best keep the actual income tax liability to an absolute minimum by spreading out the distributions.

Table of Contents

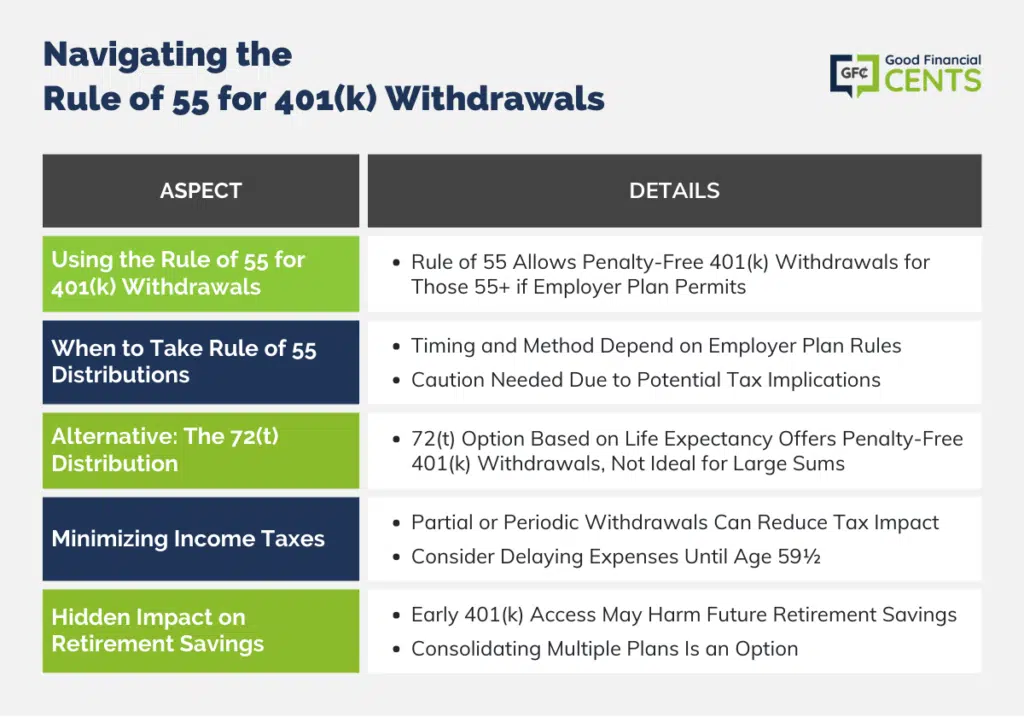

Using the Rule of 55 to Get Penalty-free 401(k) Withdrawals

Cathleen can indeed make withdrawals from her 401(k) plan, subject to ordinary income tax, but exempt from the 10% early withdrawal penalty. The IRS separation from service exception makes this possible.

This provision, sometimes referred to as the Rule of 55, enables employees to take distributions from their 401(k) or 403(b) plans without having to pay the penalty.

The employee must be separated from service during or after the year he or she reaches age 55 although it can be as early as age 50 for certain government workers.

In Cathleen’s case, she qualifies because she turned 55 in the same year that she was separated from her employer, 2016. “Separated” can refer to laid off, quit, or otherwise terminated.

This doesn’t apply in Cathleen’s situation, but it’s a point worth emphasizing in this discussion. If you still have money in the retirement plan of an employer that you were separated from before the year in which you turn 55, you will not be eligible to take advantage of the Rule of 55.

Your only option to avoid the early withdrawal penalty at that point will be to defer taking distributions until you turn age 59 1/2 when withdrawals will no longer be restricted.

Based on Cathleen’s question, however, I want to make some important distinctions. Cathleen references needing to withdraw the funds in order to have a house built.

This can put a confusing wrinkle into the question because making an early withdrawal from a 401(k) to purchase a home does not qualify for the penalty exemption.

That exemption applies only to withdrawals from an IRA, and only up to a maximum of $10,000 for a first-time homebuyer. So let’s make clear the distinction that we are not attributing the exemption to the fact that she wants to build a new home.

Second, as Cathleen acknowledges in her question, the Rule of 55 exemption does not apply to IRA accounts. It’s strictly for 401(k) plans, so if Cathleen rolls over her 401(k) into an IRA, the Rule of 55 exemption will be lost.

Something else to be aware of, even if it doesn’t apply in Cathleen’s situation, is that the Rule of 55 applies only to the 401(k) plan of your last employer.

If you have plans from previous employers, the rule of 55 will not benefit you if you begin withdrawing funds before turning 59 1/2.

Good advice here is that if you have 401(k) plans from previous employers, you should roll them over into your current 401(k) if you are permitted to do so.

One other limitation and this one is pretty important. So far we’ve been discussing the Rule of 55 based on IRS regulations. But whether or not you can actually take advantage of the rule will depend upon stipulations in your employer’s 401(k) plan.

When Should Cathleen Take Her Distributions?

Let’s start by discussing the rules regarding Rule of 55 distributions. If your employer permits you to take the Rule of 55 distribution, you’ll have to do it under the terms they permit. For example,

the employer may permit withdrawals at your own discretion, while others may require the entire account be liquidated in a lump sum.

If they do, you may be withdrawing more funds than you’d like. It also has the potential to create a huge ordinary income tax liability, though it will not trigger the 10% early withdrawal penalty.

An alternative may be to take the lump sum distribution, use the funds that you need – in Cathleen’s case, to build a home – and then roll the remaining funds over into an IRA to minimize the income tax bite.

However, an employer may give you an either/or choice – either take the full distribution or do a rollover of the entire balance. If you take the full distribution, the employer will withhold 20% for income taxes, so you’ll lose that portion when you do the rollover.

What’s more, any funds rolled over from a 401(k) plan to an IRA will no longer be eligible for the Rule of 55 penalty exception.

The 72(t) Alternative

Still another option is to set up a series of substantially equal periodic payments, sometimes known as a 72(t) distribution. These are calculated based on your remaining life expectancy, which the IRS discloses in Publication 575 – Pension and Annuity Income (Page 15).xx

According to this chart, Cathleen, at age 55, will have to calculate periodic payments based on 360 months. She can determine the amount of the annual distribution by dividing the amount of her 401(k) by 360 months, times the number of months in the year of distribution.

So for example, if Cathleen has $360,000 in her 401(k) plan, she is entitled to withdraw $12,000 per year which will not be subject to the early withdrawal penalty.

Once the distributions begin, they must continue for a period of five years or until you reach age 59½ – whichever is longest.

This option won’t work in Cathleen’s case because she has plans to use the money to build a house, and it will only allow her to withdraw about 3% of the plan funds.

Spreading Out the Distributions to Minimize Income Taxes

This is the last part of Cathleen’s question. But while there might be some wiggle room here, the reality is that the distributions from her plan will be completely determined by her employer.

If the option to take partial or periodic withdrawals is available, that will be the best way to minimize the tax consequences.

If her employer requires a full lump-sum distribution, Cathleen will have two real options:

1. Delay having a new house built until she turns 59 1/2, and can withdraw any amount of money from her 401(k) penalty-free, or

2. Take an early withdrawal on as much money out of the 401(k) as she needs to have the house built, and be prepared to pay the 10% early withdrawal penalty as well as the ordinary income tax on the amount withdrawn.

Unfortunately, a 401(k) loan is not a solution either. Employers do not permit loans to former employees, since repayment can no longer be guaranteed.

In addition, loans are limited to no more than 50% of the plan balance, up to a maximum of $50,000. That might not be enough to have the new house built anyway.

The Hidden Flaw in the Rule of 55

One factor for Cathleen and for anyone considering a Rule of 55 distribution to be aware of is the potential to impair your future retirement.

While you may get the benefit of access to the funds in your 401(k) for immediate need, any funds taken – whether through a lump sum or a partial withdrawal – will reduce your retirement savings.

A full lump sum distribution will have the most negative impact, virtually removing your entire 401(k) plan from providing a future source of retirement income.

The best option may be for those who have multiple 401(k) plans, with the majority of the funds held in plans from previous employers. You can then take a full liquidation on your current or last employer plan while leaving the remainder of your plans intact.

Cathleen, I’m sorry that there isn’t a more satisfactory answer, but those are the rules. I would suggest that you discuss your situation in some detail with both the 401(k) plan trustee and your tax preparer.

I’m sure that the amount of tax you will have to pay on any distributions – plus any early withdrawal penalties – will have an impact on which way you will decide to go.

The Bottom Line – Ask GFC 022 – How to Work the “Rule of 55” to Your Advantage

The “Rule of 55” can be a handy tool for penalty-free 401(k) withdrawals in certain situations, like Cathleen’s. But, there are some important things to keep in mind.

First, using this rule means you can tap into your 401(k) without that pesky 10% early withdrawal penalty, but you’ll still owe income tax. Cathleen’s case is a good example. She turned 55 and left her job in the same year, which qualifies her for this perk.

However, there are limits. You can only use this rule with your last employer’s 401(k), so if you’ve got multiple accounts, you might need to do some financial juggling.

Can you clear up one condition related early retirement. I will turn 55 this year and am looking to retire late this year or early next year. I dont want quit working completely, I want move to part time work. How does this impact early withdraws? What if I leave the company I am working for where my 401k is invested at and take part time work for another company. Am I still eligible to make penalty free withdraws?

Thank you. Your explanation gave a better understanding of rule 21.

Thank you. I have exact situation and the way explinatiom was purfect for me. I know what to do.

I am over 55 with my current company and have a 401k…I had a 401k with employer I left over 20 years ago, at some point they would not manage it anymore so I rolled to two Ed Jones IRA accounts. I know I can roll other employer 401k to my current 401k and it will be eligible for ‘rule of 55’… what about rolling over these two IRAs? Money in it is all pre tax. Thanks

This article appears to be confusing the Rule of 55 with the IRS section 72t distribution rules. They are not connected as far as i know. That is, under the Rule of 55 a person can take distributions from the 401k plan of his/her last employer at any amounts and intervals (subject to the specific 401k plan guidelines). The 72t distribution, also known as the Substantially Equal Periodic Payment or SEPP exemption, is a different thing and can be initiated prior to turning 55 and, i think, can also be taken from an IRA plan in the manner described in the article – i.e., equal periodic payments, etc.

Agreed Harry, we need to separate the two.

yes that was confusing need to separated the two

I turn 55 December 2019. I have my 401K only from my current employer since I started 12 years ago. I’ve maxed it out every year. I want to retire in 2019 or 2020. I’m interested in taking all of it, claim it all the year I retire, and just be done with the taxes. My wife’s salary already has us in the 32% bracket. I won’t pay that much more in taxes if I take partial distributions over several years. (3-5% with the current brackets). Can I still avoid the 10% penalty if I take all of it? My plan does not allow a partial distribution once separated if I’m under 59 1/2..

Thank you

Joe

Hi Joe – You can under the Rule of 55, but please discuss the tax consequences with a tax preparer before taking the step. You might change your mind upon seeing the actual tax liability of the distribution.

My 401k (Vanguard) stated there is no limit on how much you can take out. It’s not a pro-rated amount based on life expectancy as stated. You can take it all out at once if you so choose.

Hi Gary – The employers have a lot of latitude with these plans, so that sounds right.

Jeff, there is no requirement to take substantially equal periodic payments with the Rule of 55. Multiple withdrawals could be taken in different tax years per the original question.

Hi Matt – Can you cite the section of the tax code that confirms that?

Jeff,

I believe that your comment regarding the IRS “Rule of 55” and the SEPP requirement is incorrect. Can you provide us with the IRS section that requires SEPP on “Rule of 55” distributions?

Hi Marty – I don’t know which part you’re disagreeing with, but the IRS rules are here.

As an employee of one of the nation’s largest 401k record keepers, please let me clarify this for anyone who is confused by the author’s take on the rule of 72t/age 55 rule. It’s rather ambiguously written, as are the answers to some of the comments below the article.

First off, these are 2 distinctly different things.

The rule of 55 will allow you to take a withdrawal from your employer sponsored plan (ie. 401k, 403b) assuming that a) you separate from service during or after the year that you turn 55 and b) the withdrawal needs to wait until after the plan updates the 401k provider (ie. Vanguard, T Rowe, Fidelity, TIAA CREF) of that separation in service. There is no requirement to take more withdrawals over the subsequent years. A couple of you asked if you could take the entire balance. YES!!! Generally this is not advisable, but you can definitely do it. The catch is that each 401k plan can offer different, and sometimes, restrictive access to withdrawals. Google “402f special tax notice” and you will see nothing about annual payments.

72t is a tax strategy that allows you to take penalty free withdrawals from a 401k or an IRA before you are 59.5 in order to avoid the 10% early withdrawal penalty. This can start at ANY age, you don’t need to be 55. The stipulation is that you take “substantially and equal periodic payments” for 5 years or until you reach age 59.5, whichever is longer. Also, if accessing the dollars from a 401k plan you would need to make sure your plan offers the flexibility to take annual withdrawals. I won’t pretend to be an expert on 72t, but I’ve talked to plenty of people who have done it wrong, so please consult a tax professional instead of online articles like this one.

Thanks for the input Jim. We’re trying to address this topic in a general way. But as with all things related to pensions and income tax consequences, there are always special considerations and exceptions that we can’t possibly address in 2,000 words or so.

And I do completely agree with your advice for anyone facing this possibility to discuss it with a tax professional. This article is a primer, and everyone’s situation is a little bit different.

Topic Number 558 – Additional Tax on Early Distributions from Retirement Plans Other Than IRAs……………..

No Additional 10% Tax

Distributions that aren’t taxable, such as distributions that you roll over to another qualified retirement plan, aren’t subject to this additional 10% tax. For more information on rollovers, refer to Topic No. 413 and visit Do I Need to Report the Transfer or Rollover of an IRA or Retirement Plan on My Tax Return?

There are certain exceptions to this additional 10% tax. The following six exceptions apply to distributions from any qualified retirement plan:

Distributions made to your beneficiary or estate on or after your death.

Distributions made because you’re totally and permanently disabled.

Distributions made as part of a series of substantially equal periodic payments over your life expectancy or the life expectancies of you and your designated beneficiary. If these distributions are from a qualified plan other than an IRA, you must separate from service with this employer before the payments begin for this exception to apply.

Distributions to the extent you have deductible medical expenses that exceed 7.5% of your adjusted gross income whether or not you itemize your deductions for the year. For more information on medical expenses, refer to Topic No. 502.

Distributions made due to an IRS levy of the plan under section 6331.

Distributions that are qualified reservist distributions. Generally, these are distributions made to individuals called to active duty for at least 180 days after September 11, 2001.

The following additional exceptions apply only to distributions from a qualified retirement plan other than an IRA:

Distributions made to you after you separated from service with your employer if the separation occurred in or after the year you reached age 55, or distributions made from a qualified governmental benefit plan, as defined in section 414(d) if you were a qualified public safety employee (federal state or local government) who separated from service in or after the year you reached age 50.

Distributions made to an alternate payee under a qualified domestic relations order, and

Distributions of dividends from employee stock ownership plans.

Refer to Topic No. 557 for information on the tax on early distributions from IRAs. For more information, refer to Publication 575, Pension and Annuity Income, and Publication 590-B.pdf, Distributions from Individual Retirement Arrangements (IRAs).

Thanks Sean.

This is the first time I’ve read that the ‘Rule of 55′ requires, “taking a series of substantially equal periodic payments.”

Isn’t this how the ’72t’ rule works and not the ‘Rule of 55’?

You’re right Sean, the two are connected. The Rule of 55 is within 72t. It does have different various, 72t that is.

I will be 55 in August. I have app. 30,000 in my 401K. If I retire in Dec. 2018, will I be able to what draw the full amt. and pay 10% on tax return.

Hi Janet – You won’t be able to withdraw the full amount all at once. Under the Rule of 55 you have to select a distribution plan that will distribute the money over several years or even over your life expectancy. You won’t have to pay the penalty tax, but you will have to pay ordinary income tax on the amount of the distributions each year.

I have same situation as Jackie

“I Turned 55 in 2017 and I was laid off in Oct 2017. would I be able to use the 55 rule to withdraw all my funds from my 401k without the 10% penalty.”

It is 2018 and I am working as consultant

Am I able to withdraw still with no penalty?

Thank you

Hi Ovidio – The Rule of 55 applies to a job you’re no longer employed at. The fact that you’re working in another capacity doesn’t negate the Rule of 55.

I have a question on the over 55 age rule on my 401k. I was let go from my company in December of 2015, I turned 55 in 2016. This left me one month short of the 55 rule. I did get a sizeable severance check and bonus check in February of 2016 and claimed it as income from my old company on my 2016 return. Would this money be considered payment to put me over the 55 rule? Also, I would like to take some money out of the 401k and roll it over to an IRA. What would be the best way to do this? Take a loan out of the 401 first then rollover or rollover then take it out?

Hi Danny – You can use the 72(t) option of taking “substantially equal periodic payments” based on your remaining life expectancy. There’s no age limit on the method. And no, I don’t think the severance and bonus checks will get around the age problem – but check with a CPA on that.

As to the 401k rollover, you’ll have to do an actual rollover. Since you’re no longer employed by the plan sponsor, you won’t be eligible for a loan.

I Turned 55 in 2016 and I was laid off in July 2016. would I be able to use the 55 rule to withdraw all my funds from my 401k without the 10% penalty.

thank you,

Jackie

Hi Jackie – You should be able to on a gradual basis, but not all at once. Check with the plan administrator and see what you need to do to make it happen.

But be aware that even if you use the Rule of 55 you will still have to pay tax on the amount distributed. You won’t have to pay the 10% penalty.

From the Ask GFC 022 – How to Work the “Rule of 55” to Your Advantage article.

If Cathleen R. is using the age 55 rule she does not have to use a SEPP formula calculation for deciding the amount of money she wants to receive.

Rule of 55 is not equal payments like the 72t part iv, part v. You don’t have to be 55 or> to use the equal payment 72 t.

I am confused. From my understanding, the 72t rules you mentioned can be used for IRAs at any age, whether separated from service or not. The age 55 exemption is only for your current employer’s 401K, but is not subject to the 72t limitations imposed on IRAs.

lwadzo you have it correct. In the article above the author states the following: “Let’s start by discussing the rules regarding Rule of 55 distributions. If you use the rule, you must do so by taking a series of substantially equal periodic payments.”

If using the age 55 rule you can withdraw the amount you want. You do not need to take a series of substantially equal periodic payments.

right, doing a bit more research myself, and I can see the differences. This article is confusing. I am checking many sources, because the one thing all articles agree on, if you screw up, the IRS hits you hard!

I don’t think it’s “confusing,” I think it’s simply incorrect.

You’re right Iwadzo, you can do it at any age on an IRA. But there are specific rules relating to the number of years for the distributions.

Jeff,

Where are you getting that “rule of 55” distributions must be equal periodic payments? I don’t see it anywhere in the tax code and am wondering if I am about to do something wrong…

Hi Matt – “Consistent” may be a better word than “Equal”, but “substantially” may be the fudge factor. The IRS gives several distribution methods that can result in different amounts, like those based on percentages.

Jeff- I am unable to find any reference to how much someone can take under the Rule of 55. I believe you are mistaken and people can take as much as they want under this rule.

I don’t think so Dave. Check out this page from the IRS about the three distribution methods. I mean you probably could take it all in a lump, but then you’ve got the 10% penalty that we’re trying to avoid.