What do you think my answer is to the above question? Does the screenshot below give you an indication? It better! I cringe anytime someone asks me this question. Don’t do it. If you need a couple of other options, watch the video or read below.

Whatever you do, don’t use your 401(k) money to pay off your credit cards. When you’re paying those credit card bills every month, it can be tempting to pay off those bills in any way possible. There are a few accounts that are off-limits.

Your 401(k) is the main engine behind your retirement vehicle. It’s vital you are properly managing your 401(k) account. I get a lot of questions about taking out a loan from 401(k). This could be one of the worst mistakes you make for your retirement.

Table of Contents

You might have found yourself with thousands of dollars of debt. Credit card debt can put a serious strain on your finances. There are several ways to address this challenge.

2 Alternatives to Borrowing From 401(k)

Get a Personal Loan From Your Local Bank

You might be asking yourself why you are taking on more debt to pay off old debt. Don’t. Think of it as consolidating and reducing the interest rate on your loan. I recently had a reader who followed my advice and shaved her interest rate by 10%. If you haven’t hurt your credit you can use a balance transfer card and some of the cards will give you airline points for any future purchases.

Once upon a time, getting a loan from the bank was a long and frustrating headache. Thanks to all of the various options and products from banks, getting a personal loan has never been easier.

In fact, there are plenty of banks where you can apply and be approved for a loan online. You don’t even have to step foot in a bank. Not only is it easier to get a loan online, but you can also be approved for lower rates.

If you decide to get a loan through a bank, always compare dozens of banks before you decide which one is best for you. Every bank is different, all of them are going to offer different rates and have different fees.

Consider Peer-to-Peer Lending

P2P lending is becoming a mainstay in the financial services industry. The leading peer-to-peer lender is Lending Club having issued over $1 billion of loans.

Getting a loan through Lending Club is simple. You’ll need to provide some basic personal information, like SSN and address, as well as employment and income information. There are a few requirements you’ll have to meet:

- Credit score of at least 600

- Three years of credit history

- Max debt-to-income ratio of 40%

As long as you meet these requirements, you should have no problems. You can secure loans anywhere from $1,000 to $25,000. In most cases, the Lending Club is quick about approving applications. In most cases, the application will be approved in less than a week. After that, all you have to do is wait for the investors to back your loan.

If Lending Club doesn’t work for you, there are several other excellent P2P sites out there. Sites like Prosper or LendingTree are excellent alternatives.

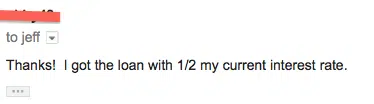

Another reader who was currently paying over 25% on her credit cards emailed me asking about cashing in her 401(k) to pay off her credit cards. (She’s the one that inspired me to film the video). I suggested she check out Lending Club which she did immediately.

A few days later I received this email:

Boom! That’s how you save money and not jeopardize your financial future.

(You can also consider Prosper, another P2P lender.)

There are several reasons why taking out a loan on a 401(k) is a bad idea. If you were to get fired or quit your job before you’ve paid the loan, you’ll then have 60 days to pay back the full amount of your loan. If you don’t get it paid, the IRS is going to treat the loan as a withdrawal from the account. If you’ve considered using your 401(k) to pay off some credit card, explore these alternatives first.

| Alternative | Description |

|---|---|

| Option 1: Personal Loan | Consolidate Debt, Apply Online for Lower Rates, Compare Bank Offers |

| Option 2: Peer-to-Peer Lending | Lending Club: Fast Approval, Lower Rates, Loan Range $1,000-$25,000. Explore Prosper, LendingTree |

Tips for Paying off Credit Cards

In some cases, you don’t have to take out a loan to pay off your credit card bills. Making a couple of financial tweaks or lifestyle changes can give you the extra cash you need to pay off those credit card bills.

Pay Off Highest APR

The first thing you should do is pay off the highest APR first. Paying off the card with the highest interest rate will save you a lot of money over the long haul. After you have the first one paid off, move on to the card with the next highest APR.

Start a Budget

If you don’t know where your money is going, then you don’t know where you could be wasting money. If the idea of creating a budget makes you want to hit your head against a door, don’t worry, there are several easy ways you can create a budget.

Having a budget (and sticking to it) can show you areas where you can trim back your spending. You can use all of the extra money to pay off some of your credit card bills. Most people are surprised to see how much they are spending every month.

Pay Credit Card Bills

After you’ve created your budget, you have to do something with it. Look for two or three areas where you can cut back or eliminate completely. Paying off your credit card bills is going to require some sacrifices.

When you’re trying to eliminate those debts, it’s important you stop using your credit card. Put the card in the freezer or chop it up. Do whatever you have to keep from racking up even more debts on the card.

Bottom Line

As I mentioned above, getting your debts in one place is a great way to help pay off your credit card bills. Consolidating your debts can save you money on your interest rates. If you can find a balance transfer card that fits your needs, this is one of the best ways to pay off your debts without paying a fortune in interest.

What kind of advice is this? You do not pay taxes when you BORROW from 401K. As long as you pay the loan back into is NOT taxes or penalized. You do, however lose interest you would’ve gained.

Balance transfers to lower-rate cards also help reduce the amount of credit card payment contributed to interest. This increases the amount used to draw down the principal balance for a faster and cheaper pay off.

Also, many financial institutions offer credit card deferment authorizations; sometimes these can be up to 90 days. Although the card still accumulates interest, this is a way to create time for seeking an alternative form of financing a balance payoff without lowering credit score.

Collateralized loans using financial instruments such as Certificates of Deposit are another option to a 401(k) loan. This protects the balance of the retirement plan and keeps it on track for its intended purpose of saving and building wealth for retirement.

I definitely agree with you. I would never recommend borrowing from your 401K to pay off your debts and loans. There are other better alternatives. Though I did not go the route you are suggesting when I was trying to pay off our credit card debts, I think they are good options. Thank you for the information.

Great advice Jeff. Paying 35 – 40% in penalties (10% excise tax + money gets taxed at your current tax bracket) in order to pay off your debt that is currently at a 25% interest is just bad math.

I heard of a family that just used their credit cards to buy everything while they were in a financial hot spot, which wasn’t smart. Turns out he is a financial adviser…. I guess common sense doesn’t always seem all that common even to business professionals.

Another good option for paying off credit card debt: Sign up for a Debt Management Plan through a nonprofit credit counseling agency.

Occasionally common sense prevails.