Do you find yourself consumed in a mountain of debt considering a debt consolidation loan and struggling to decide which bill to pay off first? Is it the department store card with a 24.99% interest rate?

Or maybe it’s your car loan that you financed for 72 months? Or should you double up on your mortgage and become a homeowner sooner? When it comes to paying off debt, many have their opinions as to where the pecking order should begin.

Dave Ramsey, author of Total Money MakeoverTM, recommends the Debt Snowball approach. This method suggests you make a list of all your debts, smallest to largest while disregarding interest rates, and paying off the smallest to largest to help you achieve satisfaction as you mark off the paid balances.

Suze Orman has a different approach.

Catching another of Suze’s episodes, she shared her Loyalty List of Paying Off Debt. Suze shares which debts you should pay off sooner rather than later. When you don’t have a lot of extra cash to spread around, this might help with your decision.

First, a disclaimer. I do not endorse Suze Orman. Sometimes her advice is downright scary. But I thought this was a decent approach to helping individuals struggling with debt to sort through the mess.

Table of Contents

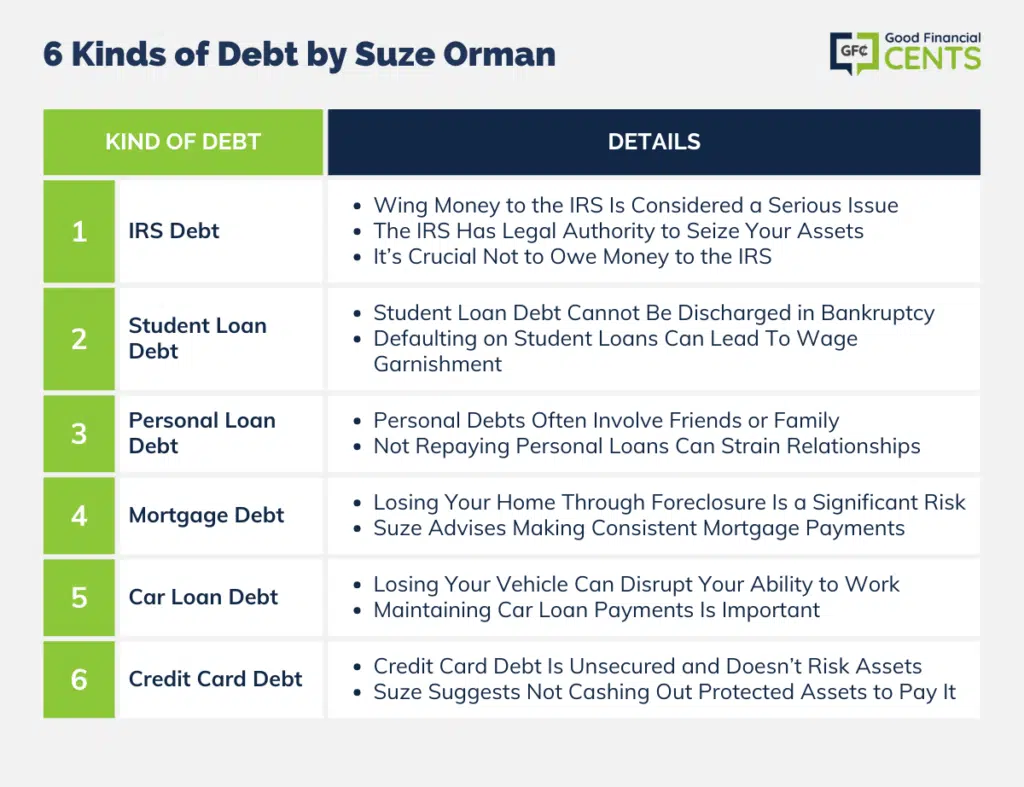

6 Kinds of Debt According to Suze Orman

Suze first breaks down the six kinds of debt that all people have:

1. IRS Debt

2. Student Loan Debt

3. Personal Loan Debt

4. Mortgage Debt

5. Car Loan Debt

6. Credit Card Debt

Does any of these sound familiar? Probably more than you want to admit.

IRS Debt

The first on the list is debt owed to the IRS. As Suze says, owing any money to the IRS is, “Bad, bad, bad.” (I think she added a few more “Bads” in there). I couldn’t agree with her more. Anytime you owe money to the IRS is not a good thing.

Why? Primarily, since the IRS can legally seize your money via your bank accounts at any time. Why would you want to own money to an entity that has legal authority and can do anything it desires? Don’t mess with them, period.

Student Loan Debt

Next on the list……paying for that college education. One reason to keep paying your student loan debt is that it can not be discharged in a bankruptcy filing.

Sure, you can arrange a deferment or forbearance, but; whatever you do the interest will continue to accrue. Thinking about not making your student loan payments? It’s okay, they can just garnish your wages to get their money back. Ouch!

Personal Debt

Why would Suze think that personal debt would rank higher than credit card debt? Suze argues that when somebody has personally loaned you money they have done so because they trusted you would pay them back.

Not paying off your friend/family member/loved one will negatively affect your relationship.

Think of the uncomfortableness of being around that person at a family function or party. Can you say, “Awkward”? Besides, by not paying them back you could be putting them at financial risk.

You must be responsible to those who helped you and make it a point to pay them back. If you rather not take the approach of being personally loaned money, here are some tips on how to get the best personal loans.

Mortgage Debt

“You don’t want somebody to take your home away from you”, Suze says.

The past year the term “foreclosure” was too commonplace and a sad reality for many homeowners. The last thing you want to lose is your home. Suze suggests to do your best and keep making those mortgage payments.

Car Loan Debt

After you continue to make your house payment make sure you still have a way to get to work to be able to keep making those payments. Losing your car might put a damper on this. Make those payments and don’t let your car get repossessed.

Credit Card Debt

Many of you think that credit card debt should be first on the debt loyalty list. Suze argues, “Credit card debt is unsecured debt.”

That means that if you don’t pay it, they can’t take your home or your car. They also can’t take your money, seize your accounts, or make you feel guilty at a party.

On that note, I agree with Suze. Often times I’ve had clients who have wanted to cash out their 401(k)s to pay off their credit cards.

Whatever you do, DO NOT do this! Your 401(k) is protected from bankruptcy and might be the only source of money if your going bankrupt becomes a reality.

What do you think of Suze Orman’s Debt Loyalty List? Do you agree with her order, or would you change it?

Wow, I couldn’t have said it better. She is what I call a friend to all of us struggling with any kind of dept. Please be sure to listen when she talks, she is way better than E.F hutin. I really know that her list is the right way to go.

I ran into financial hardship through a 4 year divorce, although the divorce is final, I’m now drowning in debt , unfortunately I have been extremely short changed, I will not be receiving the funds I was expecting. I have always taken great pride in keeping my credit good, I’m afraid of bankruptcy and would only use that as last resort, at the moment, I’m in a dilemma between consolidation or a hardship relief program the state of California offers to their residents. I have $30,000. Debt between 2 credit cards and a lending club. Please help sincerely Lilli

Hi Lilli – The best advice I can offer you is to meet with a California based debt attorney to discuss your options. I don’t know you and can’t give specific advice.

I would certainly agree that paying credit card debt comes last in any list of priorities, and that personal debt (should) rank high.

The others are situational. True, you don’t want to get the IRS mad — but they do understand the word “broke,” and are not the ogres they were 30 years ago. Student loans? There are more and more ways to get them discharged. As to mortgage and auto — there’s nothing sacrosanct about a house; if a car/work truck is essential to your livelihood, then that would come before the mortgage.

I filed a bankruptcy in 2010. I am collecting Unemployment and working 2 jobs. One is per diem and the other is part time. My monthly income is only $1000.00 and my credit score is only 640.

I would like to purchase a vehicle privately from a family member for approximately $12,000 with a down payment of approximately $2000 from the car that I currently own (which is falling apart).

So far,the only company that will give me a loan is a credit company and that company requires a co-signer (which I do not have at the moment).

Do I have any other options of obtaining an auto loan at this point?