Headquartered in Stamford, Connecticut, Synchrony Bank is an online bank that pays some of the highest interest rates on deposits available anywhere.

It’s part of the Synchrony Financial organization, which was founded in 2003 but traces its roots all the way back to 1932.

Synchrony Financial has over $104 billion in assets and is the largest provider of private-label credit cards in the U.S.

Table of Contents

But does that mean they are the right choice for you?

Synchrony Bank: A Full Review

Synchrony comprises 42% of the private label credit card market, partnering with such popular brands as:

- American Eagle

- Banana Republic

- Ebates

- Walmart

- Lowe’s

- Guitar Center

- Gap

- BP

- Ashley Home Stores

- Discount Tire

- TJ Maxx

- JC Penny

Though Synchrony Financial is primarily involved with credit cards and financing, the Synchrony Bank division is fast making a name for itself as one of the premier online banking institutions.

They pay super-high interest rates on their savings, money markets, and certificates of deposit (CDs), all of which are fully insured by FDIC.

Synchrony also offers specialized IRA CDs and IRA money markets.

As an online banking platform, you can access your account every day and at any time of the day.

In addition to very high rates, Synchrony Bank also offers loyalty perks based on the size of your account balance and/or the length of time that you have an account with them.

If you’re looking for high yields on risk-free investments, Synchrony Bank is where you’ll find them.

How to Open a Synchrony Bank Account

You can open regular savings-type accounts, as well as trust accounts and IRAs.

In order to open up an account with Synchrony Bank, you must be a U.S. person for federal income tax purposes and have a valid U.S. residence.

The following information will be required to open an account:

- U.S. Social Security Number,

- U.S. Driver’s License, State Identification Number or Military ID,

- Your Physical Address (But You Can Add an Alternate Mailing Address Once the Account Is Opened),

- Your Occupation and Employer, And

- The Source of Funds to Open Up Your Account.

In order to open the account, you can apply online, contact a banking representative who can open the account for you, or request that a paper application be sent to you.

The paper application can also be printed directly from the Synchrony Bank website Resource Center page under Bank Forms.

You can set up your smartphone access just by logging in from your phone using your customer login ID and password.

Synchrony Bank Features and Benefits

Synchrony Bank Perks

When you open an account with Synchrony Bank, you are automatically enrolled in the perks program.

Rewards are offered based on the balances that you keep as well as the length of time that you’re a customer.

This entitles you to get benefits and discounts without having to keep track of your points.

The Perks program has five different levels:

1. Basic

2. Silver

3. Gold

4. Platinum

5. Diamond

They entitle you to travel and leisure benefits, ATM fee reimbursements, and more.

At the Diamond level, you’ll be entitled to a dedicated customer service phone number, access to the bank’s webinar series, three wire transfers per statement cycle, and unlimited ATM reimbursements.

The Perk schedule looks like this:

Account Security

Synchrony Bank offers multifactor authentication.

This provides you with an extra layer of security by creating an additional way to verify your identity.

When you register for your account, or any time you change your password, you will be required to provide a one-time passcode. A four-digit code will be sent to your smartphone in a text message or to your phone by voice.

Synchrony Bank also offers 24-hour network security monitoring, as well as secure firewalls to protect your account from unauthorized Internet traffic.

Full Online and Smartphone Account Access

You can access all features of the banking experience from your mobile device, including your account summary and activity, external accounts, transfer of funds, pending transfers, and loyalty perks.

You can also deposit checks with your smartphone, as well as access secure messaging, and send emails to the bank.

Accessing Your Funds

Synchrony Bank does not offer a checking account.

However, you can request checks in order to access your Money Market account. You can also request a wire transfer to another bank by calling a bank representative during call center hours.

You will need to register an external bank account through the Synchrony Bank online banking platform in order to create quick and easy electronic transfers.

However, be aware that transfers and withdrawals are limited to six per statement cycle for both the Money Market and High Yield Savings accounts. (This is a typical requirement for both types of accounts throughout the banking industry.)

Transferring Money to Your Synchrony Bank Account

You can move money into your Synchrony Bank account through electronic debit (ACH).

You can also write yourself a check from an external bank or get a cashier’s check and then mail the deposit to Synchrony Bank.

Finally, you can always wire funds from an external bank into your Synchrony Bank account.

Synchrony Bank also accommodates direct deposits from third parties or the use of mobile check deposits. You can make a deposit just by taking a picture of the check that you are depositing using your smartphone device.

ATM Card (Optional)

This gives you access to cash and other basic banking transactions from both the High Yield Savings and Money Market accounts. You can use them at any ATMs displaying the Plus or Accel logos.

ATM cash withdrawals are limited to $1,010 per day, while point-of-sale purchases are limited to $510 per day. Point-of-sale transactions count toward the per-account limitation of no more than six transfers or withdrawals per statement cycle.

In addition, the ATM card cannot be used as a credit card (debit card only).

Customer Service

You can access customer service by phone, Monday through Friday, 8:00 AM to 10:00 PM, Eastern Time.

They are also available on Saturdays from 8:00 AM to 5:00 PM. But you can also access your account 24 hours a day, seven days a week, on your computer, tablet or smartphone.

All Accounts Are FDIC-insured

That’s up to $250,000 per depositor.

Link Your Account to Mint.com

Mint.com allows integration with Synchrony Bank deposit accounts.

Once your Synchrony Bank account is registered, the account can be registered for integration with Mint.com.

Synchrony Bank IRAs

Synchrony Bank offers IRA accounts through both their Money Market Accounts and their CDs.

You can make a regular IRA contribution or do a rollover to your IRA from an employer-sponsored plan. You can have either a traditional IRA or a Roth IRA.

Synchrony Financial

Credit cards are available through Synchrony Financial. Synchrony partners with more than 365,000 retailers and vendors to arrange retail credit card programs.

They also offer the healthcare credit card, Care Credit.

It is accepted by more than 200,000 healthcare provider locations nationwide, offering a revolving line of credit that can be used for health-related expenses.

This includes expenses that are not normally covered by health insurance, including dentistry, chiropractic, cosmetic treatments, LASIK surgery, eyeglasses, hearing aids, weight loss programs, and pet care.

Synchrony Bank Savings Rates

High-Yield Savings

Synchrony Bank is currently paying a 3.75% average percentage yield (APY) on all high-yield savings balance levels. Unlike many banks, however, you don’t have to have a high account minimum to get the advertised rate either.

It’s available for all balance levels.

Regular Money Market Funds and IRA Money Market Funds

Synchrony Bank is currently paying 2.25% APY on these accounts, which is many times higher than the 0.13% average being paid on money market accounts industrywide.

Regular Certificates of Deposit (CDs) and IRA CDs

You need a minimum of $2,000, and you can get CDs with maturities ranging from three months to 60 months. The current APYs look like this (as of January of 2025):

To put the yield on the 60-month CD into perspective, the five-year US Treasury Note pays only 2.70% as of the same date.

Synchrony Bank for Businesses

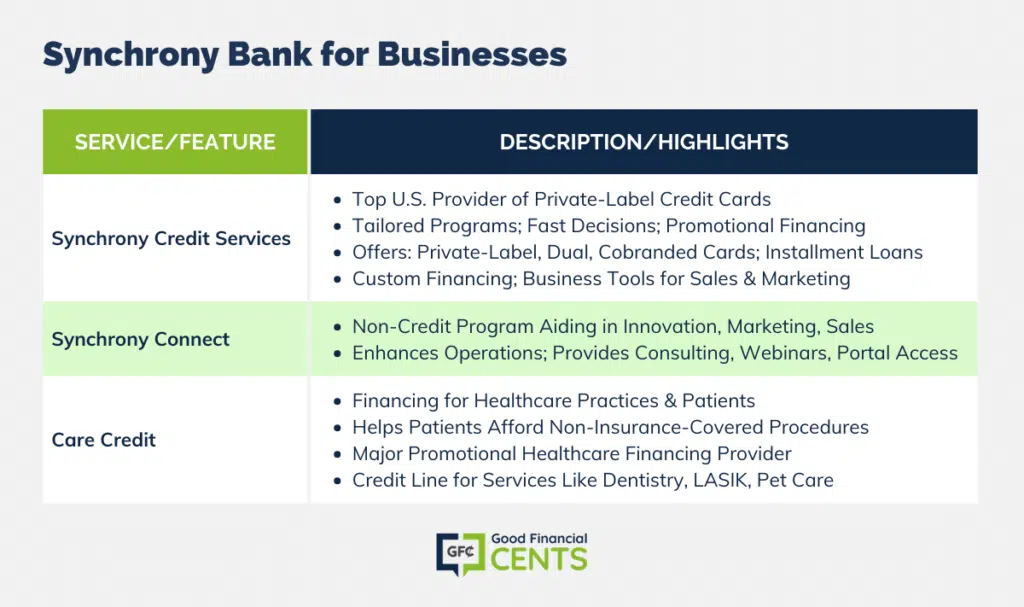

Synchrony Bank offers three basic services for businesses: Credit Services, Synchrony Connect, and Care Credit for healthcare practices.

Synchrony Credit Services

Synchrony Financial is the largest provider of private-label credit cards in the U.S. based on purchase volume and receivables. They tailor credit card programs to engage customers at point-of-sale, online, or through mobile devices.

They develop platforms that generate fast credit decisions, as well as easy online payments.

They also offer promotional financing for major consumer purchases, plus loyalty programs to generate repeat purchases and brand loyalty.

They offer the following credit services to businesses:

- Private-Label Credit Cards

- Dual Cards and General-Purpose Cobranded Credit Cards

- Installment Loans

Synchrony Bank works to create customized financing programs for different business niches, including regional and national retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers.

They even offer a business center that offers tools to help businesses with sales, marketing, sales training, and consumer research trends.

Synchrony Connect

This is a value-added program offered by Synchrony Financial that helps business partners in areas that do not involve credit specifically. They can provide information related to innovation, marketing, sales, and relationship management.

They also offer organizational strategies and talent management.

The goal of the program is to improve operations, including customer service, risk management, information technology, financial planning, and process management.

Services are offered on a one-on-one basis, including consulting projects, multiclient webinars, and access to Synchrony Financial’s online portal.

Care Credit

Just as Synchrony Financial offers bank customers Care Credit for healthcare expenses, it also makes the credit service available to healthcare practices for their patients.

It enables healthcare practices to offer qualified patients a flexible way to finance or budget for procedures that they need or even those that are not covered by health insurance.

Care Credit is one of the largest providers of promotional financing in the healthcare industry. They have handled over 20 million accounts since the program was founded.

It offers a revolving line of credit and financing options so that patients can more easily afford the healthcare services that they need.

Once again, it can be used for dentistry, cosmetic treatments, LASIK surgery, eyeglasses, hearing aids, and pet care, among other services, all of which are usually not covered by health insurance.

Should You Give Synchrony Bank a Try?

If your primary goal is to have a bank where you can get the very highest rates possible on completely safe investments, then Synchrony Bank is exactly what you’re looking for.

It’s also an outstanding platform for small business owners who want to be able to offer financing options to their customers and clients.

But if you’re looking for a full-service banking platform, Synchrony Bank won’t fit the bill, nor is it meant to. It doesn’t offer many of the usual services that you will find in a full-service bank.

For example, it does not offer checking accounts, a network of local branches, or the types of lending programs (general-purpose credit cards, auto loans, and home mortgages) that are offered by typical full-service banks.

The Bottom Line – Synchrony Bank Review

Synchrony Bank is best for someone who has a satisfactory banking arrangement and is looking either for higher returns on their savings or the business credit services that are offered by Synchrony Financial.

Synchrony does both of those tasks extremely well, and it’s worth developing a relationship with them just for those services alone.

If you want more information or you’re interested in opening up an account, check out the Synchrony Bank website. If you’re looking for the highest rates of savings available, you’ll have found the right bank.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Synchrony Bank Product Description: Synchrony Bank is a premier online financial institution known for its competitive savings products and various financing options. With FDIC-insured accounts, its suite encompasses high-yield savings, CDs, and credit offerings tailored to diverse consumer needs. Summary Established as a spin-off from General Electric in 2014, Synchrony Bank has since made its mark in the online banking landscape by offering highly competitive interest rates on its deposit products. Beyond savings accounts and CDs, the bank is renowned for its numerous credit card partnerships with large retailers, providing flexible financing solutions for consumers. Leveraging modern digital tools, the bank brings forth a user-friendly interface coupled with robust customer service, making financial management efficient and convenient. Pros Cons

Synchrony Bank Review

Overall

Synchrony with Amazon does *NOT* offer multi-factor authentication. I was just trying to set it up, couldn’t find it, and was told by a live chat representative that they don’t have it presently (11February2023). But I was assured that my feedback would be forwarded. 😉

Please send me my personal customer service phone number as I have a diamond account

can I borrow money from sycroney for home improvement

Hi Armando – it doesn’t look like they offer home loans or home equity lines of credit. But you might check with other banks, including some in your community.

I am looking to buy a house in the next year or two. If I need to get the money out and transferred back into my checking account at another bank is there a fee for that?

Jeff

Hi Jeff – It depends how you make the transfer. If you do it by check there should be no cost. If you do a wire transfer there’s probably going to be a fee.

I had a terrible experience with this bank and do not recommend them if you’re living abroad. I worked overseas for eight years and during this time this bank decided that I was not active enough and closed my Diamond status account and transferred my entire savings to the state treasurer as “unclaimed property” (instead of emailing me, they snail mailed a letter to my US address that I had to return to prove I’m still active or something, which of course I never received because I wasn’t physically in the US at the time). It was hell trying to get my money back from the state. Out of my five banks, they were the only one to put me through this hellhole.

Hi Tommy – Wow, that was a really lousy thing for them to do. Did you notify them that you’d be out of the country for an extended term? Unfortunately, most states have laws like that for inactive accounts. It’s usually two years, but some are as low as one. If you’re normally out of the country you may want to have a minor transaction at least once a year to make sure that doesn’t happen again.