Freelancing offers the allure of flexibility and the freedom to choose your projects, but it also introduces a unique set of tax considerations that can bewilder even the most seasoned independent professionals. Understanding the tax implications of freelance work is essential to maximize your earnings and stay on the right side of tax laws. This comprehensive guide provides tax tips for freelancers looking to optimize their fiscal responsibilities while minimizing liabilities.

Table of Contents

- Understand Your Tax Obligations

- Classify Your Business Correctly

- Keep Accurate Records

- Maximize Deductions

- Stay on Top of Estimated Taxes

- Understand the Self-Employment Tax

- Leverage Retirement Plans

- Hire a Professional

- Be Aware of Sales Tax Requirements

- Utilize Tax Software or Services

- Audit-Proof Your Business

- Know the Tax Deadlines

- Plan for Taxes All Year

- Invest in Your Education

- Consider International Tax Treaties

- Final Thoughts

Understand Your Tax Obligations

As a freelancer, you’re considered self-employed by the Internal Revenue Service (IRS) in the United States. You’re responsible for paying income taxes on your earnings as well as self-employment taxes, which cover Social Security and Medicare contributions.

Classify Your Business Correctly

Determine if you should operate as a sole proprietor, an LLC, or another type of business entity. Each has different tax implications, and it’s often wise to consult with a tax professional to decide which is best for your specific situation.

Keep Accurate Records

Maintain meticulous records of all income, including every payment from clients. Equally important is keeping track of your expenses. Receipts, invoices, and financial statements should be organized and readily accessible. Consider using accounting software designed for freelancers to streamline this process.

Maximize Deductions

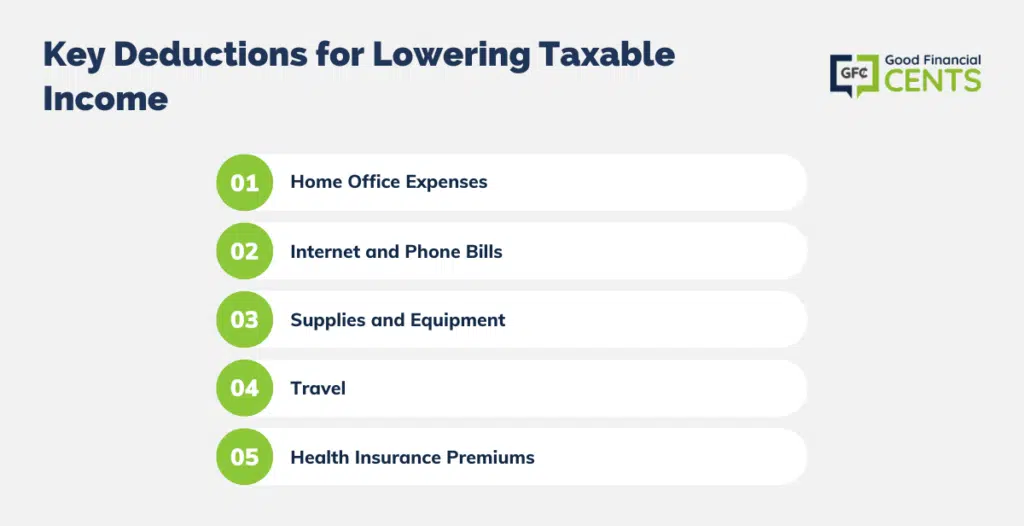

Freelancers can deduct a variety of expenses related to their business, which can significantly reduce taxable income. Common deductions include:

- Home office expenses: If you use part of your home regularly and exclusively for business, you may be able to deduct a portion of your housing expenses.

- Internet and phone bills: Costs for services that are essential to your work may be partially deductible.

- Supplies and equipment: Computers, software, and office supplies used for your freelance business are typically deductible.

- Travel: When you travel for business, many expenses, such as lodging, transportation, and meals, can be deducted.

- Health insurance premiums: Self-employed individuals can often deduct 100% of their health insurance premiums if they meet certain criteria.

Stay on Top of Estimated Taxes

Freelancers are typically required to pay estimated taxes quarterly if they expect to owe $1,000 or more when their return is filed. Failing to do so can result in penalties. The IRS provides forms and worksheets (Form 1040-ES) to help calculate estimated payments.

Understand the Self-Employment Tax

The self-employment tax rate is 15.3%, covering Social Security and Medicare. For 2023, the Social Security portion (12.4%) applies to the first $147,000 of combined wages and self-employment income, and the Medicare portion (2.9%) applies to all combined wages and self-employment income.

Leverage Retirement Plans

Contributions to retirement plans, such as a SEP IRA or Solo 401(k), are not only a means of saving for the future but also serve as tax deductions. They reduce your taxable income in the contribution year, potentially placing you in a lower tax bracket.

Hire a Professional

A tax professional, especially one with experience in freelance or small business taxes, can be invaluable. They can ensure you comply with tax laws, help with strategic planning, and often save you more money in the long run than they cost.

Be Aware of Sales Tax Requirements

Depending on your services and the location of your clients, you might be responsible for collecting and remitting sales tax. Familiarize yourself with the sales tax laws in your state and the states where your clients reside.

Utilize Tax Software or Services

Tax software can be a powerful tool, guiding you through deductions and credits, helping with estimated tax payments, and ensuring you’re compliant with evolving tax laws.

Intuit QuickBooks Self-Employed

QuickBooks Self-Employed is designed specifically for freelancers and independent contractors. It integrates expense tracking with tax preparation, which can be particularly useful for keeping tabs on potential deductions throughout the year. It also helps estimate quarterly taxes and can directly export your financial data to TurboTax, a sister tax preparation service.

TurboTax Self-Employed

TurboTax Self-Employed offers a user-friendly interface that guides freelancers through the process of inputting their income and expenses. It’s excellent for those who want step-by-step assistance in identifying industry-specific deductions and for making sure nothing is missed. TurboTax also provides a feature called “ExpenseFinder,” which automatically finds deductible business expenses, a valuable asset for busy freelancers.

H&R Block Premium & Business

This software provides tools for both federal and state tax prep and filing, designed to cater to the needs of both self-employed individuals and small business owners. Its interface is intuitive, and it’s known for offering robust customer support, including access to tax professionals if you have specific questions or unique tax situations.

TaxAct Self-Employed

TaxAct is a cost-effective tax software that offers an array of features tailored to self-employed users. Its Deduction Maximizer ensures that freelancers take advantage of all relevant deductions, and the software provides year-round planning resources to help you stay on top of your taxes.

Xero

Xero is primarily accounting software with strong tax features integrated into the platform. It’s designed for small business owners and freelancers who need comprehensive financial tracking. Xero can connect to tax services and accountants, allowing for a seamless transition from everyday accounting to tax preparation.

FreshBooks

FreshBooks offers cloud-based accounting solutions that are freelancer-friendly. It doesn’t directly prepare taxes, but it does provide comprehensive reports that you can hand over to your tax preparer. It also helps track time, expenses, and invoices, which are all critical for accurate tax filing.

Audit-Proof Your Business

Being selected for an audit is rare, but you should always be prepared. This means keeping all your business-related documentation for at least three years. Good records are your best defense in an audit scenario.

Know the Tax Deadlines

Aside from the quarterly estimated tax payments, know the annual tax deadlines. The typical deadline for filing tax returns is April 15, but if that falls on a weekend or holiday, it may be pushed to the next business day.

Plan for Taxes All Year

Tax planning is not just an end-of-year activity. Effective tax management involves year-round strategies, such as spreading out income and expenses when possible to avoid higher tax brackets.

Invest in Your Education

The costs of workshops, courses, and seminars that are related to your freelance business can sometimes be deductible. Always keep records of these educational investments.

Consider International Tax Treaties

If you have international clients, be aware of the tax treaties between their countries and yours to avoid double taxation. This can be a complex area, so consult with a tax advisor who specializes in international tax law.

Final Thoughts

As freelancers, mastering the art of taxation can be as critical as honing your primary craft. The path to fiscal responsibility and acumen is paved with diligent record-keeping, astute tax planning, and the smart use of technology and professional services. Tax software designed for freelancers simplifies what can often feel like an overwhelming process, ensuring compliance and optimizing your returns.

But it’s more than just about staying compliant. It’s about embracing the control you have over your financial narrative. By maximizing deductions, keeping impeccable records, and making strategic decisions about retirement plans and business structure, you can significantly influence your tax liabilities and savings.