College isn’t for everyone, yet those who choose to earn a degree tend to benefit for their entire lives. In fact, recent data published by the Federal Reserve Bank of New York showed that the average college graduate with a bachelor’s degree earns about $78,000, whereas the average worker with only a high school diploma brings in $45,000.

That’s a difference of more than $30,000 per year, which actually makes the cost of college tuition seem like a good value. After all, this disparity in wages could lead to $600,000 in increased earnings over a 20-year career.

Table of Contents

- How to Pay Less for College

- Apply for Financial Aid Early

- Seek Out Scholarships and Grants

- Go to Community College First

- Attend a Public, In-State College or University

- Find Easy Ways to Save

- Borrow Responsibly

- Choose a Smart Repayment Plan

- The Bottom Line – The Absolute Best Ways to Pay Less for College

How to Pay Less for College

Still, you don’t have to overpay for a college degree, and you should definitely try not to. If you are able to keep college costs down, you can limit student loan debt and enter the working world with more cash in your pocket.

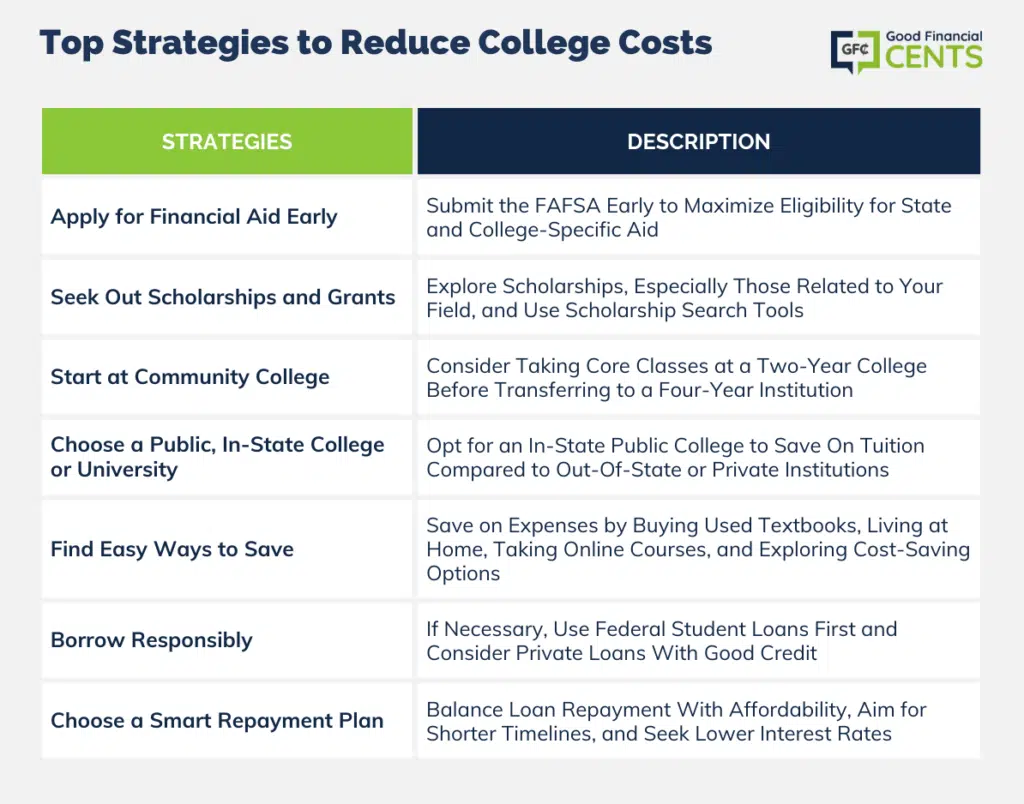

Families looking for ways to pay less for college have plenty of options to consider, but here are some of the best:

Apply for Financial Aid Early

First and foremost, you should take steps to apply for financial aid as early as you can, which you’ll do by filling out the Free Application for Federal Student Aid (FAFSA). To apply for federal student aid for the 2023-24 school year, you can fill out the FAFSA until June 30, 2024.

However, you should really strive to fill out the FAFSA as early as you can (as of now) since many states and colleges have earlier deadlines for state-specific and college-specific aid. If you procrastinate and delay, it’s possible you’ll miss out on aid you may have been eligible for, including financial assistance that is awarded on a first-come, first-served basis.

Seek Out Scholarships and Grants

Second, you’ll absolutely want to seek out scholarships and grants you may be eligible for as soon as you possibly can.

To get started, you can look for scholarships offered by professional organizations related to your field of interest. You can also use a scholarship search website to find scholarships and aid opportunities that are matched to your career field and profile.

Other places to look for scholarships and grants include the financial aid office at your school, your high school counselor, and local clubs that might award scholarship money to students who meet their criteria.

Go to Community College First

Here’s another tip that can help lower the total cost of attending college in a big way. Consider taking your core education classes at a two-year college and then transferring to a four-year school to finish your degree. Not only will you get the chance to take prerequisite courses at a lower cost, but you may be able to work while you attend college or live at home and save on room and board.

How much less does community college cost? That depends on where you live and the schools you ultimately choose. However, CollegeBoard figures show that average tuition worked out to $3,770 for public, two-year institutions for the 2020-21 school year. By contrast, tuition and fees at public, four-year, and in-state colleges worked out to $10,560.

Attend a Public, In-State College or University

If you want to attend a four-year school right from the start, you should research all your options and pricing before you commit. Also, consider choosing a public, in-state college or university since the disparity in pricing can be astronomical.

We already mentioned how tuition and fees at public, four-year, and in-state colleges worked out to $10,560 for the 2020-21 school year. Compare that to the cost of attending a public, four-year school not in your state, which currently sits at $27,020 per year, according to CollegeBoard.

Dreaming of a private school? For the 2020-21 school year, average tuition and fees at private nonprofit four-year schools worked out to $37,650 per year.

Find Easy Ways to Save

No matter which type of institution you plan to attend, make sure you don’t overlook the easy ways to save on college expenses. For example, you can look for and buy used textbooks instead of automatically buying new ones. You can also live at home and commute to school, or perhaps even take some of your courses online. Another option is becoming a Resident Assistant (RA), which can help you save on room and board while you finish your degree.

If you do live on campus, leaving your car at home can also lead to big savings since you won’t have to pay for long-term parking or storage. All of these small savings can add up and ultimately lead to paying less for college.

Borrow Responsibly

Finally, there’s nothing wrong with borrowing money to invest in a college degree. According to the same survey, 42% of students plan to borrow student loans. After all, your lifetime earnings could be substantially higher if you do, and your quality of life and opportunities could be much better as a result.

Still, you should make sure you’re borrowing smartly, which usually means taking advantage of federal student loans first. This is especially true if you’re eligible for Direct Subsidized Loans, which have the government covering interest that accrues while you’re in school.

Utilizing federal student loans first also means remaining eligible for federal loan benefits like deferment or forbearance, as well as income-driven repayment plans. If you plan to work in public service, federal student loans will also help you become eligible for Public Service Loan Forgiveness (PSLF), which can forgive your remaining loans after ten years of payments if you meet all the program requirements.

You can also turn to private student loans to fill in the gaps, and doing so could mean getting lower interest rates and better loan terms — particularly if you have good or excellent credit.

Choose a Smart Repayment Plan

If you do need to borrow for college, you should also be smart when it comes to paying the money back. This can be a tricky situation since you need loan payments you can afford now, and extending your repayment timeline can help make payments significantly lower. However, it’s all about balance and choosing a repayment plan that makes financial sense.

First, you should know that paying your loans off on a longer timeline leads to larger total interest costs, which increase the cost of your degree. If you’re able, try to pay off your loans on a shorter timeline, including the standard ten-year repayment plan.

You should also strive to pay the lowest interest rate you possibly can, which will make borrowing considerably less expensive over time. If you are looking specifically for low-interest rates on private student loans, make sure to check out College Ave Student Loans.

The Bottom Line – The Absolute Best Ways to Pay Less for College

Earning a college degree can provide significant financial benefits over a lifetime, but managing college expenses is crucial to optimizing its value.

By applying for financial aid early, actively seeking scholarships and grants, considering community college as a starting point, opting for public in-state institutions, finding everyday savings, borrowing wisely, and choosing a beneficial repayment plan, students can make a profound impact on their financial futures.

Making informed decisions and exploring all available avenues for funding can drastically reduce college costs, allowing graduates to embark on their professional journey with minimized debt and maximized earnings potential.