Divorce is a complicated process both emotionally and legally.

Thoughtful planning, however, can make your decision to divorce— and the process itself— easy.

Planning should begin immediately when you have a single notion about getting a divorce.

One tricky issue is what to do with the vehicles that were the property of the marriage.

It’s time to get a financial plan!

Table of Contents

If there was only one car in the marriage, then only one of the marriage partners would get possession of it. Sometimes a judge may rule in some divorce cases that both vehicles in a marriage should go to only one party. It depends on the circumstances, but more importantly, it’s likely the other party will need to get a new or used vehicle.

Unfortunately, uncertainties abound in divorce cases. Since the courts determine how to divide certain assets, like the vehicles, this will have an impact on one of the partners. State property laws also have to be taken into account in the divorce. If the husband or wife ends up without a vehicle after the divorce, and there’s a need for a car, then it might be time to consider scouting out options.

Getting good financial advice from a certified counselor after a divorce will help you to check out different options and strategies, based on your cash flow and expenses. Once you see the forest through the trees, then it’s time to get knowledgeable about getting a new vehicle.

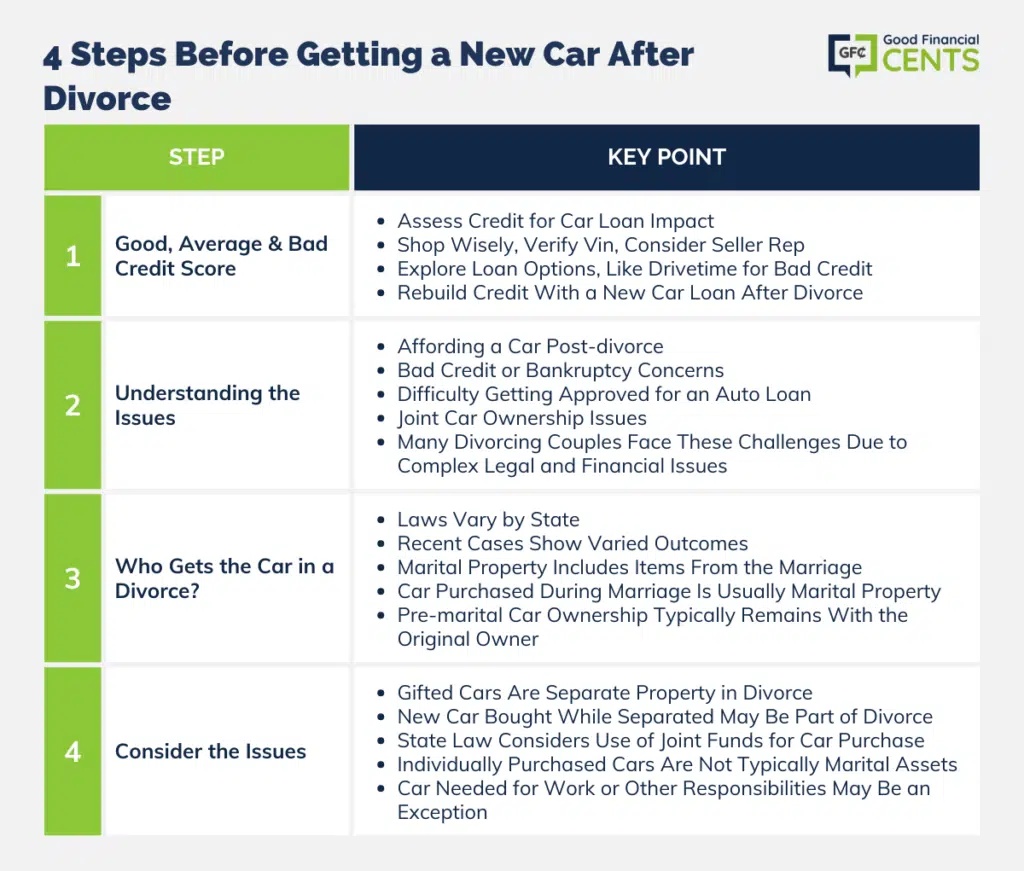

Here are five 4 critical steps you should take to get started.

Good, Average & Bad Credit Score

There are some great tips for saving money on new or used cars. For example, it helps each marriage partner to take stock of individual finances, and get to know your budget and credit score. A good, average, or bad credit score affects one’s ability to obtain loans to purchase a new car.

In looking for a new vehicle after a marriage breakup, you should shop around, verify the car’s VIN and history, and take into account the reputation of the seller. There are many great loan providers and used car salesmen who can help you in this situation. According to Good Financial Cents, we recommend these best banks for personal loans to help you in this instance.

If you lose your vehicle after divorce and need to get a new one, several options are available to you. Companies today understand the need for post-divorce individuals to obtain a vehicle and can make the process less stressful for individuals after a divorce. DriveTime bad credit auto loans can help divorced couples recovering from bankruptcy or bad credit get a new, used vehicle. Divorced partners looking to regain financial footing and creditworthiness can also use the new (used) car loan as an opportunity to rebuild credit again as a single person.

Understanding the Issues

Can a newly divorced partner afford a car? What about the prospect of bad to worse credit or maybe even looming bankruptcy due to the divorce? There’s also the prospect of one of the partners being unable to get approved for an auto loan. This can happen in circumstances when the ex is still paying for the car the couple used together. The marriage partner’s name is still on the banknote, although one doesn’t drive the vehicle anymore.

These are all very common problems divorced couples face in breakups. If you’re in that position, your first step is to know that you’re not alone. According to the Centers for Disease Control and Prevention, there are around two million marriages each year in the United States and the divorce rate is around six couples per every 1,000 couples. With all the complexities of divorce, it’s no surprise that some couples will have problems with legal and financial issues, including property during and after a divorce.

Who Gets the Car in a Divorce?

Divorce laws vary from state to state, and it’s understandable that questions arise about what will happen to your car in a divorce. One recent case found the husband giving the car he bought and paid for to his wife in their divorce settlement. In another case, both cars were held collectively in both names, with money owed on both loans. This particular situation allowed for both husband and wife to take responsibility for one car apiece but required some legal maneuvering on loan documents and more.

There are some basics for dividing assets like cars in divorce cases. First, there’s what is called “marital property” and this refers to items obtained during the divorce. If you purchased your car while you were married, paid it off and it’s in your name, it’s still considered marital property and the family judge will consider it when dividing the property. If you owned the vehicle before you were married and you brought it into the relationship with you, then it doesn’t fall under the marital property law and you get to keep the vehicle.

Consider the Issues

If your spouse purchased the car for you as a gift (such as a wedding or anniversary present), it will be handled differently. Gifts are separate property and aren’t divided in the process of divorce property sorting.

If a couple gets separated but not yet divorced, and one of the partners buys a new car while separated, that vehicle may be part of the divorce proceedings. State law will be taken into consideration, as to whether or not collective marriage funds were used to buy the car.

If joint savings were used, it would be considered marital property in most cases. However, if the wife or husband bought the car individually, with his or her own funds, that car would not be considered part of the marital assets. Especially, if one of the partners shows that a car purchase was needed in order to get to work, school, or other responsibilities.

This is a guest post from Danielle, a Good Financial Cents reader.

Getting a car after divorce is really a big issue for both husband and wife. Same case happened with my friend as well. The good thing is that both were familiar with that what things may be divided between them so they decided to sell their marriage car and divide equal money. They did it outside of court to avoid another battle far car.

I think, their decision was right but it does not happens in all cases.

My friend went through this as well after her divorce. Not only a car but credit score, schools, jobs, etc. all recognizer her as being divorced now. It was a constant reminder to her. So hard, but I am happy to say that she is now doing so much better and dating a wonderful gentleman that is a good friend of mine.

I went through some of this with my husband’s ex-wife. She ended up letting the car get repossessed. It was such a mess. It’s so much better to plan these things before it is too late. We were still dealing with it years after we were married.