I used to get a kick out of businesses with “cash only” signs in the window. I mean, join the 21st century already, right?

Why expect your customers to pull out a roll of cash when so many of us carry only credit and debit cards? Not to mention the new wave of paying at the register with your smartphone.

Then, a few years ago, I started a small business and needed to accept credit card payments online. Wow! I couldn’t believe how complicated and expensive it was to make this happen.

It turns out you can’t just plug in a credit card reader and start swiping.

Help Wanted: Small Business Merchant Services

I needed to connect my card reader to my bank. My card reader needed different authorization protocols to connect with customers’ Discover or American Express cards.

As I was figuring all this out, a customer emailed to ask if I accepted Apple Pay or PayPal.

I almost suggested they send me cash! Instead, I said, “Let me call you back.” I needed some time to figure this out.

As I was looking into that, I found an email from my bank saying it wouldn’t insure merchants from fraud unless they installed chip readers within the next six months.

Which touches on another essential issue: security for your customers. You don’t want to be the electronic window through which identity thieves can strike.

Whew! I needed to hire someone just to handle electronic payments, which wasn’t part of the business plan.

Merchant Services for Small Businesses

Then I discovered what many small business owners already know:

Finding a third-party company to handle electronic transactions can make life a lot easier.

It’s more cost-effective for a merchant services provider to make sure your small business can accept electronic payments safely, efficiently, and through the platforms your customers expect.

That way, you can spend more time making the best pizza in your town or building your collection of used vinyl for that online record store you’re running.

How to Choose a Merchant Service Provider

Realizing the need for small business merchant services gets you on the right track. But finding the right kind of merchant services? That can take a while.

Searching for help on Google raises more questions than answers, and it’s hard to compare one service with another because they all seem to perform different actions and charge you in different ways.

And, each year, more and more companies enter the merchant services marketplace. You can find hundreds of possibilities without looking very long.

Some merchant services specialize in non-profit donations, some in retail point-of-sale, some in online-only businesses, some in mobile payments — you get the picture.

Some services work with only physical credit cards, while others connect your business to PayPal, Google Pay, and other more modern payment methods.

Your Specific Needs Matter More Than Other Factors

Finding the right service will depend on a few criteria we’ll go into later in this post, but the kind of business you run matters more than most other factors:

- A Restaurant: You may need a full-blown point-of-sale (POS) system with advanced features such as inventory control and tip reconciliation. A small restaurant with only a few employees could get by with a card reader.

- A Retailer: Just like with a restaurant, the size of your business will impact your choice. A point-of-sale system could make life easier but may not be essential.

- A Non-profit: You’re probably fee-sensitive since you can’t simply pass along fees to the customer. You may also be relying on volunteers to run transactions, so simplicity and transparency will be a must.

- An Online-Only Business: You may need the flexibility to add every payment platform out there, including those not yet in use, but you may not need chip readers or mobile pay scanners.

- A Part-Time Vendor: If you sell handcrafted coffee mugs at weekend crafts fairs or run a childcare business out of your home, you may just want a way to accept credit card payments using your smartphone.

Knowing the expectations of your customers and fitting them in with the needs of your business will make your decision easier as you consider small business merchant service providers.

Your Small Business Customers Expect Security

When you shop at a leading online retailer or use your debit card to buy a hundred dollars worth of groceries at the supermarket, you expect to pay safely and securely.

When that doesn’t happen, it’s news. Just ask The Home Depot or Panera Bread which are among the scores of companies affected recently by data breaches.

Shoppers expect big box store security when they patronize your small business.

They may expect even better security if they know you personally, and every small business owner knows (or is learning) the power of making personal connections with your customers.

You owe it to yourself, your business, and your customers to find the right solution for your merchant services.

No one can guarantee 100 percent security 100 percent of the time, but you can save yourself and your customers a lot of headaches by doing a little homework before choosing a provider.

Will You Need a Degree to Use the Service?

You should also make sure you find a small business merchant service you can figure out how to use.

A family friend and fellow business owner started using a credit card authorization service a few years ago that her bank recommended.

She couldn’t get the service connected to her site. She asked me for help, and I couldn’t figure it out either, except for the most basic integration method, which didn’t include a lot of the features she was paying for.

We needed an actual computer programmer to write the code on her website.

These days, you should be able to find a service you can use without first taking a hand-coding course at your local community college.

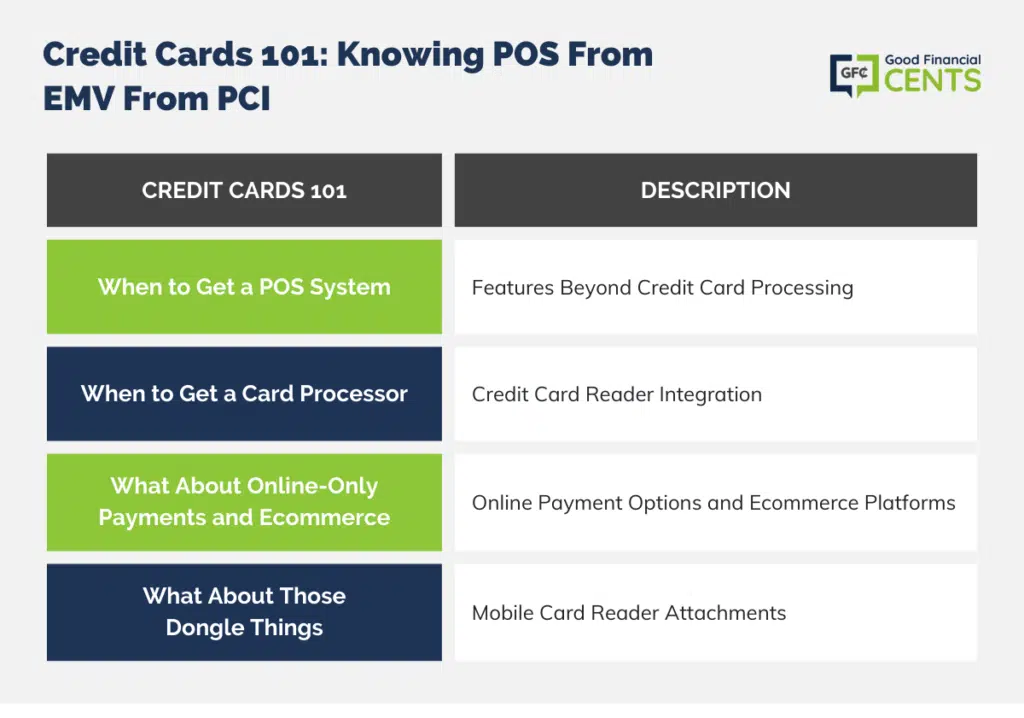

Credit Cards 101: Knowing POS From EMV From PCI

That being said, a little bit of knowledge goes a long way, saving you time and money as you decide on merchant services for your small business.

If you simply need to run credit cards safely and securely at your hot dog stand, you probably don’t need an entire point-of-sale (POS) system that includes inventory control and a time clock for your employees.

At the same time, if you never encounter a customer in person, you probably don’t need an EMV (chip) reader to interpret the data in the chips embedded in credit cards.

Again, it depends on what your business needs:

When to Get a POS System

Leading point-of-sale (POS) platforms such as Square and ShopKeep can do more than simply accept credit cards.

A POS can do a lot more, such as:

- Tracking inventory: You can keep track of inventory and even download .csv files to integrate with your business’s other systems.

- Collecting feedback: Point-of-sale systems often give you built-in customer surveys and forums for customer reviews, which can help generate more business, particularly if you’re doing a great job.

- Analyzing customer behavior: Modern POS systems can also analyze customer habits, such as what time certain products sell more quickly. Some even associate purchases with individual credit cards, meaning the system can present your customer with personalized shopping suggestions.

- Employee management: A POS portal can double as a time clock and a way to reconcile tips. You can give specific employees, such as your manager or other staff leaders, access to these features or keep them to yourself.

Some POS systems include credit card processing, while others allow you to find your own credit card processing service to integrate into the POS system.

If your business needs this kind of power, a POS system can make your life a lot easier. If not, you may be paying for a lot of muscle you’ll never use.

When to Get a Card Processor

Some business owners just need a credit card reader to integrate into their existing systems.

You’ll find a lot of options online, and we’ll look at a few below. Even if you already have a card reader, now may be a good time for an update.

Security measures change regularly. Recently, chip readers (EMV) and mobile pay scanners joined pin pads, signature pads, receipt printers, and swipe readers as standard equipment for card processors.

The Payment Card Industry (PCI) sets compliance guidelines designed to keep cardholders safe.

If your card reader’s security is out of date, there’s a chance your bank won’t support you in case of fraud.

What About Online-Only Payments and eCommerce?

Accepting payments on your company’s website can help your small business grow, and if you have an online-only business, you can probably keep things pretty simple.

PayPal, for example, can connect you and your customers safely and efficiently online without requiring you to authorize credit cards or worry much about security.

If you’re starting from scratch with your online store, you can find useful ecommerce platforms such as Shopify that handle everything from web hosting to inventory management to credit card authorizations.

And many point-of-sale services like Square also offer online payments as well as retail services.

What About Those Dongle Things?

It’s pretty common now to find merchants, especially home repair specialists or pop-up store owners, who simply pull out their smartphones and plug in a card reader to process payments.

Whether they’re chip readers or magnetic stripe swipers, the industry calls these phone attachments dongles.

Companies like PayPal and Square, along with many others, offer this kind of mobile integration.

How Merchant Services Charge Your Small Business

Hiring an expert to handle electronic payments and manage a point-of-sale system would cost a fortune. Contracting with a merchant services provider costs a lot less.

But it can still cost a lot, depending on the size of your business and the way your merchant service provider collects its fees.

Some services, including Square and many of its competitors, will not charge you even as you’re plugging in their equipment and integrating it into your business.

Then, however, the services will take a percentage — usually between 2.5 percent and 4 percent — of every transaction you make.

To keep things simple, let’s say you’re paying 3 percent on each transaction and you did $100,000 worth of business last year. In that case, you’d pay $3,000, which doesn’t seem unreasonable considering it allowed you to serve more customers.

But if you need to raise prices to accommodate this fee, you may lose some customers. This is why some businesses charge customers a fee for using a credit card.

Other systems charge a flat monthly fee and then charge a lower percentage per transaction.

Still, others charge a flat fee — 15 cents, for example — for every credit card transaction, which is why some small businesses have minimum purchase amounts for using a credit or debit card to pay.

To make things even more complicated, many services combine these fee structures. Some charge different fees depending on whether you’re entering the card manually online or reading it electronically at the register. Most services charge more if you have more than one register.

Your job as a small business owner seeking merchant services will be to find the pricing structure that fits your business.

If you sell expensive items such as handmade quilts for $500 each, you may not want to pay 3 percent ($15) per transaction. Finding a service with a flat rate could save you a lot.

But if you run a bakery and sell banana nut muffins for $2 each, a flat rate of 15 cents per swipe would equal 7.5 percent — more than double the 3 percent you could be paying with another service.

Find your business’s sweet spot so you’ll have some idea about price points as you choose merchant services.

What About Interchange Fees?

Even when you find merchant services at a flat rate, expect to see some per-transaction fees, often referred to as interchange fees.

These fees come from credit card issuers and/or banks and can vary widely among debit and credit cards.

Usually, these fees simply pass through your merchant services provider on their way to the credit card company.

Still, they come out of your bottom line unless you account for them in your price structure, so finding out how much your service will charge will be important.

Best Solutions for Small Business Merchant Services

So let’s look at some of the leading providers for small business merchant services.

As I like to say when making recommendations, you’re ultimately the most qualified person to choose the service for your small business.

I’ll just point out some of the things I like about the following services. If they mesh with your specific needs, give the company a closer look.

I recommend making a list of two or three choices and then doing a thorough examination of those services. Most services I discuss below offer at least a 14-day free trial period. Some will give you a month to try out their services.

With so many options out there, I can’t provide an all-inclusive analysis. But these are the services I’d start with if I had the following small business needs.

Best All-In-One Option: Square

Square has become one of the most relied-upon small business merchant service providers for good reason: It’s easy to use, and it offers a flexible array of services.

Square lets you turn an iPad into a cash register complete with a chip reader and other security features customers expect. Now, you can even process transactions while you’re offline, which can make life a lot easier for people with mobile businesses.

Square’s point-of-sale system includes tip reconciliation tools, a time clock, and inventory control. You can customize the system to match your business’s needs. For example, you can arrange the screen to put frequently sold items in one place and add-ons in another place.

You can even generate surveys for customers to take via email after they’ve left your store.

Square specializes in brick-and-mortar businesses, but you could use it to sell online, too. You can send invoices and sync with your site through common services like GoDaddy.

A couple of years ago, I was a little disappointed in Square because it didn’t allow mobile payments such as Apple Pay or Android Pay. The platform has responded with an adapter so customers can swipe their phones as payment.

Despite these advances, Square will not integrate with PayPal, which is unfortunate for many small business owners, especially those who specialize in online payments.

- Fee Structure: Square will not charge you for much of anything until you start taking payments from customers. At that point, Square will take 2.75 percent from each swiped transaction and 3.5 percent (plus 15 cents) for manually entered transactions which include online payments.

- Best For: A small business, retail or restaurant, with at least several employees that need to optimize POS, inventory, and customer interactions.

- Avoid If: You do a lot of business online. Square is making progress in this area, but you can find better solutions.

Other Specialized POS Systems to Consider

Square is everywhere, but it’s not the only point-of-sale solution in the marketplace. Other services also excel, especially if you have specific needs:

- Lightspeed: Great for a business with a wide variety of products such as a clothing boutique because of its muscular inventory control system. The system costs more than average ($99 a month plus transaction fees).

- ShopKeep: Businesses selling a lot of low-priced items (bakeries, coffee shops, used bookstores) like ShopKeep’s flat monthly rates. Keep in mind you’ll pay the rate for each register you operate. ShopKeep has easy-to-use hardware, too. You can get a free quote and a 14-day free trial period.

- Revel: Medium-size businesses with multiple locations like Revel’s integration with Quickbooks and other data management tools. Revel can integrate just about any form of payment safely and securely and track inventory in real-time. The service allows multiple screens in various locations to communicate, which is great for a front-of-house / kitchen relationship in a restaurant.

- Shopify: Online-only businesses starting from the ground up can benefit from Shopify’s range of services, from web hosting to collecting secure online payments.

Best Basic Credit Card Processors

Many small business owners just want a way to accept credit card payments without overhauling everything else.

They’re happy with their existing inventory control system and the time clock their employees have used for years. The cash register on the counter still works just fine, thank you.

There are hundreds of credit card processors out there ready to help. Just like point-of-sale systems, credit card processors often charge percentage-based fees or flat rates per transaction.

(Card issuers and banks charge interchange fees, too, which your processor simply passes along, so don’t expect to find a service without any per-transaction rates.)

Here’s a quick look at some of the leading possibilities:

- Payment Depot: This subscription-based model suits a lot of business owners with high volumes of transactions. For about $50 a month, you get up-to-date equipment, and then you also pay 15 cents per transaction. Payment Depot can offer lower per-transaction fees combined with higher flat monthly rates depending on the size of your business. You’ll also be able to process old-fashioned checks as well as online payments.

- Flagship: Flagship appeals to many start-ups because of its low per-transaction rates (as low as 1.58 percent for credit cards). The company charges a per-month fee for security features to meet PCI standards. Depending on what you need, you could pay around $15 a month for up-to-date security. Flagship customizes its quotes for your business, so it’s hard to know for sure without getting a quote.

- Leaders Merchant Services: Leaders offers straightforward and simple card readers with security included along with transparent pricing. The service combines flat monthly fees of about $15 with low per-transaction fees that vary depending on whether you’re doing business online or with the customer’s card present. Retail fees tend to be lower for higher-volume businesses: as low as 0.15 percent + 10 cents. Online processing costs significantly more — up to 2 percent.

- proMerchant: proMerchant specializes in smaller businesses. You can opt for per-transaction pricing or a flat monthly rate. (Both also include added interchange fees from card issuers, which means even a flat monthly rate will include some per-transaction fees.) proMerchant prefers to customize quotes for your business, so you’ll have to give some information in order to get prices. The company’s clients tend to like the transparency and simplicity of the platform once they join.

- Helcim: Canadian-based Helcim specializes in transparency and simplicity. Though it offers a wide variety of services, I especially like its approach to credit card processing. Brick-and-mortar retailers pay $15 per month plus transaction rates that vary depending on your volume and typical transaction amount. It’s a system geared for finding your best solution, and you can play with some numbers here.

An Even Simpler Approach for Simpler Needs

Maybe you just need to send an invoice and allow your customer to pay online quickly, easily, and safely using his or her credit card.

Services like PayPal exist for exactly this scenario. Your customer can use a credit card to put money in your PayPal account. Then, you can spend the money either out of PayPal or by transferring the balance to your bank account.

PayPal makes money off these transfers, and the price tag can put a dent in your bottom line, especially if you deal in big-ticket items like arbor care or you run a non-profit that nets big donations.

PayPal leads this sector because it’s been around a long time, people trust the platform, and it’s easy to use. Many other similar services have joined the market — some with name recognition (Google Pay, Amazon Pay, and Authorize.net) and many others you may never have heard of (Dwolla, Payoneer, Venmo).

All these services make money either on pay-as-you-go fees like PayPal, flat monthly fees, or some combination of the two. Check out these fees closely before sending an invoice. You don’t want to learn about a hefty fee after it’s been taken out of your balance.

Bank-Centric P2Ps

More and more banks now offer peer-to-peer (P2P) transfers, which may be less expensive depending on your account’s policies.

Essentially, you can send someone money directly from your bank account to their bank account without using credit cards, though you can also use a credit card to fund a P2P transaction.

Check with your bank or credit union if you’re interested in transferring money this way.

Final Thoughts – Top Merchant Services for Small Businesses

Ultimately, It’s All About Serving Your Customers

Whatever business you’re running — pet grooming, antique restoration, small engine repair, cake decorating, or ice sculpting — your customers will likely expect you to accept electronic payments.

While you should never sacrifice quality or go beyond your comfort zone to satisfy a customer, being open to new payment methods can help your business grow.

Third-party small business merchant services can give you the tools to safely move beyond the basics without having to be an expert on cybersecurity and authorization practices.

So take some time to assess your business’s needs, look for that sweet spot in which you can get the most merchant services for the least amount in fees, and keep doing what you do best: serving customers and making new connections.

“A small business offering excellent products and services may find itself unable to survive if it is not prepared to accept payment by credit or debit card or other forms of flexible payment, or to establish a viable electronic marketplace for its customers.”-This couldn’t be more true. The world is going digital and shows no signs of slowing down. One study even claimed that mobile payments could phase out cash by 2020: http://www.merchantseek.com/news/new-technologies-driving-payments-away-from-the-use-of-physical-money/