Discussions on mortgages usually focus on the loans as a single type. But nothing can be further from the truth. Not only are there different types of mortgage loans, but there are also different mortgage programs, not to mention mortgage lenders.

We’re going to discuss both the different types of mortgage loans and the various programs that offer them. However, this is a general discussion of the most popular types, since there are more less-popular loan types and even issuers.

Table of Contents

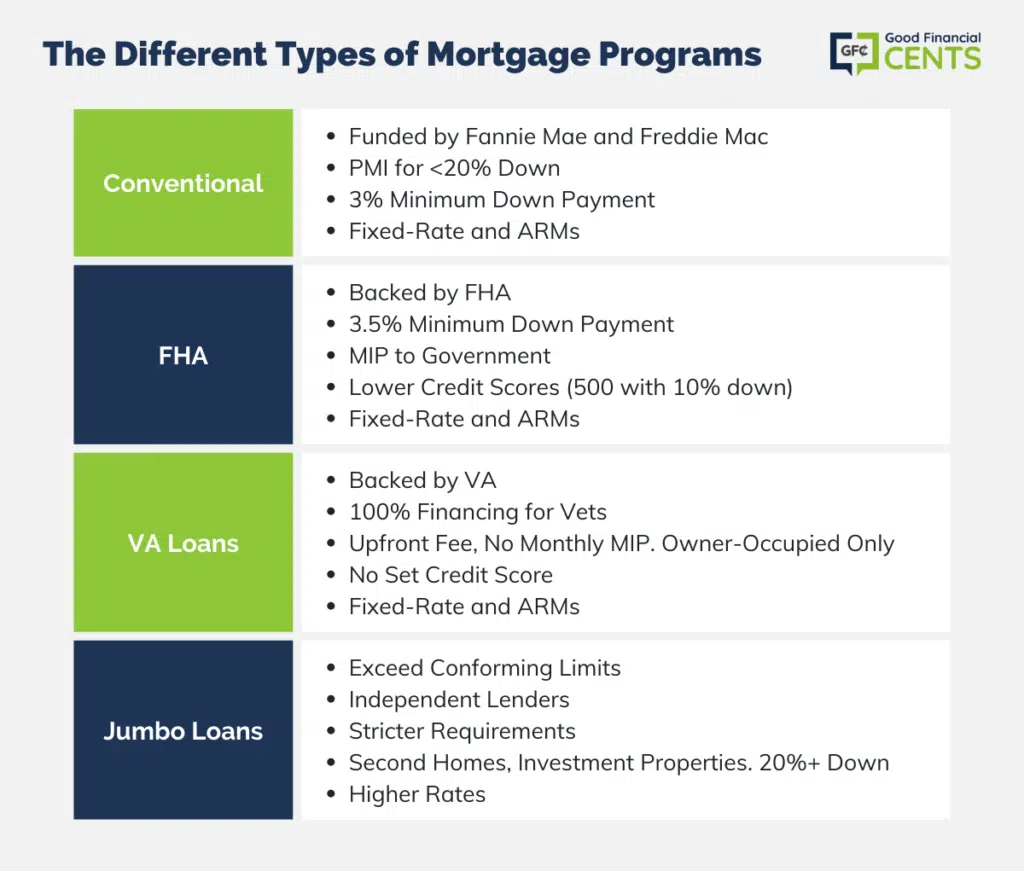

The Different Types of Mortgage Programs

There are four primary mortgage programs available:

Conventional

Generally speaking, conventional mortgages refer to loans that are funded by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac).

They’re typically originated by banks, credit unions, mortgage banks, mortgage companies, and other lenders, then sold to one of the two major mortgage agencies.

These loans are also typified by what’s known as their conforming loan limits. That is, there is a limit to the amount that can be loaned under a conventional program. That limit is generally $766,550 for 2025.

However, conventional loans can be higher for two- to four-family homes, and also for properties located in areas designated as high cost.

(These are the higher cost housing markets usually located on the East and West Coast, including New York City, Boston, Washington DC, San Francisco, and Los Angeles.)

Conventional mortgages are also distinguished from FHA and VA loans by the mortgage insurance requirement.

Commonly referred to as private mortgage insurance, or PMI, it is a type of insurance coverage that pays the mortgage lender part of the loan balance if you default on the loan.

Some of the Major Features of Conventional Mortgages Include the Following:

- The minimum down payment is 5%, but they do offer loans with as little as 3% down for first-time homebuyers as well as low- and moderate-income households.

- Unlike FHA and VA mortgages, PMI is only paid on a monthly basis as part of your loan payment. There is no required upfront mortgage insurance cost.

- The minimum credit score for conventional loans is 620, but you’ll get a better interest rate the higher your credit score is.

- Conventional loans can be used for the purchase of second homes and investment properties in addition to primary residences.

- Loans are available in both fixed-rate and ARMs.

FHA

FHA loans work much the same way as conventional loans, but the parameters are more basic. For example, the minimum down payment requirement is 3.50%, even for first-time homebuyers.

But the two main features of FHA loans, the ones that most differentiate them from conventional mortgages, are:

Mortgage Insurance:

Mortgage insurance is collected in two ways. Much like conventional loans, there is a monthly premium added to your house payment.

But there’s also an upfront mortgage insurance premium (UFMIP) that’s added to your loan balance, though it can be paid out of pocket at the time of loan closing.

Credit Considerations:

For example, while conventional loans require a minimum credit score of 620, FHA loans will accept a score as low as 580. But they’ll go as low as 500 with a down payment of at least 10%. This is definitely a loan program to consider if you have fair or poor credit.

Other Features of Fha Loans to Be Aware of Include:

- Though the minimum down payment is 3.5%, FHA loans are commonly used in conjunction with down payment assistance programs that enable buyers to purchase homes with no down payment.

- While FHA is more accommodating to lower credit scores, the program should not be viewed as a subprime mortgage. You won’t be able to get a loan if you’re six months out of bankruptcy, or if you have a recent pattern of significant late payments.

- FHA loans are available for owner-occupied, primary residences only. They cannot be used to finance investment properties or second homes.

- Loans are available in both fixed-rate and ARMs.

VA Loans

VA loans have much more in common with FHA loans than they do with conventional loans. That’s because, much like FHA loans, VA loans have mortgage insurance provided by a government agency (the Veterans Administration).

Mortgage insurance is charged as a one-time, upfront fee, with no monthly premium added to your house payment.

The loans are provided by participating lenders, which can include banks, credit unions, and other mortgage lenders. They are available only to eligible veterans and current members of the US military.

However, the big advantage of VA loans is that they provide 100% financing. That means an eligible veteran can purchase a home with no money down. And while the mortgage insurance premium is charged upfront, it’s added to the loan amount, so there is no upfront cost.

The 100% loan provision applies to the conforming loan limit. But VA loans are also available for higher-priced properties if need be. However, the borrower will have to produce a down payment equal to 25% of the amount that the loan exceeds the conforming loan limit.

For example, if the loan exceeds the limit by $100,000, the borrower will be entitled to 100% financing on up to $548,250 but must front $25,000—25%—for the excess amount.

Basic Features of VA Loans Include the Following:

- The loans are available only to eligible current and former members of the US military and their families.

- Though there is an upfront mortgage insurance premium for the loans, there is no monthly premium payment required.

- Loans are available for financing only for owner-occupied primary residences. Much like FHA loans, they’re not available for investment properties or second homes.

- The VA has no established minimum credit score, but borrowers are expected to demonstrate responsible credit management.

Jumbo Loans

As the name implies, Jumbo loans are larger loans that exceed conforming loan limits. As such, they’re typically used to purchase or refinance higher-priced properties. Loan amounts can be as high as several million dollars.

Jumbo loans have more in common with conventional loans than they do with FHA and VA loans. But unlike conventional loans, which are funded by Fannie Mae and Freddie Mac, Jumbo loans are provided by independent lenders, like banks.

Because they are, lending guidelines are less standardized than they are with other loan programs. In general, they have stricter loan requirements.

Basic Features of Jumbo Loans Include the Following:

- Loan amounts can range from just above the conforming loan limit to as much as several million dollars.

- Loans may be available for second homes and investment properties, but a lender may also restrict them only to owner-occupied primary residences.

- They generally need good or excellent credit to qualify. Minimum credit scores can be anywhere from 650 to more than 700.

- The typical down payment requirement is at least 20%. And you can expect that percentage to increase on higher loan amounts.

- Because they are larger loan amounts, interest rates charged on Jumbo mortgages are typically higher than what they are on other loan types.

Fixed-Rate vs Adjustable Rate Mortgages (ARMs)

Fixed-rate and ARMs are the two primary types of mortgage loans offered under the four main mortgage programs (conventional, FHA, VA, and Jumbo). While they’re both offered by FHA and VA, most borrowers choosing one of these loan programs opt for a fixed-rate loan.

However, the same is not true with both conventional and Jumbo loans. ARM loans are somewhat more popular with each of these loan types. This is especially true of Jumbo loans, which cater to higher-income borrowers who are often interested in getting the lowest interest rate possible.

Overall, however, ARM loans tend to be fairly rare these days. According to information released by Bankrate in 2023, ARMs comprise less than 18.6% of mortgages made in 2023. This is due to the recent phenomenon in which ARM loans are only slightly lower than fixed rates.

In addition, with fixed rates at record lows, it makes sense for most borrowers to lock in those rates rather than taking a chance on still lower rates with ARMs.

A fixed-rate loan is exactly what the name implies. Both the interest rate and the monthly payment are fixed for the life of the loan. Loan terms range between 10 and 30 years.

At the end of the loan term, the principal of the loan will be fully repaid. That will be true in the case of both a fixed-rate loan and an ARM.

ARMs

ARMs offer a fixed interest rate for a specific amount of time. Typical initial terms are three years, five years, seven years, and 10 years. After the initial fixed-rate period, the loan will become a one-year adjustable, with the rate changing nearly every year.

Interest rates on ARMs are based on a common index, such as the one-year US Treasury bill, or the six-month LIBOR. The lender will then add a margin (percentage points) to the index to produce the interest rate that future rate changes will be based on.

For example, if the yield on one-year US Treasury bills is 1.00% at the time of adjustment, and the margin is 1.50%, your interest rate will reset at 2.5%. That rate will be good for one year and will be readjusted using the same formula as the date of the next adjustment.

ARM Interest Rate Cap Limits

Fortunately, ARMs have rate caps that limit how high the rate can go on any single adjustment, or even over the life of the loan.

A common cap structure is 5/2/5. Each number represents the maximum percentage by which the fully indexed rate (index plus margin) can adjust at the time of adjustment.

The first number means the rate cannot increase by more than 5% above your original interest rate for the initial rate change. If your original rate is 2.50%, the most the lender can increase it to is 7.50%.

The second number (2, or 2%), is the most the rate can change on subsequent adjustments. If your initial rate is 2.50%, and it increases to 3.50% at the first adjustment but then jumps to 7.5% on the second adjustment, the highest rate you’ll pay is 5.50%. That’s the 3.50% rate, plus 2%.

The third number in the sequence represents the most the interest rate can increase over the life of the loan. In the example above, that’s 5%. That means if your initial rate is 2.50%, the highest rate you can be charged over the life of the loan is 7.50%, regardless of how high-interest rates go.

If you’re interested in taking an ARM, be sure to familiarize yourself with the interest rate caps associated with the loan. The lender must disclose this to you at the time of application, but it will also be included in the closing documents.

Make it a point to request the documents that specifically indicate the cap arrangement on your ARM before signing any paperwork. Once the loan closes, the cap structure cannot be changed.

When Should You Use a Fixed-Rate Mortgage Over Other Types?

Fixed-rate loans are typically the better choice when you plan to stay in the home for many years. If you expect the current home to be your “forever home,” or you expect to be there for at least 10 years, a fixed-rate mortgage is usually the best option.

It will provide rate and payment protection regardless of what’s happening with interest rates. And should rates drop after you take your loan, you can always refinance to get the benefit of a lower rate.

A fixed-rate mortgage is also strongly advised if you want to minimize homeownership risk. An inherent disadvantage of ARMs is that rates can rise, perhaps enough to threaten your ability to remain in the home. If this is a concern you have, choose a fixed-rate mortgage.

Along the same line, fixed-rate mortgages are generally a better choice for first-time homebuyers. They provide greater predictability and eliminate a potential interest rate shock that comes with ARMs.

However, given that interest rates are currently at historic lows, it makes abundant sense to lock in a fixed rate now. Though it’s always possible interest rates will go even lower in the future, it’s hardly guaranteed.

And whenever anything is at a historic low, the likelihood of further declines is much less likely to happen.

When Should You Use an ARM?

An ARM is best used when you expect to stay in your home for no longer than the fixed-rate term of the loan. For example, if you expect to live in a home for the next five years, you may be comfortable with a 5-year ARM. It’s likely you’ll move out of the home before the first interest rate adjustment hits.

Of course, the single biggest reason for taking an ARM at all is because of an interest-rate advantage. For example, if an ARM carried an interest rate a full two percentage points below that of a fixed-rate loan, the savings in the initial years might justify the risk of rate adjustment.

Unfortunately, the rate spread between ARMs and fixed-rate mortgages is nowhere near that high. That largely explains why ARMs now represent a very small percentage of all mortgages taken.

Where to Get the Right Mortgage Type

There are plenty of institutions where you can get a mortgage, whether conventional, FHA, VA, or Jumbo. But if you don’t have a favorite bank or credit union, the big national mortgage lenders are an excellent choice.

Rocket Mortgage is the online face of Quicken Loans, the largest retail mortgage lender in the country. They provide all types of mortgage loans, but they operate entirely online, streamlining and speeding up the application process.

loanDepot is also a nationwide lender, offering conventional, Jumbo, FHA, and VA loans. Similar to Rocket Mortgage, they offer an all-online application to speed up the loan application process.

Veterans United is the go-to choice for veterans and active-duty military personnel looking for VA mortgages.

As the largest VA mortgage lender in the country, they specialize in the loan type and even offer a network of VA-friendly real estate agents to help you find a home and navigate the closing process.

Credible is an online mortgage marketplace that provides an opportunity to get rate quotes from several lenders.

In a matter of minutes, you’ll complete a brief online application and receive multiple quotes to choose from. That will eliminate the need to get quotes from individual lenders one at a time.

The Bottom Line on the 4 Main Mortgage Types for Every Buyer

Selecting the right mortgage involves understanding the pros and cons of different types. Conventional loans, funded by Fannie Mae and Freddie Mac, offer various terms and down payment options but require private mortgage insurance (PMI).

FHA loans, backed by the Federal Housing Administration, cater to lower credit scores, have lower down payments, and include mortgage insurance premium (MIP).

VA loans, designed for veterans, offer 100% financing, no monthly mortgage insurance, and flexible credit standards. Jumbo loans suit high-value properties but need excellent credit and larger down payments.

Fixed-rate mortgages ensure stability, while Adjustable Rate Mortgages (ARMs) offer initial low rates with potential future adjustments.