*UIECU has officially changed its name to U of I Community College

UIECU is a credit union that provides membership to faculty, students, and community members in proximity to the University of Illinois.

Since this organization provides service to a select group of individuals, its rates are relatively competitive in comparison to industry standards.

They offer a variety of conforming and non-conforming loan options, including fixed and adjustable-rate loans, jumbo mortgages, and government-sponsored loans.

Table of Contents

About U of I Community Credit Union

The University of Illinois Employees Credit Union (UIECU) was originally founded in 1932 under the name Our Credit Union, serving hourly wage workers at the University of Illinois.

At the end of its first year, this credit union had 37 members and $116.97 in assets.

In 1935, the credit union changed its name to UIECU, moved off campus to Urbana, and expanded its membership to include university faculty.

Since the organization’s founding, UIECU has expanded its offerings to include student loans, payroll deduction, share draft checking, certificates, IRAs, money market accounts, and second mortgages.

They began offering online banking services in 2000, which enabled members across the country to manage their accounts.

In 1998, Illini Student Federal Credit Union merged with UIECU to allow students to be eligible for membership at UIECU.

In addition, Champaign Bell Credit Union merged with UIECU in 1999 to allow employees of certain telecommunications organizations to become eligible for membership.

In 2015, the organization formally changed its name to the University of Illinois Community Credit Union to represent its open membership across campus and the community as a whole. The credit union is currently based out of Champaign, Illinois.

UIECU Mortgage Rates

UIECU Loan Specifics

UIECU provides competitive rates to members on the common types of mortgage and refinancing options offered by many U.S. lenders. Eligible UIECU members may notice significant savings when applying for a mortgage through UIECU rather than through a large bank.

Here is a sample of UIECU’s loan offerings:

Fixed-Rate Loans

Fixed-rate mortgages are ideal for homebuyers who plan on living in their home for a long time and those who want consistent payments that allow for easy budgeting over a long period of time.

These home loans offer payment amounts and interest rates that do not change during the lifetime of the loan. It offers fixed-rate mortgages to members at lengths of 10, 15, 20, 25, and 30 years.

Adjustable-Rate Loans

UIECU offers adjustable-rate mortgage (ARM) products to members with low starting rates. With an ARM, the low initial rate will stay in place for a set number of years before fluctuating based on market trends.

Most lenders offer caps on these types of home loans, providing a rate ceiling that the interest rate cannot exceed.

UIECU offers ARMs with initial rates of three, five, and seven years. These types of mortgages are best for homebuyers who plan on moving or refinancing in the next few years.

Jumbo Loans

These types of nonconventional loans cover more than the limits set by major financial institutions like Fannie Mae and Freddie Mac.

UIECU offers 15 and 30-year jumbo mortgages that allow for loan amounts greater than $484,350. In order to qualify for a jumbo loan with UIECU, the borrower should have a credit score of 720 or higher.

Veterans Affairs (VA) Loans

UIECU allows veterans, military members, and their spouses to apply for VA loans.

These types of mortgages are backed by the U.S. Department of Veterans Affairs, providing borrowers with 15 or 30-year fixed-rate mortgages with up to 100 percent financing, with little or no down payment and no mortgage insurance requirement.

Federal Housing Administration (FHA) Loans

UIECU offers FHA loans to homebuyers who may have trouble qualifying for other loan programs due to a high debt-to-income ratio or low credit score. The FHA created these types of home loans to grant these buyers the opportunity to invest in real estate.

United States Department of Agriculture (USDA) Loans

UIECU offers FHA home loans to rural mortgage borrowers who otherwise may not have been able to secure a loan.

The Rural Housing Service manages and qualifies individuals for these types of loans, allowing for flexible credit scores and debt-to-income ratios. UIECU’s 30-year USDA loans have low interest rates and no down payment requirement.

Customer Service

UIECU promises that it will provide an efficient and friendly service. They guarantee that they will trust and welcome their members, offering them the best financial solutions for their personal circumstances.

To reflect a mortgage process without complication, UIECU provides a relatively simple mortgage application process.

While potential borrowers can call the credit union to speak with a loan professional on the phone, many prefer to complete this information online. UIECU has intuitive online application forms that allow individuals to apply for home loans without the hassle.

Applying for a Mortgage with U of I Community Credit Union

When applying for mortgages, potential borrowers will need to have the following information on hand:

- Social Security Number

- Contact and employment information

- Best estimates of assets, income, and liabilities

Once loan applicants have finished filling out the online form, UIECU will contact them to guide them through the loan process and help them select the best mortgage program and interest rates to fit their financial and personal situations.

During this process, the loan specialist will ask for more detailed information. Once submitted, UIECU’s underwriting team will review these facts before offering rates on their preferred types of mortgage.

Once they have been approved for a mortgage or refinance, UIECU members can manage their loan information online. They can make payments and view monthly statements through UIECU’s website.

UIECU currently has reviews from the Better Business Bureau (BBB), and the credit union is accredited with an A rating+. For the last three years, there have been five customer complaints against UIECU on BBB.

UIECU Awards and Charity Work

UIECU is a credit union that has been providing financial services to faculty and students of the University of Illinois, as well as community members in the city of Champaign, since 1932.

There is no specific National Mortgage Licensing System and Registry ID number for this organization, as it is a credit union. Instead, different loan specialists who work for UIECU have specific NMLS and Registry ID numbers.

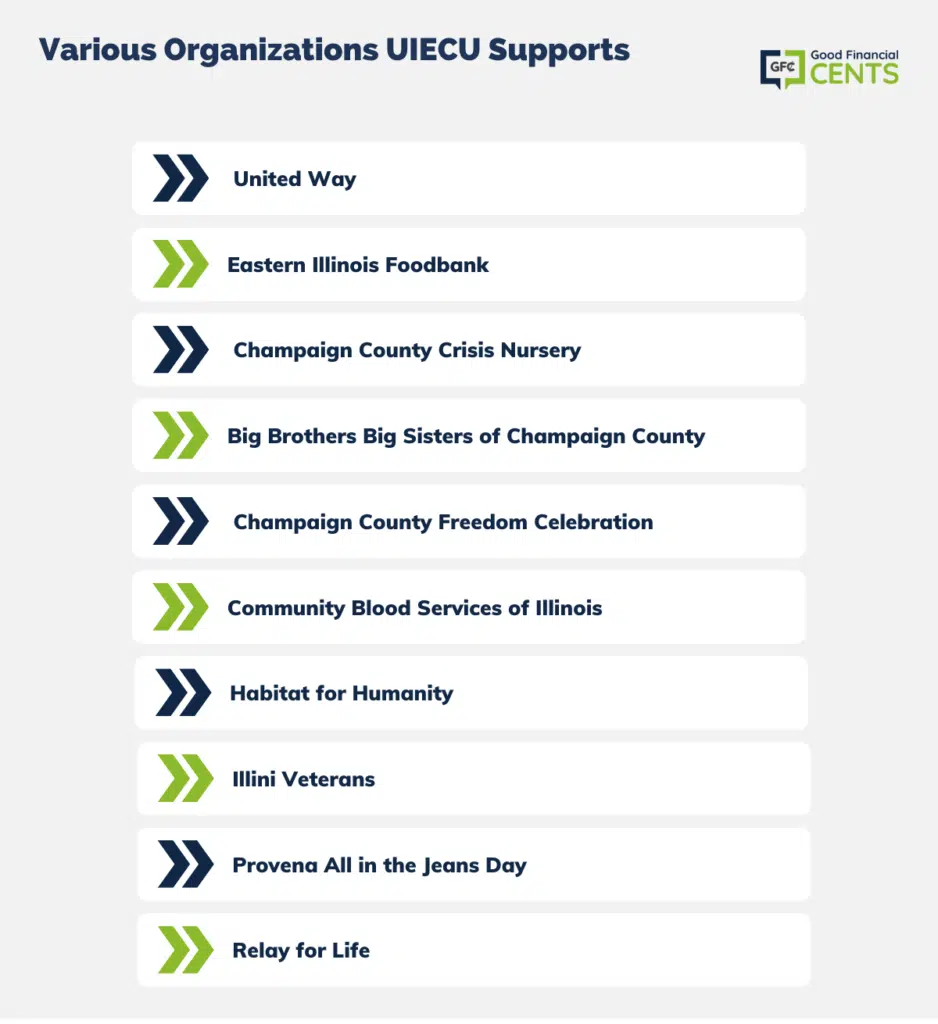

UIECU provides community efforts on campus and in the city of Champaign through volunteer efforts, involvement in community events, and scholarships.

U of I Community Credit Union Mortgage Qualifications

This credit union follows many of the industry standards when offering loans to prospective borrowers.

However, the main qualification is that borrowers must be a member of UIECU or should be direct family members of someone associated with this credit union.

The major factor that loan specialists take into account when deciding whether to qualify an applicant for a home loan is credit score.

Borrowers should have a credit score above 670 to experience higher chances of approval, but the lender will likely offer the best mortgage rates to individuals with credit scores above 760.

UIECU specifies that they will only provide jumbo mortgages to individuals with a credit score of 720 or higher.

| Credit score | Quality | Ease of approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| n/a | No credit score | Difficult |

UIECU Phone Number & Additional Details

- Homepage URL: https://uoficreditunion.org/

- Company Phone: 217-278-7700

- Headquarters Address: 2201 South First Street, Champaign, IL 618201

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment.

Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

U of I Community Credit Union (UIECU) Review

Product Name: U of I Community Credit Union (UIECU)

Product Description: U of I Community Credit Union (UIECU) is a member-owned financial institution serving the University of Illinois community and its surrounding areas. Offering a range of financial products, from savings and checking accounts to loans and credit cards, UIECU focuses on delivering personalized services with the benefits of a cooperative model. The credit union prides itself on community involvement and member-centric values.

Summary of U of I Community Credit Union (UIECU)

Established to cater to the unique needs of the University of Illinois community, UIECU has since broadened its reach to serve a wider audience while retaining its core principles. With a robust commitment to financial education and community upliftment, UIECU stands out as more than just a banking institution. Members benefit from competitive rates, lower fees, and the knowledge that their finances are managed by an institution that prioritizes their interests. The credit union’s democratic structure means that every member has a voice, fostering a sense of community and shared purpose. Beyond just financial products, UIECU is recognized for its engagement in local initiatives and efforts to make a positive impact in the communities it serves.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Member-Focused: As a member-owned institution, UIECU’s primary focus is serving the best interests of its members.

- Competitive Rates: Typically offers more favorable rates on savings, loans, and credit products compared to larger commercial banks.

- Community Engagement: Actively involved in local events, sponsorships, and charitable endeavors.

- Personalized Service: With a community-centric approach, members often receive more tailored and personal banking experiences.

Cons

- Limited Reach: As a community credit union, its physical presence is primarily around the University of Illinois, potentially limiting those outside the area.

- Fewer Technological Features: While they offer online banking, they might lag behind larger banks in terms of technological features or app capabilities.

- Product Range: Might have a more limited range of financial products compared to national banks.

- Accessibility: With fewer branches and ATMs compared to national chains, accessing in-person services might be less convenient for some.