As our society and economy continue to go paperless, the idea of reviewing and being able to understand bank statements may seem like a throwback to a different time in history.

But even though the technology has changed dramatically, bank statements still provide an important service. It gives you the ability to check your activity against a written record.

But to do that effectively, you’ll need to know how to understand bank statements. Like balancing checkbooks and preparing home-cooked meals, understanding bank statements is in very real danger of becoming a lost art.

If that describes you, please rethink the idea.

Quick Navigation:

Should You Review Your Bank Statements?

In these days of online and mobile banking, most consumers rely either on transaction alerts from the bank or simply checking the balance on a daily basis. If either or both check out, that’s where the scrutiny stops. But that’s also how you can get burned!

There are a few reasons why you need to thoroughly review your bank statements at regular intervals:

- You may have made an error, like overpaying a bill.

- Though it’s highly unlikely, your bank might make an error.

- There may be an unauthorized withdrawal or transaction in your account.

The ultimate reality of bank statement errors is that time is not on your side. The sooner you discover and report an error, the more easily it can be remedied.

But if you wait too long, the process may become much more complicated. And in some circumstances, you may not be able to fix a problem that sits too long.

One example is an unauthorized charge on your debit card. Check your bank’s policy on how they handle those situations. You’ll have a certain amount of time to report the loss, otherwise, you may be on the hook for some or all of the charge.

The Special Problems With Lost or Stolen Bank Cards

A lost ATM card is an even bigger problem. It’ll be even more so if you use the card infrequently, perhaps because you’re busy taking advantage of the rewards on your credit cards.

There are certain time limits within which you must report the loss of your debit card to minimize or eliminate your liability. Those limits are generally as follows:

- Before any unauthorized charges are made: $0.

- Within two business days after you learn about the loss or theft: $50.

- More than two business days after you learn about the loss or theft, but less than 60 calendar days after your statement is sent to you: $500.

- More than 60 calendar days after your statement is sent to you: sorry, you’re on the hook for the total amount lost, even extending to connected bank accounts.

Regularly reviewing your bank statements will enable you to stay on top of any of those developments.

How to Understand Bank Statements

Now that you know why you need to review bank statements, let’s get into the specifics of how it’s done. If you don’t review your statements on a regular basis, you may not be aware of all the details that are included. Since bank statements are typically issued on a monthly basis, they should be reviewed as quickly as possible after they are issued.

Bank statements include the following information:

- Beginning balance. This is an unadjusted balance. It doesn’t reflect deposits, checks, and other payments that have not yet cleared the bank. You should do a bank reconciliation to confirm the differences between the opening balance and your actual adjusted balance.

- Deposits. These can include payroll deposits, check deposits, transfers from other accounts with the same bank or from another financial institution, or electronic transfers from third-party sources.

- Checks paid. Checks are becoming increasingly rare, but only cleared checks will appear on your bank statement.

- Electronic payments and automatic debits. These are payments to third parties, which you may set up to occur regularly or you may initiate on a one-time basis.

- ATM card activity. This can include purchases and payments made using your ATM card or cash withdrawals.

- In-person activity. This can include both deposits and withdrawals of cash at the bank’s teller window.

- Bank fees. The most typical is a monthly service fee, but there may be other fees, like activity fees or ATM-related fees. There may also be penalty fees, like non-sufficient funds overdrawn accounts, for a dishonored check.

- Running balance. The statement will typically reflect the balance after each transaction, whether funds have been added or subtracted.

- Ending balance. This balance will also be unadjusted. It won’t reflect checks, deposits, or other transactions that have not yet cleared your account

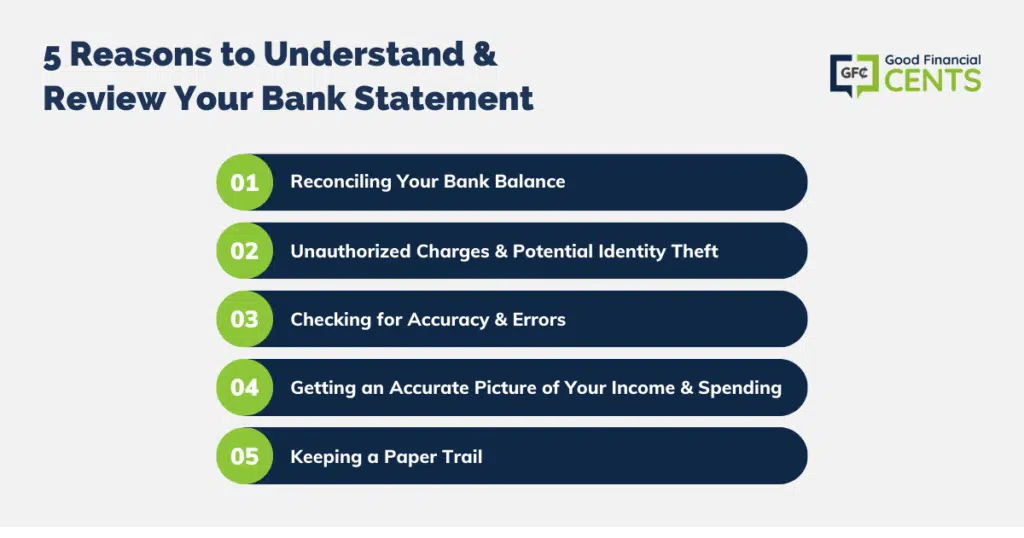

5 Reasons To Understand & Review Your Bank Statement

Maintaining an accurate bank account balance is only the most basic reason to review your bank statement, so let’s start with that and go from there:

Reconciling Your Bank Balance

Twice in the previous section, I mentioned that your bank balances are unadjusted – both the beginning and ending balances. The point of reconciling your account is to make sure both are accurate.

If you’ve never reconciled your bank statement in the past, start with the ending balance. You’ll add any deposits to the balance that have not yet cleared your account as of the closing date of the bank statement. You’ll then deduct any checks or other payments that have not cleared the account as of the same date. That will give you your actual balance, which is usually different from the bank’s ending balance.

Be sure to adjust your balance for interest paid on your account if it’s an interest-bearing account, as well as overdraft activity for either a checking or savings account.

If you can’t successfully reconcile the balance, it may have something to do with the opening balance. If that’s the case, you’ll need to go back and reconcile the ending balance from your previous monthly statement, which is the opening balance on your current statement.

In most cases, problems with reconciling your bank balance will have something to do with your own personal bookkeeping practices. You may fail to record or remember certain transactions, which makes it difficult to reconcile.

Unauthorized Charges & Potential Identity Theft

We’ve already covered this a bit in the previous section, but it is worth going into in more detail.

If you notice one or more charges on your account that look suspicious, you’ll need to investigate. Check through your own records and see if you have any documentation related to the deduction. If you don’t, call the bank to get clarification.

If the bank confirms it’s a suspicious transaction, you’ll need to report it as an unauthorized charge. The situation will be resolved based on the bank’s policy, including the timing of the reporting.

More importantly, if you identify two or more unauthorized charges, your account may have been stolen. If that’s the case, you’ll need to have your account closed or have your ATM card replaced if that was the source of the unauthorized activity.

Checking for Accuracy & Errors

We’ve just discussed the importance of reporting unauthorized activity and errors to your bank promptly. But this can also apply to outside parties.

Let’s say you accepted a check from someone in payment for a service or an item sold to them. When you got the check, you didn’t bother to look at it. You just put it in your pocket and deposit it when you go to the bank.

Maybe you were expecting the check to be for $110, but a review of your bank statement reveals that it cleared for $100. You’re $10 short on the payment.

You’ll have an opportunity to request a copy of the check from the bank, or sometimes you can access it directly from the online banking platform. If it shows that the check was made for $110 but only cleared for $100, it’s a bank error, and they’ll need to make good on it.

But if it turns out the check was only written for $100, you’ll need to go back to the issuer to collect the remaining $10. The sooner you do that, the more successful you’re likely to be.

The same thing can happen on the payment side. You make a charge on your ATM card for $50, but it clears your bank at $55. If you have a receipt that shows it was only $50, the $5 difference is a bank error or a reporting error by the merchant. But if the receipt shows $55, it’s your error. Either way, you’re better off knowing so you can correct the charge or your own bank balance accordingly.

Getting an Accurate Picture of Your Income & Spending

If you have some sort of formal budget in place, this step may not be necessary with your bank statement. But if you’re like most people and you don’t have a budget, your bank statement may be the closest you get to tracking your income and expenses.

For most people, most or all of their income ultimately ends up passing through their bank accounts. That being the case, your bank statement will be the best confirmation of your incoming cash flow.

Most people know how much they’re paid on an annual basis. It’s easy because it’s usually some sort of a flat number, like $45,000. But from a budget standpoint, that number is practically irrelevant. Because of deductions for income taxes, health insurance, and retirement plan contributions, your net income figure will be much lower.

Only by reviewing your bank statement on a regular basis will you know the actual net income you’re receiving each month. That will also tell you how much money you have to live on each month.

Let’s flip over to the expense side. One way or another, most of your expenses are likely running through your checking account. That includes not only direct payments through electronic transfers, checks, or your ATM card, but also monthly payments toward credit cards.

By adding up your income and expenses each month, you’ll have a rough budget. At a minimum, it will let you know if your income is being outstripped by your expenses. Then, you can make changes in your spending habits to get back in balance.

Keeping a Paper Trail

Even in the online, electronic world we live in, it’s often necessary to be able to document financial transactions. As any accountant will tell you, the most basic form of financial documentation is your bank statements. Since they represent what is typically the primary source of transactions in your life, each statement provides an important track record of financial activity.

You may need that information in the future to prepare your income taxes or even to dispute a bill after the fact.

That makes a strong case for maintaining some sort of system of retaining your statements for a sufficient amount of time. Whether you do that by saving your statements to your computer or by printing and saving paper copies isn’t what’s important. What matters is that you’ll have the most fundamental element of your paper trail available when it’s needed.

Don’t count on your bank retaining your statements forever – they don’t. Most banks put a limit on how far back they’ll retain your statements. Three years is a common limit. If a situation, particularly a tax-related one, comes up from more than three years ago, you’ll be in trouble if you haven’t kept a copy of your older statements.

When you save your statements – and you should – just make sure you’re doing it safely. If you’re saving them to your computer, they should be held in an encrypted file. If you’re keeping paper copies, they should be held under lock and key. Just as your bank statements provide you with a wealth of information, they can do the same for a thief.

Review Your Bank Statements Regularly

Now that you understand bank statements and the need to review them on a regular basis, be sure to do it consistently. If you haven’t been in the habit of reviewing your bank statements on a regular basis, skipping a month or two could easily lead you back to not doing it at all.

But if you make it a regular practice, not only will you do it automatically, but it’ll put you in a better position to understand what’s happening in your bank account, as well as with your finances in general.

And if you have more than one bank account, you should review them all regularly as well. That includes savings accounts. At a minimum, you’ll want to regularly monitor deposits and withdrawals from those accounts. Even if an account has low activity, you’ll still want to review it regularly to look for fraudulent or unauthorized activity.

Online and mobile banking certainly make the practice of banking easier than it’s ever been. But neither has changed the fundamental reality that you have a responsibility to yourself to know what’s going on in your bank accounts at all times. That will only happen if you understand bank statements and review them on a regular basis.

Bottom Line – Understand Bank Statements

Understanding and reviewing bank statements is a crucial skill in our technology-driven world. Despite advancements, bank statements still serve as a vital record of financial activity.

Regularly checking your statements helps detect errors, unauthorized charges, and potential identity theft. Reconciling balances, tracking income and expenses, and maintaining a paper trail are essential benefits.

By comprehending the details within statements, you safeguard your financial well-being. Consistency is key; regularly reviewing all accounts ensures you’re aware of any anomalies.

While technology simplifies banking, your responsibility to stay informed remains paramount. Understanding bank statements empowers you to manage your finances effectively and make informed decisions.