The U.S. Department of Veterans Affairs guarantees and sets the rules for its own suite of issued through qualified lenders. Military personnel considering buying a home can weigh these loan offerings alongside equivalent products. Some of the advantages of VA loans include reduced upfront costs, lower interest rates, and no mortgage insurance requirements.

Another typical mortgage option is jumbo loans, which are mortgages that exceed the maximum loan amount typically backed by government-sponsored enterprises Fannie Mae and Freddie Mac.

VA Jumbo Loans are a convergence of these two factors, loans that go beyond conforming values for a county but are still offered through VA financing. They maintain some features of smaller VA loans.

Continue reading to discover the pros and cons of these mortgages and how to apply for one.

Table of Contents

VA Jumbo Loan Mortgage Rates

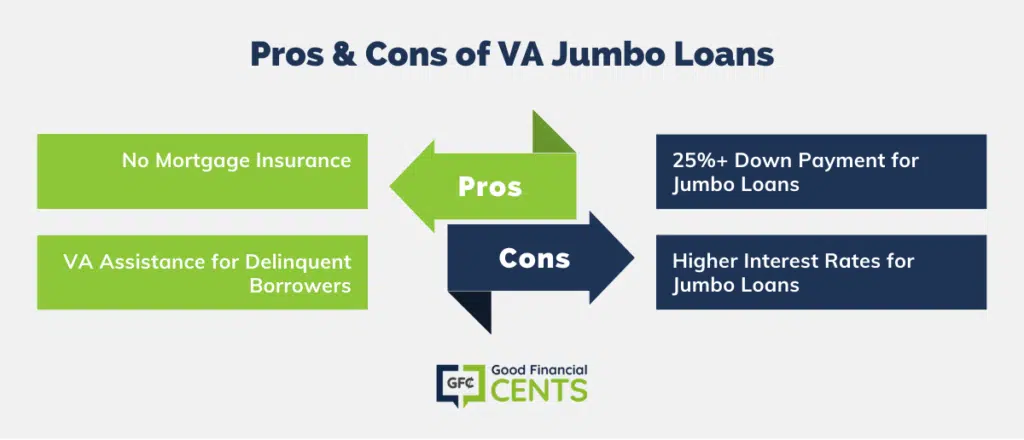

Pros & Cons of VA Jumbo Loans

Pros

Typically Don’t Require Mortgage Insurance

For those financing a home through a lender or financial institution, experts recommend having at least 20 percent of the value of the home for a down payment. Buyers who opt for a conventional mortgage with a down payment of less than 20 percent are typically required to purchase private mortgage insurance or PMI, and those costs can add up over time.

VA loans have no such requirement, making them an excellent choice for qualifying borrowers.

Come With Staff Assistance

VA personnel can provide help and support to qualified borrowers who fall behind and become delinquent on loan payments. This assistance can help prevent foreclosure.

Cons

Have Down Payment Requirements

While smaller VA loans may not require a down payment, jumbo offerings for amounts that exceed the VA’s limit for the county in which the loan is taken out will likely require a down payment of at least 25 percent. The VA funding fee also applies to these kinds of loans.

Have Higher Rates

Rates for jumbo loans may be higher than those for smaller loans that conform to the VA limits. The Consumer Finance Protection Bureau indicated lenders tend to offer tougher terms for Jumbo loans to ensure repayment.

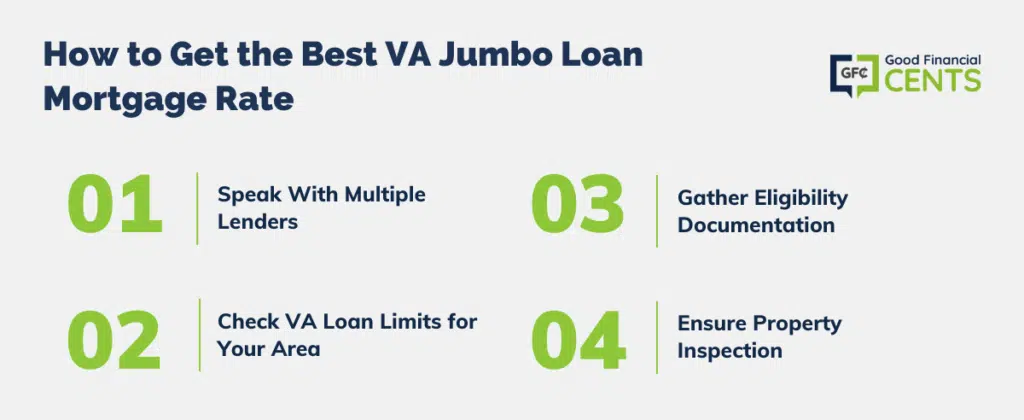

How to Get the Best VA Jumbo Loan Mortgage Rate

Speak With Multiple Lenders

VA loans are insured by a government agency, but they are offered and financed through various different lenders. Borrowers are encouraged to shop around to determine which banks offer VA loans with the most favorable rates and terms. The VA itself notes that lenders will differ in their offerings, and the best will provide competitive rates.

Determine the VA Loan Limit for Your Area

Whether or not you need to apply for a jumbo mortgage to secure the home of your dreams will depend on your residence. The Office of Federal Housing Enterprise Oversight (OFHEO) regulates the conforming loan limits annually, which vary by county.

While the baseline in 2025 was set to be $766,550, some counties have much higher limits.

Get Your Documentation in Order

To prove they are eligible for VA funding, veterans are required to present a Certificate of Eligibility from the U.S. Department of Veterans Affairs. You can get this process started yourself on the Veterans Benefits Administration’s website or get one through your lender.

Have the Property Inspected

There are some special requirements associated with VA loans, including that the property in question is “safe, sanitary, and sound.” The VA recommends working with a qualified property inspector before receiving the loan, noting that a VA property appraisal is not a full inspection.

Alternatives to the VA Jumbo Loan Mortgage

Homebuyers considering applying for a VA Jumbo Loan may want to look at other alternatives before making the investment. Some of these include:

Conforming VA Loans

Although it will put some properties out of financial reach, opting for a conforming loan as opposed to a jumbo one could benefit borrowers unable to provide a down payment. Many lenders promote the fully financed down payment as a primary benefit of securing a loan backed by the VA, and jumbo loans don’t offer this advantage.

USDA Rural Housing Service Loans

VA loans aren’t the only kind of specialized loan products backed by the government. Individuals seeking a mortgage have various options based on the value and location of the property they’re considering.

For people interested in moving away from metropolitan areas, the United States Department of Agriculture offers a loan product designed to make it easier for families to secure safe housing in rural settings.

Recommended Companies for VA Jumbo Loan Mortgages

- New American Funding: New American Funding offers both fixed- and adjustable-rate VA loans as well as refinancing programs that may help veterans improve their interest rates.

- North American Savings Bank: NASB offers detailed information for veterans interested in buying a home, including an online guide for first-time buyers. Individuals with credit scores of 620 or higher are invited to apply.

- AmeriSave: Borrowers can easily see what kind of rates they qualify for with AmeriSave’s online rate quote request tool. Veterans with a FICO credit score of over 580 will be considered (640 for loans exceeding $700,000).

- Magnolia Bank: This bank, rated A+ by its local Better Business Bureau, offers a full suite of specialty loan products to borrowers in and around Kentucky. This includes VA loans, USDA Rural Housing Loans, and Federal Housing Administration Loans.

Final Thoughts

The U.S. Department of Veterans Affairs offers VA Jumbo Loans, which are unique mortgages that exceed the typical loan amount but still retain the advantages of a VA loan. These loans come with their own set of pros, such as the lack of a requirement for mortgage insurance and the support of VA personnel. However, they also have downsides like the need for a down payment and potentially higher rates.

When considering a VA Jumbo Loan, borrowers should also evaluate other alternatives like conforming VA loans and USDA Rural Housing Service Loans. Ultimately, it’s essential for potential borrowers to shop around, understand the limits in their area, and ensure all necessary documentation is in place before committing to a mortgage option.