In 1866, Union Savings Bank was founded in Danbury, CT inside a store belonging to one of the bank’s trustees. Named Union Savings Bank of Danbury, the bank’s name probably references the Union side of the US Civil War, which was on residents’ minds at that time.

As the bank grew, a permanent three-story brick building was constructed that still houses Union Savings Bank’s headquarters. In 2010, Union Savings Bank merged with The First National Bank of Litchfield (FNBL), Connecticut’s oldest nationally chartered bank.

FNBL was founded in 1814 by one of George Washington’s spies from the Revolutionary War. Today’s Union Savings Bank carries the historic legacy of both banks.

Union Savings Bank has several lending options, but may seem to have a smaller selection than other lenders typically do; that could be because Union Savings Bank mortgages and refinance loans are carried in-house and not resold like many loans often are.

Union Savings Bank is very diligent about documentation and borrowers will need to have complete information available about their credit histories, income, and assets.

Applicants can find information about buying a home, mortgage rates, loan processes, and even apply online via the bank’s website.

Union Savings Bank does allow borrowers to get quotes online without requiring personal information.

Union Savings Bank has relatively little news available online, so it may be challenging to gauge the bank’s reputation.

Currently, Union Savings Bank is not on Trustpilot. The BBB does not rate the bank.

Table of Contents

Union Savings Bank Quick Facts

- Mortgage Loans Are Locally-Carried by Union Savings Bank

- High-Value Jumbo Home Loans Available

- Online Quotes Available Without Providing Personal Information

- Optional Rate Watch Feature on the Website Automatically Sends Out an Email When Rates Hit a Specific Number

- Online Mortgage Application Available

- First Time Homebuyer Program Offering a No-Private Mortgage Insurance (PMI) Loan for Borrowers Who Put at Least 10.1 Percent Down at the Time of Purchase

Current Mortgage Rates

Specifics

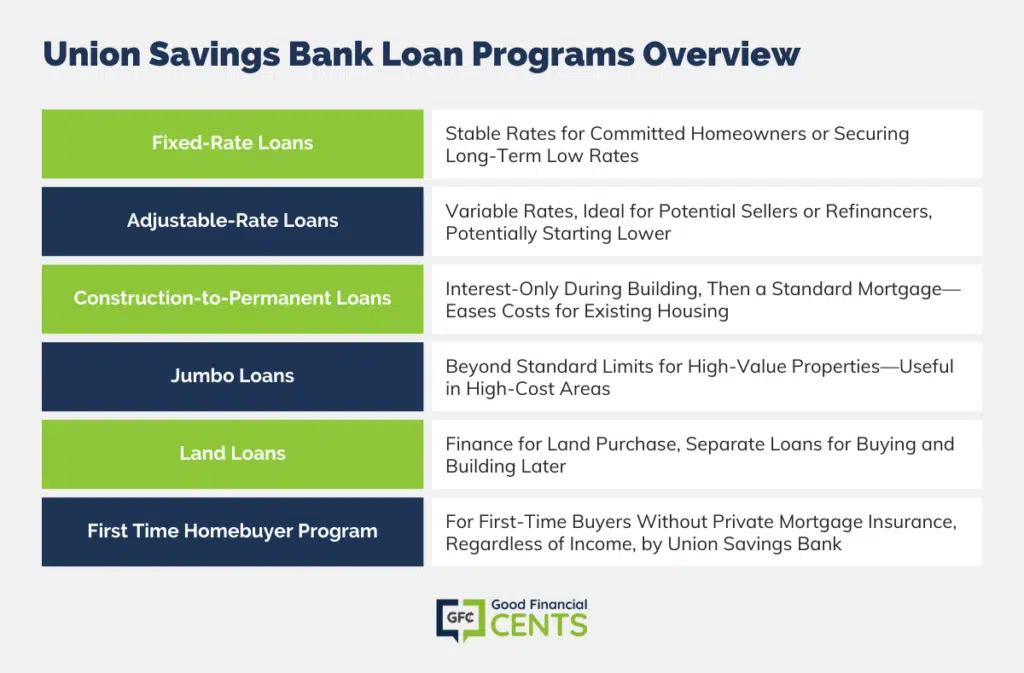

Fixed-Rate Loans

Borrowers know what to expect with a fixed-rate loan because the rate stays the same for the duration of the mortgage or refinance.

Monthly payments are consistent and do not go up or down, so this may be an excellent option for applicants who plan to stay in the same home for several years or want to lock-in a low rate that can’t increase. Union Savings Bank offers 10-, 15-and 30-year fixed-rate mortgages.

Adjustable-Rate Loans

ARM loans (Adjustable Rate Mortgages) have rates that are subject to change and can cause monthly payments to increase or decrease. Borrowers could end up paying more than they anticipated.

Rates may also fall, however, and usually start at a fixed low rate at the beginning of the loan. For borrowers who plan to sell soon or refinance, ARM mortgages may be beneficial.

Construction-to-Permanent Loans

These mortgages have two periods. First, an interest-only period while borrowers’ homes are being built, then, a traditional mortgage, once the house is finished.

This might make it easier to afford payments on a home while paying another mortgage or making rent payments for a previous residence.

Jumbo Loans

Jumbo mortgages, also known as non-conforming loans, are mortgage loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac.

These government-sponsored enterprises (GSEs) establish maximum loan amounts for conventional mortgages, which are typically eligible for purchase by the GSEs.

As of 2025, the baseline conforming loan limit for most counties in the United States is $766,550. However, in certain high-cost areas, the conforming loan limit is higher, reaching up to $1,149,825.

Land Loans

Union Savings Bank finances land purchases. Borrowers can get a separate loan for land and build later if they choose.

First Time Homebuyer Program

Borrowers who qualify can purchase a home without carrying private mortgage insurance (PMI). This exclusive program has no income limits and is carried in-house at Union Savings Bank and is designed for applicants buying a home for the first time.

Union Savings Bank Mortgage Customer Experience

At Union Savings Bank, mortgages are financed and carried in-house. As such, they may have fewer options and more stringent requirements. That said, many applicants prefer to have a mortgage they know will not be resold to another institution later.

Prospective borrowers can learn more about the bank’s mortgage application process and can apply online or in person at a branch. Sample rates and information about different mortgage types are posted on the lender’s website.

Applicants can use their free quote tool to get an estimate without providing personal information. With the Rate Watch feature, borrowers can choose their desired rate online and receive email updates when rates drop or reach a certain level.

Currently, Union Savings Bank does not appear in many news headlines, nor does it have a very visible reputation. The bank does not appear on Trustpilot and is not rated by the BBB.

To apply for a mortgage, borrowers will need personal information, including their income, credit history, and assets. This is fairly typical. Depending on the loan, applicants may need to present other documentation to Union Savings Bank.

Lender Reputation

Union Savings Bank does not have a Trustpilot score and is unrated by the BBB.

*Information collected December 12, 2018

Mortgage Qualifications

| Credit Score | Quality | Ease of Approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat Easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Difficult |

| N/A | No Credit Score | Difficult |

To get the best possible offers and options at Union Savings Bank, borrowers should have credit scores at or above 760. Applicants with scores in the 700 to 759 range may not qualify for the best mortgages but are likely to have at least a few loan choices available.

For borrowers with credit scores between 621 and 699, finding a good offer may be more difficult. Applicants with scores below 620 or no credit scores at all may not be able to get a mortgage or refinance from Union Savings Bank.

For the best chances at finding great mortgage options, applicants should have plenty of documentation available for loan offers to review.

| Debt-To-Income Ratio | Quality | Likelihood to Get Approved by Lender |

|---|---|---|

| 35% or Less | Manageable | Likely |

| 36-49% | Needs Improvement | Possible |

| 50% or Lore | Poor | Unlikely |

Union Savings Bank is much more likely to offer the best terms to borrowers with debt-to-income (DTI) ratios at or under 30 percent. The bank has few options available for applicants with higher DTIs, so it may be worth it to pay down debts before applying.

Homepage URL: https://www.unionsavings.com/

Company Phone: 1-866-872-1866

Headquarters Address: 226 Main Street, Danbury, CT 06810

The Bottom Line – Union Savings Bank Review

Union Savings Bank, with its rich history dating back to 1866, offers a range of mortgage options primarily focused on serving the local community.

Carrying mortgages in-house rather than reselling them, the bank provides stability for borrowers who prefer to know their loan won’t be transferred.

The bank offers fixed-rate and adjustable-rate loans, jumbo mortgages, land loans, and a unique first-time homebuyer program that avoids private mortgage insurance.

However, with limited online visibility and absence from review platforms, assessing the bank’s reputation may be challenging.

Prospective borrowers should ensure their credit scores and debt-to-income ratios meet Union Savings Bank’s requirements for the best loan options.

How We Review Banking or Financial Institutions

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability.

Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Union Savings Bank Review

Product Name: Union Savings Bank

Product Description: Union Savings Bank, founded in 1866 and based in Danbury, Connecticut, offers a range of mortgage options to local residents and communities. With a commitment to serving its members, the bank carries mortgages in-house, providing stability and reliability to borrowers.

Summary of Union Savings Bank

Established over a century and a half ago, Union Savings Bank has deep roots in the community and a rich history of serving its customers. The bank’s headquarters, housed in a historic three-story brick building, reflects its enduring presence in Danbury, Connecticut. One distinguishing feature of Union Savings Bank is its approach to mortgage lending. Unlike many lenders that sell mortgages to other institutions, Union Savings Bank retains its mortgages in-house. This means that borrowers can count on their relationship with the bank to continue throughout the life of the loan, providing stability and peace of mind.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Efficient In-House Mortgages

- First-Time Buyer PMI Savings

- Transparent Rate Quotes

Cons

- Limited Online Reputation

- Smaller Mortgage Selection

- Minimal Accessibility to Information