Experiencing the death of a loved one is traumatic enough, but worrying about what happens to their debt adds more heartache to the situation. Depending on the preparations your family member made in advance, surviving heirs might have to face this extra layer of grief.

A family member’s unpaid debt is usually paid from their estate before their will is settled. In some cases, if the assets remaining are not enough to repay the debts, heirs could be liable.

A study by the National Bureau of Economic Research found that 46.1% of American seniors die with less than $10,000 in assets. And it’s possible that outstanding debts could top this amount. Here’s everything you need to know about what happens to debt after your family member dies.

Table of Contents

My Family Member Left Unpaid Debt, Now What?

Don’t worry about suddenly becoming legally responsible for the debt of your deceased parents, grandparents, or siblings. Even if they die with unpaid debt, these debts don’t legally pass to you.

However, if your spouse dies, you might be on the hook for their debts. Most of the time, you won’t be, but this varies by state.

You’ll be responsible for a deceased’s debts if you’ve acted as a cosigner on a loan or mortgage for a family member who died. The same goes if you’re the joint account holder on a credit card. And, in some states, if you own property with someone who’s died, their estate has to pay any outstanding bills.

Keep in mind, if you live in a community property state you might be liable for the debt of your spouse. There are nine community property states:

- Arizona

- California

- Idaho

- Louisiana

- New Mexico

- Nevada

- Texas

- Washington

- Wisconsin

In these states, spouses share debts. Creditors could be able to use community property to satisfy debts, but the specifics vary by state so consult an attorney in your area to understand your rights.

Lastly, if you cosigned medical bills for a loved one when they entered the hospital, you could be on the hook for costs that aren’t covered by insurance. This also varies by state.

Contact From Debt Collectors

Even though it could feel traumatic, debt collectors are allowed to contact you if your spouse has died and left a debt. However, they’re not allowed to claim that you’re responsible for the debt unless you were a joint account holder or cosigner. Barring that, they’re only authorized to contact you for information about the executor of the estate so they can attempt to recover payment.

Since the deceased’s estate is still responsible for the debt, a debt collector could file a claim against the estate. However, unless you fit into the specific circumstances listed above, they can’t claim that you’re legally responsible for the debt. This is true even if you are the executor of the estate.

How to Deal With Inherited Debt

If you’re legally obligated to pay the debt left by a deceased family member, you’ll have to take steps to repay it. Not paying debt, such as a mortgage you cosigned or a credit card for which you’re a joint account holder, could have a negative impact on your credit. This includes affecting your ability to receive financing in the future. Creditors can even go as far as to garnish your wages, in some cases.

What Happens to a Mortgage When a Spouse Dies?

Family members who inherit a property are allowed to take over the mortgage from a loved one who’s died. Federal law excludes heirs from having to prove they can actually repay the funds before assuming the mortgage.

Although this gives you some flexibility to determine how to come up with the mortgage payments, it can also be stressful if you truly can’t afford the rest of the mortgage. You can always ask the lender about modifications you can make to the mortgage to help the payments fit your budget.

If you decide you don’t want to pay the remaining funds left on the mortgage, you can opt to sell the home or allow the lender to foreclose.

Preventing Unauthorized Debt

The executor of your loved one’s estate should let all lenders know of your loved one’s death so they can settle the accounts. These lenders will then report your loved one as deceased to the credit bureaus. This can prevent any scammers from attempting to rack up additional debt in your family member’s name.

Typically, the funeral home also notifies the Social Security Administration (SSA) of your loved one’s death if you provide them with their Social Security number. You can also do this yourself over the phone or in person at an SSA office.

Facing Secured Loans

There’s a chance you might face a creditor over items that were used to secure loans. For example, let’s say you owned a car jointly with your spouse, and the auto loan is in your spouse’s name. If your spouse dies and their estate can’t repay the loan, you might find yourself battling a creditor who’s trying to repossess your car.

For this reason, reach out to lenders of secured loans, immediately, to notify them of a death and arrange a payment plan.

Paying Joint Debt

If you were previously a cosigner or a joint account holder, you can find yourself legally responsible for debt that you can’t afford. In this case, one option is to look at refinancing the debt to potentially obtain a lower interest rate or longer term.

If you’re having trouble or feeling overwhelmed handling a new set of bills, consider obtaining professional financial advice. You can often get free or low-cost credit help from nonprofits or credit unions. When doing so, be sure that anyone you receive advice from is accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America.

How to Protect Your Family From Inheriting Debt

People commonly take steps to prevent passing on their debt after death by obtaining a life insurance policy that provides such coverage. There are several versions of life insurance that could help your heirs pay any of your remaining debt. Remember, always compare life insurance companies online to make sure you’re getting the best deal for your circumstances.

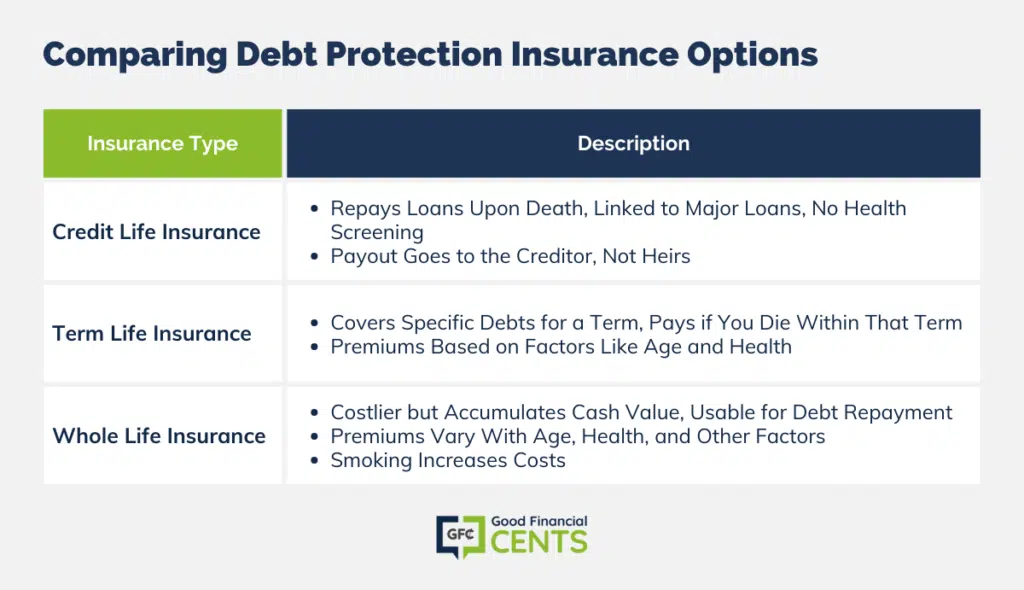

Credit Life Insurance

You’ll typically be offered credit life insurance when obtaining your mortgage, or another major loan such as an auto loan. If you obtain credit life insurance, when you die your loan is repaid based on your policy.

As your loan matures and the outstanding amount lessens, so does the death benefit of the policy. Because credit life insurance is a guaranteed issue, it usually doesn’t require a health screening. Keep in mind, that credit life insurance isn’t paid to your heirs but directly to your creditor.

Term Life Insurance

The death benefit from term life insurance can also be used to repay a debt. If you have a large source of debt, like a mortgage, you could opt to purchase term life insurance to last the entire term of your loan. You can also opt to cover debt for which you have a cosigner with a life insurance policy.

For example, let’s say you have a $1,000,000 mortgage — so you’d want a death benefit that covers this cost. Term life insurance only pays the death benefit if you die within the term of the policy. If your mortgage has a 30-year term, you’d likely want a term that covers the same time period.

Your monthly premiums are determined by the length of your term, death benefit, age, and possibly other factors such as your health. The annual premium for a $1,000,000 term life could range anywhere from $514 (for a 20-year-old female) to $1,894 (for a 40-year-old male) for a 30-year term.

Be sure to name a specific beneficiary so the life insurance doesn’t go directly to your estate, where creditors might have access to it.

Whole Life Insurance

Though typically more expensive, whole life insurance builds cash value throughout your lifetime which you can withdraw to repay debts while you’re still alive. Your heirs can also use the death benefit to pay debts such as a mortgage or auto loan.

Whole life insurance premiums also vary based on the age you are when you obtain your insurance, gender, age, and policy amount. Health can also impact your premiums. For example, being a smoker can cause your life insurance to be more expensive.

Whole life can be significantly more expensive. For example, a 40-year-old woman might be quoted $80 per month for a 20-year, $1,000,000 term life policy, and $1,000+ per month for a $1,000,000 whole life policy.

The Bottom Line

Although there are many scenarios where you’re not liable for a deceased loved one’s debts, there are enough ways you can be liable to cause a significant financial crisis if you’re unprepared.

One of the best ways to prepare is ensuring your loved one has enough life insurance to cover their debts, and that you’re named as a beneficiary. This could be particularly important if you’re the cosigner on a loan or if you’re concerned about affording the mortgage on a home you share with your family member.