Veridian Credit Union was founded in 1934 by a group of employees working for Deere & Company, who established its headquarters in Waterloo, Iowa. Originally named The John Deere Employees Credit Union, this banking institution has operated as a not-for-profit entity since its inception but only extended its field of membership in 1986.

Today, individuals and families living in Iowa and parts of Nebraska can take advantage of Veridian’s full-spectrum banking service, which includes a range of conventional and government-backed home loan products.

Table of Contents

Veridian Credit Union Background

Since 1934, Veridian Credit Union has supplied its members with home loan options that suit a diverse range of financial needs. Formal membership is required to qualify for Veridian’s mortgage programs, which are widely available to residents living in Iowa and some counties in Nebraska.

Once a membership is obtained, borrowers can choose from conventional and jumbo fixed or adjustable-rate mortgages, along with government-backed options like IFA, USDA, and VA loans. Qualified first-time homebuyers may be eligible for a fixed-rate mortgage with down payments as low as 3 percent and financing up to a 97 percent loan-to-value ratio, though some restrictions may apply.

As a not-for-profit credit union, Veridian is solely dedicated to providing affordable rates and personalized service to its members. Borrowers can apply for a home loan in person, over the phone, or through the credit union’s website.

Veridian also provides prospective customers with a host of educational resources and tools that can help them secure the best mortgage option with monthly payments they can afford. While specific credit scores and debt-to-income requirements are not readily available via the website, Veridian’s live chat feature makes it easy to get in contact with a lending agent for further details.

Overall, this lender is a great fit for first-time homebuyers and low-to-moderate-income borrowers living and working in Iowa.

Current Veridian Mortgage Rates

Veridian Mortgage Options

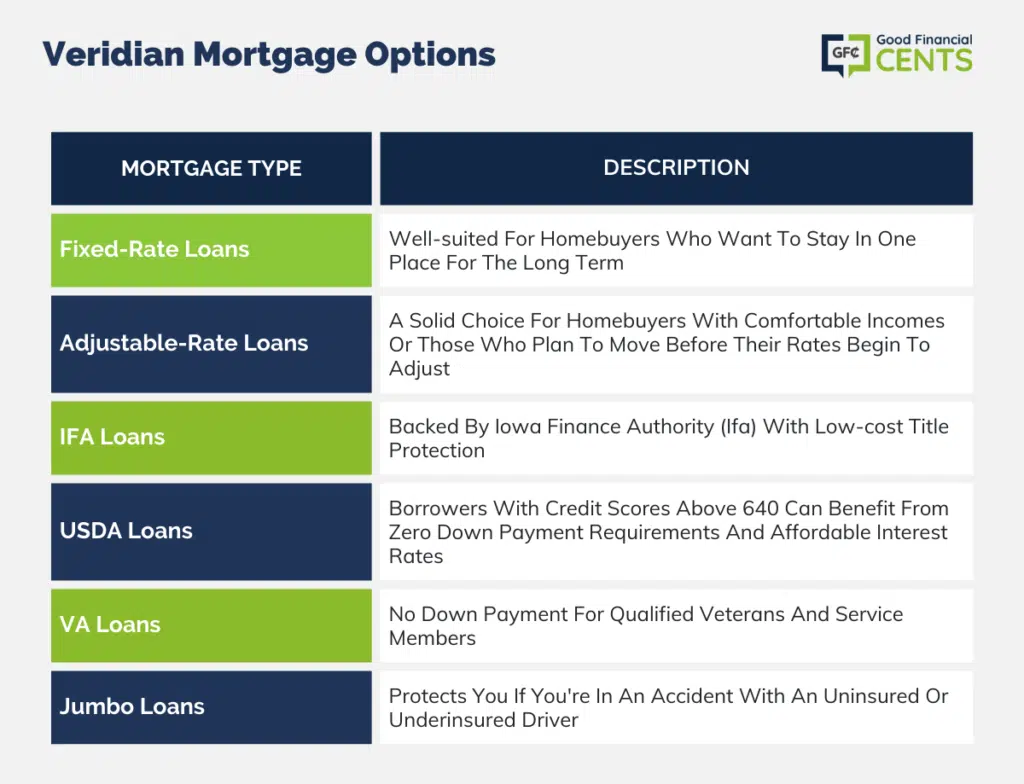

Veridian Credit Union provides its members with a diverse selection of mortgage options, including fixed and adjustable-rate, IFA, USDA, VA, and jumbo loans. It also offers a range of specialty programs and promotions that are uniquely tailored to meet the needs of Iowa residents, first-time homebuyers, and borrowers who are unable to make large down payments.

Fixed-Rate Loans

This traditional mortgage option maintains stable interest rates and monthly payments over the full life of the loan, regardless of any fluctuations within the market index. Veridian offers fixed-rate loan terms of 10, 15, 20, 25, and 30-years, though a longer repayment period typically results in higher rates.

Eligible first-time homebuyers can put as little as 3 percent down on this lender’s 15- and 30-year loan products, though some restrictions apply. This loan type is well-suited for homebuyers who want to stay in one place for the long term.

Adjustable-Rate Loans

These types of loans are based on variable interest rates, which means monthly payment amounts can vary depending on market conditions. Rates may increase or decrease over time, though Veridian has a yearly cap of 2 percent and a lifetime cap of 6 percent on all rate adjustments.

Borrowers can select from an initial fixed-rate starting period of five, seven, or ten years, though longer periods may result in higher rates. Overall, adjustable-rate mortgages feature lower interest rates than other loan types, making it a solid choice for homebuyers with comfortable incomes or those who plan to move before their rates begin to adjust.

IFA Loans

These mortgages are backed by the Iowa Finance Authority and provide low-cost title protection for purchases up to $500,000. The IFA offers two mortgage programs, both with 30-year fixed-rate terms. The FirstHome Program is available to first-time homebuyers who want to purchase a primary residence in Iowa.

The Homes for Iowans Program can be obtained by both first-time and repeat homebuyers who qualify, though eligibility guidelines are strict. IFA’s mortgage programs have income limits, and purchase price limits and borrowers must have a minimum credit score of 640 and a maximum debt-to-income ratio of 45 percent.

USDA Loans

This loan option is facilitated by The United States Department of Agriculture and extends 100 percent financing options to qualified borrowers. Homebuyers with low to moderate income are encouraged to apply, but the property in question must be located in a designated rural area.

Eligible borrowers with credit scores above 640 can benefit from zero down payment requirements and affordable interest rates. Income limits for these types of loans, however, are strict.

VA Loans

Qualified veterans and service members may benefit from this mortgage type, as it features no down payment minimums and does not require private mortgage insurance. Backed by the Department of Veterans Affairs, these home loans provide eligible borrowers with affordable rates and a range of financing options, though a minimum credit score of 620 is typically required.

Government-backed loans tend to have lower interest rates than conventional mortgages, along with reduced closing costs. This loan type also allows the seller to pay up to 4 percent of the purchase price toward closing costs, but gift funds are not allowed.

Jumbo Loans

Veridian provides jumbo loans on mortgages that exceed $726,200, though the conventional conforming limits are typically set by the Federal Housing Finance Agency (FHFA). The agency recently announced that the 2025 maximum conforming loan limit for one-unit properties will be $766,550.

Veridian Mortgage Customer Service

Veridian Credit Union mainly operates in Iowa, with membership open to persons living in or working for a business within any of the state’s 99 counties; it also services a few communities in Nebraska, including Cass, Douglas, Lancaster, Sarpy, Saunders, and Washington counties. Members can extend their benefits to any family member, making it easy for Iowa residents to partner with this credit union.

Veridian’s small service area allows it to focus exclusively on the unique needs of residents in this region. Interested homebuyers can contact a representative by visiting a physical branch, via phone or email, or by using the live chat feature on Veridian’s website. Borrowers must first obtain formal membership with the credit union before they can apply for a home loan from this lender.

In addition to information on its various loan products, Veridian’s website contains a host of educational resources that can help members understand the mortgage application process and secure affordable rates, including blogs, checklists, FAQ pages, and a video series tailored to first-time homebuyers.

The website also permits members to apply for pre-qualification and to submit a mortgage application entirely online, without the need to visit a branch in person. Additionally, Veridian’s home and mortgage calculators make it easy to compare different loan options, but members cannot receive personalized rate quotes through its website.

Veridian Grades

Veridian has earned a reputation as a member-focused credit union with over 80 years of experience serving the banking needs of Iowa residents. The financial entity has been accredited as an Equal Housing Lender and its members are insured by The National Credit Union Administration for up to $250,000.

While Veridian does hold an A+ rating from the Better Business Bureau, its BBB profile currently features a one-star customer rating based on a handful of reviews.

Veridian Mortgage Qualifications

| Loan Type | Rate Type | Loan Terms |

|---|---|---|

| Fixed-Rate Loans | Fixed | 10, 15, 20, 25, and 30 years |

| Adjustable-Rate Loans | Variable | 5-1 ARM, 7-1 ARM, and 10-1 ARM |

| IFA Loans | Fixed | 30 years |

| USDA Loans | Fixed | 30 years |

| VA Loans | Fixed or Variable | 30 years |

| Jumbo Loans | Fixed or Variable | N/A |

Home loans from Veridian are only available to homebuyers who have obtained official credit union membership and each program has unique eligibility guidelines. The credit union’s website does not provide any information on median income or debt-to-income requirements, nor does it specify whether its mortgage offerings have minimum credit score qualifications.

According to FICO, the standard credit score stands at around 740, which is needed to secure the best available mortgage rates. Most lenders will consider applications from borrowers with credit scores as low as 680, but direct confirmation from a lending agent is advised. It is unclear whether Veridian considers non-traditional credit history for determining program eligibility or interest rates.

Many of Veridian’s government-backed mortgages feature less strict qualification requirements. For example, USDA loans can be obtained with little or no down payment and up to 100 percent financing, but the property must be located within an eligible rural or suburban area.

Veridian also extends a number of affordable fixed-rate programs for first-time homebuyers, allowing down payments as low as 3 percent for 15 and 30-year repayment terms. Additionally, closing costs can be paid for with borrowed funds, a gift, a grant, or other permitted sources, though some program restrictions apply.

Veridian Phone Number & Additional Details

- Homepage URL: https://www.veridiancu.org/

- Company Phone: 1-800-235-3228

- Headquarters Address: 233 Fisher Drive, Waterloo, IA 50701

Conclusion

Veridian Credit Union, with its roots in 1934 and an affiliation with Deere & Company, has evolved as a trusted member-focused institution in Iowa and parts of Nebraska. Prioritizing affordability and personalized service, they offer a diverse portfolio of home loan products. While highly dedicated to member education and digital accessibility, they uphold a localized approach, reflected in their specialized offerings and member-centric ethos.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Veridian Credit Union Product Description: Veridian Credit Union, founded in 1934, offers a comprehensive range of banking services primarily to Iowa and certain Nebraska residents. Established as a not-for-profit institution, Veridian primarily focuses on providing a wide array of home loan products tailored to meet diverse financial needs. Summary of Veridian Credit Union Emerging from its historic roots as The John Deere Employees Credit Union, Veridian Credit Union has cemented its reputation over the decades as a trusted financial partner in the Midwest. As a member-focused credit union, Veridian extends various mortgage options, from conventional and jumbo loans to government-backed solutions like IFA, USDA, and VA loans. Dedicated to the welfare of its members, Veridian offers educational resources, competitive rates, and personalized services. While maintaining its traditional values, they’ve also embraced the digital age, allowing members to access services online seamlessly. Pros Cons

Veridian Credit Union Review

Overall