A lot of people think banks and credit unions are the same thing. For the most part, they are very similar. However, there are several key differences that set credit unions apart from banks.

We are going to look at the difference between the two types, and some of the advantages of a credit union. You’ll also get some of the information you need to decide which one is best for you.

There are a lot of misconceptions and myths surrounding credit unions. We’ll dispel those today, too.

Table of Contents

What Is The Difference Between a Bank and a Credit Union

The main difference between a credit union and a bank is credit unions are cooperative, meaning they are owned by the members of the financial institution.

The concept of a credit union is simple. All of the members pool their money (which is technically buying shares in the co-op), and the money is used to give out loans and services to the members of the union.

Credit unions are run by a volunteer board of directors which is nominated and elected by the members of the union. This board of directors differs from union to union. Each institution has various ways they utilize their directors and requirements.

Some prefer a larger board, while others try to keep the management group smaller.

Another way credit unions are drastically different than traditional banks is size; they tend to be much smaller. If you’re looking for a financial institution that gives you dozens of branch locations you can visit, then a credit union probably is not going to be the best choice for you.

Even the larger credit unions only have around 300 branches, but most will only have a handful.

Requirements to Join a Credit Union

Another key difference between banks and credit unions is the requirements you have to meet to join a credit union.

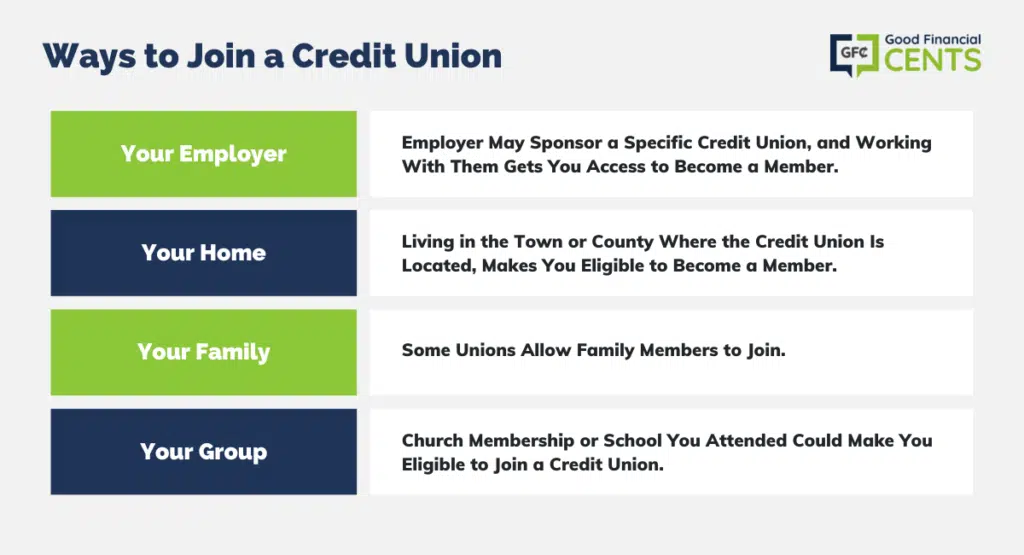

There are a couple of ways to be eligible to join a specific credit union:

- Your Employer: There are a couple of ways your employer can help you join a credit union. In some cases, your employer may sponsor a specific credit union, and working work them gets you access to become a member. In other cases, a specific industry might have a credit union. There are credit unions that only allow members in the education field.

- Your Home: Most credit unions are based on where you live. If you live in the town or county where the credit union is located, then you can become a member.

- Your Family: Some unions allow family members of members. Each union will have different stances on family members. Some restrict it to immediate family, while others open it up a little more.

- Your Groups: Just like with employers, there are several ways a group you’re a part of can help you get into a credit union. If you are a member of a church, attend a school, etc. then you could be eligible for a credit union work with a group or is in the same county as the group.

Aside from meeting one of the requirements above, joining a credit union is as simple as joining a bank.

All you have to do is provide some basic information about yourself, provide proof of residence or employer (based on your qualifications) pay a small fee (normally between $5 and $25), and then decide which type of account you want to open. You can become a credit union member in less than an hour.

Most people assume they aren’t eligible to join a credit union, but that’s rarely the case. More than likely, there is a credit union you’re eligible for.

With the larger credit unions, like Navy Federal, as long as you have a family member who was in the military, then you can become a member. Most people have someone in their family who is serving or has served in the past. If not, there is probably a credit union in the town you live in or where you work.

Why Choose a Credit Union?

Since we’ve looked at some of the basic differences between the two financial institutions, we are going to outline some of the advantages of becoming a credit union member versus joining a bank.

One of the obvious reasons to join a credit union is to become a member and shareholder of the union, not simply just another customer. For some people, this might not mean much, but for others, having a say in the decisions of the union is a huge advantage.

With most credit unions, you can attend meetings where you can vote on some of the decisions about the intuition or policies. You’ll never have this type of say with a bank.

Another key advantage of a credit union compared to a traditional bank is the fees you’ll pay. Credit unions tend to have much lower fees than a bank is going to.

Most unions don’t charge any ATM fees, and their overdraft fees and policies are much more forgiving than you’ll find with large banks.

The main reason most people pick credit unions over banks, however, is because of the interest rates.

You’re going to find much better rates at a credit union than you will at a large national bank. Because credit unions have lower operating fees and are not concerned with paying dividends at the end of the year, they don’t inflate interest rates to make more profit. For most people, the lower rates are the hook that pulls them toward the credit union.

Credit Union Versus Bank – Which Is Best for You?

Now you know the difference and the advantages of a credit union. You might be wondering if you should take your finances to a credit union. That’s a big decision, and it can be a confusing one.

When you’re trying to decide what to do with your money, you need to decide what you value most.

Do you want an institution with hundreds or thousands of branch locations?

If you do a lot of traveling across the United States, and you want to be able to stop at a bank wherever you go, then choose a bank.

On the other hand, if you want a “smaller, close-knit” feel for your banking experience, a credit union is perfect for you.

Some credit union members perfect the friendly experience they get with their union compared to the close, impersonal experience with a large bank.

However, if you’re worried about the safety and protection of a credit union, don’t.

Just like banks have FDIC coverage for up to $250,000 per account, credit unions have NCUA insurance protection for up to $250,000 per account. You’ll get the same amount of financial protection with either option.

One of the drawbacks of credit unions is you won’t be able to enjoy some of the rewards programs big banks offer. While credit unions have started offering credit cards to their members, they still don’t have excellent reward programs.

If you want somewhere you open a savings account and get the highest interest rate, then a credit union is going to be slightly better than a bank. Some people will use a credit union to hold their savings while using a traditional bank for their checking account.

On average, a credit union is going to have slightly better rates. One thing to take note of is online savings accounts. Thanks to these online accounts, banks are offering higher interest rates for their savings account.

In the end, every person and family is different, and everyone has different financial needs. When looking at the bank versus credit union battle, there is no clear winner. Each of them has pros and cons and you’ll need to compare them to decide which one is best for you.

The Bottom Line – What Is a Credit Union?

Credit unions offer unique advantages. They foster a sense of community and ownership among members, providing them with a say in decision-making. Lower fees and attractive interest rates make credit unions a financially wise choice. However, the decision ultimately hinges on your priorities. Do you value convenience and national reach, or do you prefer a personal, community-oriented experience? Both options have their merits, ensuring you can choose the financial institution that aligns best with your individual needs and preferences. Remember, your financial security remains protected, whether you opt for a bank or credit union.

Good afternoon. Somebody told me you can help me with a refinancing my current loan car. I am paying a high interest and son, who is the only one that used to help me, lost his job because of the Coronavirus. Could you help me please? Thank you.