You may think of life insurance in very simple terms: you buy a policy so your loved ones will have some financial assistance when you die.

But, if you have assets of $1 million or more, you should view life insurance as a tool – kind of a Swiss army knife, in fact.

Life insurance has many potential uses in estate planning, and a life insurance trust can certainly help a family.

Regardless of how you do it, it’s essential your family has the protection they need if something were to happen to you.

If a traditional life insurance policy doesn’t meet your needs, then a life insurance trust could be an excellent choice for you and your loved ones.

Table of Contents

What Does A Life Insurance Trust Do, Exactly?

It enables you and your family to do three things in particular:

1. It provides you, your spouse, and your heirs with life insurance coverage after it is implemented.

2. It allows a trustee to distribute death benefits from a life insurance policy as that trustee sees fit.

3. It gives you the chance to reduce your estate taxes.

The Main Advantage of the Life Insurance Trust

The main advantage of the life insurance trust is the tax advantage. Because you don’t own the life insurance plans, they are not considered a part of your estate. It can help keep some of the money in your family’s hands, instead of going straight to the government.

When you create a life insurance trust, you are creating an entity (the trust) to buy life insurance policies for you and your loved ones. You don’t own the policies, the trust does.

The insurance proceeds go into the trust when someone passes away. Because the trust owns the insurance policies instead of a person, the insurance proceeds aren’t subject to probate, income taxes, or estate taxes.

The trustee can distribute those proceeds to one or more parties as stipulated in the language of the trust. Also, if your estate ends up really large, the trust can buy additional life insurance to provide additional cash to pay additional estate taxes.

Sometimes these trusts establish investment policies for life insurance proceeds, and even timelines for who receives what and when (families may want to delay an heir from legally receiving an inheritance until age 18 or 21, for example).

Life Insurance Inside of the Trust

The life insurance trust, itself, is not the insurance.

Inside of the trust you have to have a life insurance policy. Just like in a normal situation, you can buy a term insurance policy or a whole life insurance plan.

Most people buy whole life insurance or universal life insurance plans to go in their trust. Remember, your family will only get the money from the trust if the plan is active.

With a whole life insurance policy, you don’t have to worry.

Aside from not having to worry about outliving your coverage, another advantage of permanent life insurance is the cash value it builds. The longer you pay the premiums for the whole life insurance, the more value is inside of the plan. The cash value can be used to pay the premiums or invested depending on the type of plan you purchase.

Just like if you were to traditionally purchase a plan, it’s vital you compare dozens of companies before you decide which one is best for you and your life insurance trust. Every insurance company, regardless if it’s in a trust or not, is going to have different premiums.

Finding the most affordable company can save you hundreds of dollars every year.

Why Not Just Have Someone Else Own My Insurance Policy?

That scenario can lead to major financial and familial headaches.

If that person dies before you die, the cash value of the policy will be included in their taxable estate. So the heirs (and relatives) of that person will have higher estate taxes to pay as a result.

Also, if you do this, you surrender control of your policy; the loved one you trust could end up naming another beneficiary or even cashing your policy out.

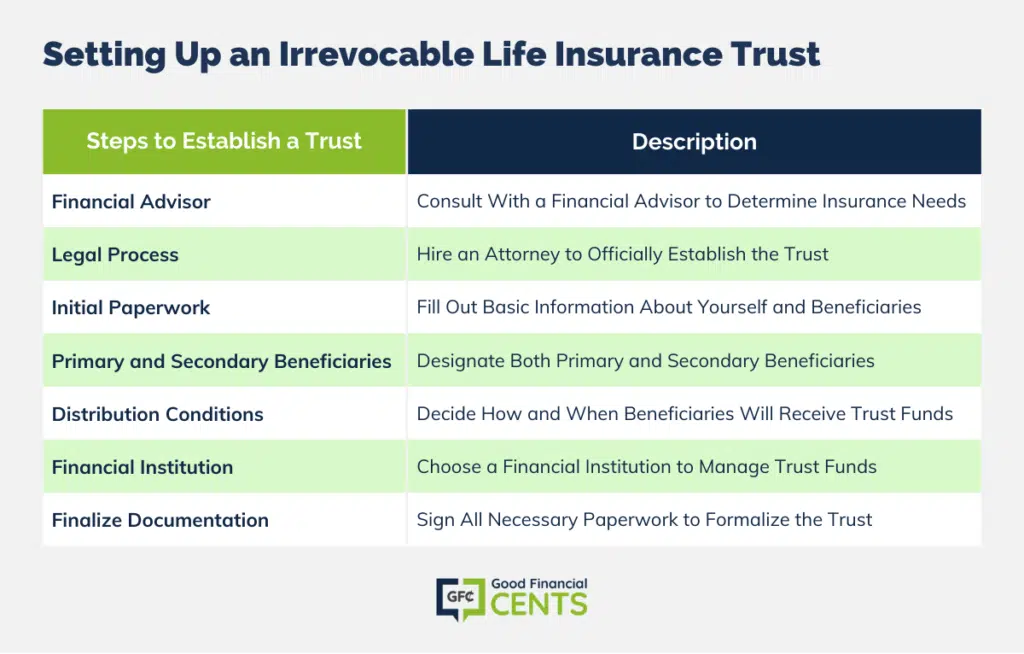

Setting up an Irrevocable Life Insurance Trust

Creating a life insurance trust is pretty simple. Here are some steps to help you get started.

Find a Financial Advisor

You can use a financial advisor to determine how much life insurance you should buy based on your family’s needs and the estate taxes your family will be facing when you pass away.

Find an Attorney

You’ll need an attorney to officially establish the trust.

To begin, you’ll have to fill out some basic paperwork about yourself. It’s simple basic information, like name, address, marital status, and much more.

After you’ve completed the first paperwork, you then have to decide who the beneficiary of the life insurance trust is. You need to get all of the contact and personal information of the beneficiary.

Determine Your Primary and Secondary Beneficiary

Not only should you name the primary beneficiary, but you should name a secondary one as well. Always designate a secondary beneficiary in case something awful were to happen to the primary beneficiary before they receive the payout from the life insurance trust.

Determine How Your Beneficiary Will Receive the Money

Not only do you need to decide who is going to receive the money, but how and when they are going to get the money from the life insurance trust. You can outline just about any condition for the distribution of the money.

You can have the money distributed as soon as you pass away or you can wait until a specific milestone, like having a child, buying a home, or graduating college.

Additionally, you can have the funds paid in one lump sum or distributed every month or year. As the creator of the trust, you have all of the power to decide how the money will leave the trust.

Determine the Financial Institution to Handle the Funds

Depending on the plan, you will need to choose a financial institution to handle the funds of the trust. In most cases, the life insurance company will manage the funds with no additional fees, as long as there are no investments being made with the trust.

Finalize Your Paperwork

After you’ve made those decisions, you’ll need to sign all of the papers and set everything in stone. You will also need to have the beneficiaries sign some forms as well. Congratulations, you know how a life insurance trust is in place.

It’s as simple as that.

One important factor to note is you should set up the life insurance trust as soon as possible.

If you were to pass away in the first three years after setting up the life insurance trust, the money from the trust would be included in the estate value, which means it’s going to be subject to some serious taxes. After the first three years, the trust money will no longer be counted in the value of an estate.

Bottom Line: Understanding Life Insurance Trusts

Almost all life insurance trusts are irrevocable trusts. That is, they are legally “set in stone” once created, unlike a revocable trust which can be amended or revoked after creation.

You can make these trusts revocable, but if you do, you lose the tax benefit: the insurance proceeds will be included in your taxable estate when you die, which could increase the estate tax bill for your heirs.

However, some irrevocable life insurance trusts purchase survivorship life insurance in a profit-sharing plan to permit the ability to change beneficiaries.

Obviously, one of the major disadvantages of these life insurance trusts is they are irrevocable. Once you sign those papers, that’s it. There is no way you can change it.

As long as you’re comfortable with the permanency of these trusts, they can be an excellent option for providing for your family if something were to happen to you.

If you’d like to know more about life insurance trusts or the potentially significant changes in estate taxes over the next few years, talk to a qualified legal, financial, or insurance professional today.