Getting a loan is undoubtedly a great way to meet short-term needs. Whether you’re looking to consolidate debts, partake in home improvement projects, or pay for unexpected expenses, a personal loan can help you achieve your goals.

Personal loans, like any credit product, come with costs. The most obvious cost of the loan is the interest rate charged to the borrower. These interest rates are incurred over the life of the loan and are charged against the amount you borrowed.

However, one of the more obscure costs that you might incur is Origination Fees.

Table of Contents

What Are Origination Fees?

An Origination Fee, at its core, is simple to understand, but many people don’t. Some lenders call it a service fee, commission fee, closing fee, or even a setup fee.

Whatever you decide to call it, it’s a fee that the lender charges the borrower for “originating” or issuing the loan. Here’s a simplistic way to think about origination fees:

You are getting a personal loan for $10,000 at a 20% interest rate for three years. At the end of the application, you find there is an Origination Fee of 5%.

As soon as you sign the dotted line to finalize the loan agreement, the lender is automatically charging a 5% Origination Fee. So, instead of the $10,000 that you thought you were borrowing, you’re only receiving $9,500.

But guess what? You still pay interest on the full $10,000, AND when you pay the lender back, you still owe them $10,000 PLUS interest.

Sounds a little unfair, no? Paying 5% sounds like a small number, but think about what you’d be able to do with that extra $500 in your pocket.

What’s the Big Deal With Origination Fees?

Now that we know what origination fees are and how much some lenders charge, the real question is – Why should you care?

Two reasons:

1. As mentioned above, if you apply for a $10,000 loan, you won’t get that full amount. If you qualify for a $10,000 loan (with a 5% origination fee) to pay for that home improvement project, you’ll only get $9,500 that you can use. Here’s a quick example of how origination fees can impact your loan.

2. If you intend to pay back the loan before the full term, that $500 origination fee you paid will still have to be paid back. Lenders may advertise that they don’t have any prepayment penalties, but these origination fees essentially act as a prepayment penalty in disguise.

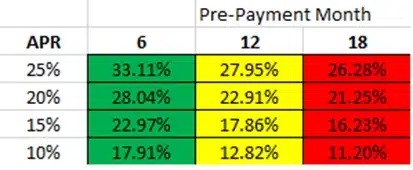

Depending on how fast you expect to pay off the loan, the true cost of the loan will vary. If you look at the chart below, it assumes you pay a 5% origination fee. It illustrates a $10,000 loan for 36 months that with a 5% origination fee. Here’s how to read it:

- If you intend to pay back a loan within 6 months with an interest rate of 25%, you’re better off getting a loan that has an APR of up to 33.11% without origination fees.

- If you intend to pay back the loan within 12 months with an interest rate of 20%, you’re better off getting a loan that has an APR of up to 22.91% without origination fees.

So, What Type of Fees Are Lenders Charging?

The fees that lenders charge vary. Some go by the “grade” of the loan (how qualified you are), and others may charge you an origination fee based on your loan amount.

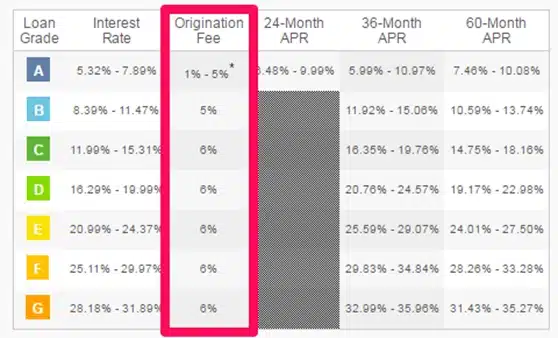

Lending Club: Lending Club charges anywhere from 3-6% in origination fees, depending on your creditworthiness. You’ll need to be a super-prime borrower – basically, a pristine credit score and a really low debt-to-income ratio. In 2016, only 17% of borrowers qualified for an “A” grade, and even if you qualify for this grade, you’re not even guaranteed the lowest origination fee.

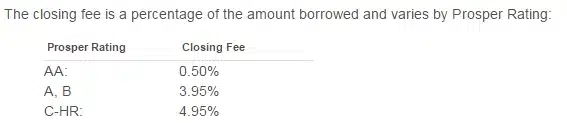

Prosper: You’ll notice a very similar pattern with Prosper as well. In order to be charged a 0.5-5% “closing fee” (aka origination fee), you’ll need to be a super-prime borrower. Otherwise, you’ll be charged at least 3.95% in origination fees; see chart below.

Other Lenders that Charge an Origination Fee:

- Upstart: 1-5%

- BestEgg: 0.99-4.99%

- Cirleback Lending: 0.99-4.99%

- Pave: 1-6%

- Peerform: 1-5%

- Payoff: 2-5%

- And the list goes on….

Are Origination Fees Prepayment Penalties in Disguise?

Let’s do a quick recap of origination fees on personal loans and how they affect your loan.

- You’re approved for a $10,000 loan with a 5% origination fee.

- You actually receive $9,500 ($500 in origination fees).

- Your loan balance is still $10,000.

- You continue to pay interest on the $10,000 loan amount when you only technically receive $9,500.

What happens if you decide to pay off the loan in the next week? Or even the next day. You’re not entitled to any refund on the origination fee you just paid.

So, the origination fee is disguised as a prepayment penalty.

To say that origination fees are the same as pre-payment fees is technically incorrect. However, these origination fees are embedded into the loan to ACT like a prepayment fee.

If you ever decide to pay off the loan in full in advance, the only person who really benefits from this is the lender. You, as the borrower, are getting the short end of the stick.

The Bottom Line – Loan Origination Fees – More Painful Than Interest

Origination fees, though often overlooked, can significantly impact the overall cost of a personal loan.

While they are charged for “originating” or issuing the loan, they can reduce the actual amount a borrower receives while still obliging them to pay interest on the full amount. Additionally, even if a loan is repaid early, these fees remain, acting like a hidden prepayment penalty.

While not all lenders charge origination fees, understanding their implications is crucial for borrowers to ensure they get the most out of their loans. Before committing, always assess the real cost of borrowing and consider alternatives that might be more financially beneficial.

If i a apply for a loan you we dont hve need to.pay any fees before inget the loan?you mean s is the organisations fee is will be deducted at my loan amount something like that?which is gud good for us…

Hi Sheryl – You understand correctly. You typically don’t pay any fees upfront, unless you’re applying for a mortgage and they require an application fee. The origination fee is deducted from the loan amount when the loan closes. If it doesn’t you don’t pay the fee.

I have a personal loan at almost a 26% interest rate. I paid a loan origination fee of $310. About 3 weeks later I was offered a loan with a rate of about 16% with a loan origination fee of about $750. Would it be worth it to take the new loan to pay off last months loan to save the 10% interest? Both loans are for 3 yrs and I plan to pay whichever loan off in about 1 – 1.5 yrs in either case. The second loan amount would cover the first loan (26% interest rate) and pay off my cc of about $2700 with a 17% interest rate. Is it worth it?

This is really a math problem Danny. Crunch the numbers and see if the interest you’ll save on the loan will be more than what you’re paying for origination fees. If so, take the new loan. If not, stay put. You also have a variable in the mix – if you payoff the loan in one year, you’ll get one set of numbers. If you pay it off in three, you’ll get a different answer. If you have any doubt about paying off in less time, assume three years, and see how it looks.

wow ! Thanks. I was looking at Best Egg’s offer and you answered my question. if I get 10,000 with a 500 origination fee, I only get 9500. But my first bill says I owe 10,000. They say I am only “financing 9500” which is misleading.

This is all predatory. Only people in certain situations who know they will have the money down the line to pay this off quickly will benefit. otherwise it is taking advantage of desperate people.

Actually George, what you described is how it has to be presented. The same is true with car loans and mortgages. Fees paid for the loan are deducted from the loan, but you still owe the face amount of the loan. It’s how APR is calculated. But I agree that high fee financing arrangements take advantage of the desperate.

So… where can I find loans without an origination fee?

The best places, at least for a personal loan, are banks and credit unions. But there may be certain loans where they will charge an origination fee, so you have to be alert.

so what if leading club says they give you back the origination fee at a prorated amount if it is over 5%. how can you know how much it would be?

Hi Ora – The official wording of that provision from the Lending Club Loan Agreement is:

“Any origination fee of 5% or less is not refundable regardless of when, or if, the loan is paid in full. Any origination fee amount in excess of 5% is refundable on a prorated basis over the term of the loan when and if the loan is paid in full prior to its maturity date.”

I would interpret that to mean that if you have a 60 month loan, and you pay a 6% origination fee, that the amount of the refund will be based on the number of months the loan has been paid. So since you lose the first 5%, it would be based on just 1%. If you paid the loan off (completely) in 30 months – half the agreed upon loan term – you’d get a 50% refund of the 1% portion of the fee that exceeds 5%.