I have a little secret for you.

Your broker might not have your best interest in mind when they make recommendations to you.

In fact, brokers can legally put their interests ahead of yours.

Did you catch that?

Translated, that means that your broker can get a speeding ticket for going 75 mph on the interstate but won’t get punished for selling you a crap investment that makes them a bunch of money.

Table of Contents

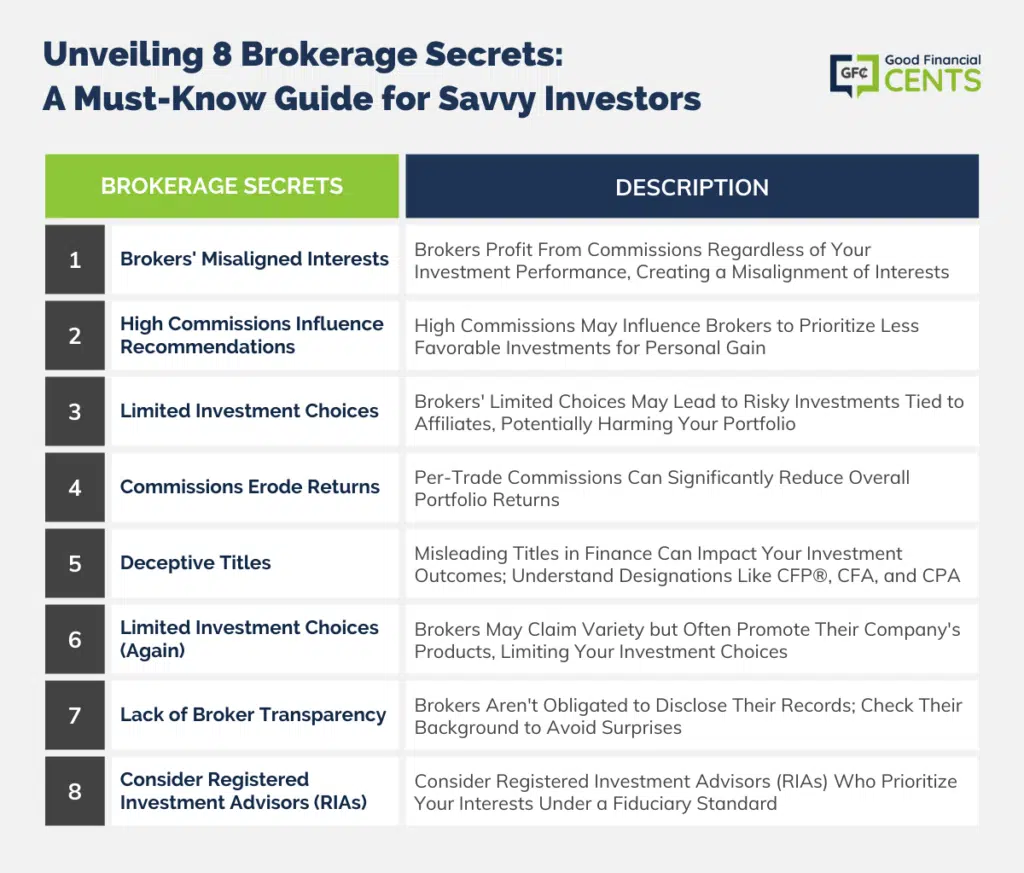

- 1. Brokers Make Money Even if You Don’t

- 2. High Commissions Are a Good Thing, Right?

- 3. Looks Good on Paper

- 4. Their Commissions Can Eat Away at Your Returns

- 5. Alphabet Jumbo Soup

- 6. I Have a Sales Quota

- 7. My Records Are Clean…. Kind Of

- 8. It Could Be Better Somewhere Else

- The Bottom Line – 8 Secrets Your Broker Won’t Tell You (And Why You Need to Know Them)

This is because most brokers operate under what’s called the suitability standard, which simply means the securities they recommend must be appropriate for you given your financial profile; however, many of the securities that can be considered suitable may be far from the best investment options available at a particular time.

How do you like them apples?

You may be surprised to learn that brokers working under the suitability standard are not legally obligated to find the best prices or the best investment options available at a particular time. As a result, your broker may offer you securities that provide lower returns and carry more significant risks than other alternatives, as this may be more profitable for the broker. The suitability standard can apply to brokers that sell insurance, stocks, annuities, or other investment types.

1. Brokers Make Money Even if You Don’t

This is because of the commissions-based compensation model presently used by many brokerage firms. Let’s say your broker convinces you to buy into XYZ stock at $50 per share. If the price subsequently increases to $60, then your broker may call you and advise you to buy more of the same security because of the 20% appreciation in price. This transaction would then generate a commission for your broker.

On the other hand, let’s say that the same investment in XYZ stock instead dropped to $40 per share. In this case, the same broker might call you and still tell you to buy more of the same security because it is now less expensive than it once was and should, therefore, be considered a bargain. This transaction would also generate a commission for your broker.

Great for them. Not so much for you.

As you can see, your broker’s success can have little relation to your own. This represents a misalignment of interests that may cause your broker to benefit at your expense.

2. High Commissions Are a Good Thing, Right?

Brokers may choose to offer you only those investments that pay the highest commissions. To illustrate this point, let’s consider another example. Let’s say that Investment 1 is the best investment for you, but it offers no commissions to your broker.

On the other hand, investment 2 is a worse investment, which pays a 5% commission. Under the suitability standard, your broker is not obligated to offer you investment 1 and may instead sell you investment 2 in order to collect the commission on the transaction. This conflict of interest is currently permitted under the suitability standard, which is applicable to many brokerage firms.

Isn’t that special?

3. Looks Good on Paper

Your broker may sell you an investment that is illiquid or highly risky. This is due to the fact that brokers are often associated with particular issuers of securities or certain investment companies.

As a result, they may be limited to offering only the proprietary products sold by their affiliates even though other more attractive investment options may be available in the market. They may also be restricted to a particular list of securities and may be compensated to offer one investment over another at any time.

What’s the big deal about that? Well, this particular limited partnership ended up being a fraud, and most investors lost everything that they invested into it. What makes the story even worse is that this particular broker thought it was “suitable” to put over 1/3 of her portfolio into it.

4. Their Commissions Can Eat Away at Your Returns

If you’re paying commissions on a per-trade basis, you may be spending more than you might expect.

For example, if you’re charged 2% per trade, then making just three trades per year could result in you paying 6% of your overall portfolio in commissions annually.

5. Alphabet Jumbo Soup

Brokers may be using deceptive titles to give you the wrong impression about their compensation model and qualifications. Currently, the sheer abundance of professional designations being used within the financial services industry is confusing even to the most experienced investors. However, understanding the differences between these titles could have a dramatic effect on your long-term investment results and overall satisfaction.

As an example, the term financial advisor is one of the most used terms in the industry; however, many of the individuals using this title are salespeople looking to meet quotas by selling financial products. They may, in some cases, sell non-marketable securities, which include long-term commitments, excessive fees, and a high level of risk.

Titles with the word “senior” — Certified Senior Advisor (CSA) and Certified Senior Consultant (CSC), for instance — have come under a great deal of scrutiny. I get offers in the mail all the time to buy designations. Don’t let the alphabet soup impress you.

The only one that should be in the financial planning profession is the CFP® designation. Other notables are the CFA and CPA designations.

6. I Have a Sales Quota

I love it when I get a statement from a competitor that is sponsored by a mutual fund or insurance company. The broker claims to them that they have their client’s best interest at heart and can utilize all types of investment choices, except that the only investments I see are from that company’s proprietary products.

Hmmm……now whose best interest is first? I assure you, not the client.

7. My Records Are Clean…. Kind Of

Your broker is not obligated to tell you if there’s anything on his or her record. And why should they? It’s reported that 70% of prospective clients do not do a background check on the broker before hiring them.

Want to make sure that your broker doesn’t have a record like Bernie Madoff? Head over to FINRA BrokerCheck to see what’s on your broker’s record.

8. It Could Be Better Somewhere Else

With a broker, you’re dealing with a salesperson who may or may not have your best interest in mind. On the other hand, registered investment advisors, also known as RIAs, are firms that operate under the fiduciary standard, which means that they are legally obligated to put their client’s interests first at all times.

As an independent registered investment advisor, Alliance Wealth Management, LLC was founded as a welcome alternative to the traditional brokerage model that many investors have become accustomed to. We are compensated only by management fees paid directly by our clients.

How do you pay your broker? If you don’t know, maybe it’s time to find out.

The Bottom Line – 8 Secrets Your Broker Won’t Tell You (And Why You Need to Know Them)

In navigating the financial realm, understanding the motivations and incentives of brokers is critical. Often, they operate under the suitability standard, which doesn’t necessarily mandate offering the best investments available.

Factors such as commission-based compensation and high commissions can cloud their advice, possibly leading to recommendations that benefit them more than the investor. Furthermore, deceptive titles, undisclosed sales quotas, and unsavory records further complicate the relationship.

Notably, registered investment advisors (RIAs) operate under the fiduciary standard, prioritizing the client’s interests. As an investor, awareness is your most powerful tool. Ensure you know how your broker is compensated and consider their motivations in every transaction.

As far as I’m concerned, these are all good reasons to use a fee-based CFP.

Can’t argue with that one 😉

This post is absolutely incorrect. I am not a broker but I know for a fact broker have a feduciary responsibility to act in the best interest of their clients with their clients money. If they are not working in your best interest, they have to disclose why. Brokers know this and clients should too. If you have a broker that you think isn’t, do something about it or switch to a broker with a CFA.

@ Danny

Sorry, bro. But your remark, “….I know for a fact broker have feduciary responsibility of their clients…” is absolutely incorrect.

Not sure where you got your “fact” from.

Here’s another article that discusses the topic: http://www.slate.com/articles/business/the_customer/2011/01/does_your_broker_love_you.html

FYI, even an advisor with the CFA designation isn’t always a fiduciary. Same holds true for the CFP designation. Here’s an article that addresses that: http://investmentwriting.com/blog/2010/11/brokers-cfa-charterholders-and-fiduciary-duty-charterholders-are-not-always-fiduciaries/

Thanks for sharing this insightful post. Will keep it in mind if/when I get a broker.