Life insurance remains one of the most underappreciated components of financial planning, shrouded in misconceptions and often relegated to a future consideration. Yet, in financial planning – much like in health and wellness – prevention is better than cure. The “right time” for life insurance, against common intuition, isn’t a distant milestone; it’s a pressing priority.

Table of Contents

Understanding Life Insurance

At its core, life insurance is a promise—a financial promise from an insurer to your beneficiaries that in the event of your death, they will receive a sum that helps to mitigate the financial loss of your absence. It’s a product of foresight, designed to eliminate ‘what-ifs’ and provide tangible security to those you cherish.

However, life insurance is not monolithic. It comes in various forms, each tailored to different needs and stages of life. Term life insurance offers a pure death benefit for a specified period, making it akin to a fixed-term financial shield. On the other hand, permanent life insurance, including whole life and universal life, not only provides a death benefit but also accumulates cash value, serving multiple financial purposes over a lifetime.

Timing Life Insurance: A Life-Stage Approach

In the Roaring Twenties: The Foundation Years

Life insurance seems counterintuitive when you’re young, but these are the golden years to establish a strong foundation. Securing a low premium rate now is akin to investing in a stock that promises guaranteed returns. You may have few financial dependents, but student debt and personal loans can be a silent concern; life insurance at this stage can address those obligations should anything happen.

Thirties’ Thrive: The Decade of Multiplying Responsibilities

Often, your thirties bring heightened responsibilities—family, homeownership, and career establishment. Life insurance is a safeguard, protecting the financial ecosystem you are building. It’s a buffer against the ripple effect that the loss of your income could create, offering stability in a time of potential upheaval.

Forties to Fifties: Peak Earning and Preparing

These are typically your peak earning years, where your financial footprint deepens. Life insurance policies during this time are not just about protection, but also about potential tax planning. The intricacies of estate planning begin to emerge, and life insurance becomes an elegant solution to potential estate taxes, providing liquidity to your heirs.

Sixties and Beyond: The Retirement Horizon

Retirement planning is about enjoying the fruits of your labor without worry. Life insurance now transforms into a strategic financial instrument, potentially serving as a buffer for retirement funds, ensuring that your spouse can live comfortably or that you can leave a legacy to your grandchildren or a cherished cause.

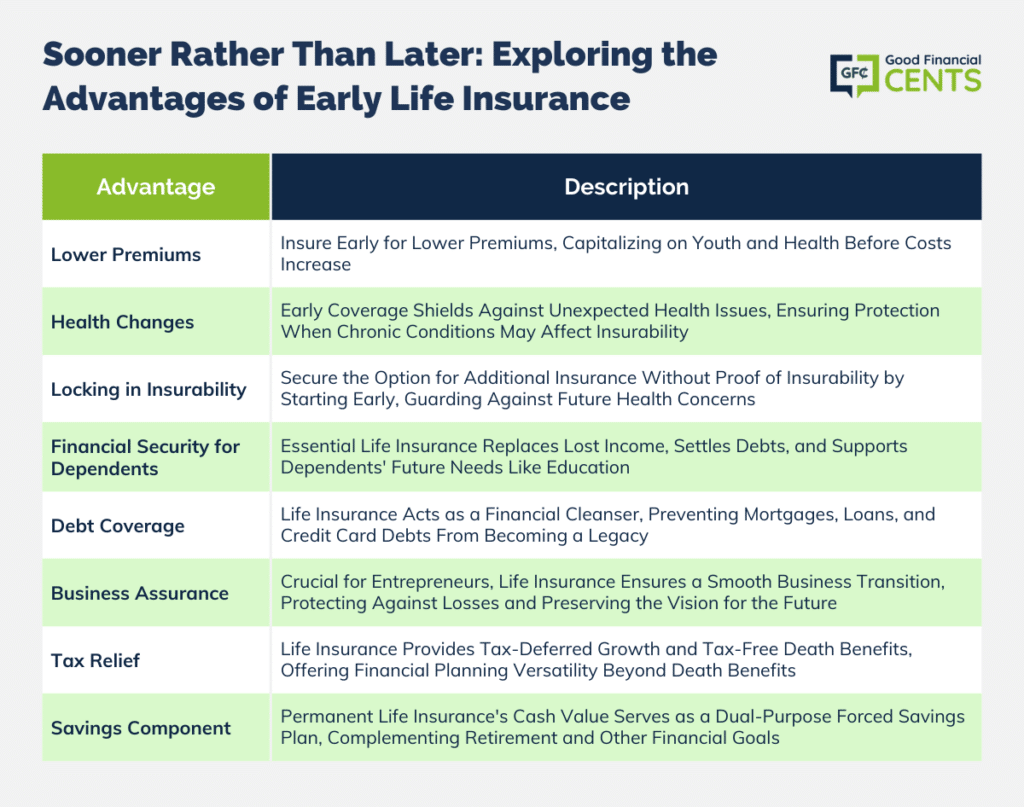

Sooner Rather Than Later: A Closer Look at the Advantages

Lower Premiums

Insurance is a game of probabilities, and from an insurer’s perspective, youth and health are your best bargaining chips. They translate directly into lower premiums. The actuarial tables are in your favor when you’re young, locking in affordability before age and health issues make it costly or even prohibitive.

Health Changes

Locking in Insurability

Some policies come with the option to purchase additional insurance at a later date without further proof of insurability. Starting a policy early could guarantee this option, hedging against future health concerns.

Financial Security for Dependents

If anyone relies on your income, life insurance is non-negotiable. It replaces lost income, settles debts, and can finance future needs like education. It’s about continuity for your dependents’ lifestyles in your absence.

Debt Coverage

Mortgages, personal loans, and credit cards can become a legacy of debt if not managed properly. Life insurance serves as a financial cleanser, washing away these potential burdens after you’re gone.

Business Assurance

For the entrepreneur, life insurance is a linchpin for the survival of the business. It can facilitate a smooth transition, protect against losses, and ensure that your vision endures.

Tax Relief

The benefits of life insurance often extend beyond death benefits. They can provide tax-deferred growth and tax-free death benefits, positioning life insurance as a versatile financial planning tool.

Savings Component

The cash value in permanent life insurance is a forced savings plan with a dual purpose. It serves as a living benefit that you can access during your lifetime, offering a financial resource that complements retirement savings and other financial goals.

Conclusion

Life insurance is a product as much about living as it is about dying. It’s an essential component of a robust financial plan, and timing its purchase is crucial. The misconceptions about when to buy can be costly. The early acquisition isn’t just about lowering premiums or insuring against the unexpected—it’s a proactive step in life planning that ensures whatever chapters are yet to be written, the financial plotline remains stable and secure.

In every sense, the right time for life insurance is far sooner than most think. It’s a financial product that thrives on foresight and diminishes in value with procrastination. Whether it’s for peace of mind, financial stability, or ensuring your legacy, life insurance stands as a testament to responsibility and care—an unwavering sentinel against the caprices of fate. The “right time” is not a future milestone; it’s an immediate priority, a critical step in safeguarding the narrative of your life and the well-being of those you hold dear.