I’ve never won the lotto.

I once found a $20 bill in a Target dressing room and thought I was on top of the world.

That’s about the biggest cash prize that I can brag about.

That is until a certain event changed my life…….

As a financial advisor who has been busting my butt for many years, it’s very exciting to finally see your paychecks grow.

Starting off, most financial advisors don’t make jack.

Heck, most are lucky to survive in the first year.

In my training class of 50+, only half made it through the first year. Somehow, I survived. 🙂

I had been growing my business for over six years when I received an unexpected phone call from one of my coworkers before work. It was very unusual for him to call so early.

He quickly asked, “Did you hear the news?”. I hadn’t a clue what he was talking about.

He had called to let me know that the firm that I had been working with for my entire six-year career had been bought out.

I really had no idea what that meant, though I did know that change was on its way.

Table of Contents

How the Biz Works…

When I got to the office and was talking with some of the other advisors who had been there for a while, they quickly educated me on how the business works and the potential that we would get a retention bonus.

Having a military background, I equated a retention bonus to getting an upfront check but then also having to sign my life away for X number of years. In the military, that usually meant either three or six years. The financial services industry is very similar.

While in Iraq, I had balked at a tax-free re-enlistment bonus of $15,000. I would have had to resign for an additional six years. I had concluded that I could sell lemonade over the summer and accumulate $15,000 over the six-year period and wouldn’t have to worry about being shot again.

What I quickly learned was that being a financial advisor is a very lucrative position. When your firm gets bought out, the acquiring firm will pay you a bonus to keep you and prevent you from being lured by a competitor.

It was very hard to digest this because I know that a lot of people, when dealing with buy-outs of their company, are usually very worried. Most stress about the fact that they may not have a job anymore.

In our situation not only do we have a job, but we also get a bonus check for staying.

Ridiculous, huh? I agree, but I’m not complaining.

Competitors Come Knocking

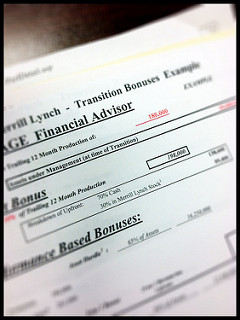

As the buy-out process continued, I learned something else. Not only will your new company pay you a handsome bonus for staying, but competing firms will pay you even more if you agree to come on board. One of those companies was Merrill Lynch.

Merrill Lynch had contacted one of the top advisors in our office and was trying to solicit both of us to jump ship and open a new branch office in our town.

I have never been recruited before in my life unless you count the National Guard recruiter who came to my house to sign my contract. I assure you his recruiting tactics weren’t nearly as sexy as what Merrill offered. We got the whole shebang.

We were flown out to New York to visit their downtown headquarters and offered rooms in the Ritz Carlton. We toured New York City in a Cadillac Escalade with our own personal driver. We dined at one of the finest restaurants in downtown New York.

At 29 years of age and living in the Midwest, I was in heaven. Merrill wasn’t only offering fine dining to try to get us to come over, but they also were enticing us with a big, fat bonus check.

I will say that the amount they offered me was nowhere close to what was offered to the other advisor, but once again, I was 29 years of age. I was making roughly $70,000 a year, so any check, especially a large one, was extremely attractive.

Seeing Dollar Signs

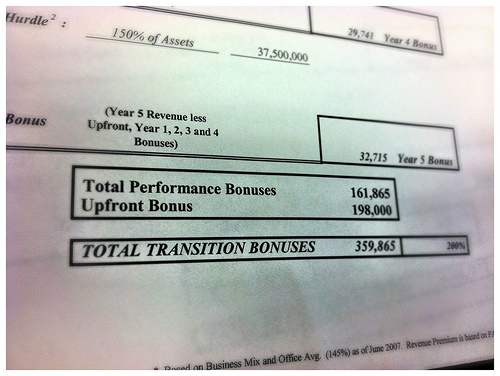

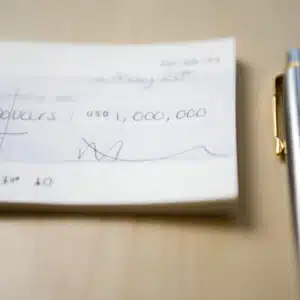

The offer that was on the table was that they would give me $198,000 upfront if I were to come on board. Of that check, 70% would be cold hard cash that I could deposit into my checking account, and 30% was Merrill stock that I could sell after it was vested. This check did not include any income that I would make for the upcoming year.

Realistically if I were to maintain my current salary, I would make over $200,000 for that year – almost triple what I had made the previous year!

Oh wait, it gets better….. If I were to hit certain target numbers over the next several years, the back-end compensation could be an additional $300,000 to $400,000.

Jackpot.

To sit here and try to make you believe that I didn’t have dollar signs in my eyes would be an absolute lie.

I was sold.

I was more than sold.

I was ready to bolt.

Luckily, I didn’t make any rash decisions and I took some time to think about it more.

What Turned Me Off

One of the items that turned me off about the offer was I had to sign a seven-year contract. If I ever wanted to leave and do my own thing, I would have to pay back a portion of the bonus I received.

Another turn-off was how Merrill treated their smaller accounts. For any client that didn’t have at least $100,000 invested with us, we wouldn’t make a single dime on anything we did with them. Even if a client was an active trader, but their account was only, say, $75,000, I wouldn’t make a single penny if I were to execute a trade for them every day. On the flip side, if I referred my smaller clients to Merrill’s Call Center, then I would get paid, albeit a smaller percentage.

I live in the Midwest, in a small town with a population of 30,000, and I have several clients, even to this day, that have less than $100,000 with me, and I’m more than happy to work with them. These are friends, family members, and individuals that I’ve built personal relationships with, and the thought of having to turn them over to a call center totally turned me off.

Still, the upfront check and the financial security that I felt it would give me and my family was impossible to ignore. In my mind, I wanted to go. As I mentioned, Merrill wasn’t so much as interested in me as they were the other advisor they were recruiting; I was just along for the ride. Oh, what a ride it was…

The Decision

After a few weeks of deliberating what was a major decision for the both of us, the advisor I was hoping to partner with decided not to pursue Merrill and stay put.

I felt like how the Cleveland Cavalier fans felt when Lebron James decided to take his talents to South Beach – I was crushed. I was thoroughly and utterly depressed.

When I found out the news, I remember leaving the office for the day and just going home and sulking. How pathetic, right?

After internalizing the events that played out, it dawned on me: Did I really want to be locked into something for that long of a time, no matter how big the paycheck? There was a certain level of freedom that I felt that I was giving up, even with such a large check dangling in front of my face.

What I Did Know

I did know, however, the arrangement I was in was not where I wanted to be. The bank that had bought out my small regional firm was not the company I had started with six years prior, and I knew that I needed to make a change.

Luckily, there were some other advisors in our office who were considering going in a different direction, more the independent route. I quickly jumped into their search of finding a new brokerage firm to call home. Seven months later, we left, and the rest is history.

It’s been over five years since that incident took place where, one day, I thought I was walking away with a check close to $200,000, to not getting the check and then also leaving my firm and starting my own financial planning practice.

Being able to reflect, I’m so thankful that I didn’t let greed consume me.

I’m now in a much better place, having the freedom to do what I want with my practice and my online properties and, indeed, be the free-spirited entrepreneur that I craved. Cashing in that $198,000 check would have been imprisonment. I would have been stuck.

What hasn’t even been mentioned in this whole discussion was what happened to Merrill after that. Remember, this was Merrill in their prime, not after they fell from grace and had to merge with Bank of America.

All that potential bonus money never would have come to fruition. Disaster averted.

Can you think of a time that you compromised who you were in order to get ahead?

I’m currently an FA at a Wirehouse. I’m LOS 7 and have been offered 150% of my trailing 12 upfront to come to a competing Wirehouse. Plus another 150% on the backend. The recruiter says that it’s a “once in a lifetime deal” and that I would be crazy to pass it up. I’m not going independent anytime soon but I hate the idea of changing firms, fighting for my clients, etc. Most articles online are written by recruiters and encourage swapping firms for the big check. I’m racking my brain to find good financial reasons to stay where I am. It would take me many, many years (if ever) to save the kind of front end money they’re offering me. How can I make as much money by staying at my current firm rather than leaving?

@John I think you have to take into consideration that all of your clients won’t follow. For the same reason you don’t want to change firms, many of your clients will feel the same way (even though they like you). The other aspect is…..how much do you want to work?

Changing firms is a lot of hard work and definitely takes away from your production. Not to mention time away from family and friends.

I have a question. When Bank of America aquired Merrill Lynch, would that have meant that you cold have left at that time and still kept your entire bonus? Thank you in advance for reading my question.

@Phips I’m not sure 100% sure, but I don’t think so. If I recall, advisors still had to stay for the term of the forgivable loan.

Great story Jeff! It would have been a real disaster–financially, emotionally and socially had you taken the bait.

I watch your story closely because I think it’s ultimately the path ill choose (and want to choose). From what I’ve heard, you definitely did the right thing. Companies rarely pay you a huge lump sum and then give you the freedom you want.

Great story telling! I didn’t even skim, but read the whole thing. I can’t for your future book(s)!

Great post:

It takes incredible fortitude to “just say no…” Even with the nudge by the other advisor, it had to be incredibly difficult to watch that check fade from view. That said, I suspect that had you taken the deal 7 would have very quickly become much larger than 200,000…

Congrats…

Excellent article, Jeff. I’ve had a similar decision before with selling a portion of my business. I turned down the prospect of a lot of up front cash for the freedom of being able to make my own path. It turned out to be a huge blessing. I’ll tell you the story in more detail another time and in another venue!

Jeff…your story illustrates two things very well: 1) how misaligned the incentives are in the industry, and 2) how the tides of change, particularly with the larger companies, can have such an impact on both clients and advisors. Freedom is good, isn’t it? Great post!

Jeff, excellent post about how parts of the industry work. You made a great decision, and you are right you would have been a slave to Merril. Good for you to do what is right for your clients and yourself as a small business owner. If you went with Merril you would have just been an employee and I am sure it would have eaten away at your soul! Look at how much you have accomplished now. Questions: You said starting your own RIA as one of the best decision you ever made. Knowing what you now know, would you have started it earlier than you did?

Thanks for all that you do! Always looking forward to this blog.

Great Jeff. I appreciate your decision. Sometimes in life there are some decisions that are hard to make but they are necessary. If you were not ready to stuck there for 7 years, you have made a good decision.

Would you have been able to take that job without the heavy hitter partner? Or were you a package deal?

@ Kathleen I doubt it. They were banking on the two of us starting the new branch and then recruiting others. At the time I was a “small advisor” – actually, I’m sure I still am in their eyes – and there’s no way a new branch would have been profitable with just little ‘ol me.

I turned down what at the time seemed like a big deal to trade for an outfit that’s now a part of UBS. It was tough, because a professor that I considered a good mentor arranged the deal for me without me knowing about it. But it would have meant ending my relationship with my then girlfriend, now wife and it was just a bad idea. Hard to say ‘no’ when there’s big money though.

@ W Good thing you didn’t take the job. You’re wife would have been ticked! 🙂

It’s great that you didn’t get stuck with them for 7 years, could’ve sucked if you had wanted to leave. Of coruse some people would be happy with such job security, lol. The question is, are you monetarily doing okay with the route you took? Or does yoru bank account squirm a little because you could be making more had you gone with Merrill?

@ TB Not going to Merrill and going independent was one of the best career decisions of my life (forming my own RIA last year being the best). What my income is now would have taken me into my early 40’s to replicate based on their payout structure. That doesn’t include the freedom I get from being able to run this blog and explore other online ventures.

Great story. It IS hard to hold one’s integrity, when another is dangling “money candy” in from of you. You did take the time to review ALL of the implications of a move, much as we will take the time mulling over a career change opportunity, or a major purchase.

i can not tell you how many “offers” never saw the light of day, or how m,any cars, furniture, even long term care insurable was not bought on the “spur of the moment” without great appraisal before we made a commitment.

This of course, is not new, or unique. Most people;e who want to win at the game of life, plan, study, and execute their plans diligently.

Thank You for being one of the wise ones!!!