Voya Financial, Inc. is a combination of insurance, retirement, and investment product and services conglomerate. The company serves the financial needs of approximately 14.7 million customers – both business and consumer – throughout the U.S.

The vision of Voya is to become America’s Retirement Company – and it is well on its way, as the firm helps its customers meet the challenges of saving for retirement through its more than 7,200 dedicated employees.

Need help finding a different form of insurance coverage, such as burial insurance plans, auto insurance coverage, or health insurance, we can help find the best company to work with according to your needs!

Table of Contents

The principal businesses of Voya include Insurance Solutions, Investment Management, and Retirement Solutions. Each component has a very specific focus. These are broken out as follows:

- Insurance Solutions: The Insurance Solutions component of Voya is considered to be a top-tier provider of term policies, as well as a top-ten provider of medical stop-loss insurance coverage in the United States. On the individual life insurance side, Voya currently has more than $2 billion in gross premiums via its term, universal, and variable life insurance products. This component of the business also consists of Employee Benefits whereby Voya currently serves nearly 14.7 million individuals.

- Investment Management: On the investment management side, Voya holds in excess of $207 billion in assets under management for both external and affiliated institutions and for individual investors. The company has a focus on investment solutions, with a clear emphasis on fixed income, equities, and multi-asset income strategies.

- Retirement Solutions: Retirement Solutions is a leading provider of retirement products and services in the United States. This section of Voya’s business has roughly $375 billion in assets under management and administration and it serves approximately 47,000 institutional clients and more than 5 million individual retirement plan investors. In addition, more than 2,300 financial advisors are also served in this area, as well as more than 417,000 retail fixed annuity product customers.

History of Voya Life Insurance Company

In the scope of financial services companies, Voya is quite new. It actually made its debut in April 2014 – and completed its overall re-branding in September. The company’s name originated as an abstract name that was coined from the word “voyage,” and it reflects both momentum and optimism.

While it has only a short history, Voya has strived to impress. In 2014, the company was named one of the World’s Most Ethical Companies by Ethisphere Institute, as well as a top-five retirement plan provider based on a number of plans, participants, and assets. In addition, the company is also a top-tier independent broker-dealer network in the U.S. a top-tier provider of life insurance, and a top-10 medical stop-loss coverage provider in the United States.

Products Offered By Voya

Voya offers a wide range of insurance and financial products. For individuals, the choices include life insurance, annuities, IRAs, workplace retirement plans, employee benefits, and college savings options.

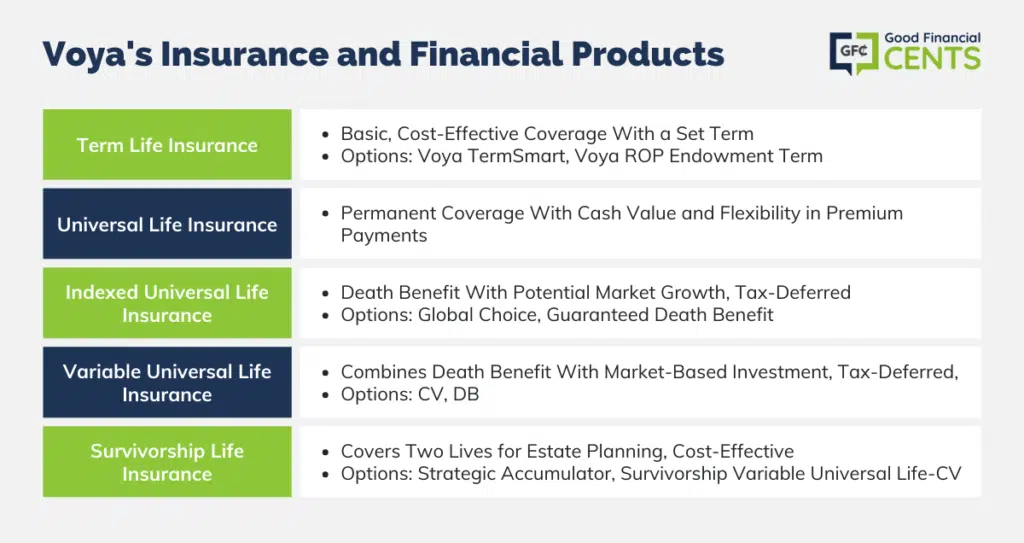

On the life insurance side, options include the following:

- Term Life – Term life is the most basic of all coverage options. This is because the term provides pure death benefit protection only, with no cash value or investment build-up. Term life is also typically the most economical form of life insurance protection, especially for those that need a larger death benefit amount such as a 1 million dollar life insurance policy. This can especially be the case when the applicant for coverage is young and in good health at the time of application. If you are not in the best of health and feel a no-exam life insurance policy would be best for you, we can help find the carrier to best suit your needs. Term coverage is sold for a set period of time – typically a certain number of years. Voya offers several term life options, including the Voya TermSmart, and the Voya ROP (Return of Premium) Endowment Term.

- Universal Life – Universal policies are a type of permanent life insurance protection. This means that the policy is not sold for a set period of time but rather, it will last for the entirety of the insured’s life – provided that the premium is paid. Universal coverage offers both a death benefit and a cash value. Cash value growth is tax-deferred, meaning that the policyholder does not have to pay any income tax on the cash while it accumulates inside of the policy. Universal policies are also quite flexible in that the policyholder is allowed to adjust the frequency of premium payments in order to meet his or her changing needs. The death benefit of the policy can also be adjusted up or down, within certain guidelines, as well.

- Indexed Universal Life – Indexed universal policies provide death benefit protection, as well as the ability to build funds inside of the policy based upon increases in underlying market indexes. Even if the indexes perform poorly, however, the policyholder is safe based on the policy’s guaranteed minimum interest rate. Like other types of permanent coverage, the funds that are inside of the policy are allowed to grow tax-deferred. For indexed universal life insurance, Voya offers the Voya Indexed Universal Life – Global Choice, and the Voya Indexed Universal Life – Guaranteed Death Benefit products.

- Variable Universal Life – Variable universal coverage provides death benefit protection and the flexibility of universal life insurance plans. Policyholders also have the ability to build funds in their policy using variable investment options from the market. Funds in these policies can also grow on a tax-deferred basis. Voya offers the Voya Variable Universal Life – CV, and the Voya Variable Universal Life – DB plans in the area of variable universal life insurance.

- Survivorship Life – A survivorship policy ensures the lives of two people – and the death benefit is paid out when the second person passes away. These policies are oftentimes used for estate planning strategies. They can be especially beneficial as the premium on a survivorship policy is generally less costly than that of two separate policies. Voya offers the Strategic Accumulator Survivorship Universal Life policy, as well as the Voya Survivorship Variable Universal Life-CV plan.

Financial Strength Ratings

Voya is a strong company, and it has been provided with very good ratings from the ratings agencies. These marks are as follows:

| A.M. Best | Fitch Ratings | Moody’s Investor Services | Standard & Poor’s |

|---|---|---|---|

| A | A | A2 | A+ |

Advantages and Disadvantages

Although not at the very top of the list, Voya is considered to be an extremely strong contender in the life insurance arena. The company has very strong ratings in terms of financial ability for paying out claims, and it offers a nice array of different products for meeting a diverse mix of client needs.

As with some of the other life insurers, however, if an applicant has any type of adverse health condition, he or she may be at an impasse in terms of how to proceed through the “traditional” application channels – especially if applying directly through the company. In this regard, it is best to instead work with an agency or company that specializes in higher-risk insurance cases.

Obtaining Life Insurance Quotes

Any time you are seeking coverage, it is always best to obtain quotes from several different insurance carriers. This will allow you to review various policies, as well as premium prices, and to truly see what types of plans are available to you.

Just as with other types of important purchases, you wouldn’t typically opt for the first and only item that you see. So, with life insurance, it is important to keep in mind that this is in most cases going to be the financial security that your loved ones will be counting on to pay their living expenses, erase large debts, or eliminate substantial tax obligations. With that in mind, you will want to ensure that you are obtaining the very best coverage that you can.

When you’re ready to begin shopping for policies, our recommended partner, Root Financial, can help. They work with the top life insurance carriers in the nation today and can get you all of the information that you need in order to make a well-informed decision. They can also assist you with decisions such as:

- What type of coverage to purchase – term, whole life, or universal?

- Determining how much benefit will be enough.

- Finding the best carrier that will meet your protection needs, as well as your premium budget

In addition, should you have any type of adverse health condition, Root Financial specializes in helping people find the carriers that are more apt to cover various applicants. So whether you are a smoker, a diabetic, or just in good health, this can save you countless hours of time and frustration throughout the application process. Use the form on this page to get started with your own set of quotes.

Conclusion

Voya Financial, Inc., having emerged from the former ING US, has swiftly established itself as a key player in the U.S. financial market, with a clear emphasis on retirement and insurance solutions. Despite its relatively recent inception in 2014, the company has received acclaim for its ethical practices and holds a strong position in various sectors like term life insurance, investment management, and retirement solutions. Their diversified portfolio, strong financial ratings, and commitment to customer needs underscore their growing significance in the financial arena. While the vast range of offerings may be daunting for potential customers, seeking assistance from specialized agencies like Root Financial can simplify the decision-making process. As with any financial product or service, prospective customers should compare offerings and consider individual circumstances to ensure they make an informed decision that best suits their personal and financial goals.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Voya Financial Product Description: Voya Financial, Inc. is a premier U.S. financial institution offering a blend of insurance, retirement, and investment products and services. Catering to both individual and business needs, the company is dedicated to helping Americans navigate the challenges of financial planning, especially with retirement solutions. Summary of Voya Financial Established as a rebrand from the former ING US, Voya Financial has rapidly grown to serve approximately 14.7 million customers across the United States. The company’s product and service lines, including Insurance Solutions, Investment Management, and Retirement Solutions, cover a vast range of financial necessities. From top-tier term policies and stop-loss medical insurance to assets under management exceeding $207 billion, Voya’s offerings are tailored to meet the diverse financial requirements of its clientele, backed by a dedicated team of over 7,200 employees. Pros Cons

Voya Financial Review

Overall

We purchased a large term policy from ReliaStar/ voya and paid premiums for over ten years that totaled over $250,000. Last year we sent voya an amount equal to the annual premium due. Voya refuses to take the full payment and never gave us a reason why. They returned the funds and later cancelled the policy. After going back and forth with voya for months we asked them to show us the language in the policy which would allow them to reject the full payment from the insured and after they looked tiny out they acknowledged that there wasn’t any such language nd promised to correct their error. Instead they want the insured to reapply and have made that process almost impossible. Who would ever do business with voya? It is a terrible company.